Heavies hard to find

Market Morsel

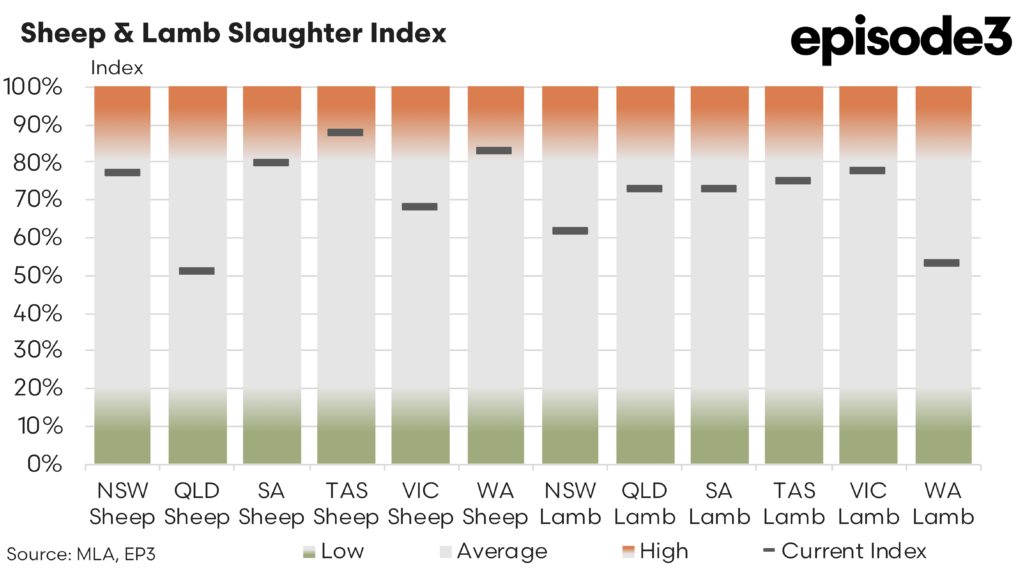

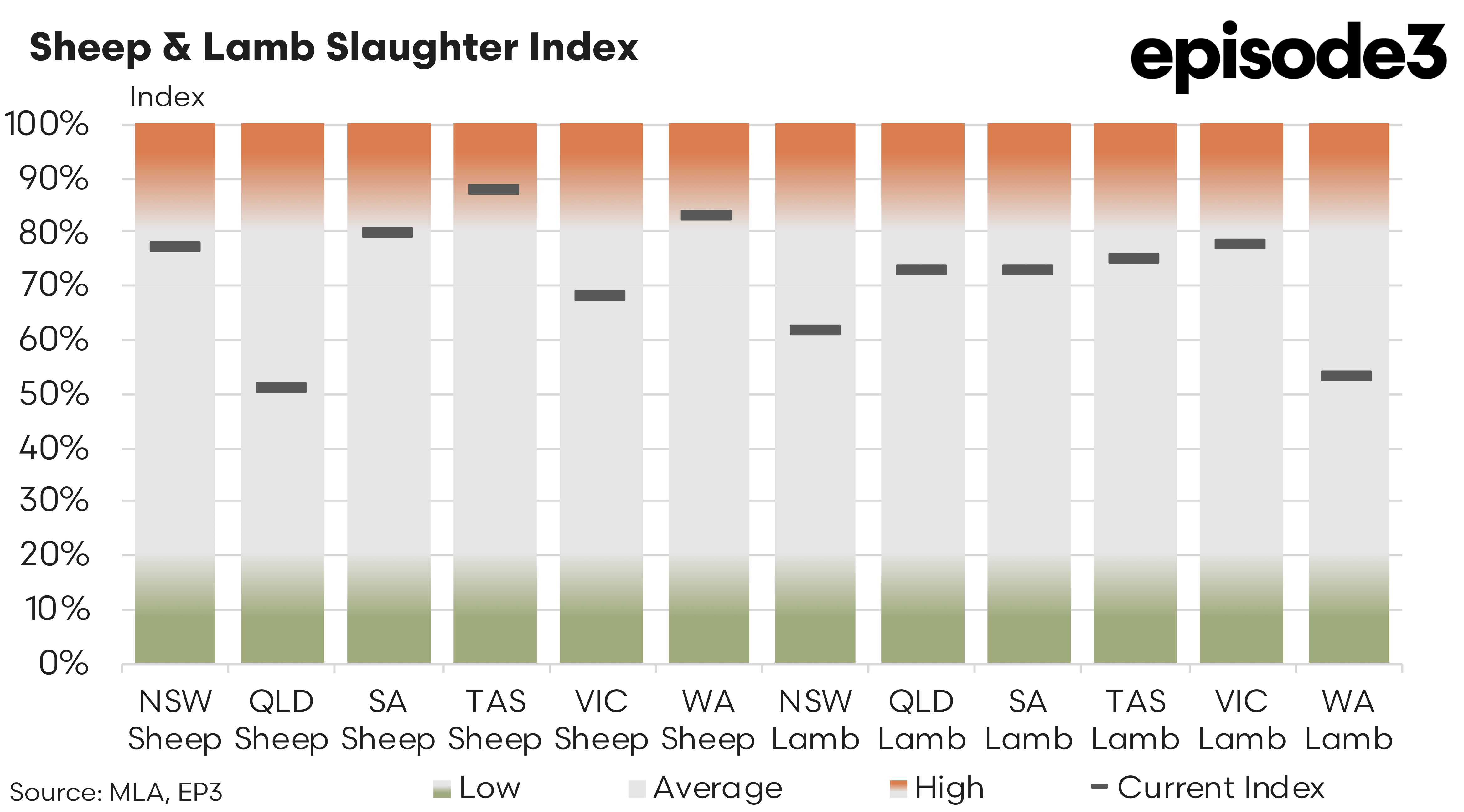

The fluctuations in slaughter index scores between January and February highlight the pace of processing activity across different regions, while price trends indicate varying levels of demand for different lamb and sheep categories.

In the sheep sector, processing volumes have seen considerable increases across multiple states. New South Wales recorded a strong rise in its sheep slaughter index, increasing from 64% in January to 77% in February. Victoria followed a similar trajectory, climbing from 61% to 80%, reflecting heightened throughput. Tasmania also experienced a significant uplift, moving from 69% to 88%, reinforcing the overall trend of increased slaughter activity. Western Australia recorded a smaller but still notable increase, with its slaughter index rising from 60% to 68%. Queensland saw the most dramatic jump in sheep processing, with the slaughter index climbing from 54% to 83%, albeit on a very low base. South Australia was the only state with minimal change, with its sheep slaughter index increasing slightly from 50% to 51%. The overall increase in sheep processing has been accompanied by improved demand, particularly for mutton, which has seen stronger price support over the past month.

The lamb sector has also seen higher processing volumes, aligning with the seasonal influx of stock into abattoirs. In New South Wales, the lamb slaughter index rose from 45% in January to 62% in February, while South Australia saw an increase from 65% to 73%. Victoria recorded one of the most substantial increases, with its index moving from 51% to 73%, reflecting a higher volume of lambs moving through processing plants. Tasmania followed the trend, with its index rising from 67% to 75%, while Western Australia recorded the highest increase, from 63% to 78%. Queensland, however, experienced a more modest rise, with its lamb slaughter index increasing from 49% to 53%. These figures indicate that processors are handling a greater volume of lambs, though concerns remain over the availability of heavier lambs as the market transitions into autumn.

The impact of recent processing activity is evident in the monthly price trends across different lamb and sheep categories. Mutton prices have strengthened over the past four weeks, rising by 32 cents per kilogram to 376c/kg cwt, indicating continued demand despite increased slaughter levels. In the lamb market, price movements have been mixed. Heavy lamb prices have edged up by 11 cents per kilogram over the past month, now sitting at 823c/kg cwt, while trade lamb prices have seen only a marginal four-week increase of 1 cent per kilogram, bringing them to 794c/kg cwt.

Light lamb and restocker lamb prices have shown resilience but with minor corrections. Light lamb prices have softened slightly, declining by 5 cents per kilogram over the past four weeks to 721c/kg cwt. Restocker lambs have followed a similar pattern, easing by 3 cents per kilogram to 717c/kg cwt during the same period. The most notable price decline has been in Merino lambs, which have dropped by 21 cents per kilogram over the past month, bringing their current value to 612c/kg cwt, reflecting weaker demand in this category.

Despite recent volatility, lamb prices remain significantly higher than they were at the same time last year. The heavy lamb indicator is currently trading 168 cents per kilogram cwt above early 2024 levels, while trade lambs are 167 cents per kilogram higher on a year-on-year basis. Light lambs have gained 163 cents per kilogram, while restocker lambs have surged by 183 cents per kilogram compared to the same period last year. Even Merino lambs, despite recent declines, are still trading 72 cents per kilogram higher than in early 2024. These year-on-year gains indicate that overall lamb supply remains constrained, helping to keep prices elevated across most categories.

Heading into autumn, a key concern for the industry is the availability of heavy lambs for processing. While overall lamb throughput has increased, processors are reportedly struggling to source heavier lambs, a factor that could drive price increases in the coming months. If supply constraints persist, demand pressure could intensify, particularly for heavier weight categories, which may see stronger premiums as processors compete for limited stock.

The shifts in slaughter index scores across states illustrate the seasonal adjustments in processing volumes and their subsequent impact on market pricing. Mutton has experienced renewed demand and increased processing throughput volumes, while most lamb categories have remained stable. With concerns mounting over heavy lamb availability, price pressures could emerge in specific segments as the year progresses.