Lamb’s year

The Snapshot

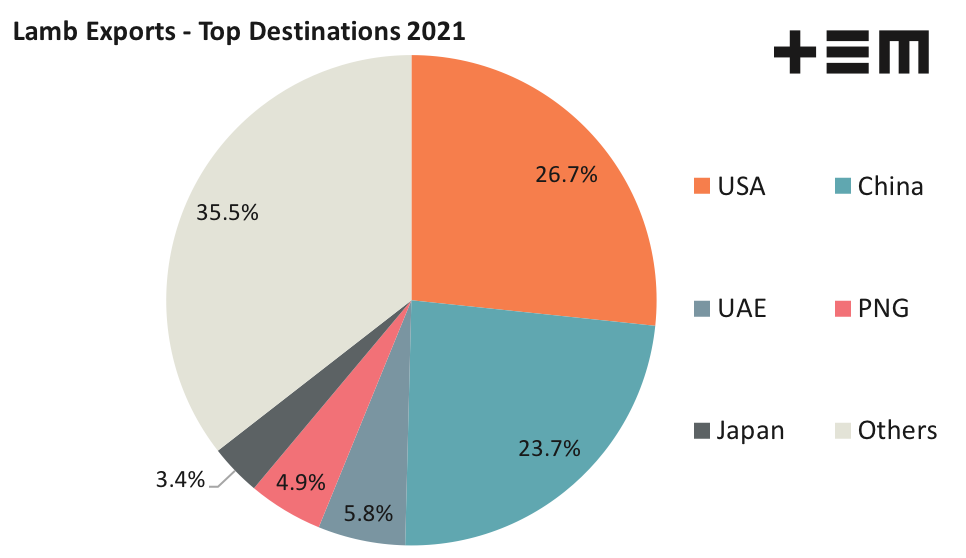

- The USA have consolidated their position as top export destination for Aussie lamb exports with their market share of the trade moving up from 23% in 2020 to 26.7% in 2021.

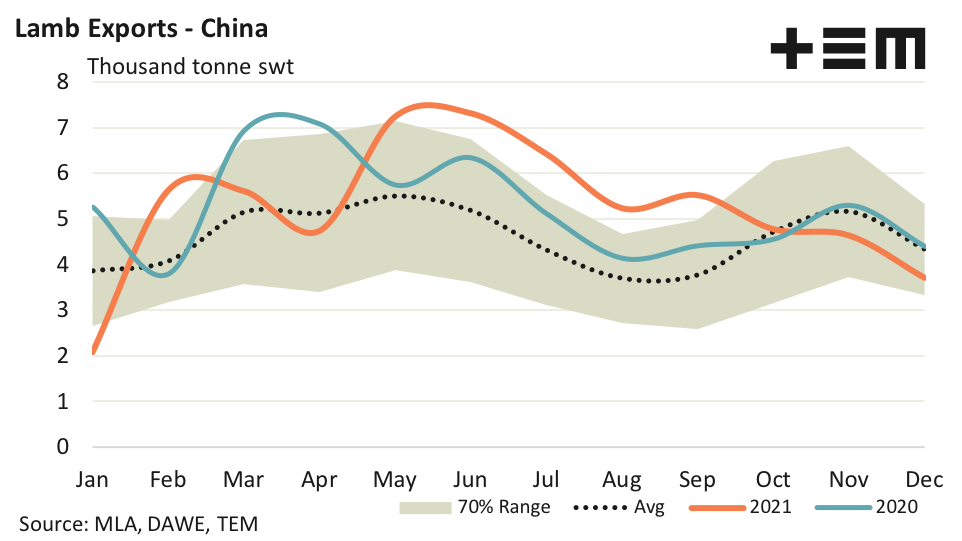

- China retain their second place with a marginal adjustment to their market share, from 23.9% in 2020 to 23.7% in 2021.

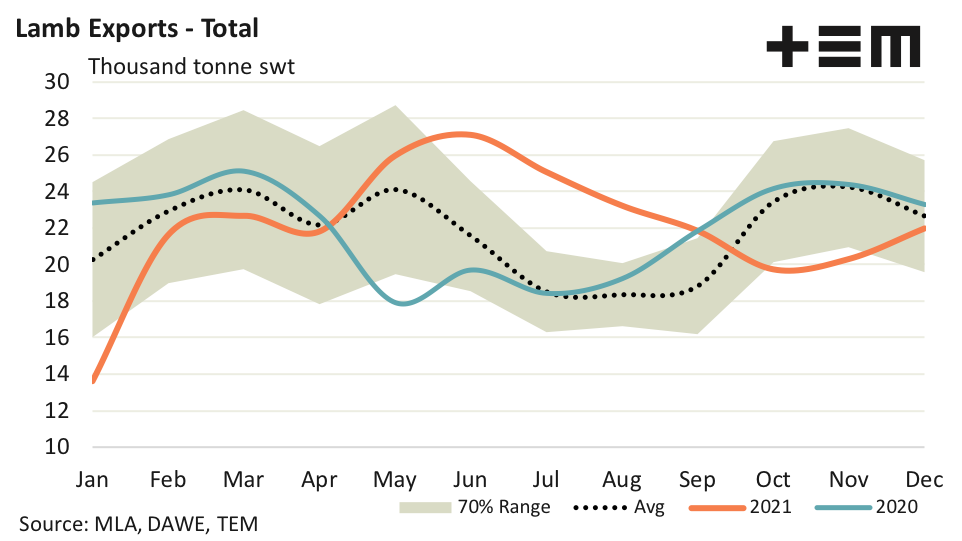

- Total Australian lamb export flows hit 264,823 tonnes for 2021, just 953 tonnes above the 2020 total lamb export volumes.

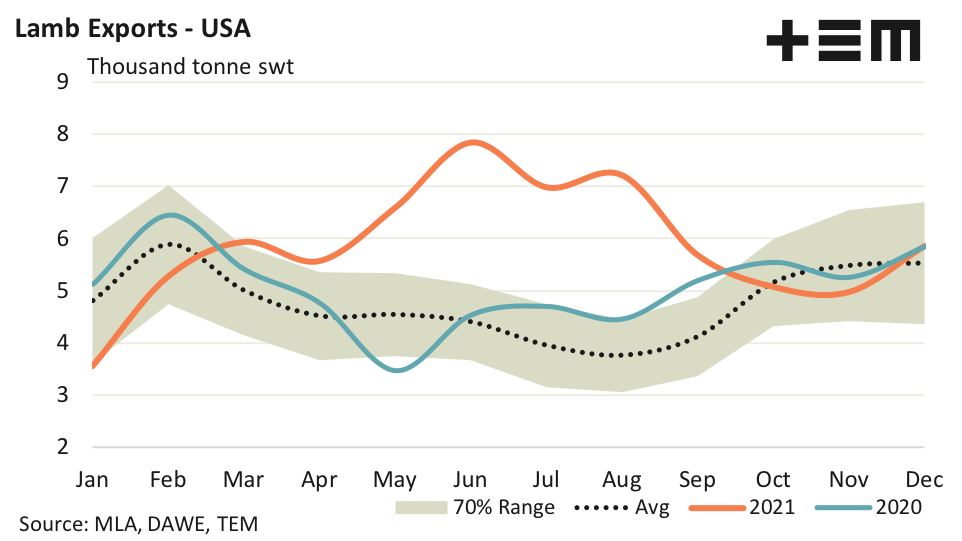

- Annual Aussie lamb exports to the USA reached 70,606 tonnes in 2021, the highest annual figure on record and 16.4% higher than the levels seen in 2020.

- Total Australian annual lamb exports to China in 2021 came in just 216 tonnes lower than the 2020 tally with 62,882 tonnes reported shipped last year.

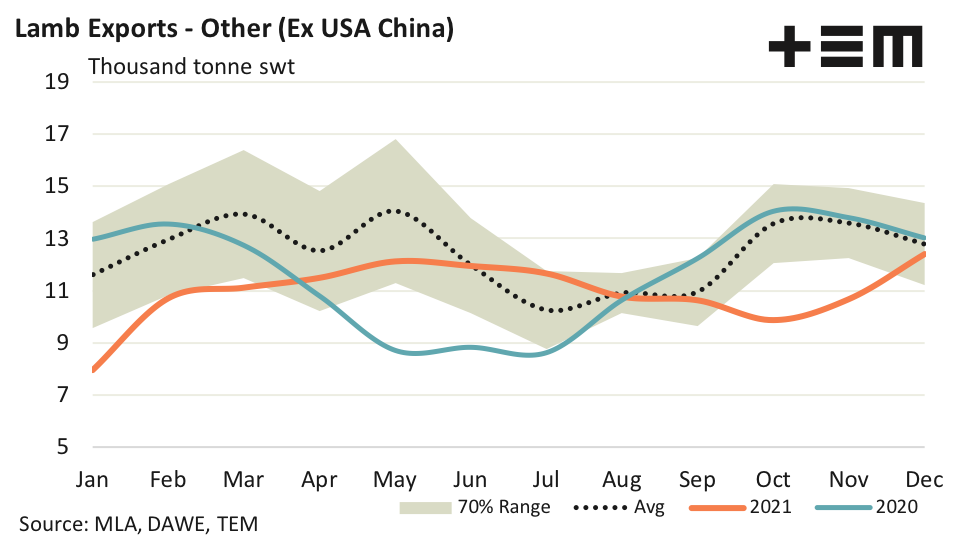

- Total annual flows for lamb exports to “other destinations” (ex USA and China) came in at 131,336 tonnes, which represents volumes that are nearly 12% below the five-year average annual tally of 149,095 tonnes.

The Detail

Australian lamb export volumes for the full 2021 season have been published by the Department of Agriculture, Water and Environment (DAWE) and they show the USA have consolidated their position as top export destination with their market share of the trade moving up from 23% in 2020 to 26.7% in 2021. China retain their second place with a marginal adjustment to their market share, from 23.9% in 2020 to 23.7% in 2021.

Qatar have dropped out of the top five after removing import subsidies for Australian lamb exports and their third place position has been replaced by the United Arab Emirates (UAE), whom accounted for 5.8% of the market share in 2021, down from 6.7% in 2020. Meanwhile Papua New Guinea (PNG) move up into fourth spot with an increase in market share from 3.9% in 2020 to 4.9% in 2021. Japan edged out Malaysia for fifth spot, taking an extra 36 tonnes to bring their market share to 3.4% last year.

Total lamb export volumes increased by 8% over December 2021 with 21,968 tonnes reported shipped. This increase at the end of the season lifted the annual Australian lamb export volumes to 264,823 tonnes for 2021, just 953 tonnes above the 2020 total lamb export volumes. Total lamb exports for the 2021 season finished the year 1.4% above the five-year average annual total of 261,145 tonnes.

Australian lamb export flows to the USA saw some solid results during the middle of the year in 2021 and finished the year well with a near 18% gain noted in flows during December. There was 5,861 tonnes swt of Aussie lamb exported to the USA in December 2021, bringing the total annual lamb exports to 70,606 tonnes, the highest annual figure for Aussie lamb exports to the USA on record and 16.4% higher than the levels seen in 2020. Indeed, compared to the five-year average annual volumes of 57,141 tonnes, lamb export flows to the USA were 23.5% higher in 2021, highlighting the solid growth seen in this export destination in recent years.

Total Australian annual lamb exports to China in 2021 came in just 216 tonnes lower than the 2020 tally with 62,882 tonnes reported shipped last year. Lamb export volumes from Australia to China eased 20% over December, registering just 3,706 tonnes for the final month in the season. Despite the softer finish to 2021, annual total volumes for Aussie lamb exports to China sit 14.5% above the five-year average annual volumes of 54,909 tonnes swt.

In a positive sign for 2022, other lamb export markets (ex USA and China) finished the 2021 season in an upbeat fashion. In December 2021 Australian lamb exports to “other destinations” increased 16.1% to 12,401 tonnes swt. However. much of the 2021 season was spent below the average seasonal trend and the total annual flows for lamb exports came in at 131,336 tonnes, which represents volumes that are nearly 12% below the five-year average annual tally of 149,095 tonnes.