In the midst of another lockdown

The Snapshot

- A three-month moratorium on the live sheep trade comes with significant economic cost to the supply chain and workers within regional areas, particularly in live sheep export dependent Western Australia.

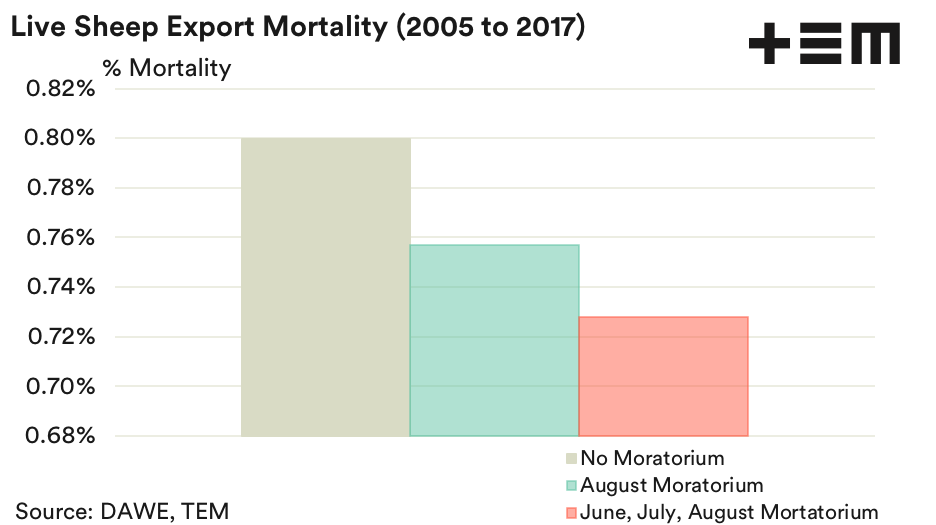

- Modelling on the historic mortality data suggest that reducing the moratorium from a three-month to a one-month window would still have a significant impact in reducing the annual average mortality level.

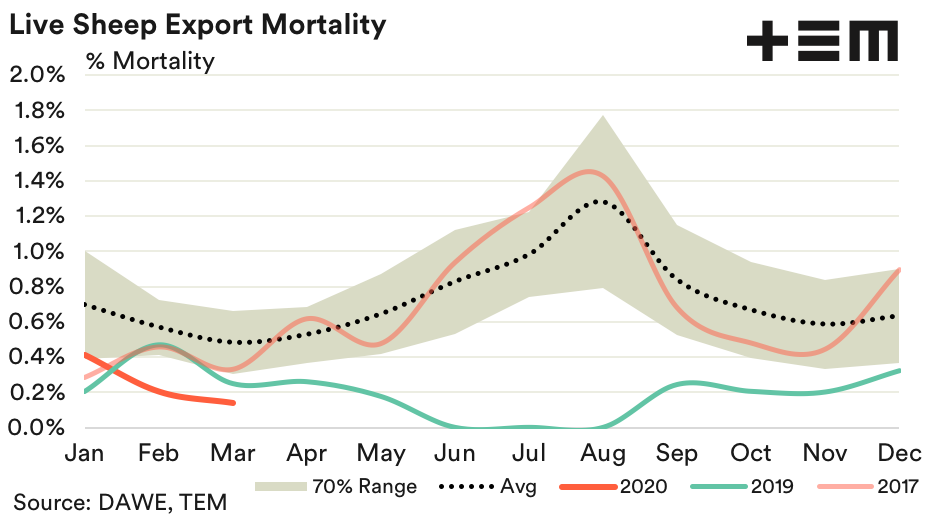

- August is considered the riskiest month, with sheep mortality figures rising above 1.2% and displaying a normal seasonal range anywhere between 0.8% to 1.8%.

- Changes to onboard practices and limits on stock density have seen live export sheep mortality reduce significantly across the entire season.

- The 2019 annual average mortality rate was 0.26%. Significantly below the annual mortality level of 0.74% averaged across the ten years prior.

The Detail

The difficulty facing workers in the current economic environment, with regulatory constraints limiting how an industry can operate has been plain to see. Long queues at the Centrelink office litter the evening news stream as many unfortunate unemployed face extending months of uncertain job prospects.

It would be easy to think this dire situation is in reference to the many employed in hospitality, tourism, retail and the performing arts that have had the rug of job security pulled away from beneath them as Covid19 lockdown restrictions have limited many businesses ability to operate, and employ staff, in their usual manner.

However, it is not in reference to the difficult future facing many workers in the hospitality, tourism, retail and arts sector. It’s actually in reference to a form of lockdown that has been impacting the live sheep supply chain, and those employed within it, for the last three years.

Since 2018 the live sheep export supply chain has faced a moratorium on the trade during the northern hemisphere summer whereby live sheep export vessels have not departed Australia between June and August.

Historically, live sheep export mortalities during the northern hemisphere summer reach their seasonal peaks. August is considered the riskiest month, as the ten-year average seasonal trend in mortality demonstrates, with figures rising above 1.2% and displaying a normal seasonal range anywhere between 0.8% to 1.8%.

Changes to onboard practices and limits on stock density have seen live export sheep mortality reduce significantly across the entire season, compared to the historic trend from the last ten years, as identified by the 2019 pattern. Indeed, the 2019 annual average mortality rate was 0.26%. Significantly below the annual mortality level of 0.74% averaged across the ten years prior.

The impact of the northern hemisphere summer moratorium on sheep mortality is quite evident in the 2019 pattern and clearly helps to bring down the annual average mortality rates. However, a three-month moratorium on the live sheep trade doesn’t come without significant economic cost to the supply chain and workers within regional areas, particularly in live sheep export dependent Western Australia.

While the 2020 LiveCorp report identified that farmers and exporters were adjusting their operations to work around the moratorium period there were several participants in the supply chain that were significantly impacted by the length of the moratorium.

Shearing teams in regional towns reducing their workforce from forty to ten staff and noting the difficulty in holding onto already scarce shearing contractors during the moratorium lockdown. Not to mention the reduced spend in regional communities on daily supplies for these shearing team as they travelled across the state from contract to contract.

Some livestock transport operators reported up to an 85% reduction in their usual workload during the 2019 moratorium. The reduction in contract work of this magnitude also had economic implications for regional suppliers such as fuel depots, tyre fitters, mechanics and engineering firms providing services to the livestock transport sector.

These type of economic impacts of the moratorium-based lockdown to the live sheep export trade isn’t limited to shearing teams and transport operators. Feed mills, contract balers, feed suppliers, livestock agents, veterinarians and other associated livestock export services reported declines in their business revenues during the moratorium mirroring the magnitude of revenue decline seen across many sectors impacted by Covid19 lockdowns during 2020.

Analysis of mortality data from the 2005 to 2017 period demonstrates that removing the June to August period reduces the annual average mortality by 0.9%. Interestingly, modelling on the historic mortality data suggest that reducing the moratorium from a three-month to a one-month window would still have a significant impact in reducing the annual average mortality level. Excluding the August data alone drops the annual average mortality by 0.4%, without the lengthy three moth economic impact on the live sheep export supply chain.

Furthermore, improvements to live export shipping practices in recent years have meant that transportation during June, July and September would likely result in lower mortalities than have been experienced pre-2018. This is evident in the very low mortality rate of 0.08% recorded on the June 2020 departure of the MV Al Kuwait, which was given an exemption to travel during the moratorium period this season. Perhaps it is time to consider a shorter moratorium period?