Is there a bustle in your hedge tool?

The Snapshot

- The price spread between Australian heavy steers and US Live cattle futures has approximately 30% more volatility than the monthly movement in the Australian heavy steer price, on average.

- The measure of correlation between monthly movements of the Live Cattle futures prices and Heavy steer prices is very weak, with a Person’s coefficient of just 0.0076.

- Using US Live Cattle futures to hedge price risk for cattle in Australia would expose the local producer to more risk rather than less.

The Detail

Hedging is the process of managing price risk on a commodity and can be undertaken with the use of financial instruments such as futures contracts. In simple terms, putting on a hedge is taking an opposite position in the futures markets to that which you have in the physical market.

In the case of a cattle farmer that wants to protect themselves from a decline in the cattle price it would be to sell a futures contract in cattle for a date in the future that he expects to turn off his cattle. Unfortunately, for the Australian cattle farmer there isn’t really a viable local version of a futures market that has the pricing and liquidity to facilitate a hedge. However, there is a cattle futures market in the USA that is actively traded, namely the Live Cattle contract traded on the Chicago Mercantile Exchange (CME).

For a futures contract to be a suitable hedge it needs meet a handful of key criteria that fit the underlying physical commodity upon which it is attempting to negate the price risk. Ideally the price of the futures contract will move in the same direction as the underlying physical commodity and the movement of the spread (the price difference between the futures contract and the underlying commodity) will be less volatile than the movement in the underlying commodity, itself.

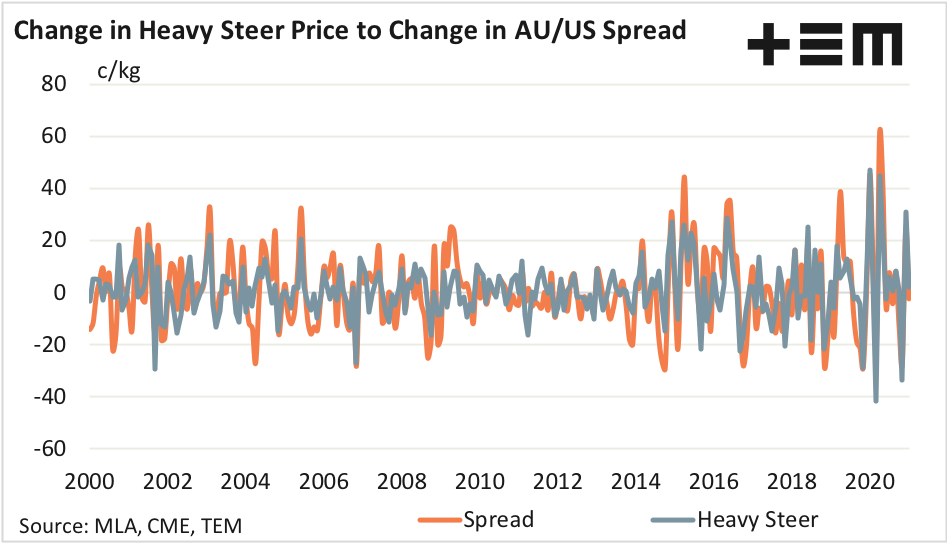

Taking a look at the monthly movement in price of Australian heavy steers compared to the movement movement in spread between Australian Heavy Steer prices and US Live Cattle futures prices (when converted from US cents per pound into AU cents/kg) we can see that the spread between the two price series has a higher degree of variability that the movement in Australian heavy steer prices.

Indeed, monthly data since 2000 shows that the spread has approximately 30% more volatility than the monthly movement in the Australian heavy steer price, on average. This indicates that Aussie beef producers using US Live Cattle futures to hedge would open themselves up to the potential of more price risk, rather than less.

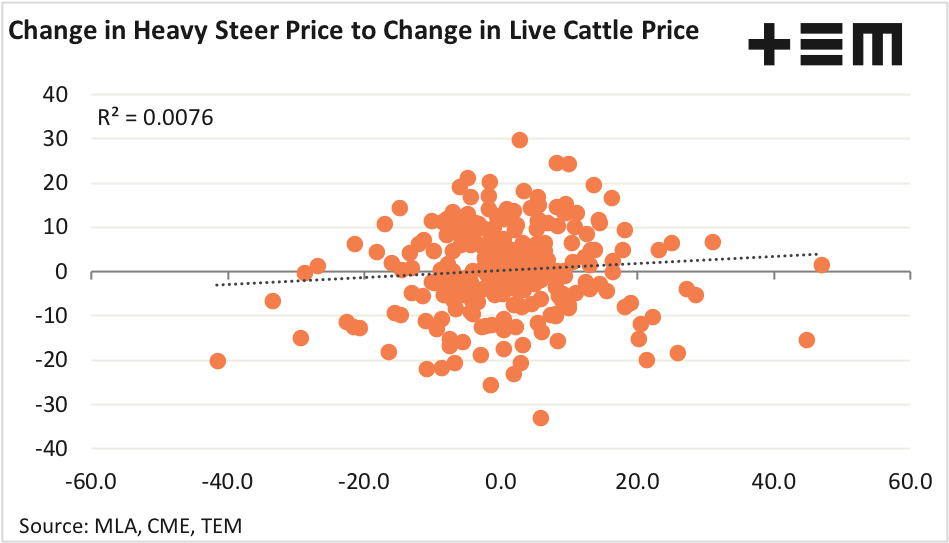

Analysis of the directional monthly change in price between Australian heavy steers and US Live cattle futures prices also raises significant cause for concern in that the measure of correlation between the two price series is very weak, with a Person’s coefficient of just 0.0076. This measure ranges between 0.0 and 1.0. A measure of 1.0 reflects perfect correlation, while a zero correlation indicate no relationship.

This suggest that on a monthly basis the price movements between the US Live Cattle futures do not match up with movements in Australian cattle markets. Therefore, using US Live Cattle futures to hedge would be problematic as some months the price movements could match but other times they could go in opposite directions. For a hedge to work effectively the futures price movement and the price of the physical commodity should match each other relatively closely so that a gain in one price would be offset by a loss in the other, thus reducing the price risk.

As outlined earlier there are local futures contract alternatives to manage price risk, but they are not adequately supported by participants within the cattle sector and therefore are largely irrelevant. The main tool a producer has to manage their price risk at present is to forward contract direct with a processor, but generally these are only available for short term horizons of a month or two ahead. This short time frame doesn’t allow for longer term strategic planning and effective price risk management.