Hamming it up

Market Morsel

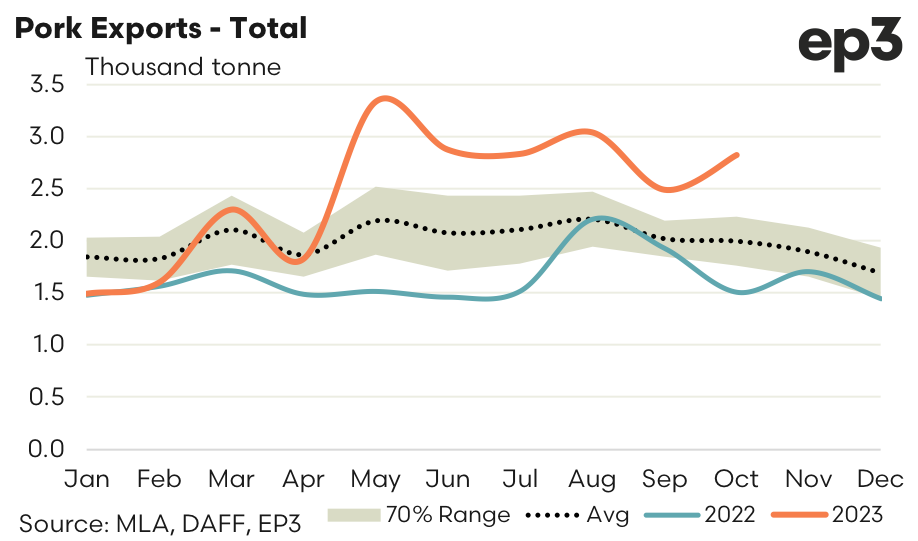

Piggybacking off of Minister Murray Watt’s tweet today, reminding Aussie retailers not to raise the price of Xmas hams, the team at Episode 3 are taking a look at the local pig industry and the growing export demand for Aussie pork seen so far during 2023. The current season for pork exports started slowly, with total pork export volumes running below average trends during January and February.

However, after April export flows for Aussie pork roared into life and has remained elevated through to October. To date, average monthly exports of pork during 2023 has been nearly 2,500 tonnes per month. Compared to last year export flows from January to October are nearly 51% higher and 22% above the monthly pattern set by the five-year average seasonal trend.

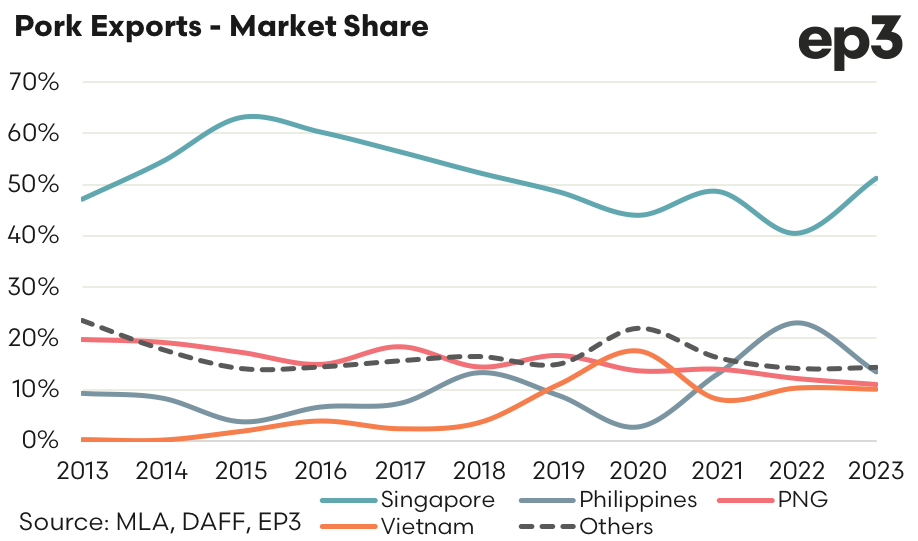

Analysis of the market share of Australian pork exports highlights that Singapore is the dominant trade destination, accounting for 40%-60% of the trade most years. So far in 2023 Singapore has taken 51% of total Aussie pork exports. The Philippines sits in second top place for Aussie pork exports accounting for nearly 14% of the trade flows during 2023. Meanwhile Papua New Guinea (PNG) and Vietnam are battling it out for third place sitting on 10.9% and 10.1% of total pork exports this year, respectively.

A summary of the top four trade destinations for Aussie pork during 2023 is as follows:

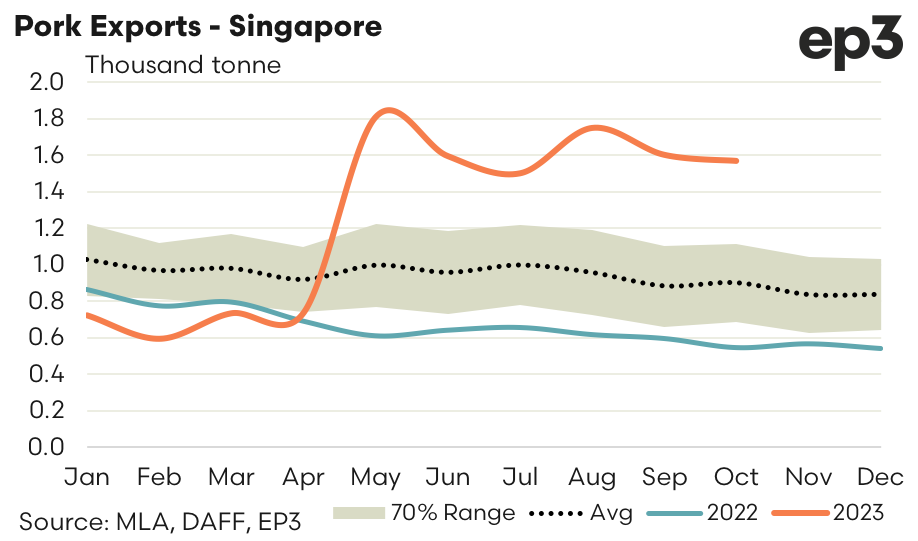

Singapore – Mirroring the pattern set by the total pork flows, demand for Aussie pork in Singapore started 2023 in a subdued fashion with average monthly volumes from January to April running about 28% under the five-year average seasonal trend. However, since May the demand has improved significantly with average monthly flows from May to October sitting 73% above the five-year seasonal pattern.

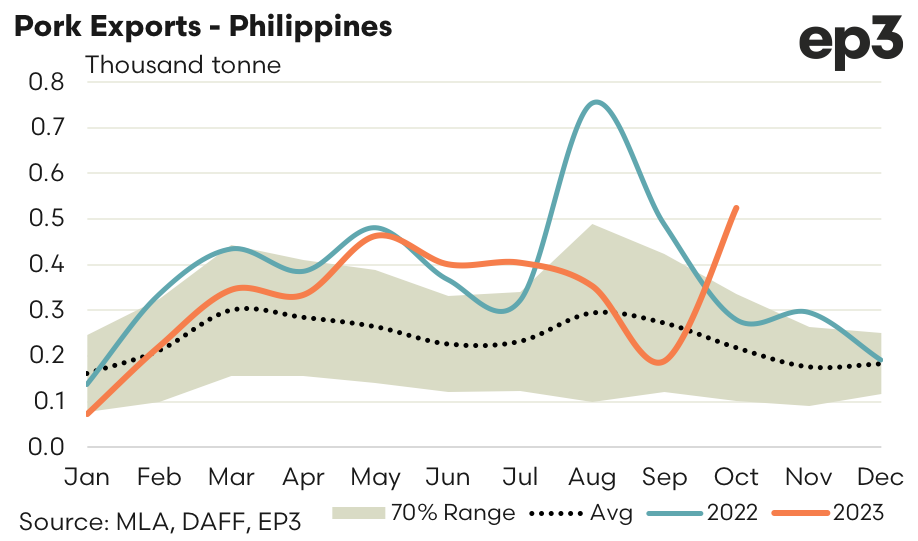

Philippines – Apart from a weak start to 2023 and a dip in volumes during September the remaining months for 2023 have seen above average pork exports from Australia to the Philippines. Compared to the five-year average pattern the trade over 2023 has been running nearly 35% higher this year. Although, compared to 2022 export volumes to the Philippines are down by 17% this year.

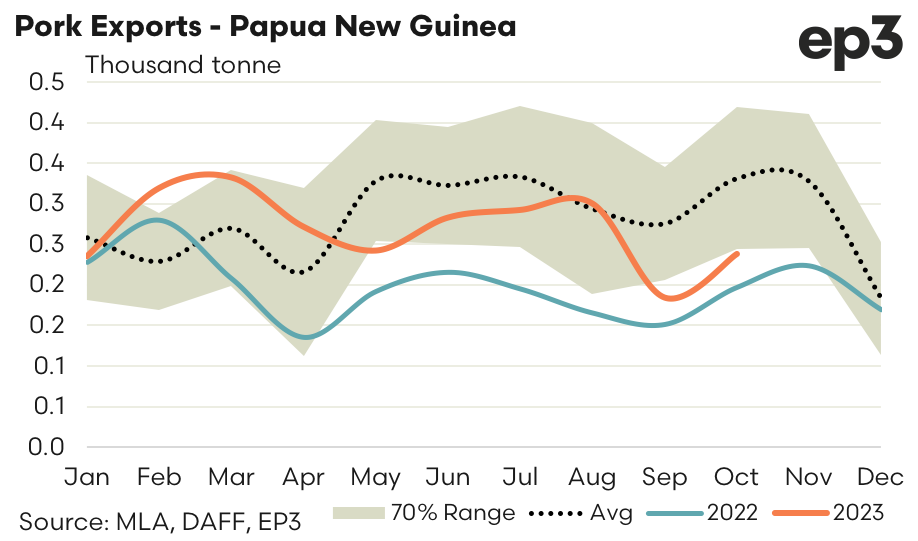

PNG – Papua New Guinea saw a rather subdued 2022 in terms of Aussie pork demand with average monthly volumes running 30% below the five-year average trend last year. So far in 2023 trade volumes to PNG are averaging monthly flows that are nearly 37% higher than the volumes seen exported in 2022, but are still 6% under the five-year average seasonal pattern.

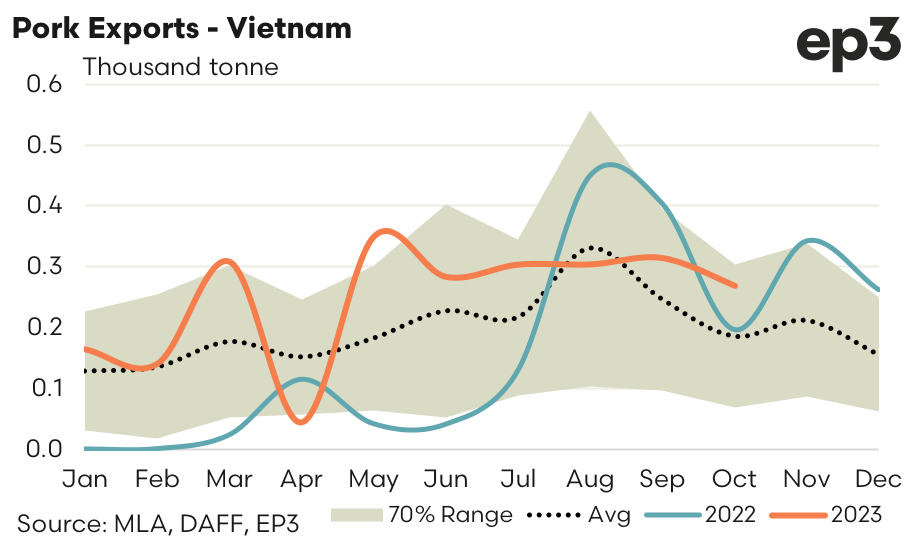

Vietnam – There was a brief dip in Aussie pork exports to Vietnam during April 2023, but other than this most months during this year have seen above average flows recorded. Compared to the five-year seasonal average pattern pork exports to Vietnam have been 25% higher during 2023 and 77% stronger than the levels seen during 2022.

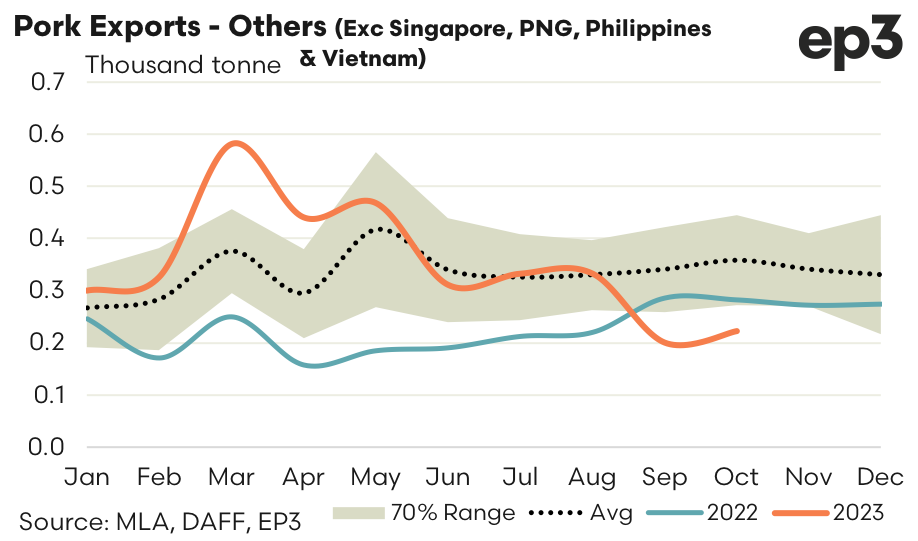

Meanwhile, monthly pork export flows from Australia to all other destinations (excluding the top four countries listed above) has been in a downtrend since March 2023. Despite the downtrend, average monthly flows to other destinations during 2023 have run at about 351 tonnes per month compared to average of 333 tonnes per month based on the last five-years of trade, which equates to pork export volumes nearly 6% above the average monthly pattern.