Get some local pork on your fork

The Snapshot

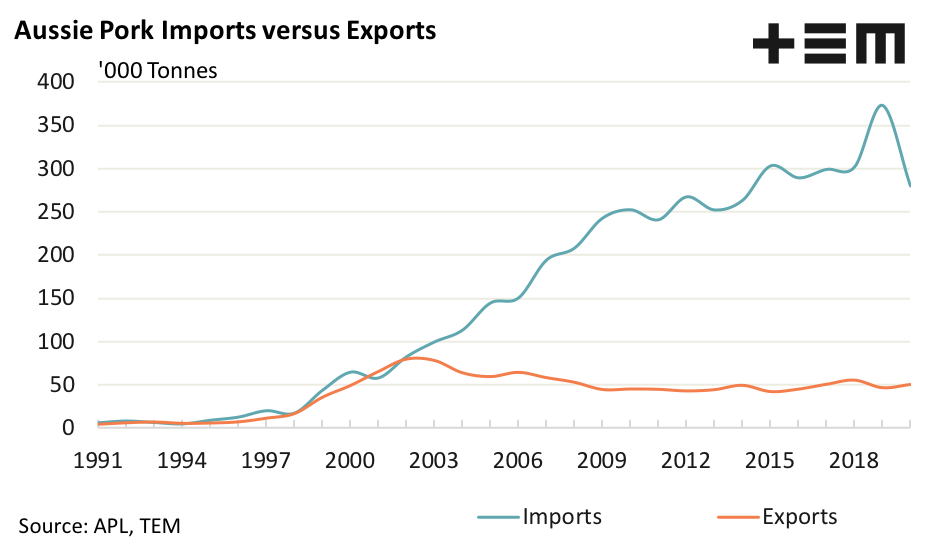

- In 2020 the annual volume of pork imports into Australia equated to nearly 600% of the volume of what was exported.

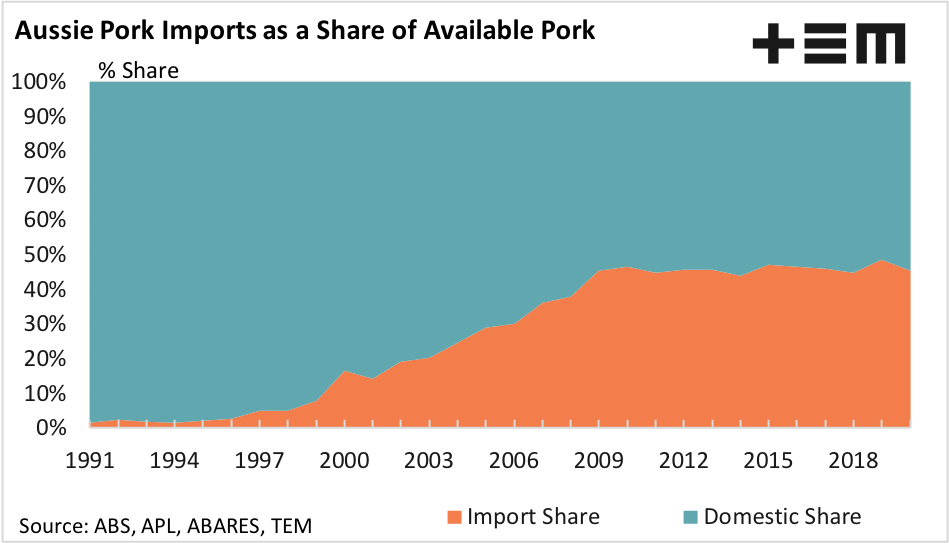

- Pork imports represented less than 5% of what was produced domestically in the early 1990s.

- Since 2010 the market share of imported pork volumes has sat relatively steady, ranging between 45% to 49%.

The Detail

Through the 1990s the local pork sector managed to keep pace with the rise in imported pork product coming into Australia. However, in the mid 2000s the imported pork volumes continued to accelerate while our export focus diminished.

As of 2020 the annual volume of pork imports into Australia equated to nearly 600% of the volume of what was exported. It has been this way for some time. Indeed, over the last decade the annual volume of pork imports have represented levels that are 500% above the volumes that are exported each season.

The steady increase in pork imports into Australia have eroded the retail market share of the local pork producer. In the early 1990s imports represented less than 5% of what was produced domestically. However the 2000s set off an expansion in imported pork market share, moving from 17% in 2000 to 47% in 2010.

Since 2010 the market share of imported pork volumes has sat relatively steady, ranging between 45% to 49%. Fortunately, for the local pork producer the African Swine Fever (ASF) outbreak in China has seen a large amount of international pork product diverted to fill the large void in China. This may have allowed the local producer to maintain their market share in recent years.

Despite reports late last year that China was getting on top of their ASF issues this year there appears to have been a few stumbling blocks and in recent months news of variant strains of ASF wreaking havoc across China has put their pig herd rebuild on the back foot.

China continues to take in large flows of pork imports, along with increased alternative meat protein imports, and their domestic pig prices remain elevated. While this remains to be the case, and international pork product keeps flowing into China, then the local pork producer can breathe easy knowing that the chance of increased incursion of imported pork on the supermarket shelves in Australia is somewhat limited.

However, it is probably a good opportunity to encourage the local consumer to buy local, and perhaps even to consider a focus to expand our pork export sector.