Lamb slaughter stays stubbornly low

Market Morsel

The Australian lamb and sheep market remains in a holding pattern as winter draws to a close, with little sign of a meaningful turnaround in slaughter activity across most states.

The latest data through August shows a slight lift in sheep slaughter activity, while lamb slaughter remains stubbornly low. Price movements reflect this continued constraint in availability, particularly for finished lamb categories, where indicators remain well above 1100 cents a kilogram (carcase weight).

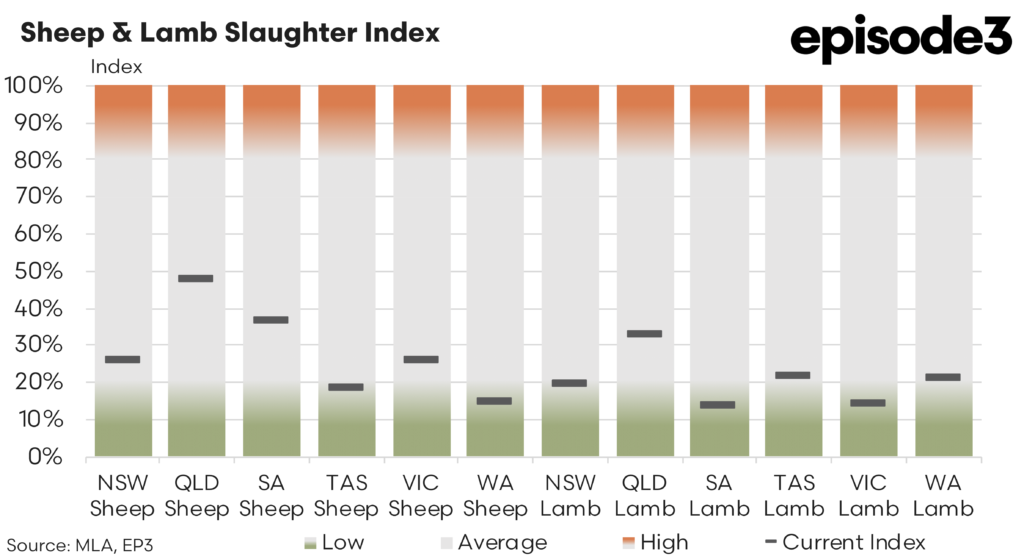

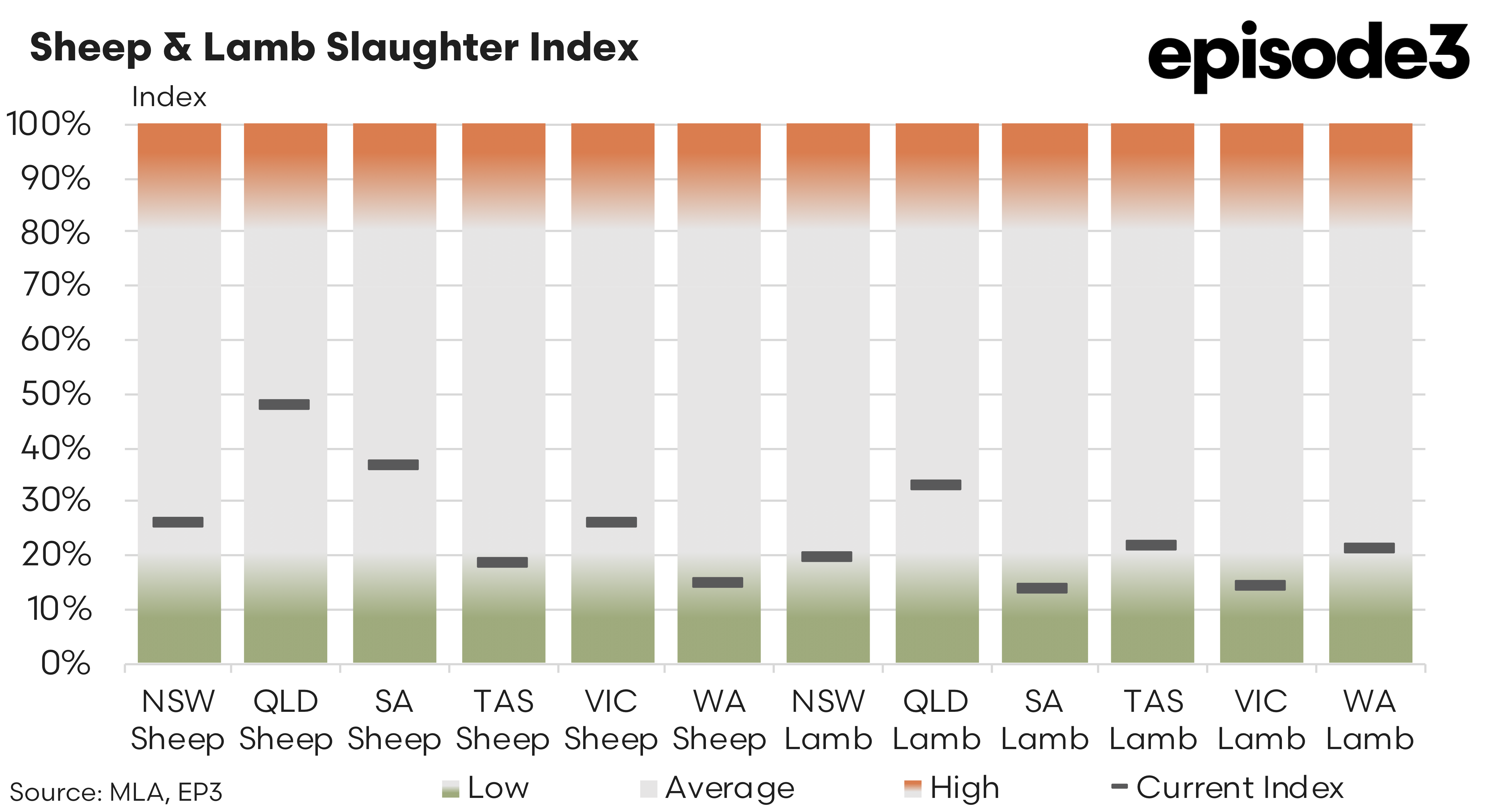

However, despite those elevated price levels, processors are persisting with selective buying behaviour, prioritising heavier lambs and topping up volumes with mutton as needed.Between July and August, the sheep slaughter index nudged higher in NSW and Victoria, up one and eight points respectively.Queensland held steady near 48 to 58pc, while South Australia maintained 48pc.Tasmania dropped sharply from 54 to 37pc, and Western Australia fell from 21 to just 15pc.

On balance, the national picture for sheep slaughter suggests processors are keeping mutton in the mix to maintain throughput, even if state-level shifts are uneven.These trends support the earlier June observations that mutton remains a key tool for balancing processing capacity in the face of tight lamb supply.

Lamb slaughter indices, by contrast, remain at low ebb.NSW lifted marginally from 19 to 21pc, and Queensland held steady at 33pc.Victoria remained unchanged at 14pc, one of the lowest levels recorded this year, while South Australia and Tasmania each hovered at 14 and 22pc, also unchanged.Western Australia reported 21pc, matching July’s figure.

The lack of significant improvement across any major state reinforces the view that lamb supply remains deeply restricted, particularly for finished lambs suitable for export or domestic retail programs. Price indicators over the past four weeks reflect this continued tension in the market.

Trade Lamb eased 15 cents to 1,195 c/kg cwt, while Heavy Lamb eased by 69 cents to 1,158 c/kg.Despite this minor decline, Heavy Lamb remains well above historical averages and continues to reflect strong competition for quality stock. Merino Lamb lifted 5 cents over the four-week period to 1055 c/kg, and Light Lamb was up 26 cents to 1045 c/kg.

Restocker Lambs posted the strongest gains, climbing 38 cents over the month to 1,085 c/kg cwt.This rebound is particularly interesting given the flat restocker sentiment earlier in winter. It may reflect renewed buying confidence in select areas where seasonal conditions have improved, or a tightening in restocker-type availability driving up competition.

However, headcount figures tell a more sobering story. The number of restocker lambs traded week-on-week collapsed by over 10,000 head, the sharpest fall among all lamb categories.This suggests that despite the higher prices, actual restocker activity remains constrained by availability and confidence, and price volatility is likely being driven by a very thin market.

Mutton prices dropped 38 cents over the past four weeks to 712 c/kg cwt.This follows a longer trend of price stability for sheep, reflecting the reliable throughput and relatively predictable processor demand.Despite the lift in volumes in states like Victoria, mutton prices remain anchored well below lamb indicators.Nevertheless, at more than 700 c/kg, mutton remains historically strong and continues to play a critical role in processor supply chains during this seasonal squeeze.

This aligns with anecdotal reports that processors are focusing on meeting specifications and minimising waste, particularly as operating costs and labour pressures remain elevated. The emphasis is clearly on maximising yield and maintaining throughput without exposing operations to the volatility or margin squeeze associated with suboptimal lines.

The August data confirms what was already apparent in June and July: processors are walking a tightrope. With finished lambs in short supply and restocker activity patchy, mutton provides a vital buffer. It allows plants to maintain workflows without overpaying for lambs that do not meet export specs or domestic programs. Meanwhile, the elevated lamb prices speak to the underlying demand strength in overseas markets, particularly the US and Middle East, which continue to absorb Australian product despite tighter global supply conditions.