Lamb exports solid performance

The Snapshot

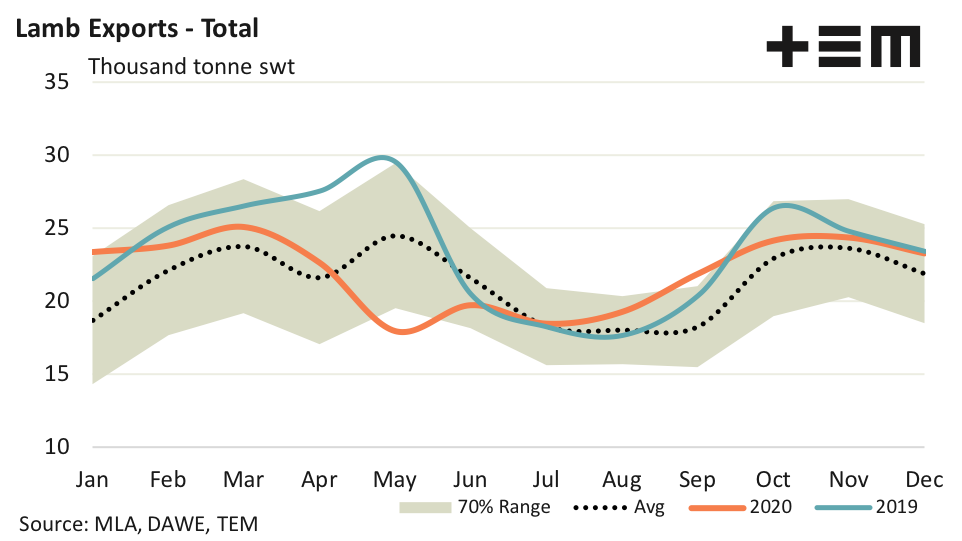

- The 2020 December total lamb export volumes recorded 23,277 tonnes swt consigned and remain 6% ahead of the December five-year average, despite a 5% easing from levels seen in November.

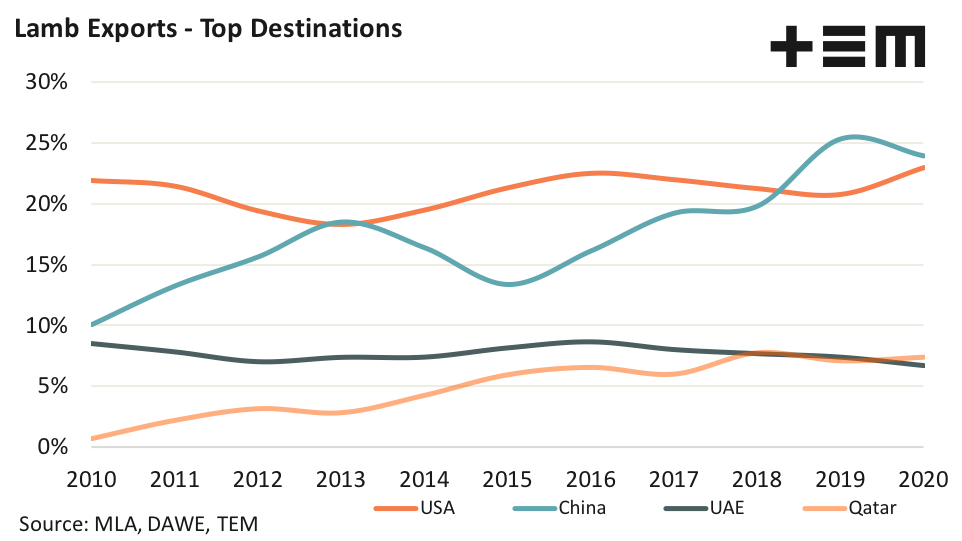

- China has retained the top destination spot for Australian lamb export flows with 23.9% of total volumes, despite seeing annual volumes decline by 11% over the 2020 season.

- The demand for Australian lamb in the USA increased nearly 4% over the 2020 season to see it retain the second top spot, capturing 23.0% of total lamb export volumes.

- In a solid outcome for December lamb exports both Chinese and USA flows sit 10% above their respective five-year December average levels.

- Qatari flows remained strong in December, but the dark cloud of the removal of subsidies favouring Australian lamb exports hangs over the 2021 season.

The Detail

Total lamb export volumes for December have mirrored the robustness displayed each month since July 2020 with export volumes finishing above the five-year average pattern, despite a 5% easing from levels seen in November. The 2020 December total lamb export volumes recorded 23,277 tonnes swt consigned, almost matching the December 2019 figures and sitting 6% above the December five-year seasonal average level.

In terms of market share of total Australian lamb export volumes, China retained the top destination spot despite seeing annual volumes decline by 11% over the 2020 season. China took 63,098 tonnes of Australian lamb during 2020, compared to 71,223 in 2019. Despite the lower annual volumes for the 2020 season it still represents levels that are 30% above the five-year average annual figures and 23.9% of total lamb export flows from Australia for the 2020 season.

The USA retained the second top spot with 23.0% of total export volumes. Annual lamb exports to the USA increased nearly 4% over the 2020 season hitting 60,652 and managed to narrow the gap on China to less than 2,500 tonnes. Meanwhile the tussle for third and fourth spot remains close with Qatar pipping the United Arab Emirates with 7.4% of total Australian lamb exports compared to 6.7%

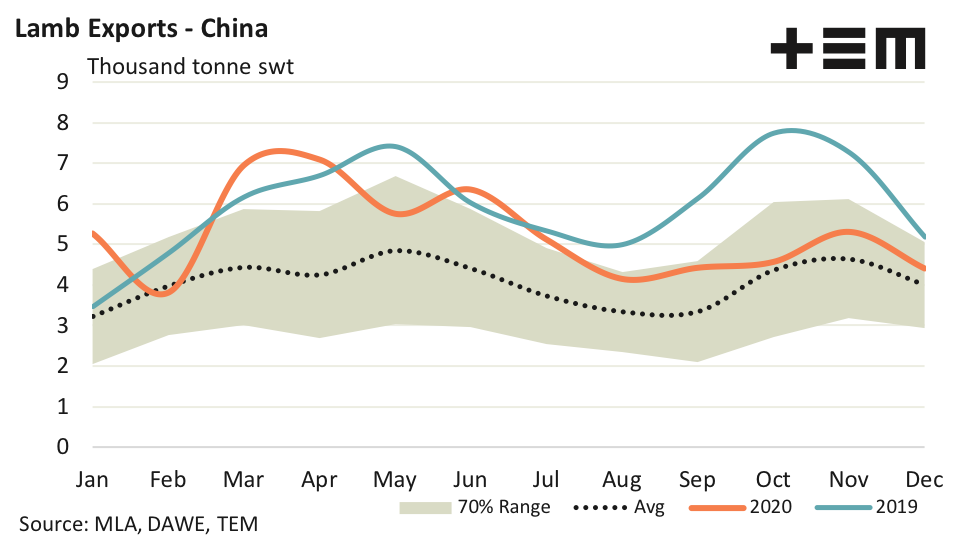

China

Apart from a brief dip in lamb export volumes during Covid-19 inspired lockdowns during February Chinese demand for Australian lamb product has performed relatively strongly all season. The first half of 2020 mirrored the strong performance seen in 2019, which was a great result given the Covid-19 disruption and the historic high price of Australian lamb during the year, not to mention the appreciating Australian dollar. The second half of 2002 saw monthly volumes much softer than during 2019, but levels remained above the average pattern for the entire period.

December flows of lamb to China eased 17% from the November levels to record 4,396 tonnes swt consigned. Despite the softening trend this still represents levels that are 10% above the five-year average December pattern.

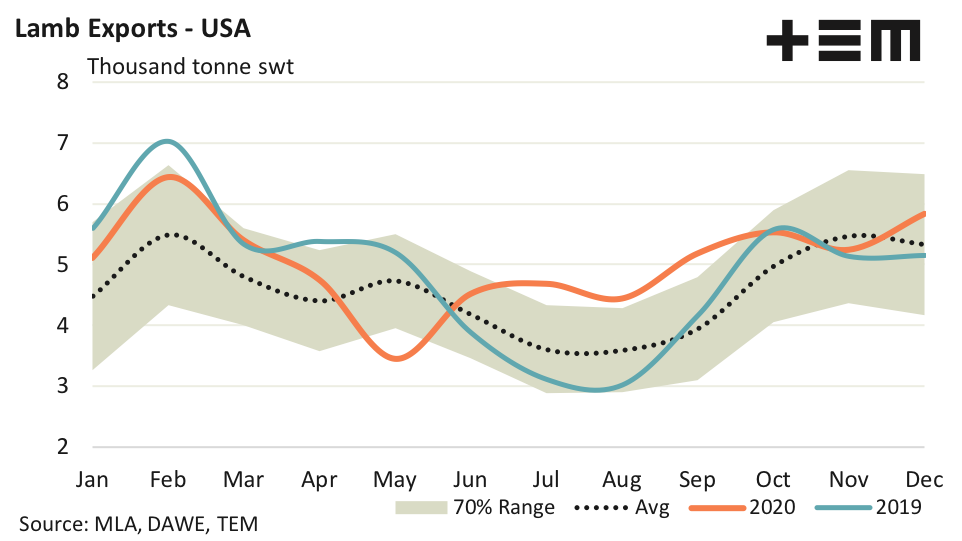

USA

The primary Covid-19 disruption to Australian lamb export flows the USA occurred during May, with monthly volumes displaying a solid growth trajectory since then. The December lamb export volumes have regained well from the November blip below the average seasonal pattern to see an 11% gain on the month to record 5,838 tonnes swt. This represents levels nearly 10% ahead of the average five-year seasonal pattern for December.

Qatar and UAE

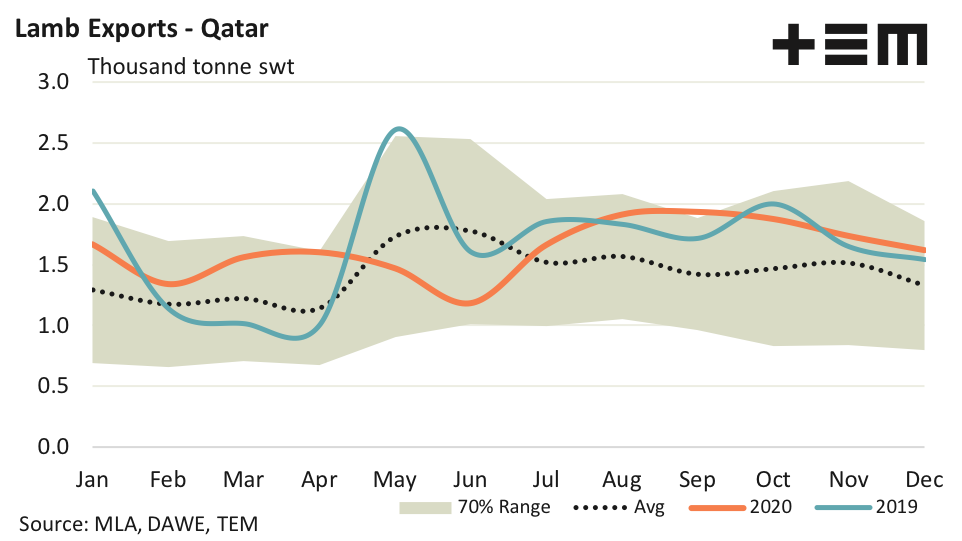

Australian lamb exports to Qatar finished the 2020 season relatively well, after a strong second half of the year. The key for Qatar will be the outcome of the removal of the export lamb subsidy this year that has been favouring Australian lamb exports in recent years.

December flows to Qatar hit 1,618 tonnes, 22% above the five-year average pattern for December. Annual volumes of lamb from Australia to Qatar have managed to sit stable at around 20,000 tonnes per annum for the last three years which is nearly 50% higher than levels seen prior to the introduction of the export subsidy. It will be interesting to see if volumes drop by 50% over the 2021 season.

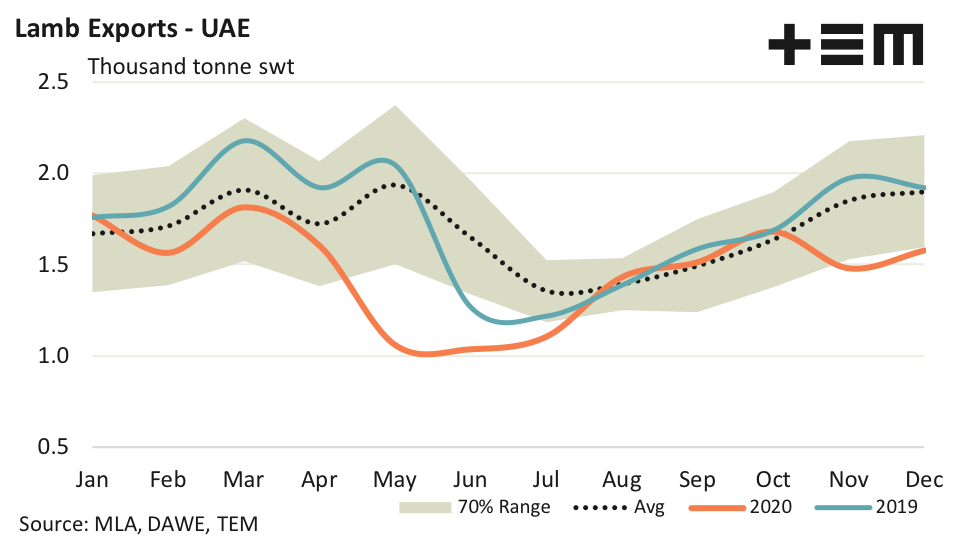

The UAE has been the most underperforming destination out of the top four destinations for Australian lamb exports during the 2020 season, spending much of the year posting monthly volumes under the five-year average pattern. The December figures were no exception to the 2020 trend with the 1,577 tonnes consigned representing levels 17% under the five-year December average.