Lamb volumes spring into action

Market Morsel

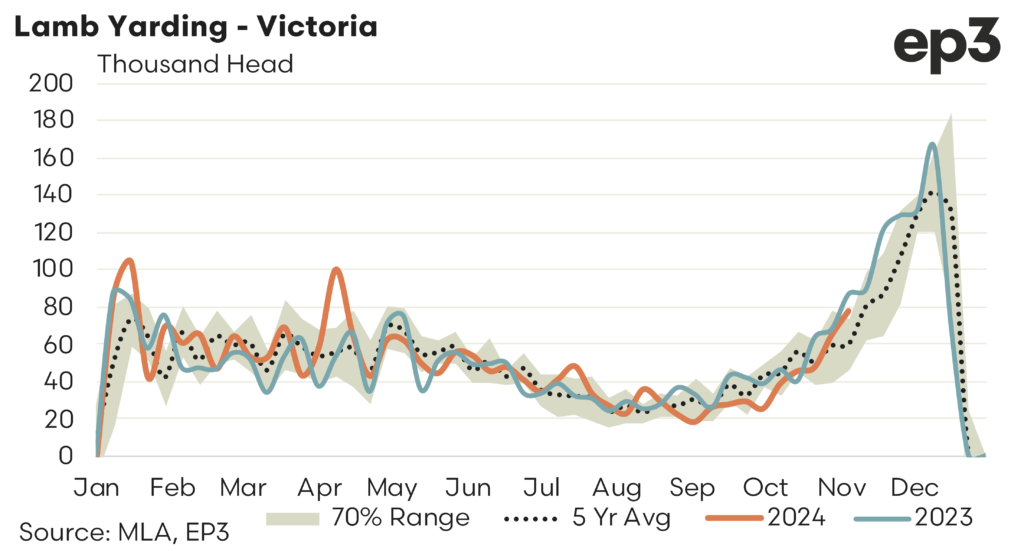

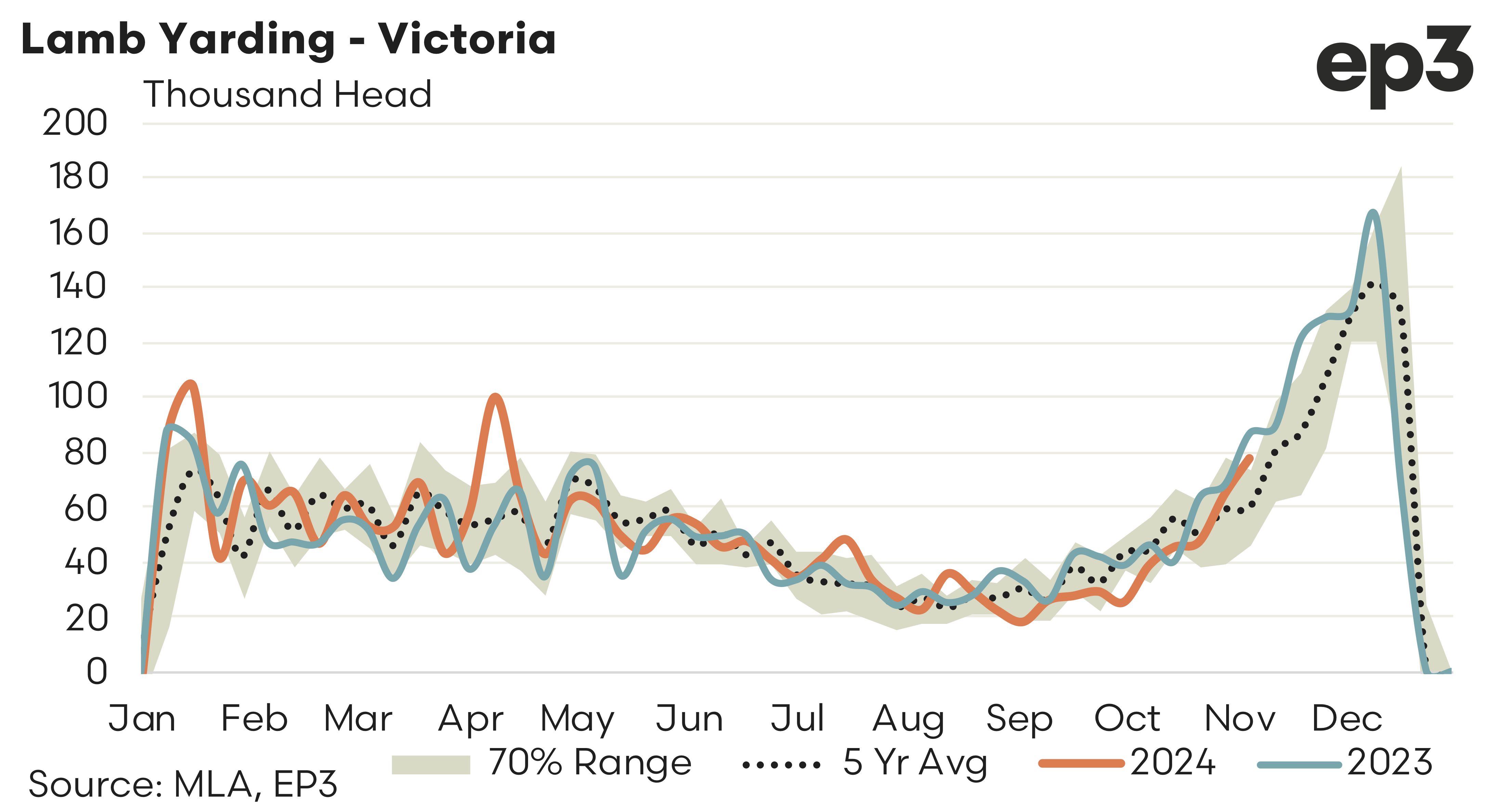

The spring flush of new season lambs has been running behind schedule this year, particularly in Victoria and South Australia where the flush is usually most evident, but recent weeks have seen numbers begin to lift.

The last time we looked at the lamb saleyard throughput levels during October it was noted that the volume of lamb being presented at Victorian and South Australian saleyards was running 23% behind the five-year average weekly yarding levels normally seen at this time in the year. Fast forward to mid-November and the pace has picked up.

In the last fortnight lamb saleyard throughput along the east coast has lifted by 20%, underpinned by higher volumes of lamb in Victoria and South Australia. Into mid-November weekly lamb throughput in SA reached nearly 33,500 head, which is a 140% increase on the throughput volumes seen a fortnight earlier. Indeed in SA lamb yarding levels are now sitting 12% above the five-year average for this time in the season, based on the last five-years of saleyard data.

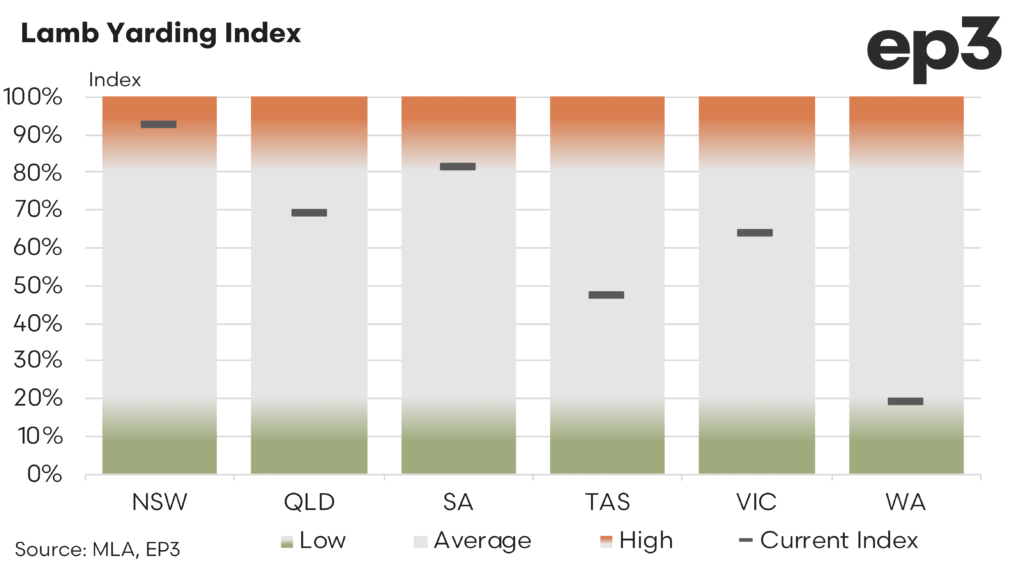

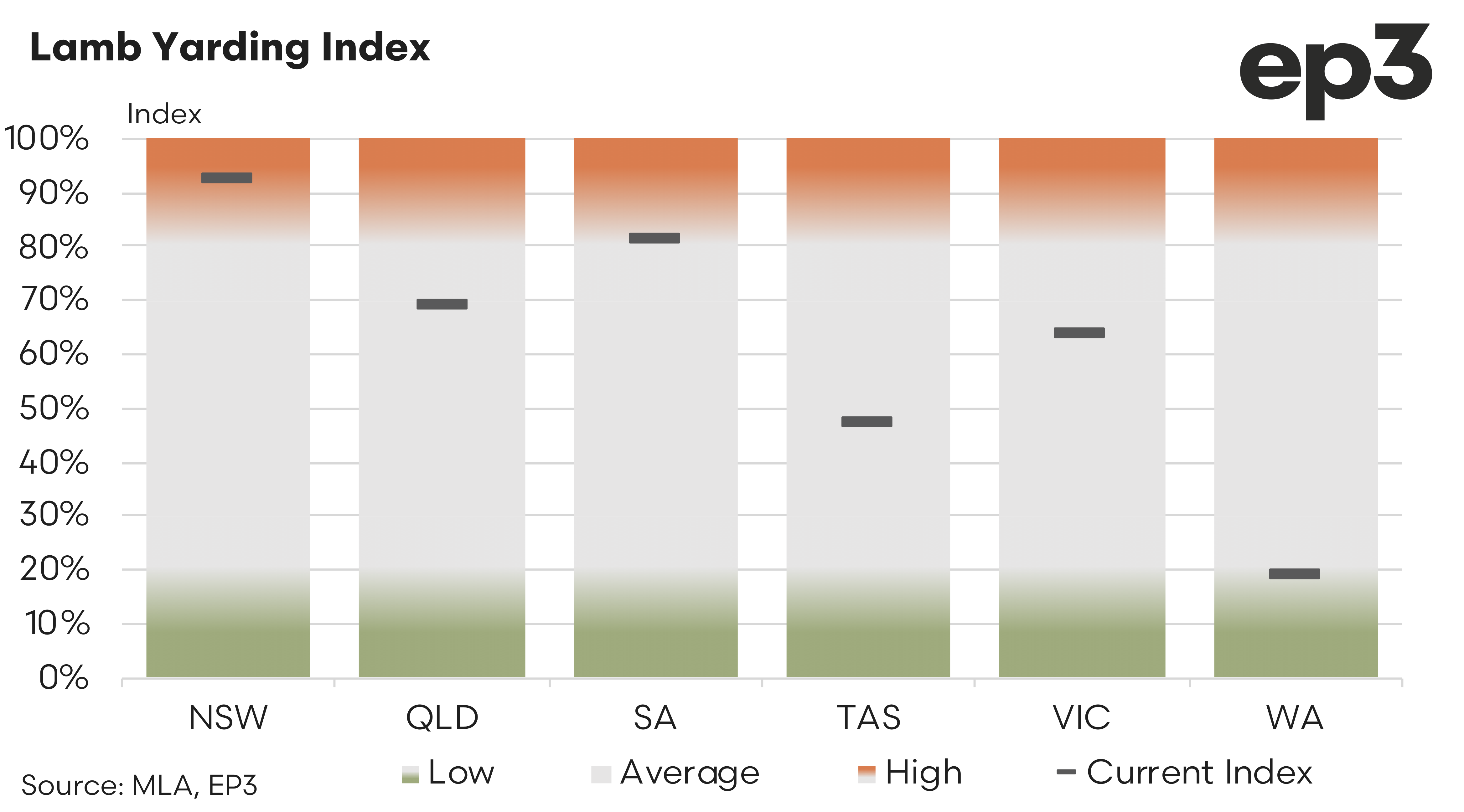

The increased lamb volumes in South Australia is reflective in the yarding index score sitting at 81% for November, a fortnight ago this yarding score was at 61%. Remember these index scores are percentile ranks based on historic weekly yarding data for the last five years. They are similar to rainfall decile numbers, so a move from 61% to 81% is like rainfall going from a decile 6, which is just a little bit above average, to a much wetter than average decile 8.

Victoria has seen lamb yarding numbers swell too over the last fortnight with their lamb yarding index score lifting from 35% to 64%. In number of head this surge in weekly Victorian lamb throughput translates to an increase from 47,000 head a fortnight ago to 77,000 head into mid-November. The last two weeks have seen a 64% increase in Victorian lamb yarding levels which has propelled current weekly throughput of lambs in Victoria to levels that are now running 30% above the five-year average for this time in the season.

In New South Wales sale yards lamb numbers are swelling too, lifting from an index score of 76% a fortnight ago to 92% as at the middle of November. Meanwhile, away from the mainland, Tasmania has started to see more lambs presented too over the last fortnight with their yarding index lift from 37% to 47%.

The increased lamb supply have seen most of the Meat & Livestock Australia saleyard lamb indicators come under pressure during the last week. The National Trade Lamb Indicator has dropped 32 cents to sit at 780c/kg carcass weight (cwt). Light & Merino Lambs are down by about 45 cents, meanwhile the National Restocker Lamb has been the worst performer over the week with a 70 cent price slide reported, taking it down to 670 c/kg cwt. The only MLA reported lamb category to hold its ground has been the National Heavy Lamb, sitting steady over the week on 835 c/kg cwt.

The lamb yarding index numbers in Western Australia have been demonstrating an interesting trend in recent weeks with unusually low volumes of lamb going through the sale yards and it is playing havoc with MLA lamb indicators for WA. The WA lamb yarding index score sits at just 19% for mid-November, down from 27% a fortnight ago.

During October we noted on the Episode 3 website that WA price discounts at the saleyard for lamb versus the east coast were running at much wider than normal levels with the WA Trade Lamb Indicator around 40-45% below trade lambs prices being achieved in the mainland eastern states. But it is important to remember that if the price indicators are being calculated off lower than normal volumes this can distort the accuracy of the number, particularly if a specific week has some lower quality runs going through the sale yard.

Anecdotal reports from the WA processing sector noted that saleyard prices were not matching what was being offered “over the hooks”. For example, during the middle of October the WA Trade Lamb Indicator dipped to 472c/kg cwt however average pricing being paid for trade lambs by WA processors during this time was closer to 700c/kg cwt.

Within a week or two the WA Trade Lamb Indicator had corrected toward the mid 600 cent area, sitting back nearer to price levels more consistent with what was being paid by processors, but this doesn’t take away from the shock factor faced by WA sheep producers at seeing their sale yard prices at such extreme discounts to the eastern states prices.