Good golly this OLI

The Snapshot

- The AuctionsPlus OLI indicator is based upon online sales for lambs and suckers (both males & females) with carcass weights from 0–24kg and fat scores ranging from 1 through to 4.

- The dollar per head pricing for the OLI and the MLA Light Lamb saleyard indicator have been a reasonably close match over the past year, which makes sense as they are comparing lambs of similar weight ranges.

- A comparison of the OLI and the MLA Trade Lamb saleyard indicator, on a cents per kilogram basis, highlights that prices have been a fairly close match over the past year.

The Detail

Meat & Livestock Australia (MLA) have released a new online lamb indicator termed the OLI, which presently exclusively uses online lamb pricing data supplied by AuctionsPlus. However, as other online platforms availability to provide sales data increases MLA plan to expand data sources for the OLI indicator so that it includes data from several online sources.

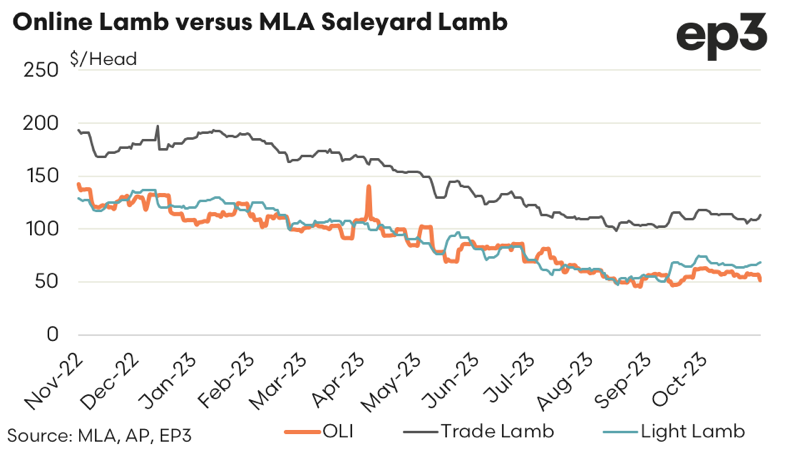

The OLI pricing data is based upon online sales for lambs and suckers (both males & females) with carcass weights from 0–24kg and fat scores ranging from 1 through to 4. The OLI will be presented as a seven day rolling average indicator and will be expressed in both $/head and c/kg format. A comparison of the daily $/head values of the OLI to MLA’s other saleyard indicators, the Light Lamb Indicator and the Trade Lamb Indicator, for the past year is shown below.

The MLA Light Lamb Indicator includes lambs up to 12 months of age with all fat scores and carcase weights ranging from 12–20kg, which is more consistent with the data collected for the OLI in terms of weight range, therefore the dollar per head pricing for the OLI and the Light Lamb have been a reasonably close match over the past year.

In contrast the MLA Trade Lamb Indicator includes lambs up to 12 months of age with all fat scores and carcase weights from 20–26kg that have been purchased by processors at the saleyard. Given that the Trade Lamb sales data is collected for heavier lambs than the OLI and the MLA Light Lamb indicator it stands to reason why the dollar per head figure for Trade Lambs is also higher.

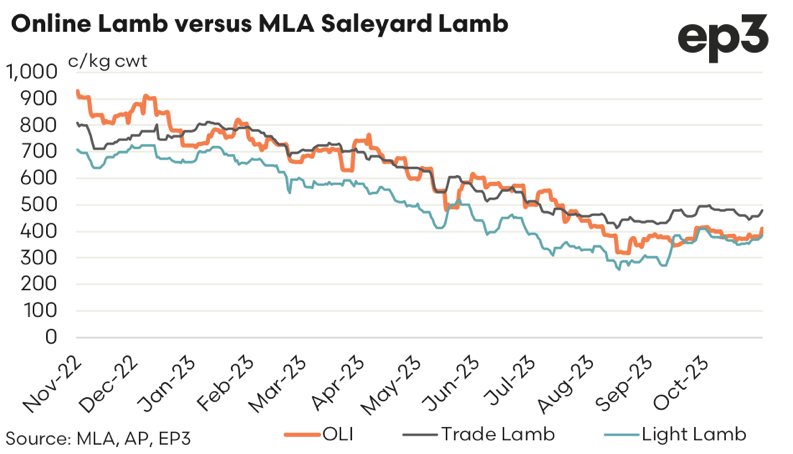

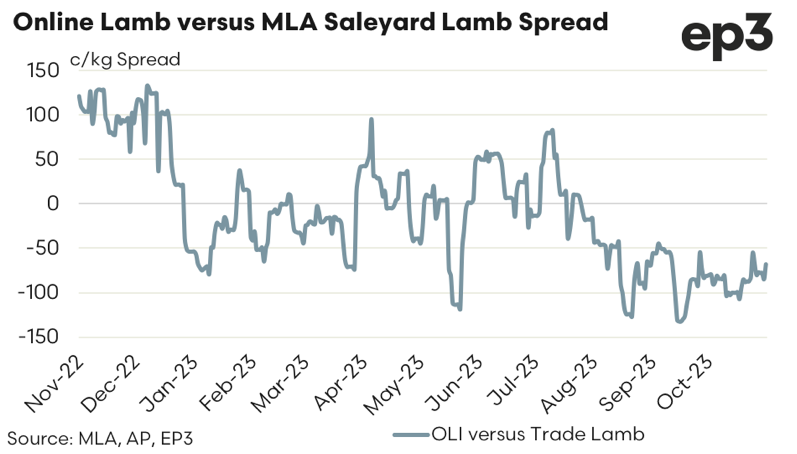

A comparison of each indicator on a cents per kilogram basis highlights that the OLI prices have been a fairly close match to what the MLA Trade Lamb indicator has been achieving over the past year. The exception has been the last few months of 2022, when the OLI ran at a c/kg premium to Trade Lamb and since late August/early September 2023, when the OLI has moved to a c/kg discount to the Trade Lamb Indicator.

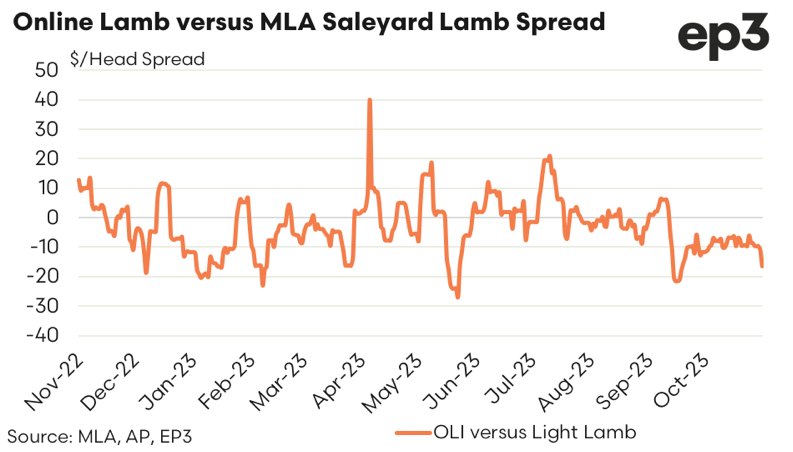

Analysis of the $/head spread between the OLI and the Light Lamb demonstrates that for much of the last year the spread has ranged between a $20 premium to a $20 discount, with the average spread in $/head terms since November 2022 to present running at $3 discount.

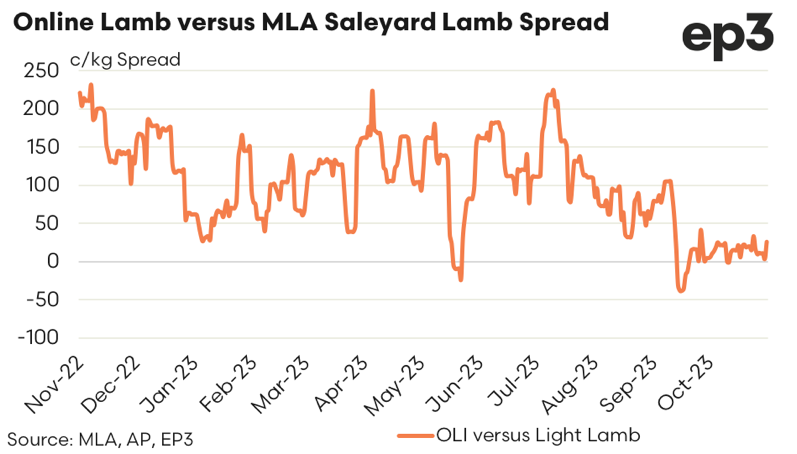

Measuring the spread between the OLI to the MLA light lamb indicator on a c/kg basis over the past year rather than on a dollar per head basis paints a different picture with the spread mostly ranging between par to a 220 cent premium, in favour of the OLI. The average spread in cents per kilogram for the OLI to the MLA Light Lamb indicator since November 2022 sits at a premium of around 100 cents.

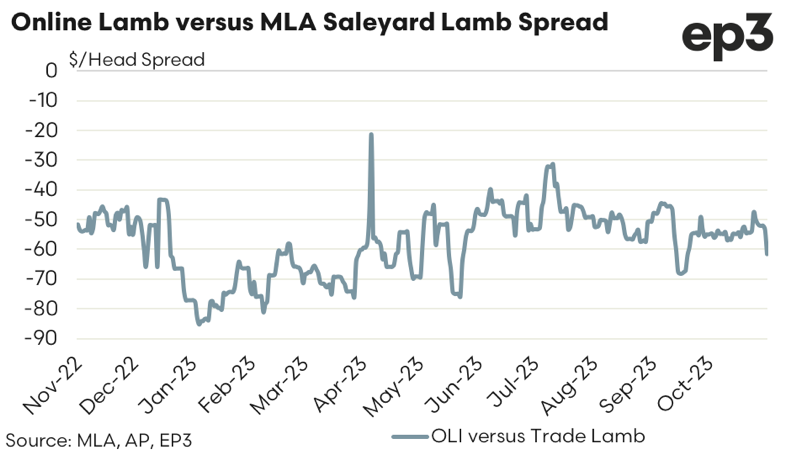

As previously outlined the $/head spread between the OLI and the Trade Lamb Indicator runs at a discount, based on the weight difference of the lambs being sold via online versus saleyard. Over the past year the spread in $/head between the OLI and the Trade Lamb Indicator has ranged between a discount of $30 to a discount of $80, with an average discount since November 2022 coming in at about $58.

However, based on a cents per kilogram approach the historic range in the spread between the OLI and MLA’s Trade Lamb Indicator for the past year has been between a 125 cent premium to a 125 cent discount. Since November 2022 the average cents per kilogram spread for the OLI to Trade Lamb has run at a discount of just 11 cents.

At this stage there is limited historic data with which to compare price and spread movements between the OLI, Light Lamb and Trade Lamb. However, as the data availability grows for the OLI and more platforms are included in the calculation of this online indicator we will be able to measure spread and price behaviour across the season to see if predictable patterns exists or if changes to the sheep flock cycle, such as the movement from liquidation to rebuild, has any influence on spread and price behaviour.