How’d you like your beef – boxed or boat?

The Snapshot

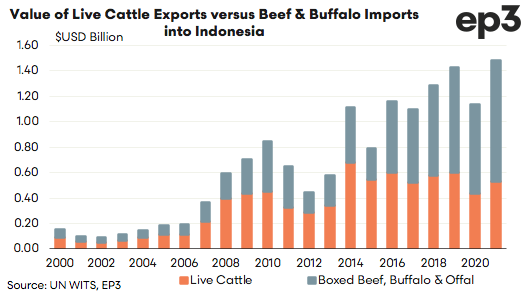

- Combined, the value of the boxed beef/buffalo and live cattle trade into Indonesia has grown from under $US0.2 billion in the early 2000s to around $US1.5 billion in recent years.

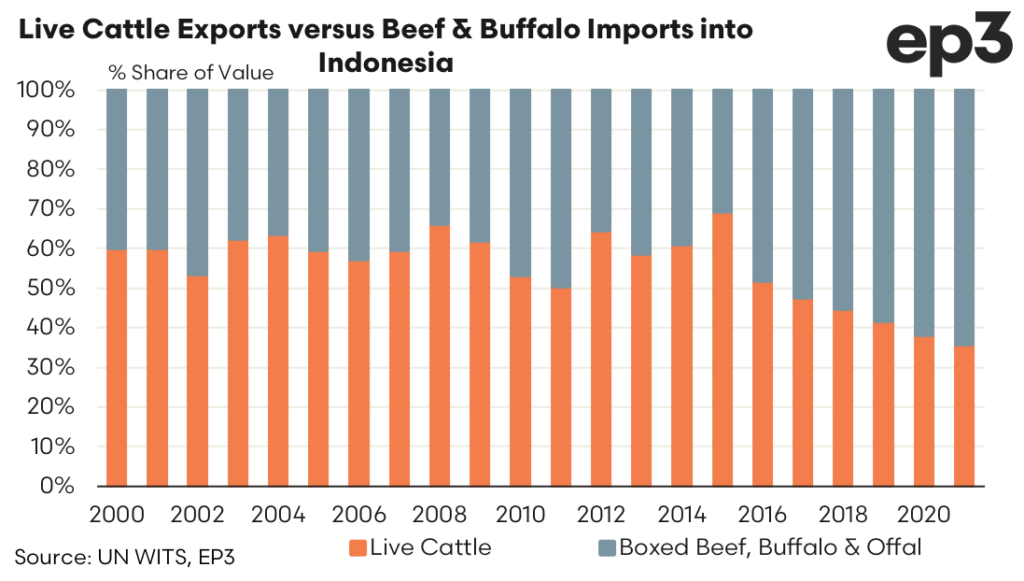

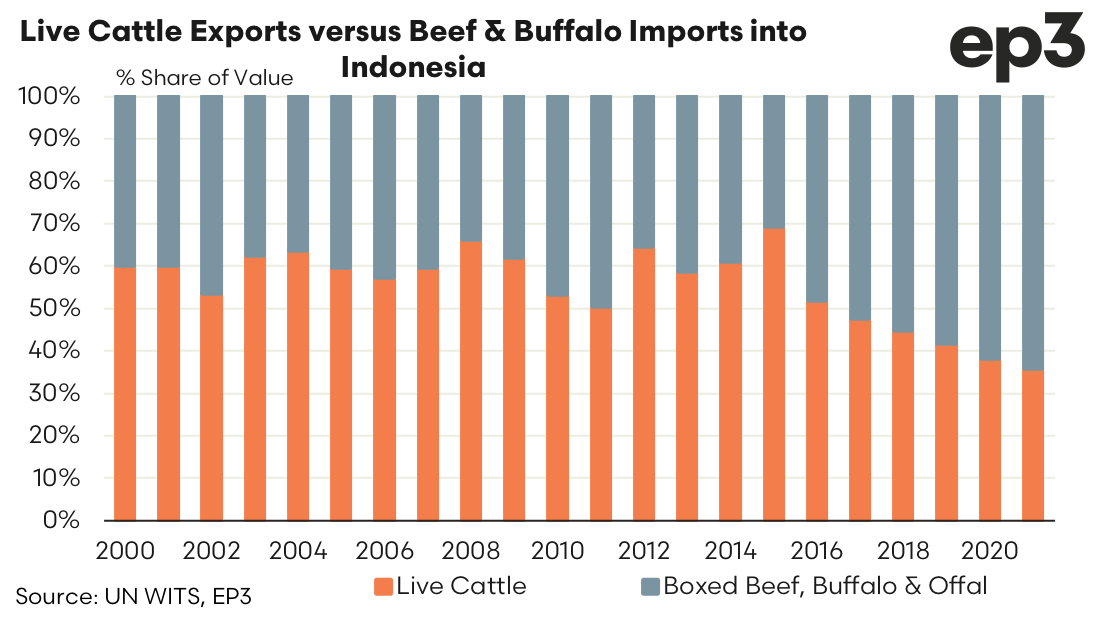

- In recent years the share of value of the live cattle trade into Indonesia has declined in favour of boxed product, with live cattle accounting for nearly 70% of the combined trade (live and boxed) in 2015 versus just 35% in 2021.

- In 2021 Australia accounted for 41.0% of the boxed trade into Indonesia, followed by India in second place on 30.4%.

The Detail

We received a subscriber request via Twitter from Pat Coole to look at the boxed beef trade into Indonesia versus the live cattle trade over the last few decades to see what trends are developing in terms of market growth in each segment. Indonesia is Australia’s largest market for live cattle exports and the fifth biggest market in terms of the market share of boxed beef/offal volumes exported from Australia, so it is definitely worthy of a spotlight.

Combined, the value of both boxed (beef, offal and buffalo meat) and the live cattle export trade has grown from under $US0.2 billion in the early 2000s to around $US1.5 billion in recent years. These values reflect boxed product and live cattle from all sources globally, however the live trade of cattle into Indonesia is dominated almost exclusively by Australia. A breakdown of the top importing countries for boxed product into Indonesia is highlighted further into this analysis and while Australian sources account for a significant share, Indian buffalo meat and boxed beef/offal from the USA and New Zealand also feature prominently.

Expressing the share of the value of total boxed exports versus total live cattle exports (from all destinations) shows that for much of the 2000 to 2015 period the live cattle trade dominated the export flows, accounting for around 60%-65% of the trade value for much of this time frame. In 2015 the share of the live cattle exports into Indonesia was 69% of the value of the combined live/boxed trade. However, since 2015 this share has reduced towards 35% in recent years with the boxed trade now accounting for the bulk of the combined trade value.

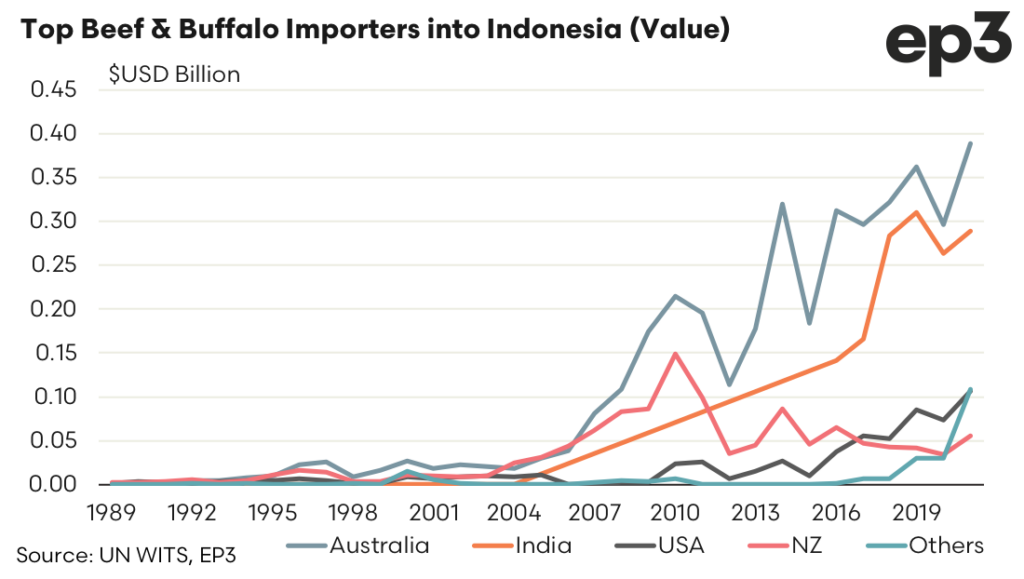

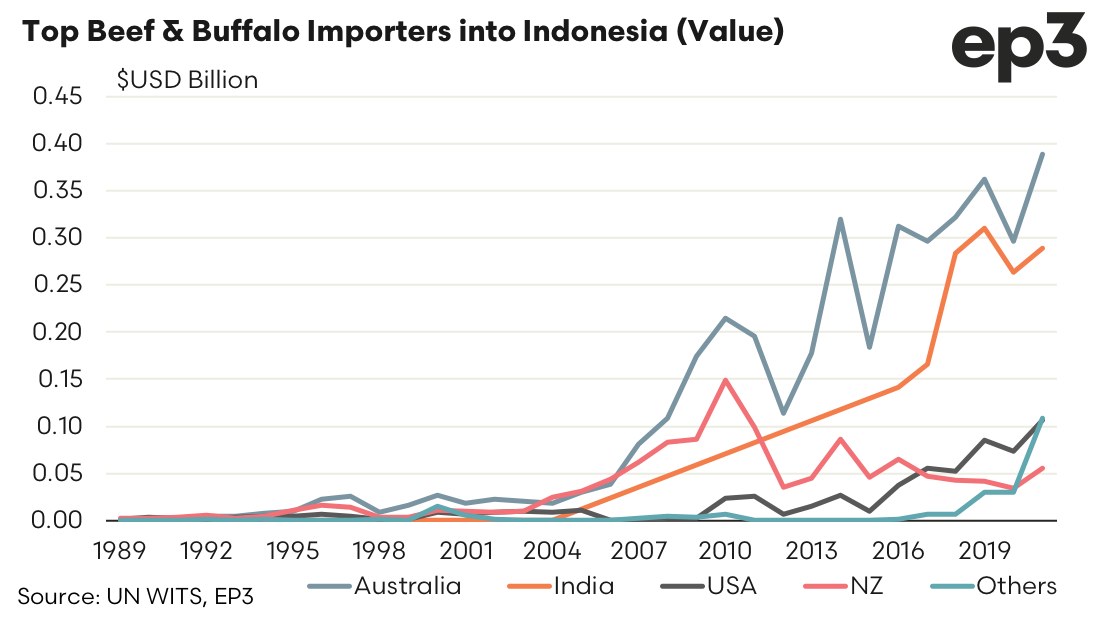

A focus on boxed beef, offal and buffalo exports to Indonesia highlights that the trade began to expand rapidly in the mid 2000s with Australia and New Zealand gaining the early lead over India and the USA. However, the rise in imported Indian buffalo meat into Indonesia has been a prominent feature of the last decade.

2010 signalled the peak in the boxed trade for New Zealand with more recent annual flows accounting for just one third of the value seen in 2010. By 2021 the value of the boxed beef & offal trade from Australia to Indonesia was nearing $US0.4 billion, meanwhile the trade in Indian buffalo meat was approaching $US0.3 billion.

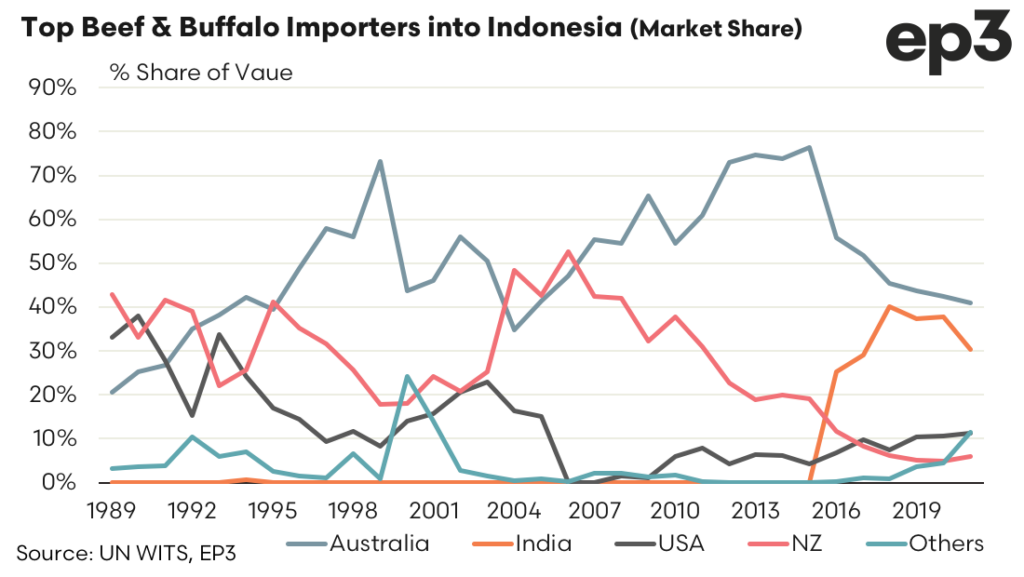

Over the last few decades Australia has dominated the share of value of the boxed trade into Indonesia, ranging from 40% to 70% of the share of value of these trade flows. New Zealand has accounted for 20% to 50% of the trade flows, by share of value but in recent years has seen their share erode towards 5% of the total trade.

The last five years or so has seen India capture 30%-40% of the boxed trade value into Indonesia taking some market share away from Australia and New Zealand with their more price competitive buffalo product. In 2021 Australia accounted for 41.0% of the boxed trade into Indonesia, followed by India in second place on 30.4%. The USA sat in equal third position on 11.3% of the trade, matched by “all other destinations” on 11.4%. Meanwhile, the Kiwis share of the trade sat at just 5.9%.