Global flock versus export flock

The global sheep population is an important component of agriculture and food production across many regions of the world. As of the most recent estimates, the worldwide sheep flock numbers to nearly 1.3 billion animals, with significant variations depending on geographical, cultural, and economic factors.

China holds the title for the largest number of sheep in the world, contributing significantly to the global count. Following China, countries like Australia and India also boast substantial sheep populations. Over the last six decades the Chinese sheep flock has added around 100 million head growing from 60 million head in the early 1960s to nearer 173 million head in recent years. While the supply of sheep has increased steadily within China the demand for sheep meat has grown faster.

An analysis of flock size by country shows China holds the largest sheep flock at nearly 173 million head, or nearly 14% of the global flock. Australia holds second place with about 6% of the global flock followed by India at 5%. The top fifteen countries for sheep flock size account for around 57% of the global flock. Interestingly only four of these nations are in the top ten sheep meat exporting nations; Australia, India, UK and New Zealand.

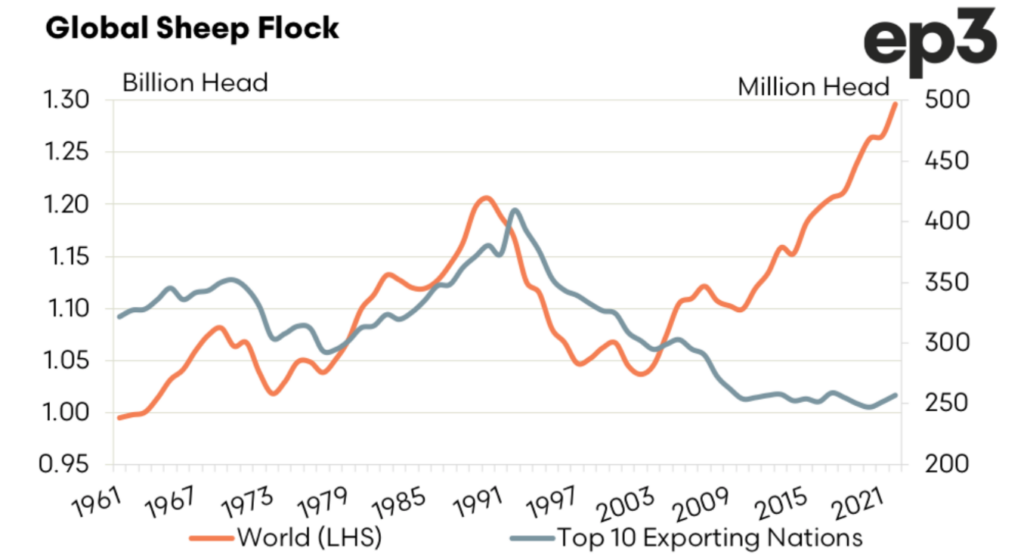

Analysis of the sheep flock of the ten top sheepmeat exporting nations gives a clue to the strong sheepmeat prices being achieved in recent years as the “global export flock” has been in decline since the early 1990s from 400 million head to just over 255 million head.

While there has likely been production efficiencies in key sheep meat exporting countries such as Australia and NZ, enabling them to produce more sheep meat with a lower flock size it just hasn’t been enough sheep meat production to keep up with the global demand.

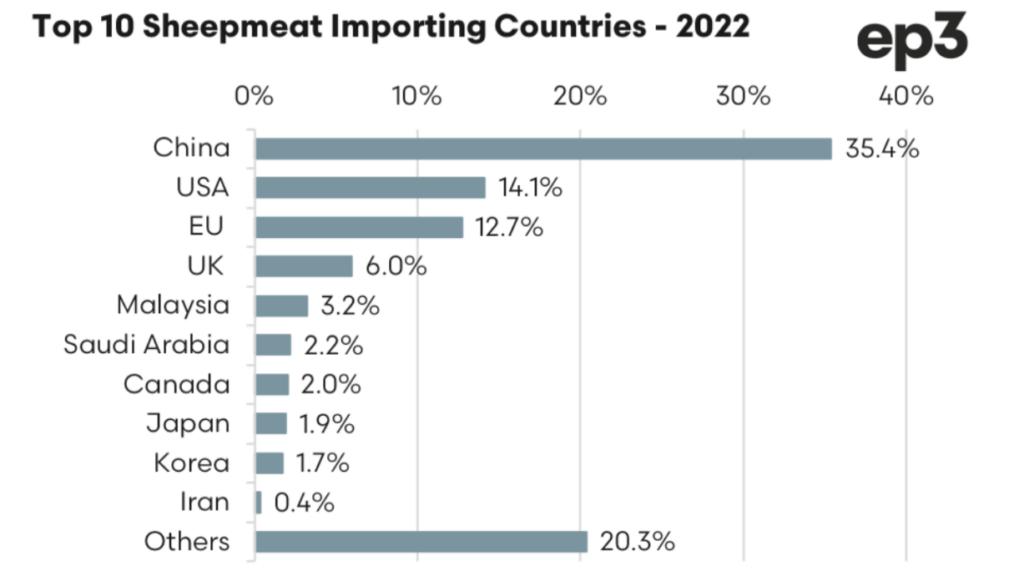

Despite having the world’s largest sheep flock China is the top importer of sheepmeat with their volumes outweighing sheepmeat imports into the USA, EU &UK, combined. This is no mean feat as the USA, the EU and the UK are the world’s second, third and fourth top sheepmeat importing nations.

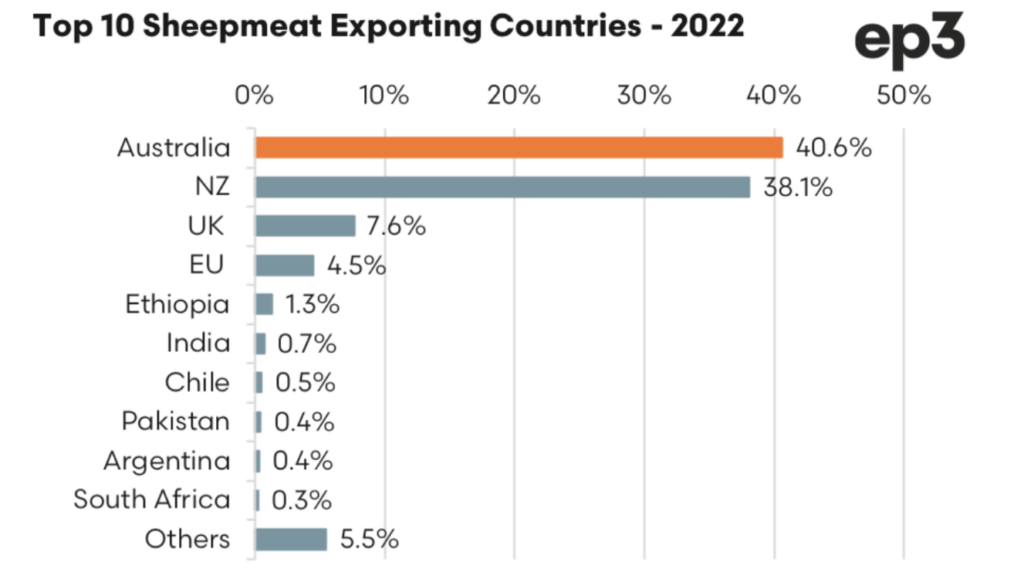

Meanwhile the global distribution of sheep meat exports by region for the year 2022 demonstrates the dominance of Oceania (Australia & New Zealand) as the leading exporters of sheepmeat with a 78.7% share of the market. The second-largest exporter is Europe, contributing 12.8%. This is followed by Africa at 3.3%, Asia at 2.8%, and South America at 2.2%. North America has a very minimal share, almost negligible, at 0.2%.

The top 10 sheepmeat exporting countries during 2022 demonstrates Australia is the leading export nation at 40.6%, closely followed by New Zealand (NZ) at 38.1%. The United Kingdom (UK) stands out as a significant exporter with 7.6% of exports, although it is noted that they also import about 70-75% of the volume of sheepmeat they export, which diminishes their net export contribution to the global trade.

The EU region accounts for 4.5% of the exports. Other notable exporters include Ethiopia at 1.3%, India at 0.7%, Chile at 0.5%, Pakistan at 0.4%, Argentina at 0.4%, and South Africa at 0.3%. Combined exports from countries not in the top ten add up to 5.5% of the total market.

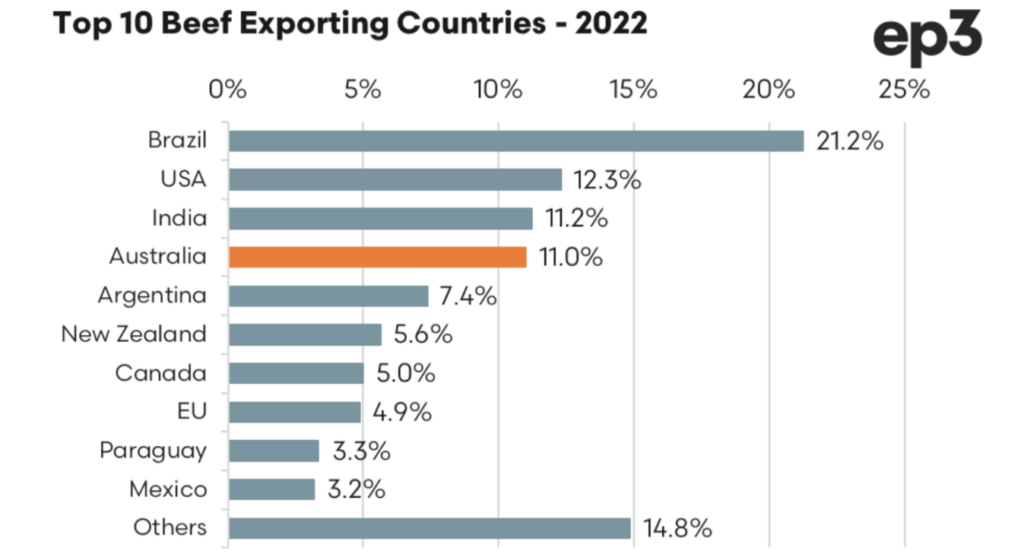

In contrast to the sheepmeat exporting landscape, the top ten beef exporters by country demonstrates a much more competitive situation with Australia in a far less dominant position.

Furthermore, in key beef export destinations for Australia, such as Japan, South Korea, China and the USA, Australia faces ongoing and potential competition from a range of global beef exporting nations including the USA, Brazil, India, Argentina, New Zealand, Canada, Mexico and Paraguay.