Lamb exports chopped

The Snapshot

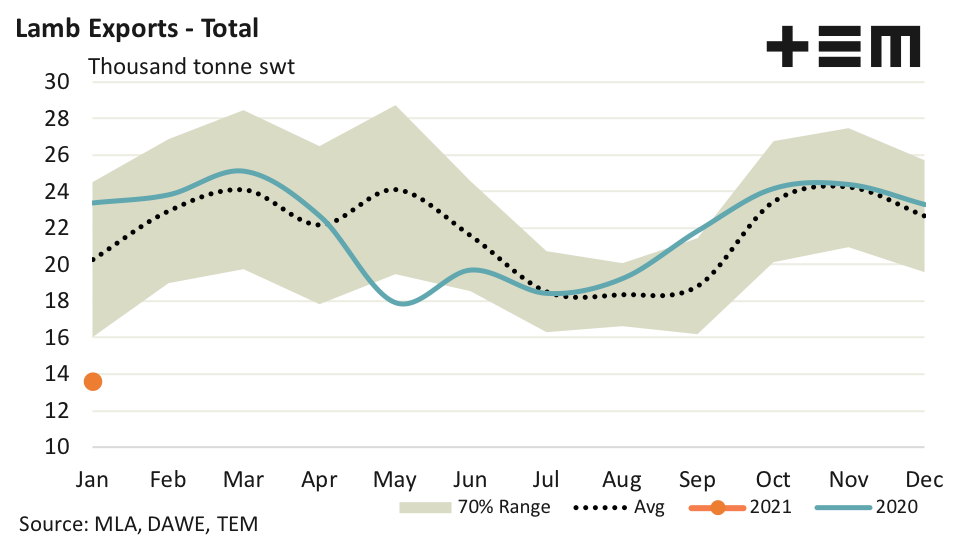

- Total lamb export volumes for January 2021 came in at 13,595 tonnes swt, 33% under the five-year average pattern and 42% below the levels seen at this time last season.

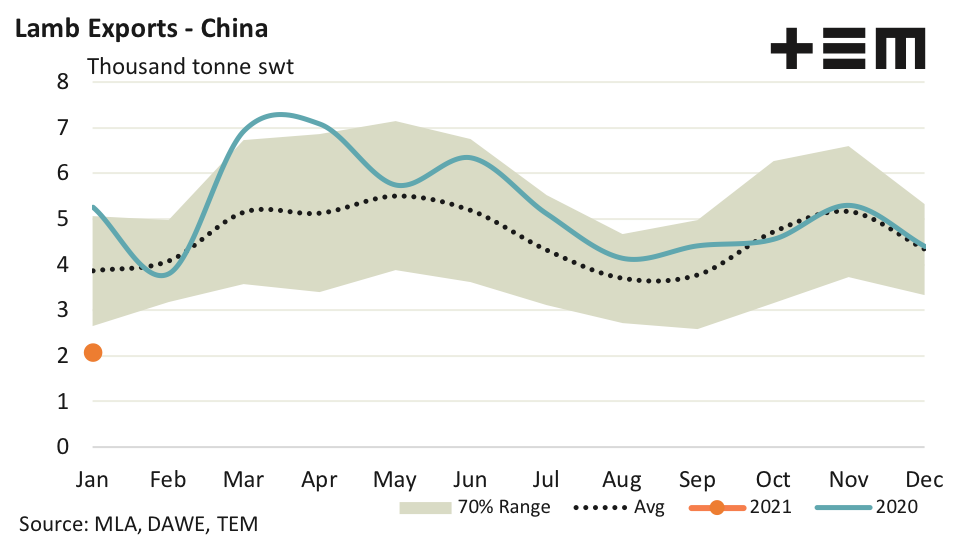

- China recorded just 2,078 tonnes swt, a level 46% under the January average pattern and a 60% decline on the 5,260 tonnes reported in January 2020.

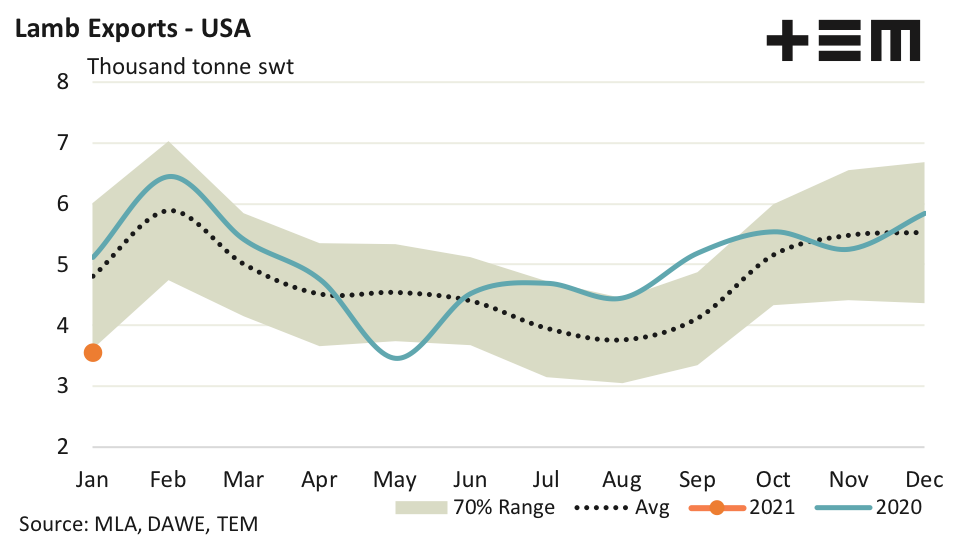

- The USA reported a January 2021 figure of 3,562 tonnes swt. A better figure than the Chinese effort, but 26% under the five-year seasonal average trend for the January period.

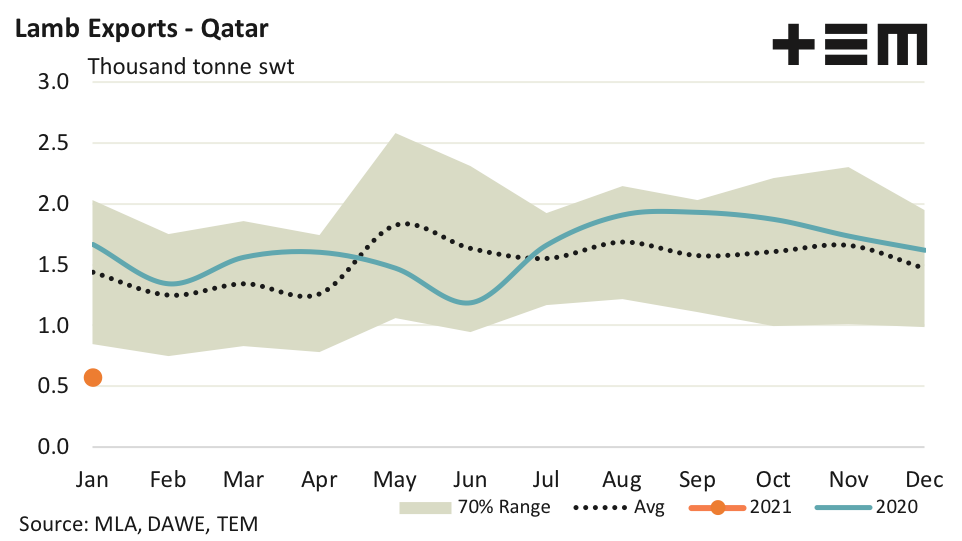

- Qatari lamb export volumes came in at just 575 tonnes swt, which is 60% under the five-year January average and a possible signal that the removal of the import subsidy on Aussie lamb is having an impact.

The Detail

Total lamb export volumes for January 2021 came in at 13,595 tonnes swt, the lowest January figure since the 2012 season. The five-year average volume for January sits at 20,276 tonnes and the January 2020 volumes was 23,366 tonnes. This puts the current levels at 33% under the average pattern and 42% below the levels seen at this time last season.

Taking a look at the top four export destinations for Australian lamb exports there wasn’t much joy, with all centres reporting well below average trade volumes. Additionally, the “other nations” category, which includes all other countries except the top four (China, USA, Qatar and the United Arab Emirates) was also well below average. Indeed, these destinations all reported lamb export volumes below the lower boundary of their normal seasonal range which demonstrates a really weak start to the year.

In 2020 China took the most Australian lamb with a market share of 23,9% of total lamb exports. In January 2021 they recorded just 2,078 tonnes swt, a level 46% under the January average pattern and a 60% decline on the 5,260 tonnes reported in January 2020.

Meanwhile the USA, which was second top destination in 2020 at a market share of 23.0% of the total lamb volumes from Australia, reported a January 2021 figure of 3,562 tonnes swt. A better figure than the Chinese effort, but 26% under the five-year seasonal average trend for the January period.

Qatar held third spot during the 2020 season, accounting for 7.4% of the total lamb trade out of Australia. However, the decision to remove an import subsidy late last year was a concern for Aussie lamb producers and exporters. January volumes came in at just 575 tonnes swt, which is 60% under the five-year January average. The three years prior to the import subsidy January volumes to Qatar averaged nearly 500 tonnes, so perhaps we are back to the pre subsidy status quo here.

Although, taking into account that all export destinations have performed well under the average for January it is hard to see if the low volumes to Qatar are all related to the removal of the subsidy so it is probably a good idea to keep tracking this over the season to compare volumes when/if other centres pick up their game a little.

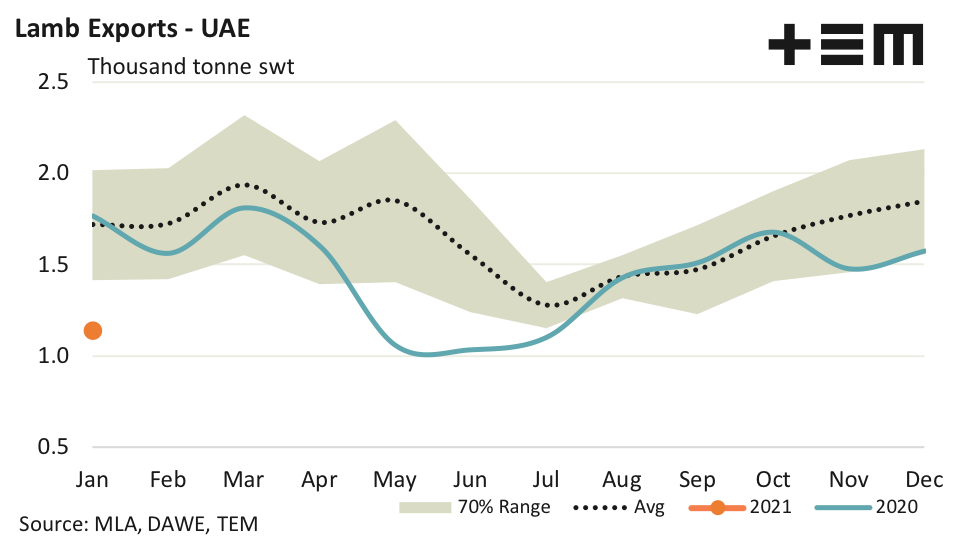

The UAE was Australia’s fourth top destination for lamb exports in 2020 and the January 2021 volumes were equally dismal coming in at just 1,140 tonnes swt, representing a level 27% below the average seasonal volumes for this time in the year.

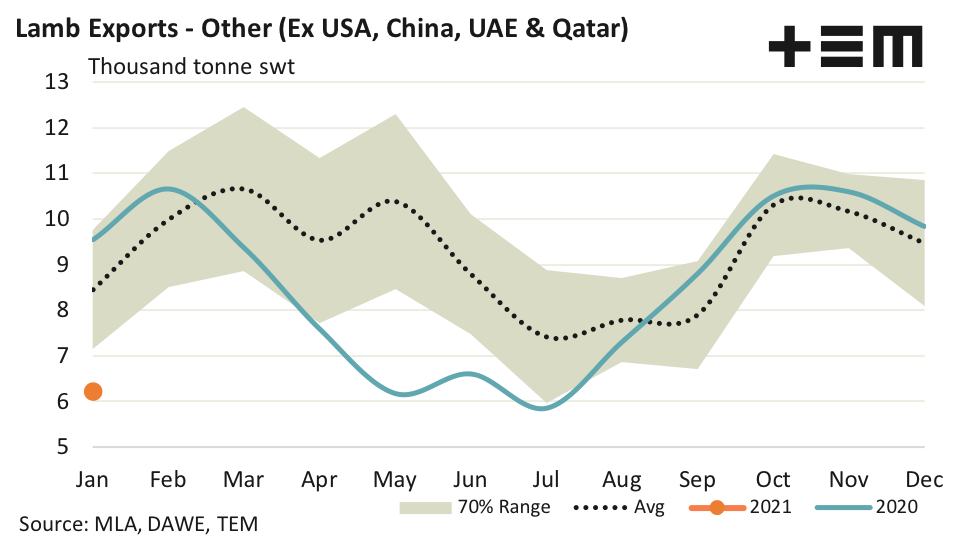

Rounding out a underwhelming start to lamb exports for 2021 was the trade volumes to all the “other nations”. January 2021 volumes for the balance of the trade destinations were pegged at 6,239 tonnes swt. This is a level 26% under the five-year January average. In the words of one ex-US leader “sad”.