Gone, in the USA

The Snapshot

- The threshold FSR level that determines if herd liquidation is underway in the USA is 47.5%, which is remarkably close to the threshold level in Australia of 47.0%.

- With the US FSR annual average holding above 49% since the start of 2019 we have seen the US herd ease by 0.4% from 94.8 million head last season to 94.4 million head this year.

- During a liquidation there is a definite bias toward increased prices, particularly in the later stages of the de-stocking period.

The Detail

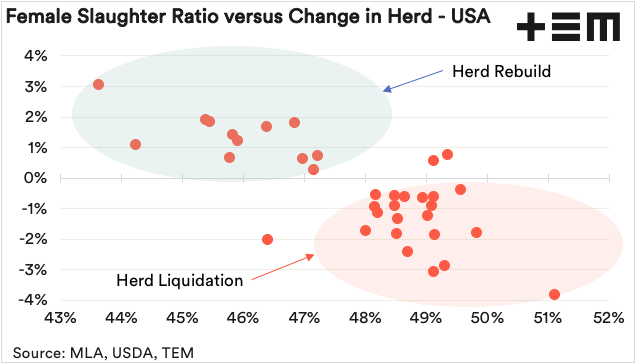

Just like in Australia the Female Slaughter Ratio (FSR) for cattle in the USA can be used to signify when the herd is in liquidation or rebuild. The FSR is a measure of the proportion of female cattle processed expressed as a percentage of total cattle slaughter.

The threshold level that determines which phase is underway in the USA is 47.5%, which is remarkably close to the threshold level in Australia of 47.0%. In 2019 the annual FSR in the USA moved into liquidation territory averaging 49.1% across the season.

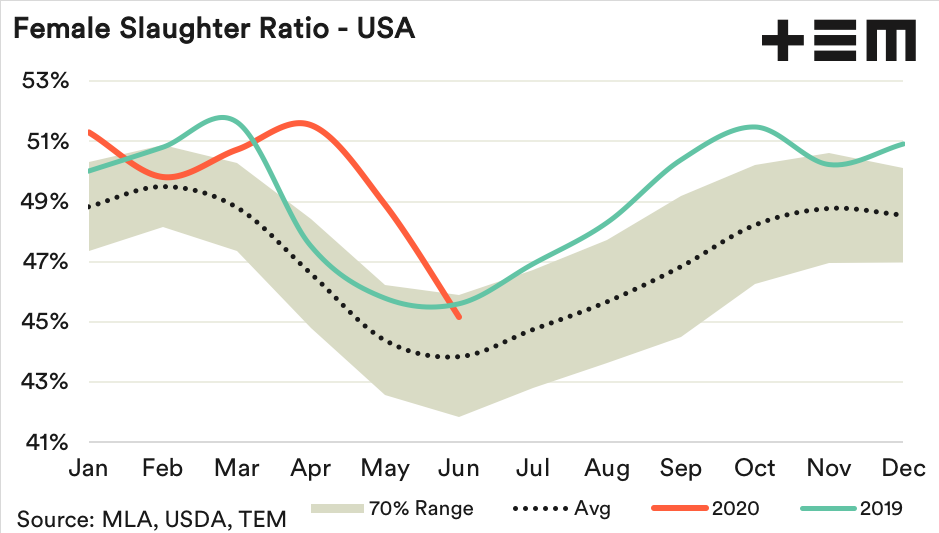

The 2020 pattern has remained elevated too, averaging 49.6% for the first half of the year. Although it has eased in June to see it dip to 45.2% on a monthly basis. As the seasonal average pattern demonstrates it is not uncommon to see the FSR reach a nadir during June each year. Furthermore, sitting at the higher end of the normal range these levels would still be considered to be consistent with a herd in liquidation.

Analysis of the relationship between the FSR and the annual change in the US cattle herd since 1986 shows that twelve years out of thirteen where the FSR was below 47.5% the herd increased. Similarly, nineteen out of twenty-one seasons where the FSR was above 47.5% saw the US herd decrease.

With the US FSR annual average holding above 49% since the start of 2019 we have seen the US herd ease by 0.4% from 94.8 million head last season to 94.4 million head this year. Big deal – you may scoff. What does the US cattle cycle have to do with Australian cattle markets?

The answer to that question is that the long-term direction of Australian cattle prices is influenced by US cattle prices, as they tend to set the benchmark price level for global cattle markets. In turn, US cattle prices can be influenced by whether their herd is experiencing a rebuild or a liquidation.

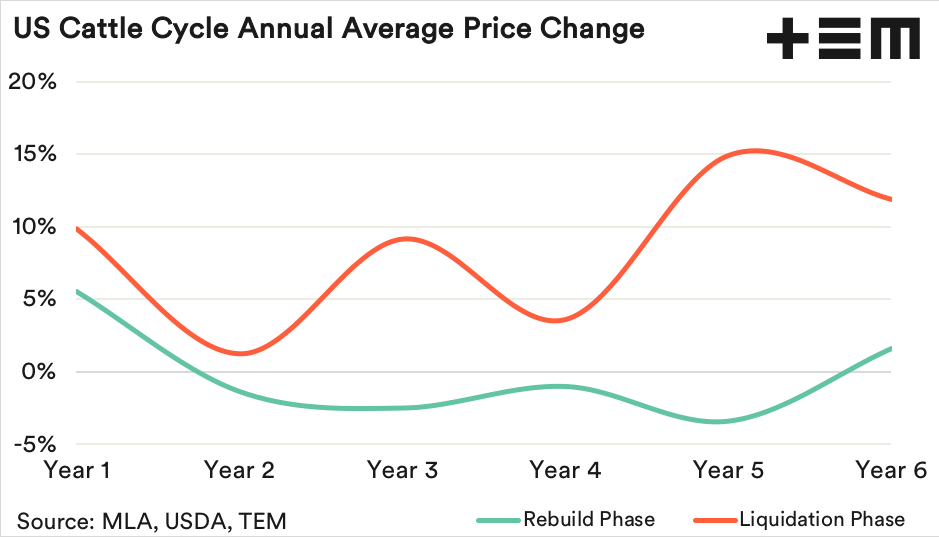

An assessment of the last one hundred years of US cattle cycles shows that on average rebuild and liquidation phases last around six years. Analysis of the average price pattern for the first three years of the cattle cycle to the last three years of the cycle demonstrates a clear difference in price behaviour, depending upon which phase is underway.

During much of the herd rebuild phase US cattle prices have close to a 50/50 chance of posting an increase or a decrease each season, such that the average price pattern across the period tends toward a sideways consolidation with a slight negative bias between years two to five.

However, during a liquidation phase the average trend has a definite bias toward increased prices, particularly in the later stages of the liquidation period. The ongoing reduction in the cattle herd during the liquidation phase likely results in tighter cattle availability toward the final stages of the de-stocking phase encouraging price support as supply dwindles.

This suggest that as the global economy recovers from the Covid-19 inspired recession in the coming years an increased demand for beef, as per capita wealth increases, will likely coincide with the later stages of the US herd liquidation. This will likely lead to some robust support for cattle prices, both offshore and within Australia, as we head toward the middle of the decade.