He ain’t heavy, he’s at a premium

The Snapshot

- In September 2016 the Australian National Heavy Steer reached a record premium spread of 13% to the US Choice Fed Steer. However, by mid-November 2016 it had moved back to a discount.

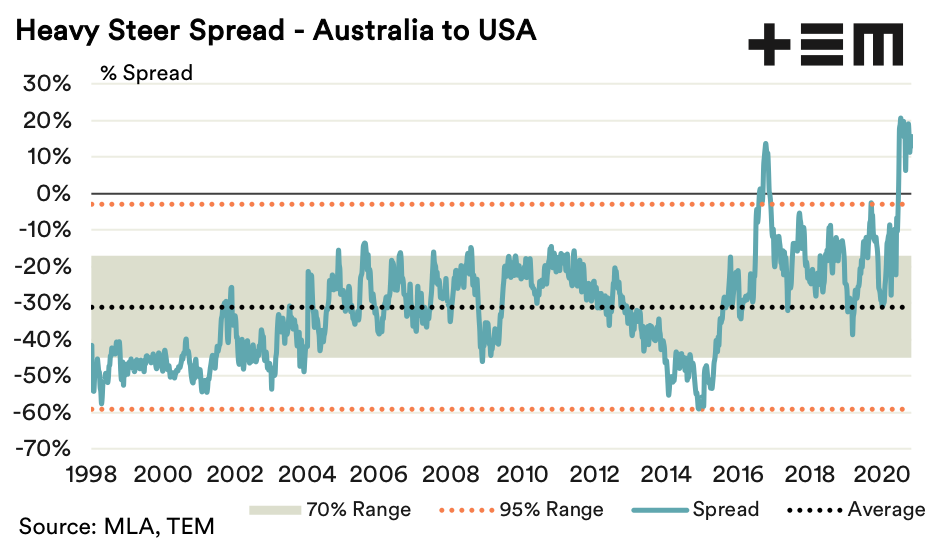

- Since 1998 the long-term average spread has been a discount of 31%, with the spread fluctuating for 70% of the time between a discount of 45% to a discount of 17%.

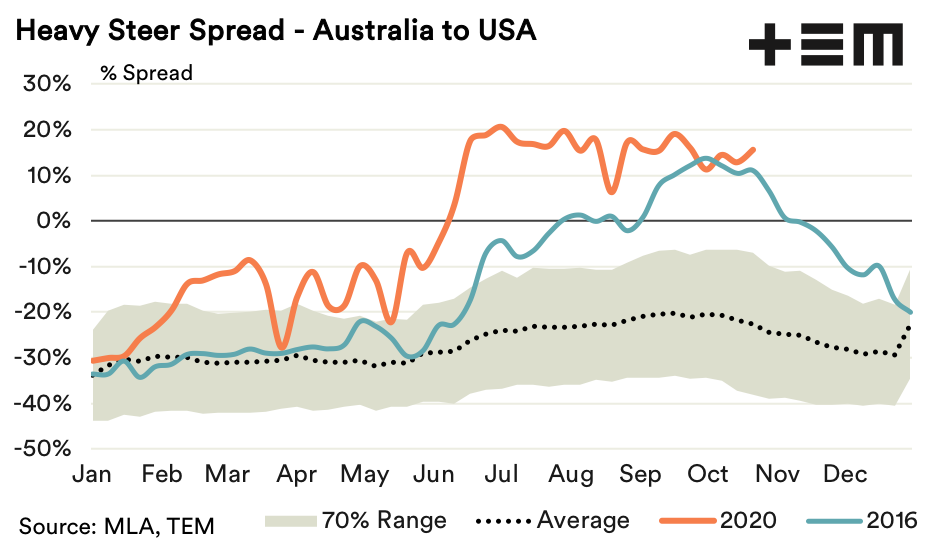

- During the 2020 season the spread moved to a premium in early June and currently sits at a 15% premium, after peaking at a record high of 20% at the end of July.

The Detail

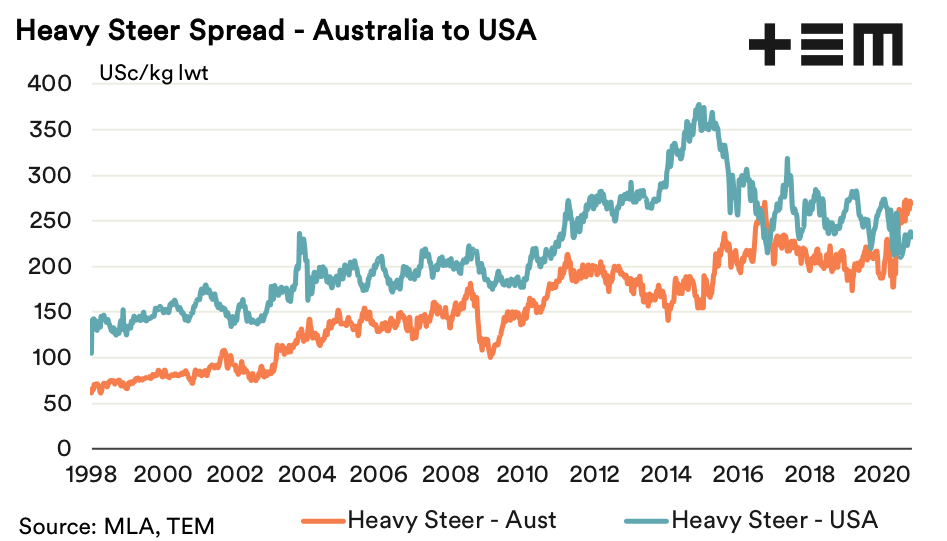

In June the National Heavy Steer moved to a premium to the US Choice Fed Steer based on assessing the two categories of cattle on a USc/kg live weight basis. This is a relatively uncommon occurrence, as usually Australian finished cattle prices run at a discount to the USA.

Historic price data highlights that the last (and only other) time that the National Heavy Steer indicator moved to a premium to the US equivalent in the last two decades was briefly during the 2016 season. In July of 2016 the National Heavy Steer moved into premium territory and by September was sitting at 262USc/kg lwt compared to the US Choice Fed Steer at 231USc/kg lwt, representing a premium spread of 13%. However, by mid-November 2016 it had moved back to a discount.

Historic analysis of the spread between these two categories of Heavy Steer highlights that since 1998 the long-term average spread has been a discount of 31%, with the spread fluctuating for 70% of the time between a discount of 45% to a discount of 17%.

During the 2020 season the spread moved to a premium in early June and currently sits at a 15% premium, after peaking at a record high of 20% at the end of July.

The seasonality chart for the spread highlights the current seasons performance compared to the premium period during the 2016 season. The move to a premium came much more rapidly this time around and the premium has persisted at relatively strong levels for a longer time frame during the current phase.

Prominent US cattle market commentators suggest that during quarter four of 2020 we could see an improvement to prices as lower turnoff figures are expected in the next few months from US feedlots.

During the Covid19 disruptions to the US cattle supply chain earlier in the season US, with the shutdown of processors during April/May, there was a backlog of cattle to get through. After noting increased numbers of cattle of feed during July US feedlots reduced placements accordingly.

US processors have managed to get on top of the backlog in recent months and with export demand for beef, particularly from China, increasing in recent months there are expectations that cattle on feed marketings for the remainder of the year will be a bit light on and likely provide some support to US cattle prices as we head toward the end of the year.

This could put some pressure on the current premium spread between Australian and US cattle prices. Although, with the tight supply in Australia to continue into 2021 don’t expect to see it back near a 30% discount any time soon.