Live Export 7: The winners from a live export ban

Live Sheep Export Special Edition

This article is part of a series focusing on the live sheep export trade and the recent decision by the Australian Government to phase out the trade by May 2028.

It was a big weekend for Western Australian sheep producers, as the announcement was made of when the phase-out of sheep live exports was expected to be completed. The last sheep live exported by sheep will be traded by 1st of May 2028.

The live export of sheep is a global trade, there are many players who contribute to trade, of which Australia is one.

These short analysis pieces are designed to give insights into the live sheep export trade. These articles are produced pro-bono and independently. It is just data-based observations.

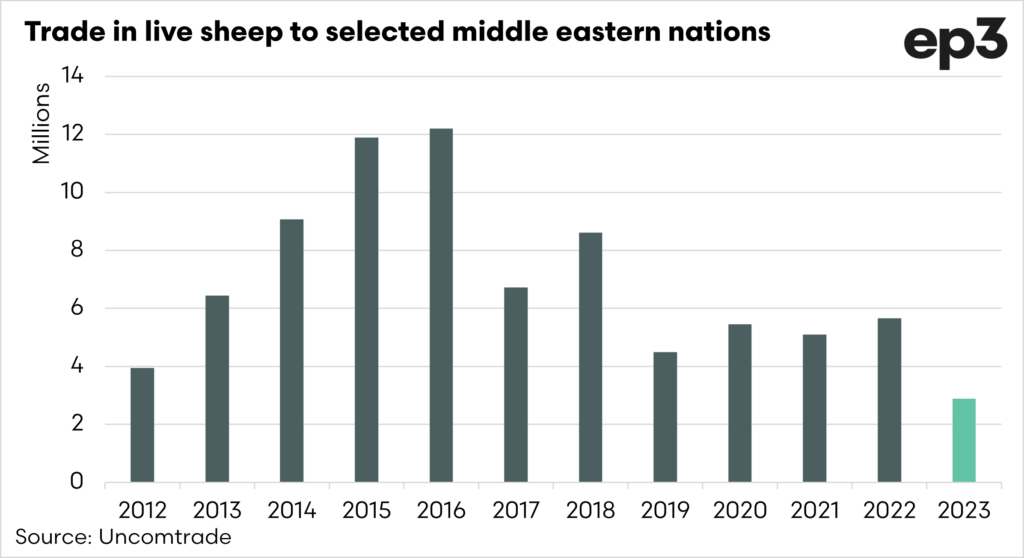

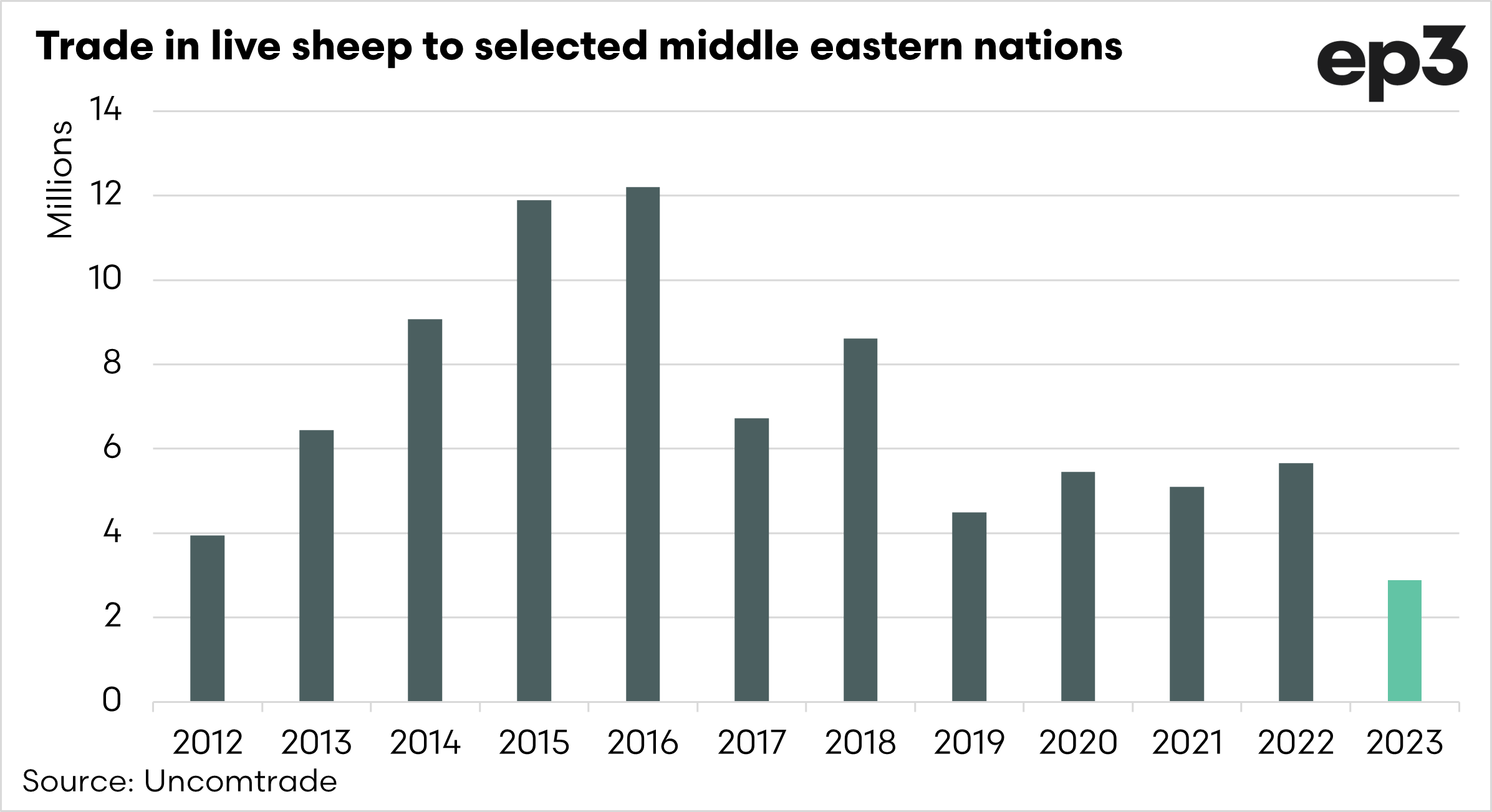

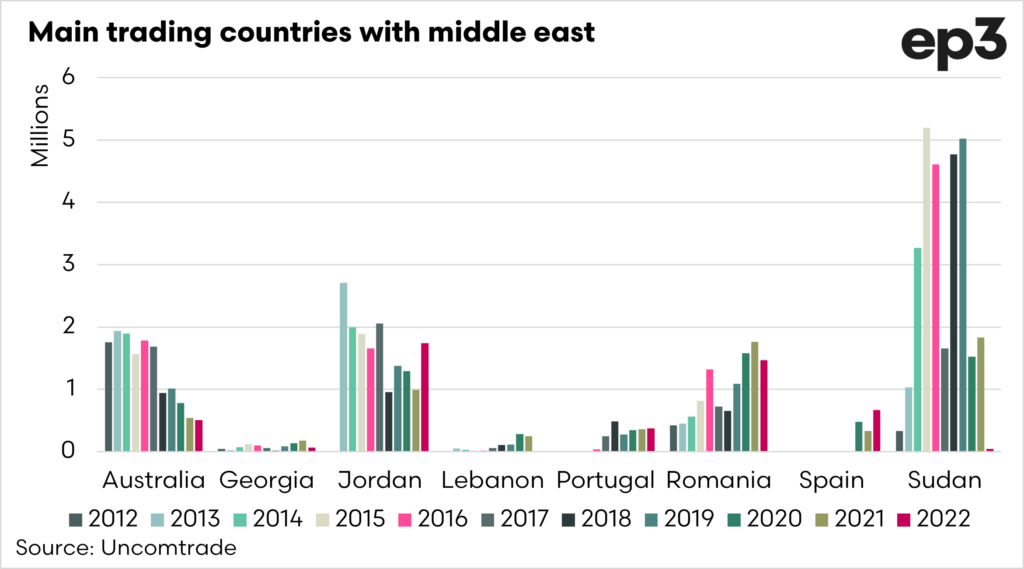

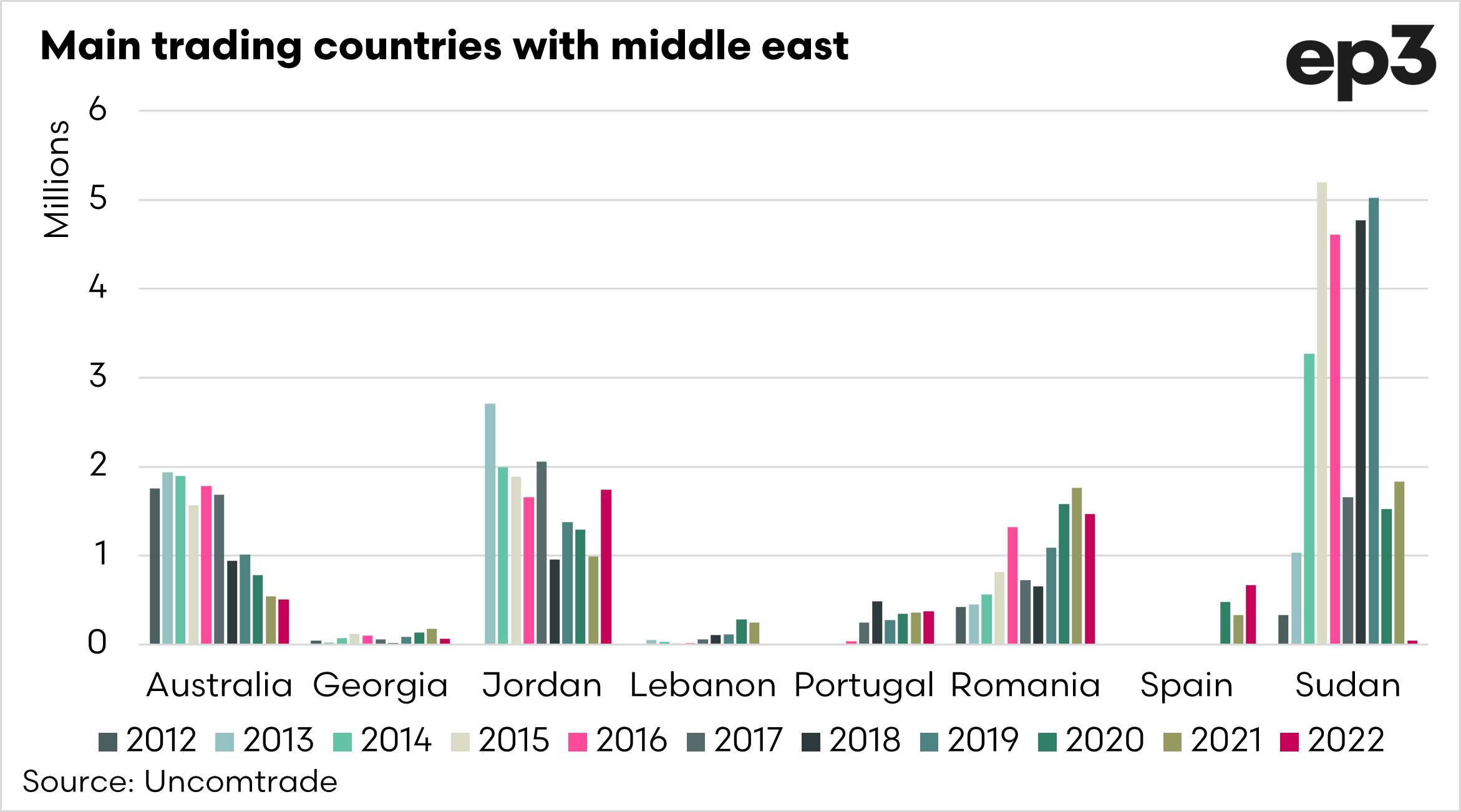

The chart below shows the full volume of sheep exported from all nations to a selection of Middle Eastern countries. The importing nations selected for this analysis are Israel, Jordan, Kuwait, Oman, Qatar, Saudi Arabia and the United Arab Emirates.

The data used in this analysis is specifically sheep. I have not included goats, but if sheep are unavailable for these nations, goats may be a replaceable commodity. The data for 2023 is not yet complete.

The live sheep trade went through a lull in 2019, when according to UN trade data, 4.5m head of sheep were exported to these countries. 2022, the last year of full data, saw 5.6m sheep moving. This was still pails to volumes in the 2010s when 2016 saw over 12m sheep moving into the Middle East.

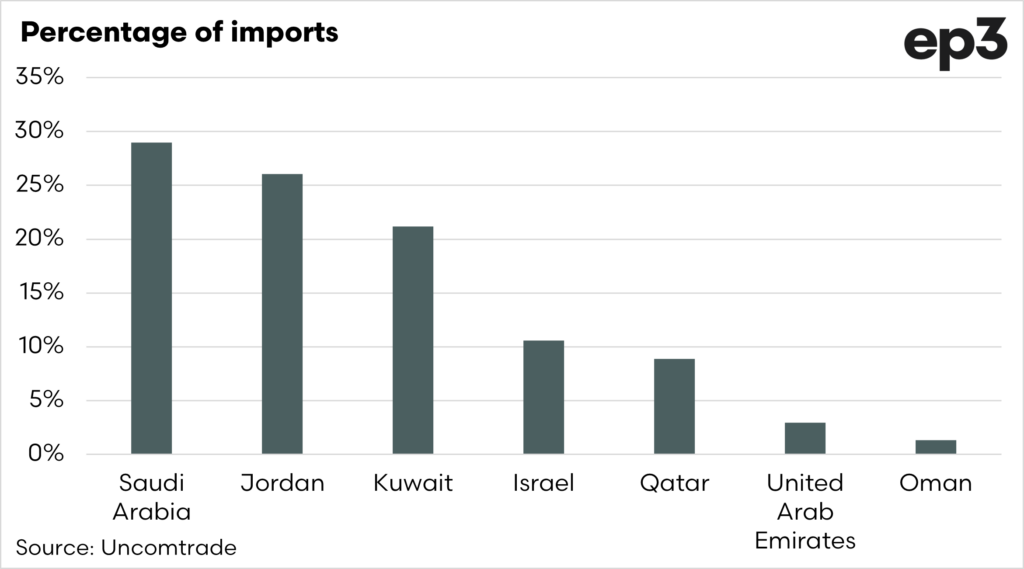

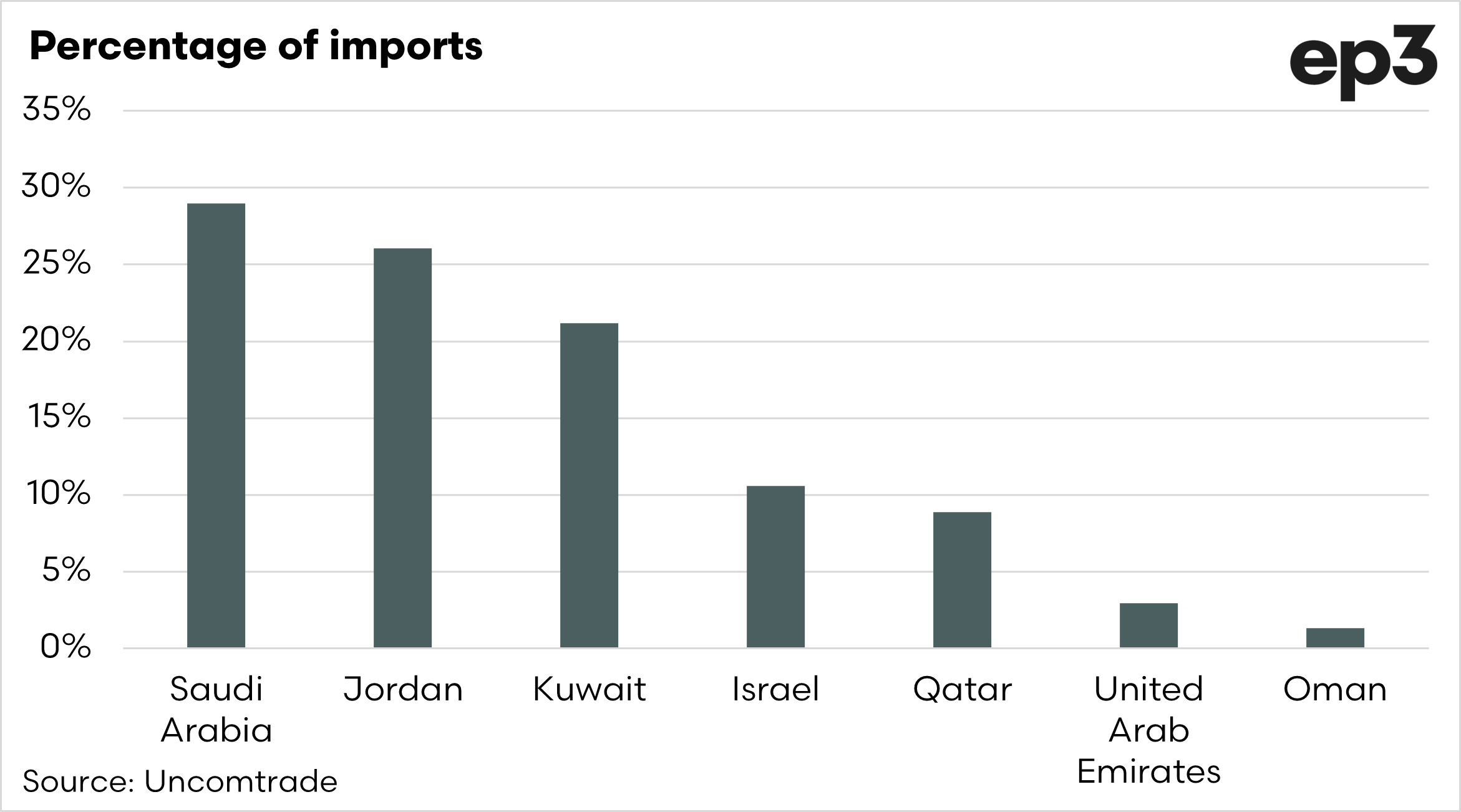

The chart below shows which countries are the biggest to smallest import nations in the Middle East, based on the five-year average. Saudi Arabia is the largest buyer, but have purchased very little from Australia.

Last year, they came back into the market with a small purchase in December. However, it is promising that they may enter the market again.

So, let’s take a look at the trading environment for live sheep to the Middle East. There are a number of countries which send live sheep into the Middle East (the 7 listed above), the main ones are:

- Sudan

- Australia

- Jordan

- Lebanon

- Portugal

- Romania

- Spain

- Sudan

One thing EP3 always discuss is the change of trade flows. When you throw a rock in a stream, the stream doesn’t stop flowing, it just flows around the rock.

This happened when an 80.5% tariff impacted the barley trade on Australian origin. Trade flows changed; our barley went to other markets, and other origins won trade into China.

The same occurs with live sheep. In the chart below, the trade between each origin and the Middle East is displayed from 2012 to 2023

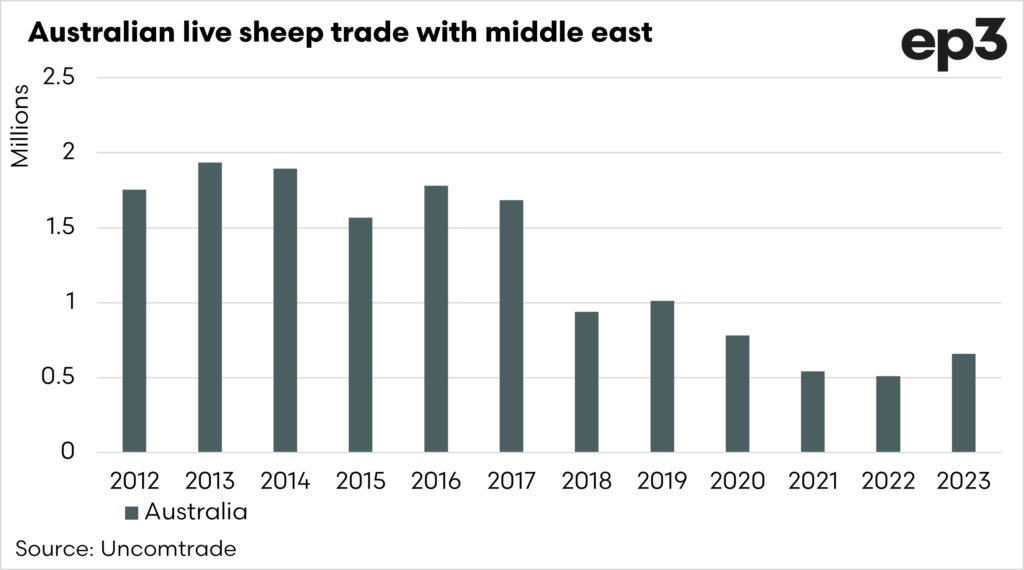

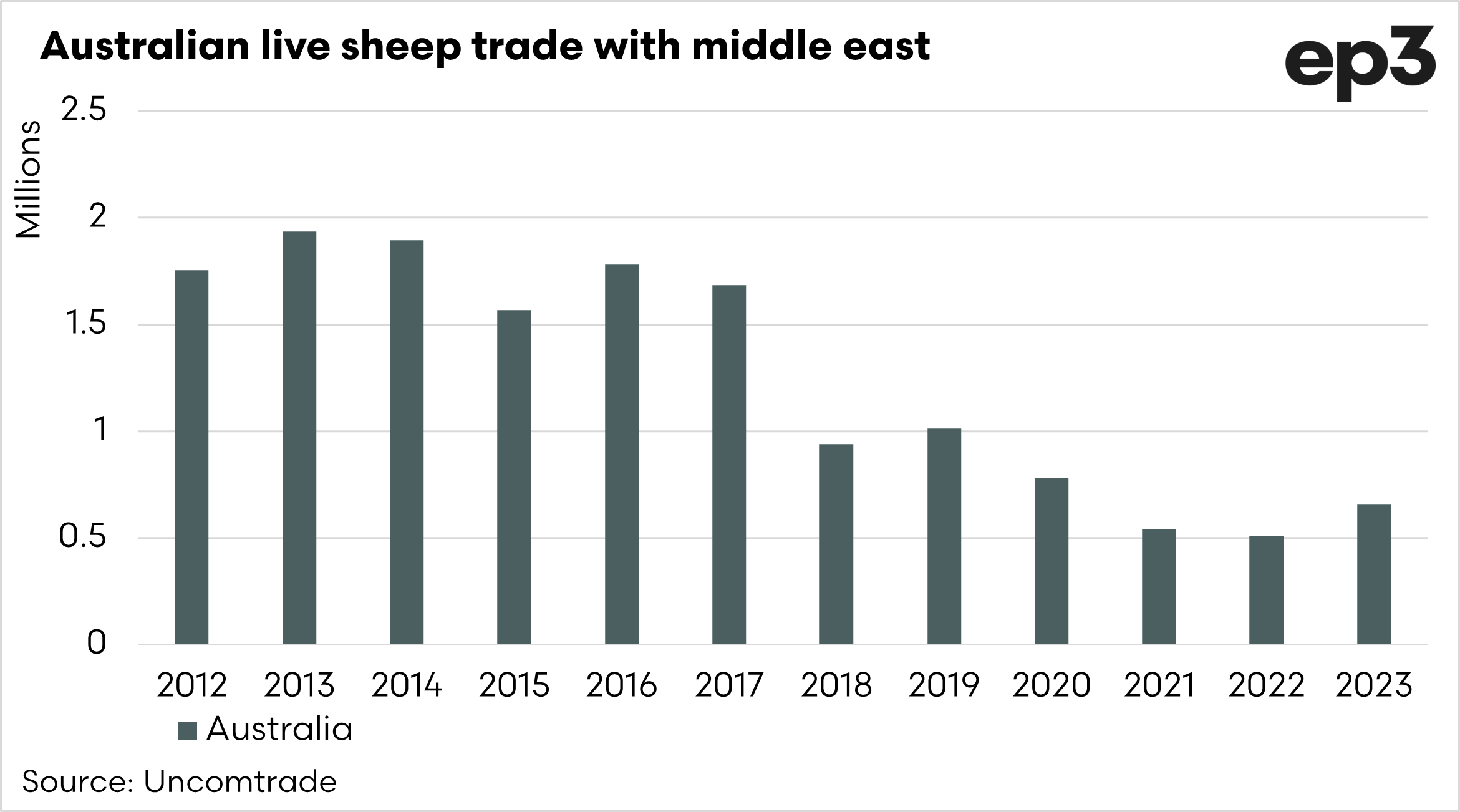

As we can see in the data, Australia as an origin has dropped dramatically since 2018. This coincides with the live sheep moratorium, originally introduced by the live sheep industry, then subsequently legislated when David Littleproud was the agricultural minister.

The moratorium removed 1/3 of the year’s capacity to export, causing a disruption to trade flows and reducing the ability to meet market demand.

The trend of declining trade caused by the northern hemisphere export moratorium indicates who will likely gain market share from a complete phase-out of Australian exports by sea.

If we look at the chart below, some countries like Sudan export very large volumes of sheep. However, trade can be erratic, with issues such as Rift Valley Fever causing import countries to ban them as an origin. Sudan is also a country which in the past decade, has experienced many bouts of instability from civil conflict to natural disasters.

Sudan struggles with animal welfare due to a lack of regulatory frameworks, economic constraints, and access to veterinarian infrastructure. It must be noted that export data from Sudan may not be as accurate as that from more developed nations.

The other countries which have gained have been the likes of the European countries, such as Portugal, Romania and Spain. These nations have stricter animal welfare standards than the likes of Sudan. Under European Union rules, standards are set for conditions, durations of journeys, rest periods, animal space and food/water availability.

The absence of Australia from the live sheep export trade may result in more boxed meat flowing into some of these nations. The reality is that many buyers, especially those purchasing for Eid al-Adha, will source from elsewhere, and it is not guaranteed that they will have the same standards of animal welfare.

It is extremely important that investment is made to increase Australia’s capacity to export boxed meat to the Middle East.

Support EP3

Please note that EP3 are not paid to do this analysis by any sheep industry representative nor live export representative bodies. We believe it is valuable information that should be provided to Australian farmers, the live export supply chain participants and any other interested parties, so we allocate time out of our work day to produce these articles completely free of charge to the reader.

We prepare our reports based on the data available and we aim to maintain objectivity in our analysis so that the insights delivered are only what the data shows.

If you want to support the work of EP3, then remember to sign up and forward our articles to your friends, family and other contacts.