Killing time in the US

Market Morsel

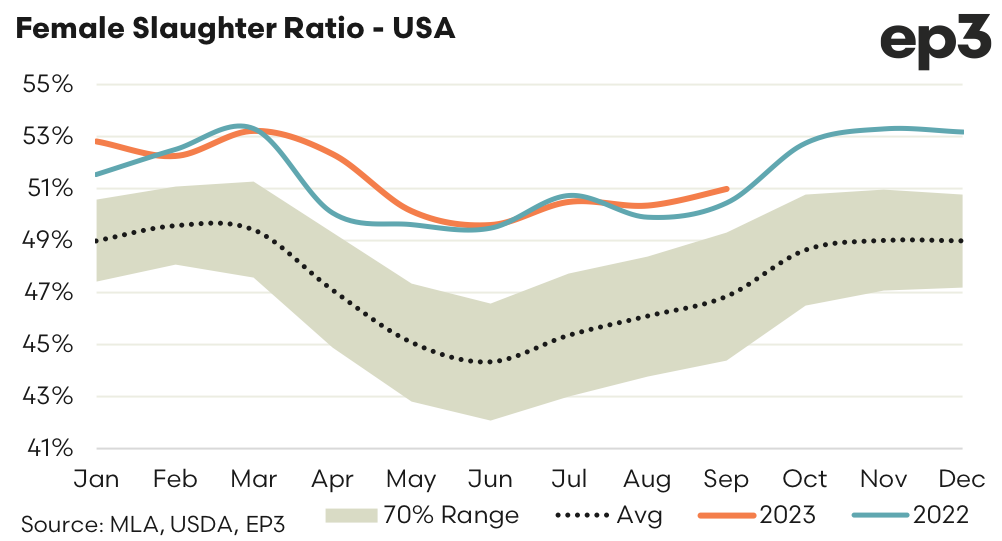

United States Department of Agriculture (USDA) cattle slaughter data as at the end of the September quarter highlights that the USA remain entrenched in a herd liquidation phase. The female slaughter ratio (FSR), a reliable indicator of which phase of the cattle cycle is active – herd rebuild or liquidation, shows that the USA are showing a strong preference for liquidation.

The monthly FSR pattern for 2023 is running at similar levels to what we saw during 2022 and last year saw the FSR at its highest on record, averaging 51.4% for the whole year. An FSR that is above 47.5% in the USA denotes that a herd liquidation is underway so an FSR measure above 51% is well into heavy liquidation territory. The annual average FSR in the USA this year sits at 51.3% (as at the end of September 2023) so this season is on track for further declines in the US herd.

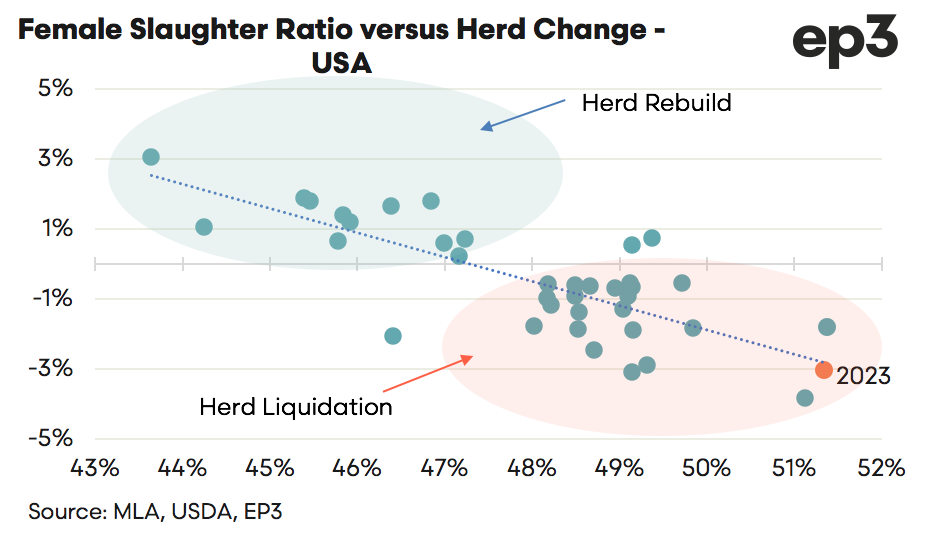

A scatter plot of annual herd change versus the FSR clearly identifies the rebuild from liquidation phase, and just how well the FSR explains what is happening with regard to the US cattle cycle. Most years when the FSR was below 47.5% the US herd increased, similarly most years when the FSR was above 47.5% saw the herd decline. Generally speaking, the further the FSR moves below 47.5% the stronger the rebuild is that year. Similarly, the further the FSR moves above 47.5% the stronger the herd liquidation becomes.

Based on the line of best fit from the scatter plot an annual average FSR of 51.3% for 2023 suggests that the US herd decline is likely to come in at around 3%. Tighter supply is beginning to impact beef cold stores in the USA during 2023 and it has pushed US cattle prices to record levels recently. This will mean more opportunities for Australian beef exports into the USA and will also make Aussie beef exports more competitive against US beef product in key markets like Japan, South Korea and China.