Great start

Market Morsel

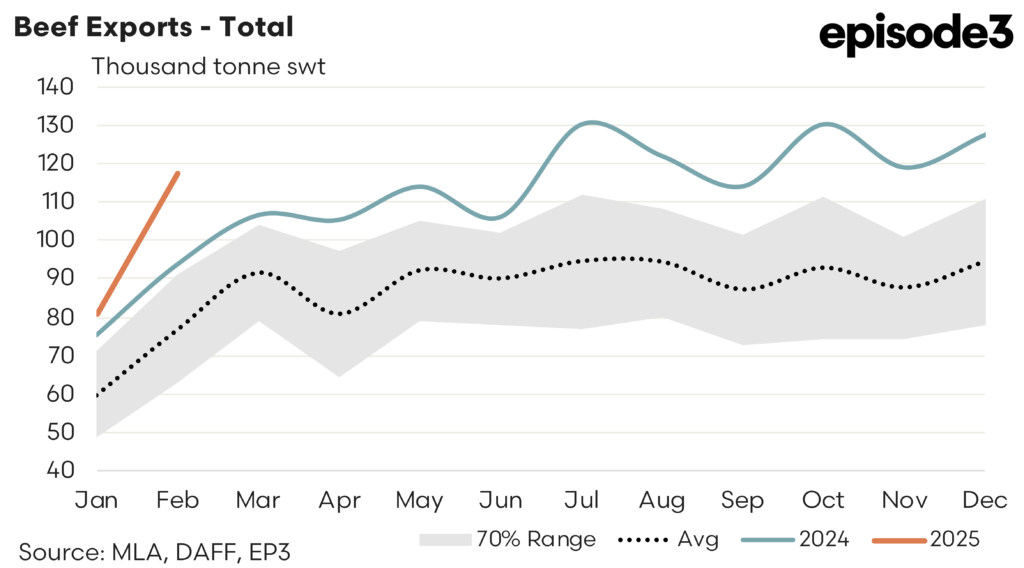

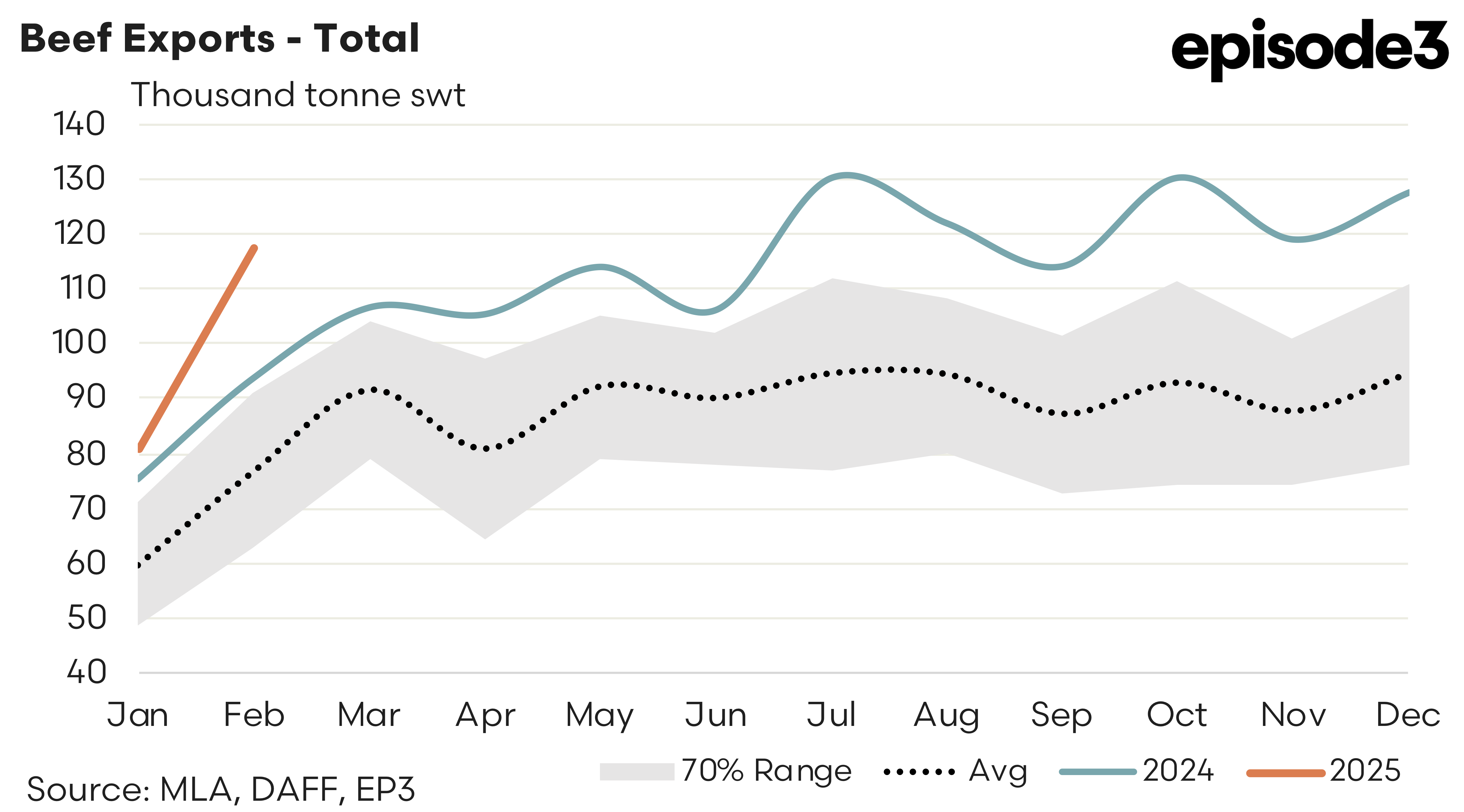

The strongest January on record has been followed by the strongest February flows on record for Australian beef export volumes heading offshore. February 2025 saw 117,502 tonnes shipped, a 25% increase on February 2024 and levels that are 53% higher than the February average flows, based upon the last five years of the trade.

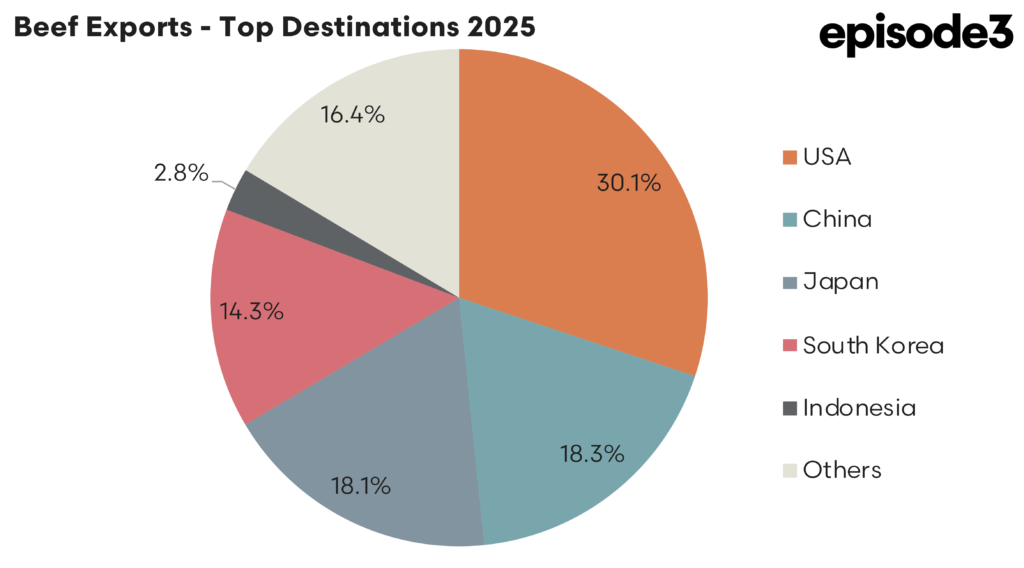

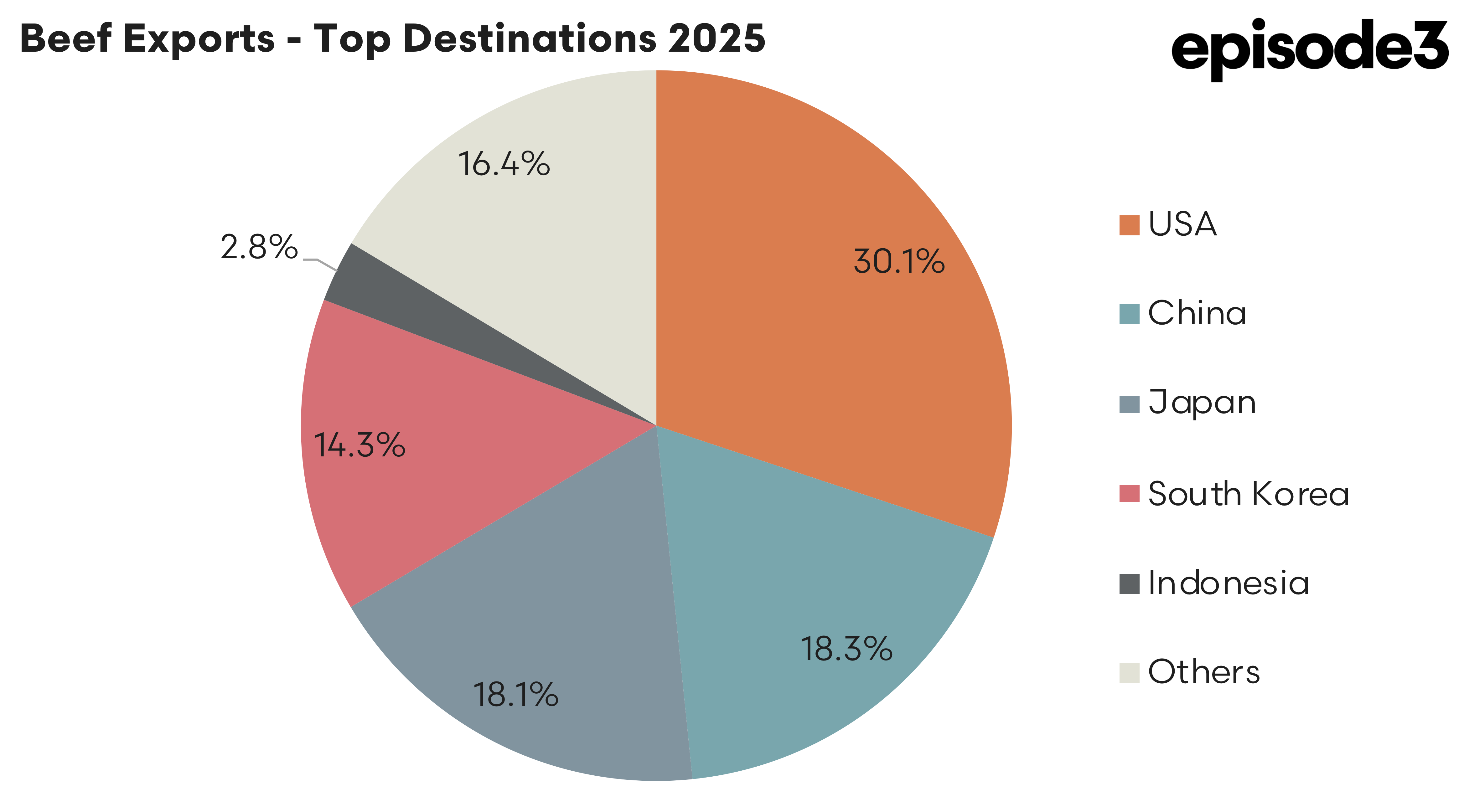

The USA retains top spot for market share of export flows with 30.1% of the trade so far in 2025. China rockets into second spot, displacing Japan, with 18.3% share versus the Japanese consumers on 18.1%. South Korea sit in fourth top destination with 14.3%.

A summary of the top trade locations, in order of top market share for 2025, is as follows:

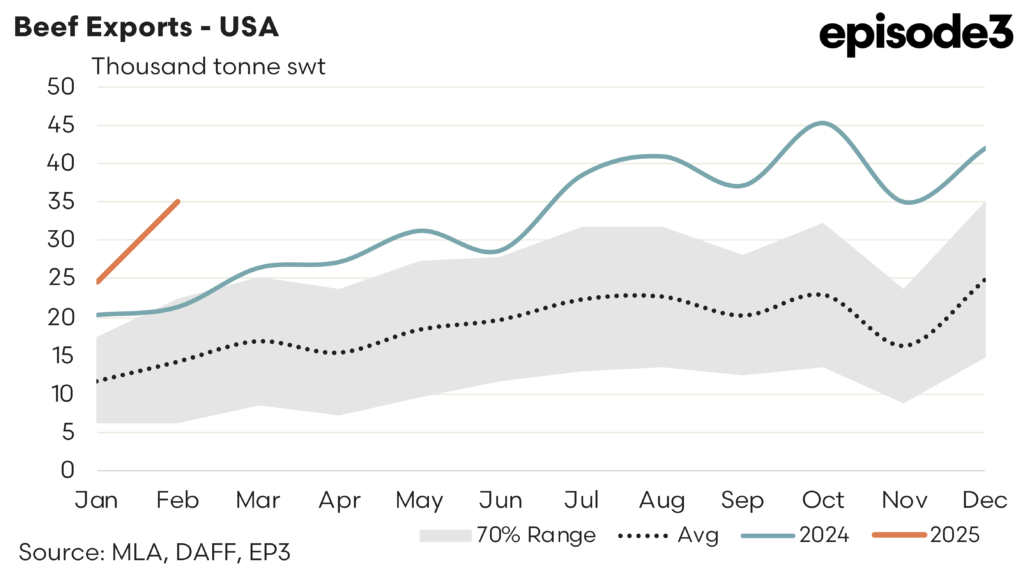

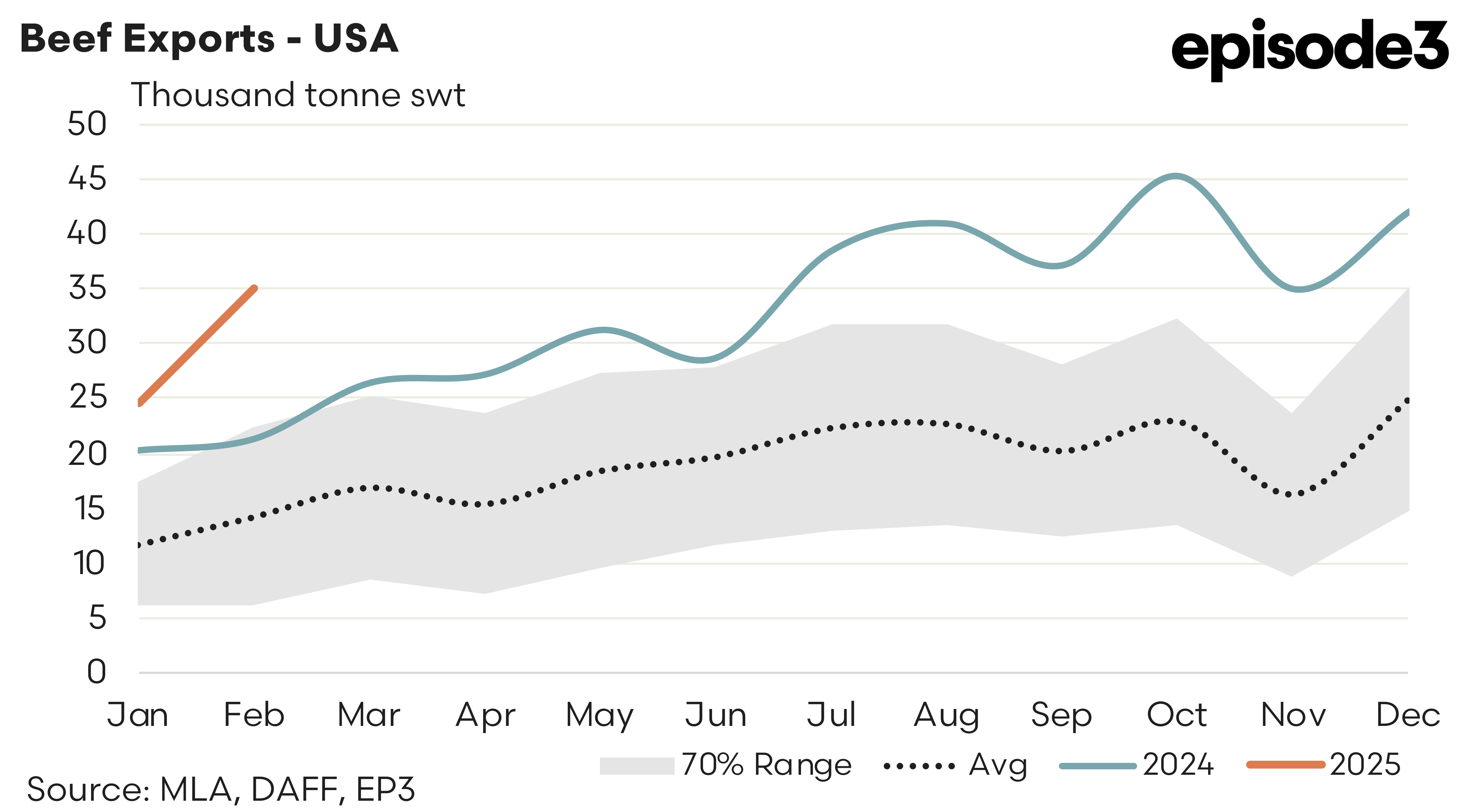

USA – February flows of Aussie beef to the USA increased by 42% from the already elevated January levels to see 35,092 tonnes exported. This is the strongest February flows to the USA since February 2015. Compared to February 2024 the current trade volumes are 64% higher and sit 146% above the February five-year average pattern. It will be interesting to see if the Trump trade tariff being discussed will end up being enforced, and if so, will it begin to impact demand for imported Aussie beef or will the US consumer just have to pay more?

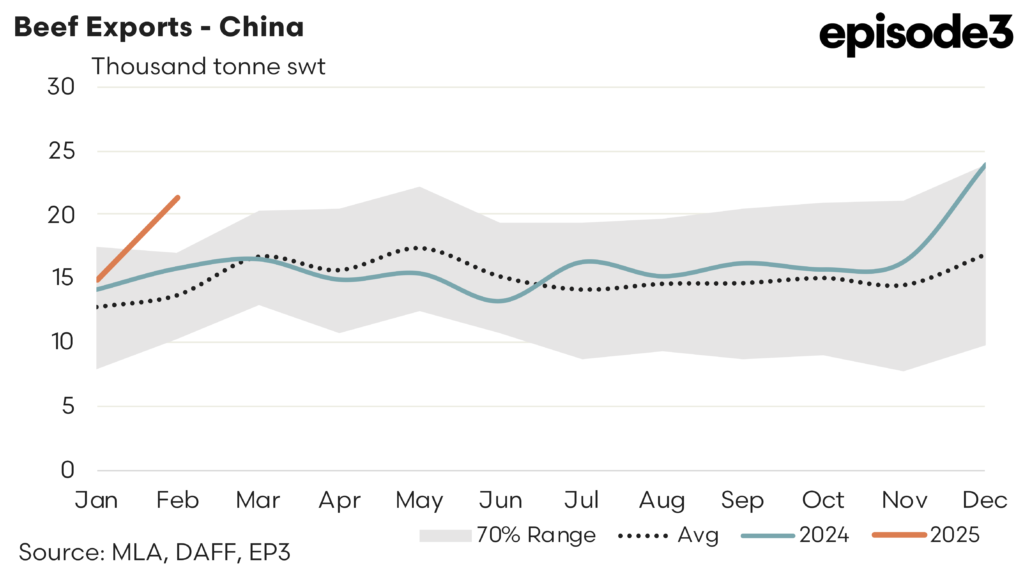

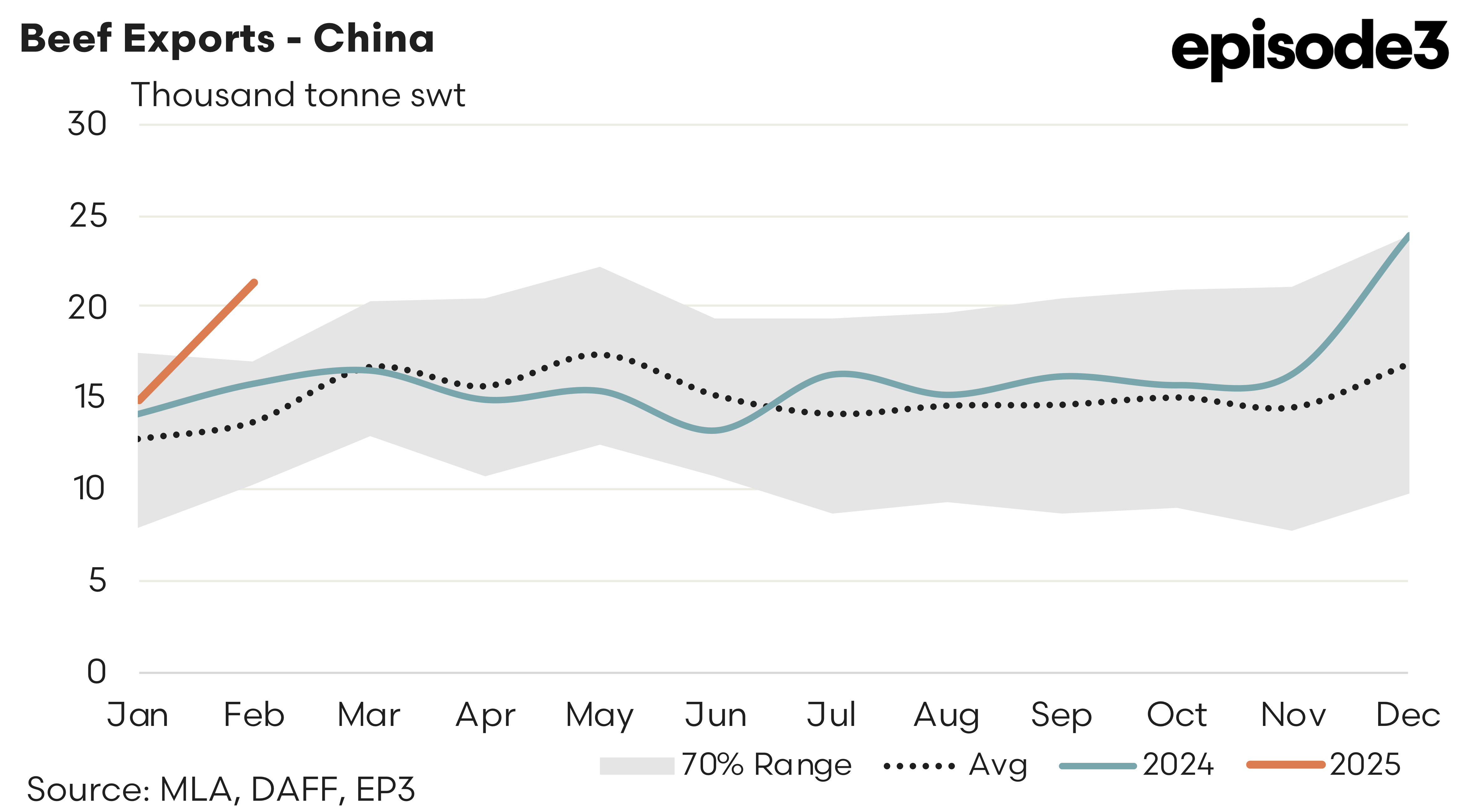

China – Beef exports from Australia to China made a new record for February flows, beating the prior February record, held in 2019 when China was in the midst of its African Swine Fever crisis, by 12%. There was 21,373 tonnes of Aussie beef shipped to China during February 2025 a 36% improvement on February 2024 and reflective of levels that are 57% above the five-year average flows usually seen during February.

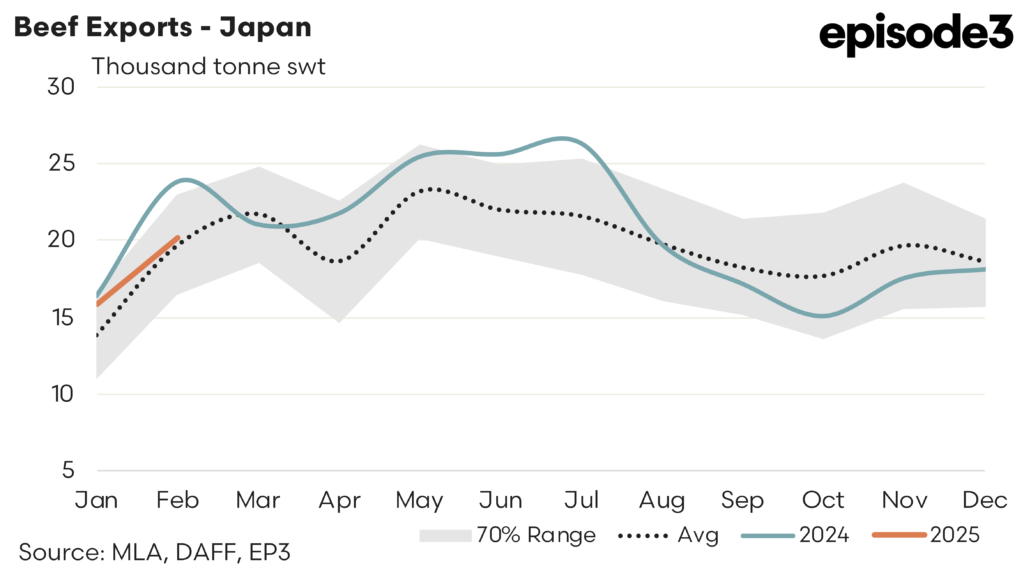

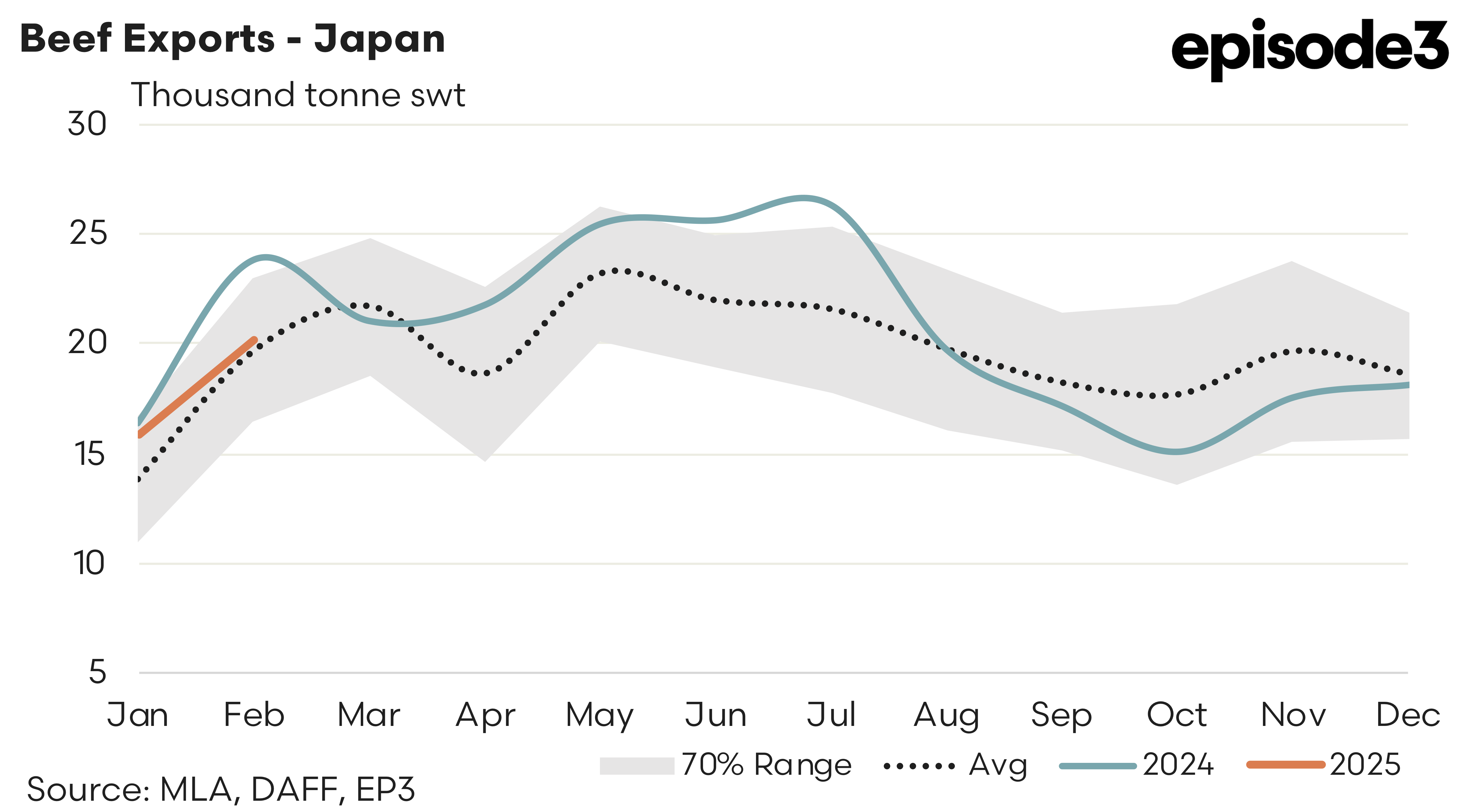

Japan – There was 20,115 tonnes exported to Japan over February 2025, which is just 2% above the five-year average trend for this time in the season. Compared to February 2024 the current trade volumes are 15% softer.

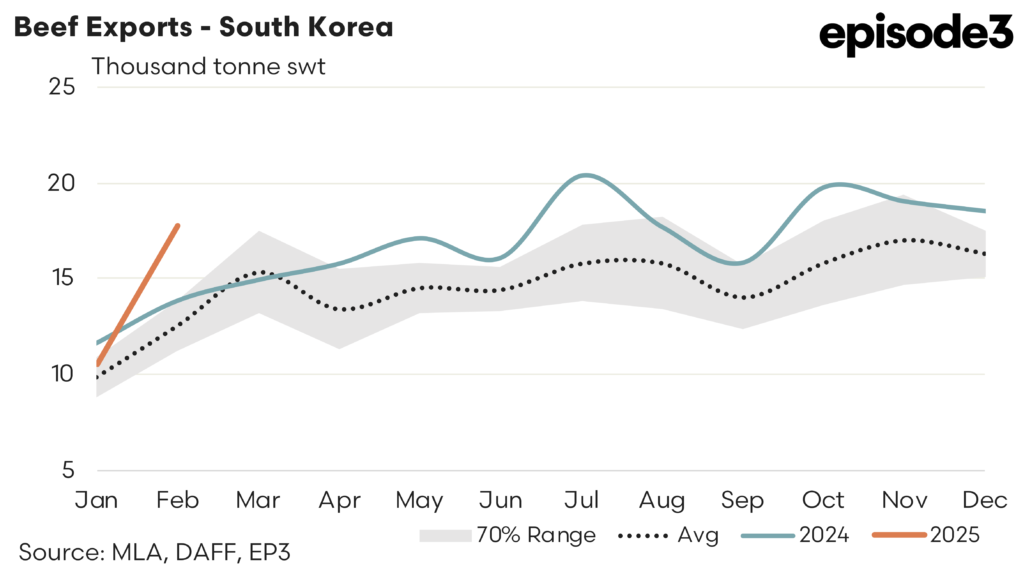

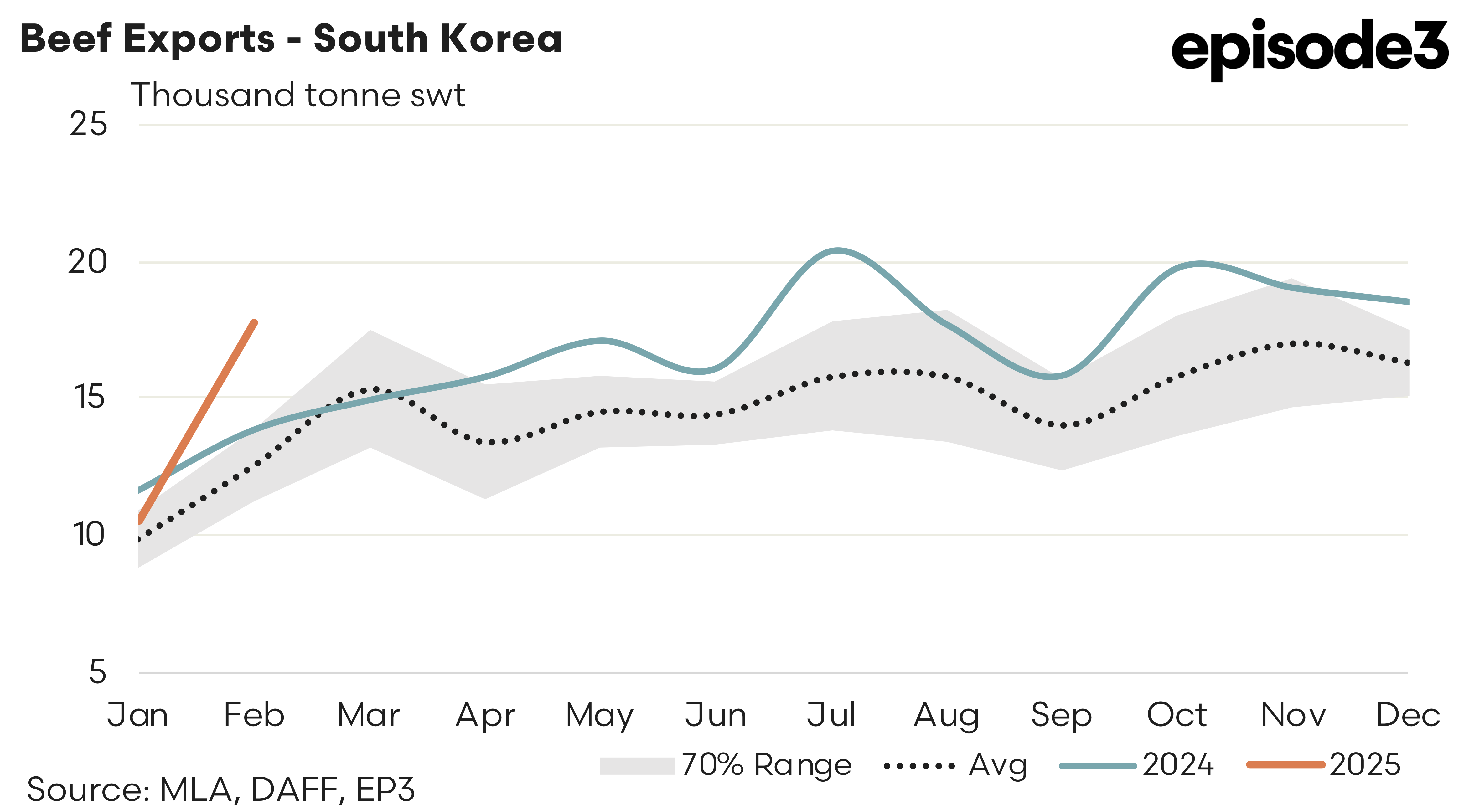

South Korea – Aussie beef demand from South Korea roared into life with a 68% gain on the levels shipped during January to see 17,778 tonnes exported. This represents trade flows that are 28% higher than what was sent in February 2024 and is 41% higher than the average February flows, based on the last five years of the trade.