Getting tougher

Sheep Processor Trading Conditions Model

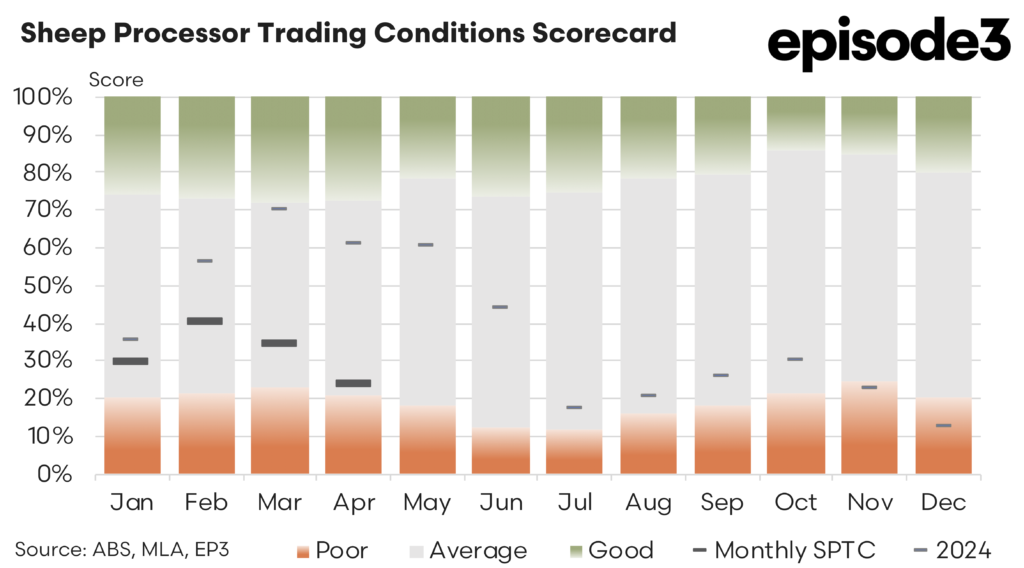

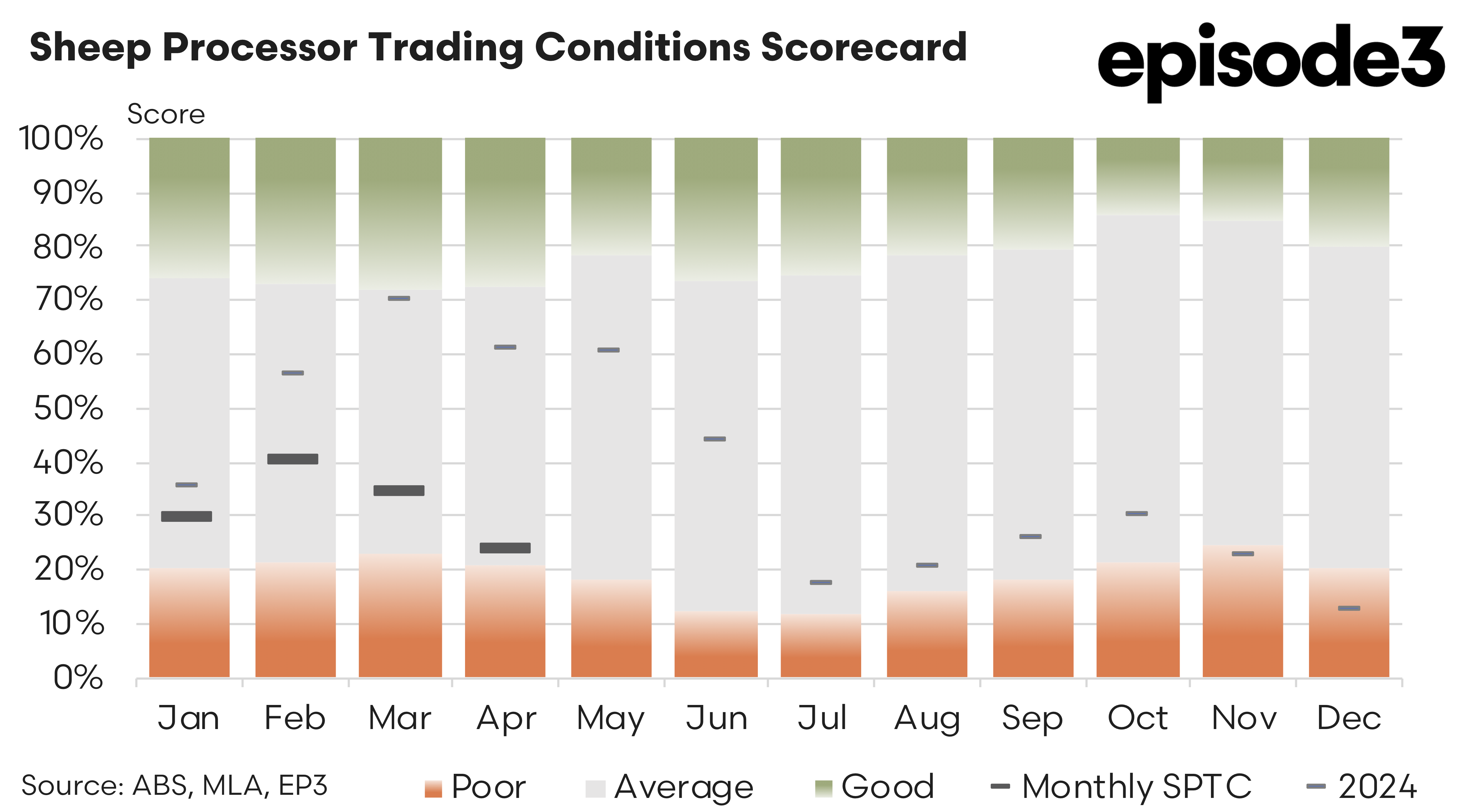

After early signs of recovery in the first quarter of 2025, Australia’s sheep processing sector has taken another step backward. April data has delivered a further reality check. The Sheep Processor Trading Conditions (SPTC) Index dropped from 33% in March to just 24% in April, a decline that underscores the fragile and volatile nature of the recovery. With the average SPTC for 2025 now sitting at 32%, it is clear the sector remains well below historical profitability levels.

For context, the SPTC Index operates much like a rainfall decile with anything in the orange area reflective of drought-like conditions for processor profitability. At 24%, the April reading indicates a renewed squeeze on margins, especially for those heavily exposed to mutton processing. While January and February offered cautious optimism, the gains have now been largely eroded, and the sector is facing another round of challenges.

A major driver behind this latest dip in profitability is the sharp increase in mutton procurement costs. Between March and April, mutton prices surged by 25%, placing enormous pressure on processors’ bottom lines. Unlike earlier months when lamb prices were the primary concern, April has seen average lamb costs actually fall slightly, down 1.4%, which offered limited relief. However, that minor dip in lamb prices was nowhere near enough to offset the cost blowout on the mutton side.

On the retail front, domestic lamb prices showed only a modest increase of 1.1% in Q1 2025. This minor uptick reflects the difficulty in passing higher farmgate prices on to consumers in a constrained economic environment. With margins already under strain, the imbalance between rising input costs and static consumer pricing remains a key concern for processors.

Export markets, once again, presented a mixed picture. Export values from China, the single largest destination for Australian sheepmeat, continued to fall, down 5% across Q1 2025. This decline reflects broader economic softness in China and weaker demand across protein categories. The UAE market also softened, with export prices falling 9%. These two declines are significant, as both countries are core markets for Aussie mutton and lamb.

In contrast, Malaysia and the United States posted solid price gains. Export prices to Malaysia lifted 11%, while the US market climbed 10%. These increases helped buffer some of the downside risk but were not enough to lift average export returns meaningfully, given the tough export price conditions in the Middle East and China.

The squeeze is particularly acute for processors specialising in mutton, where input costs have skyrocketed just as some key export markets are paying less. It’s a classic cost-price squeeze with processors being asked to pay more for livestock, while being paid less for the product on the other end. As a result, profitability has dropped to levels that make life difficult for the nation’s sheepmeat abattoirs.

This comes at a time when external pressures are growing. The impost of a 10% US tariff on Australian red meat still looms large. While US sheepmeat prices have held firm so far, any implementation of the tariff could significantly dampen demand and further hurt processor returns.

Processors now find themselves in an increasingly precarious position. The improvement seen in January and February is beginning to look more like a dead-cat bounce than the beginning of a full recovery. Without structural improvements in export pricing or a correction in livestock procurement costs, particularly for mutton, the outlook for processor margins remains bleak.

The April SPTC score of 24% is not yet crisis territory, but it is alarmingly close. For reference, levels seen during the worst of late 2024 dipped to the low teens. A return to those conditions would likely trigger further operational cutbacks, reduced shifts, and more aggressive procurement strategies.

To weather this next phase, processors will need to remain nimble. Cost control will be essential, and supply chain coordination more critical than ever. There is also a pressing need for diversification into higher-value markets to limit the impact of the tighter margins of the current commodity lamb export landscape.

On the policy front, the sector must continue advocating for clarity and stability in trade settings, particularly regarding potential US tariffs. Strategic engagement with policymakers and exporters will be essential to maintaining market access and smoothing over the risks posed by geopolitical and regulatory disruptions.

April has reminded everyone in the sheep processing sector that the road to recovery is anything but smooth. The rest of 2025 will be critical in determining whether the sector can stabilise or whether deeper structural change is needed to restore sustainable profitability.