January’s tone

Market Morsel

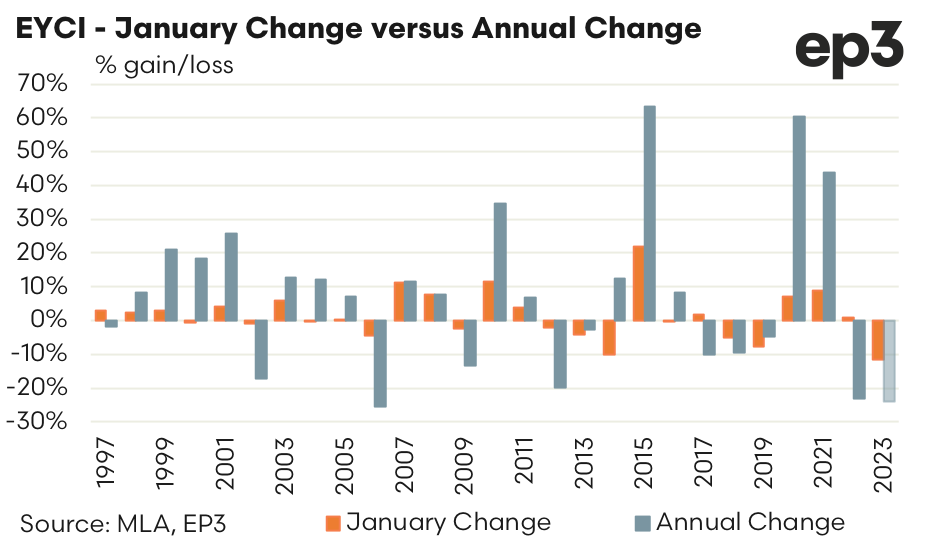

This piece of analysis should start with a disclaimer that past performance is no indication of future performance, as the economic logic behind this one is pretty flimsy. Yet it is an interesting historical observance – that the directional trend in the Eastern Young Cattle Indicator (EYCI) seen over January often shows what the directional trend for the EYCI will be over the year.

In simple terms if the EYCI goes up over January then it usually goes up for that year too. Similarly, if the EYCI falls over January then the price trend is also usually down for the year.

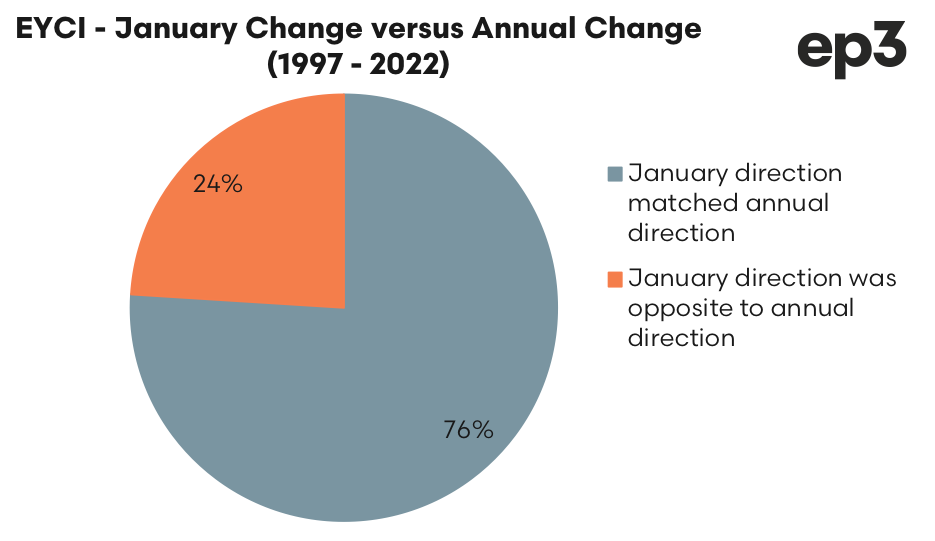

Assessment of the January trend since 1997 to 2022 shows that the annual gain or loss in the EYCI followed the January price pattern 76% of the time. For those that are wondering, the EYCI declined by about 10% in January 2023, an ominous sign.

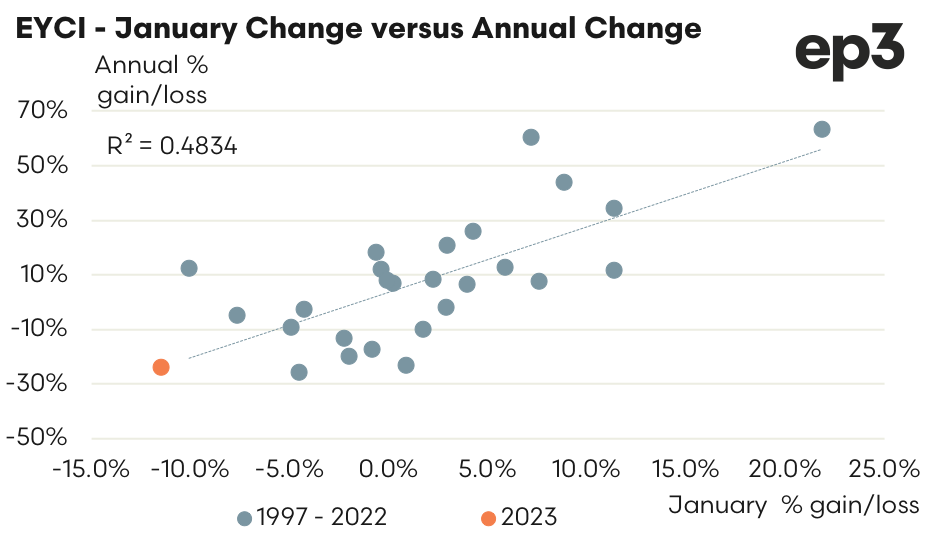

The obvious next step is to see if the magnitude of the January gain or loss in the EYCI has any bearing on the size of the annual change too. A scatter plot of January gain/loss to annual gain/loss shows that there is a mild degree of correlation here. (Bear in mind correlation doesn’t equate to causation!).

However, using the January 2023 EYCI decline as a guide, and comparing the tend of the line of best fit on the scatter plot, this suggests a drop in the EYCI of around 10% in January foreshadows a decline in the EYCI of around 25% this year from the 2023 opening price. If this comes to fruition it will place the EYCI at about 640c/kg by the end of 2023.

For what it is worth, I think the current EYCI levels (circa 730c/kg cwt) are a bit undervalue at present and I anticipate price support to materialise at these levels and likely show some mild price gains over Q1 and perhaps into Q2 of 2023. However, price pressure into Q3 and/or Q4 isn’t out of the question, so a target of 640c/kg by the end of the year is still a feasible outcome.