Eyes on the south

Market Morsel

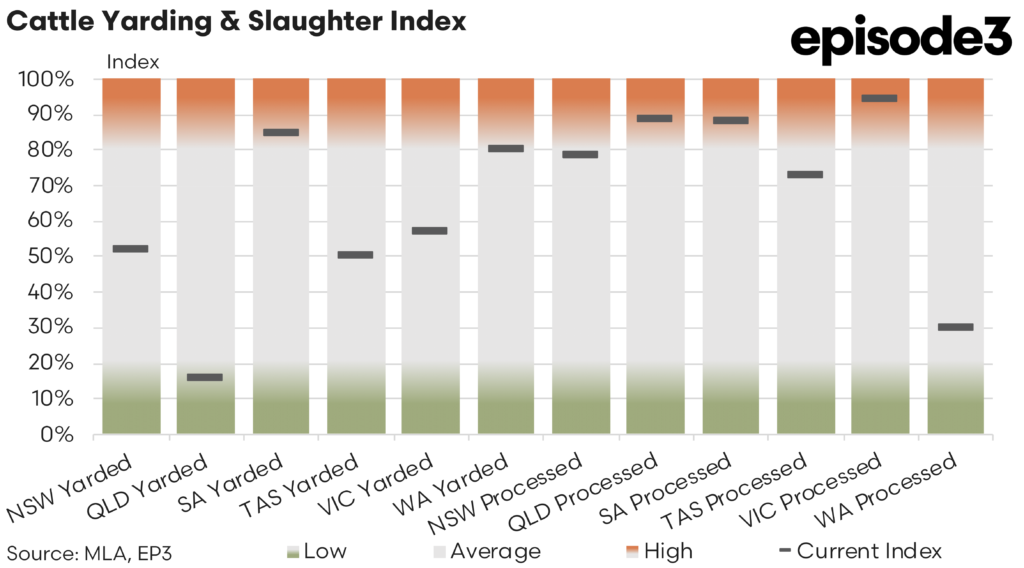

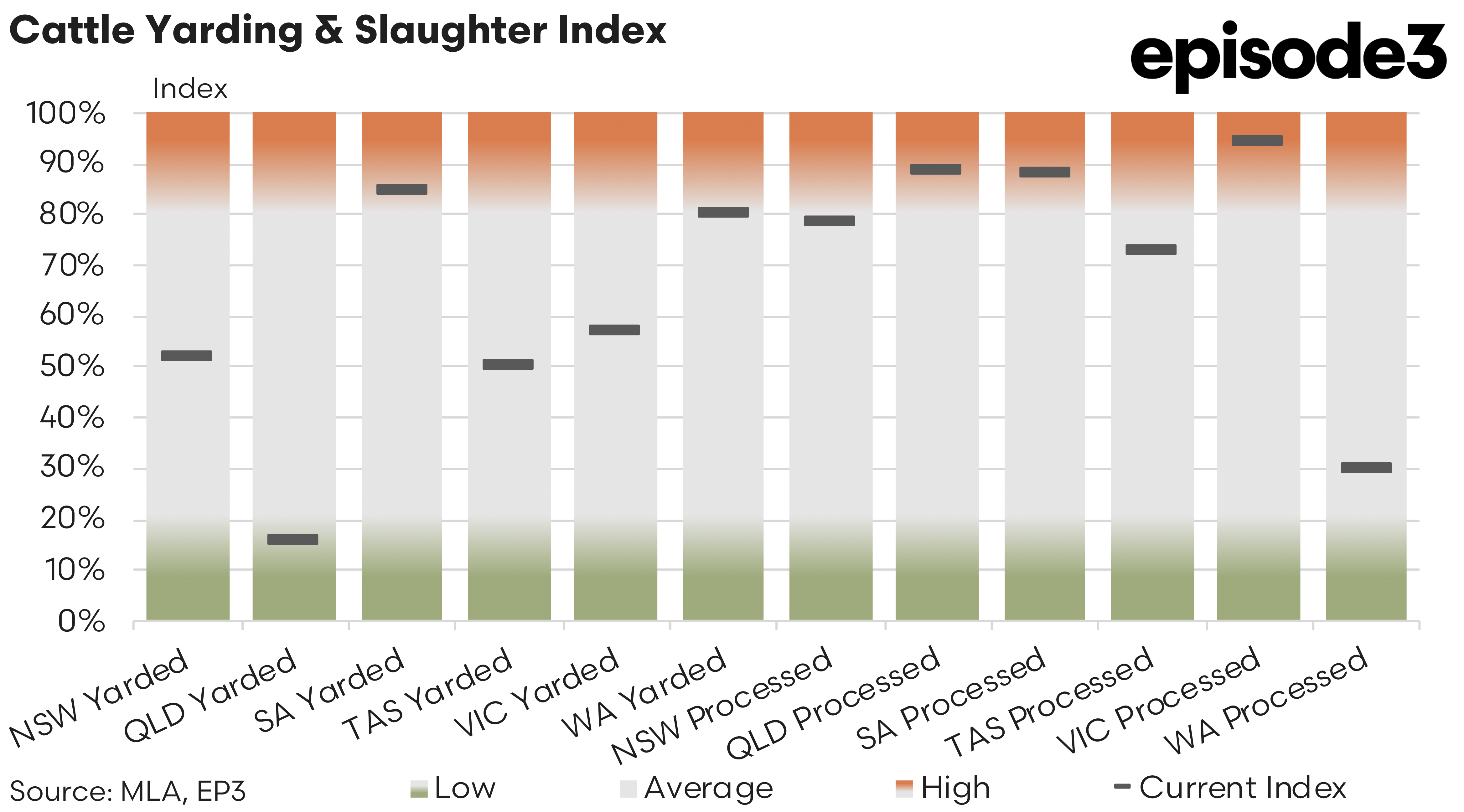

The final quarter of 2024 has marked a significant shift in Australia’s beef production landscape, with Queensland processors aggressively sourcing cattle from southern regions. Despite Queensland’s low yarding index of just 16%, the state’s cattle processing index score finished the 2024 season at a robust 89%, highlighting the strategic movement of cattle northwards to meet high processing demand.

This discrepancy between yarding and processing volumes in Queensland underscores the ongoing search by northern abattoirs for cattle in southern markets. Processors have been capitalising on the price differentials and increased cattle availability in Victoria, southern New South Wales (NSW), and eastern South Australia (SA). Notably, some Queensland processors have extended their reach as far south as Wodonga, Victoria, reversing the earlier trend of southern buyers sourcing from Queensland saleyards throughout much of the year.

NSW reported a yarding index of 52% and a processing index of 79%. The relatively balanced figures suggest steady local supply meeting processing demand. However, the steady processing activity also reflects the state’s role in supporting Queensland’s processing surge.

Victoria demonstrated a yarding index of 57% and an exceptionally high processing index of 94%. This indicates strong cattle supply and processing activity, making it a key region for Queensland processors seeking additional cattle to meet their high slaughter rates.

SA’s yarding index stood high at 85%, paired with a processing index of 88%. The abundance of yarded cattle has supported both local processing needs and the overflow demand from Queensland. SA’s position has been instrumental in balancing supply pressures across the eastern states.

Tasmania maintained a yarding index of 50% and a processing index of 73%. While not a source for Queensland processors, Tasmania’s steady figures reflect moderate supply and processing activity contributing to the national beef output.

WA presented a yarding index of 80% but a significantly lower processing index of 30%. This disparity suggests a potential bottleneck in processing capacity during the Christmas/New Year break. WA’s limited processing capacity woes extends to the sheep meat sector with the recent announcement of the immediate closure of Minerva Foods Australia abattoir plant in Tammin.

Queensland’s low yarding index of 16% starkly contrasts with its high processing index of 89%. This gap highlights the reliance on external cattle sources to maintain high slaughter volumes. The state’s proactive approach in securing cattle from southern states underscores the aggressive market behaviour driven by strong demand and favourable pricing dynamics.

Queensland slaughter grid prices have remained stable as we rounded out the 2024 season, with southern Queensland processors offering 560c/kg on heavy cows and 620-630c/kg on heavy steers. Central Queensland processors, slightly behind at 10c lower. In contrast, southern states have seen steady pricing after minor drops, with eastern South Australia offering 540c/kg on slaughter cows and 610c/kg on slaughter ready steers. Southern NSW grids showed 510c/kg on heavy cows and 590c/kg on heavy steers, reflecting the supply-driven market stability.

Queensland processors’ aggressive sourcing from southern regions has been a defining feature of the final quarter of 2024. The state’s low yarding but high processing figures underscore its strategic manoeuvring to secure cattle amidst tight local supplies. This interstate dynamic has not only bolstered Queensland’s processing output but also contributed to Australia’s record beef export levels for 2024.

Australia’s beef export market concluded 2024 at record highs, driven by soaring demand from key international markets, particularly China. In the final quarter, beef exports surged to 376,318 tonnes, which was a 29% rise from Q3 and 23% higher than Q4 2023. China’s imports alone reached 55,875 tonnes, marking its highest intake since mid-2023. This growth in Chinese demand played a crucial role in pushing total annual beef exports to approximately 1.34 million tonnes, surpassing the previous record set in 2016.

The United States remained Australia’s top export destination, accounting for nearly 30% of total shipments. Japan, South Korea, and China followed closely, each showing steady or increased demand. Australia’s ability to meet this global demand was supported by increased slaughter volumes in Queensland and across the eastern states, despite regional supply challenges.

This strong export performance highlights Australia’s resilience and competitiveness in global beef markets, which is expected to remain strong into 2025 due to tight beef supplies. The global beef market is expected to tighten in 2025 due to declining cattle herd sizes among major exporters like Brazil, the USA, and Australia. This supply pressure positions Australian beef competitively, especially with its relatively lower cattle prices compared to the USA, enhancing export opportunities in key markets like Japan, South Korea, and China.