London calling

The Snapshot

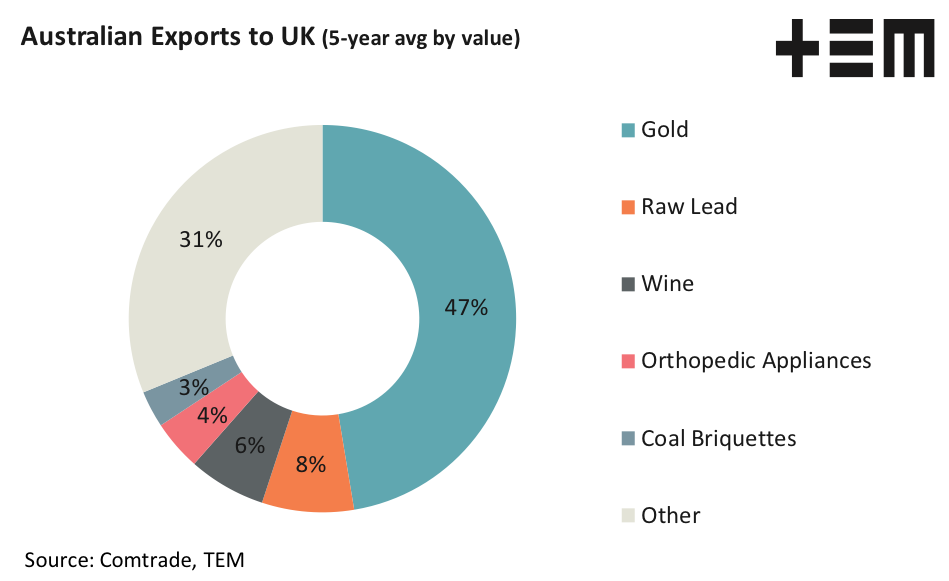

- Gold has topped the share of value of all export flows, scoring a 47% share of total value of exports to the UK over the last five years, on average.

- Wine is the lead agricultural product exported to the UK, averaging 6% of the total export trade value over the last five years.

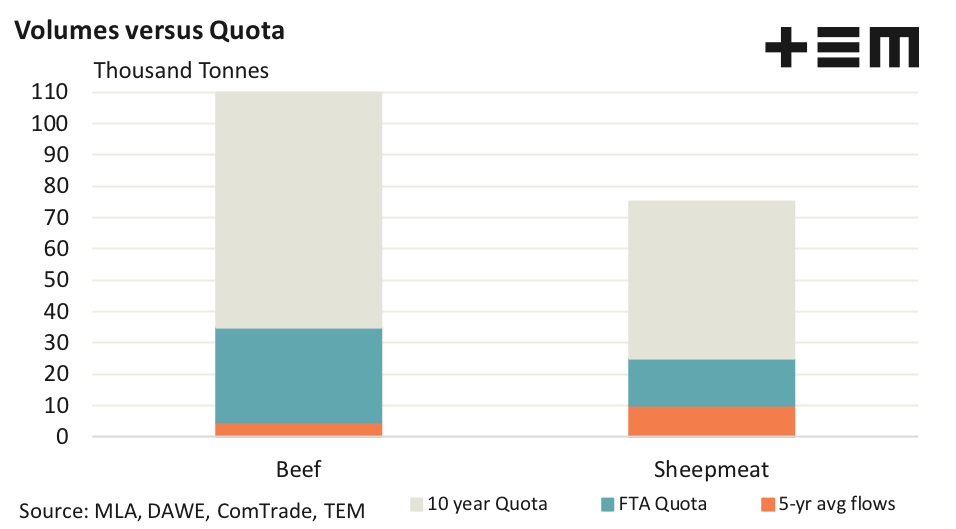

- The initial FTA agreement allows a quota of 35,000 tonnes of beef and 25,000 tonnes of sheep meat to be exported to the UK. Based on recent red meat flows there is plenty of upside to grow this market.

The Detail

This week a free trade agreement (FTA) was announced between the UK and Australia so the EP3 team decided to look at the recent major trade flows between the two countries to see which products or industries are likely to benefit most and what the prospects look like for the red meat sector, specifically.

Analysis of top Australian exports to the UK on a trade value basis demonstrates that over the past five years gold has topped the share of value of all export flows, scoring a 47% share of total value of exports to the UK. The only agricultural product to make it into the top five was wine, which came in third and representing 6% of the total export value over the last five years.

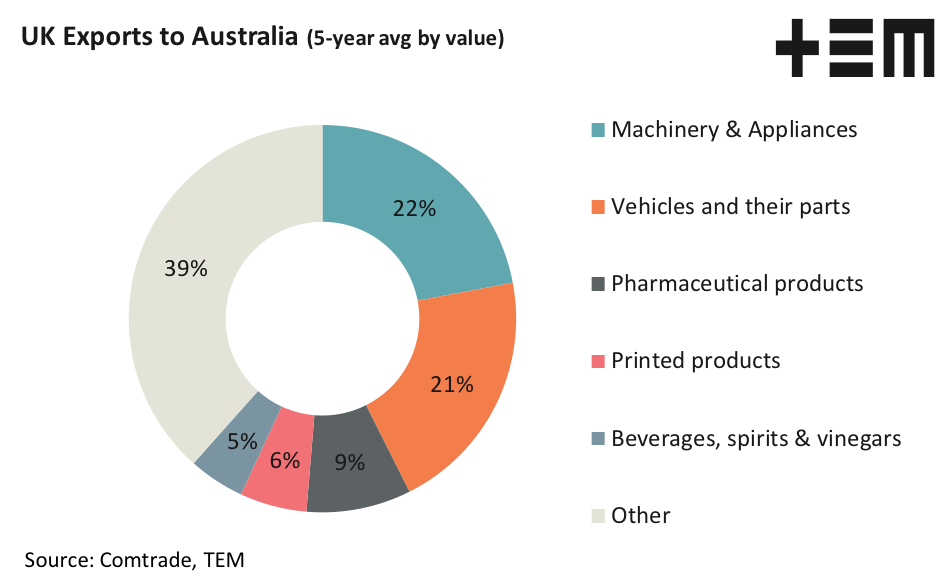

In terms of UK exports to Australia, machinery, appliances and cars (including their parts) feature prominently in trade flows with a 22% and 21% share, respectively. The closest to an agricultural related product on the import side of the equation coming from the UK to Australia in the top five are beverages, spirits and vinegars, which represent 5% of the total value of UK exports to down under.

If you are a lover of single malt or perhaps Tennets Lager, then these may get a little cheaper in Australia in the coming years.

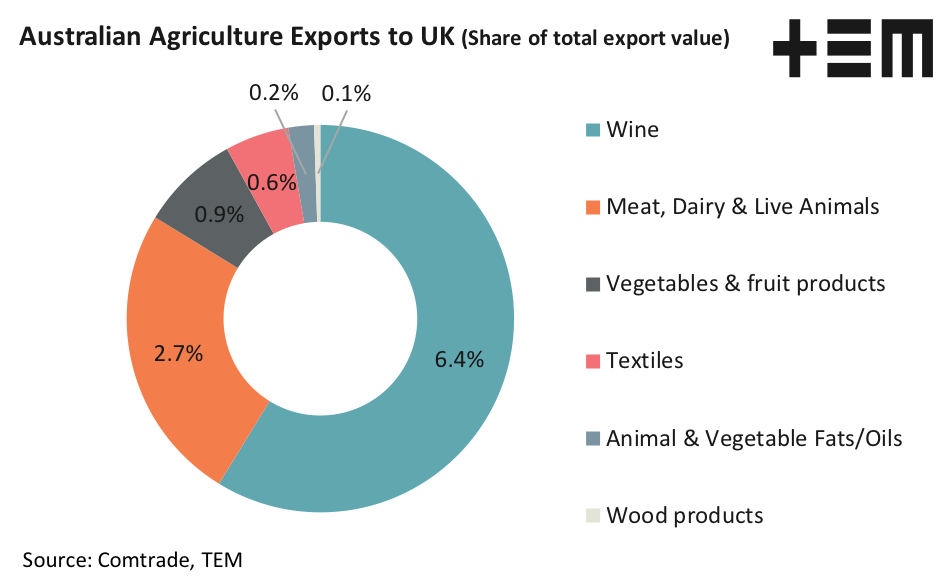

Taking a look at the main Australian agricultural export industries and their share total export value to the UK market in the last five years there is a clear dominance of wine. It is a fair chance that of all the agricultural products, wine is the most likely to get some good initial traction into the UK market place as the British consumer already has some familiarity with the product.

However, the red meat sector, with a average of nearly 3% of the total trade value into the UK is also reasonably well placed to grow some presence in the UK market. Indeed, prior to the UK joining the EU in 1973 the British Isles was the top destination for Australian beef exports.

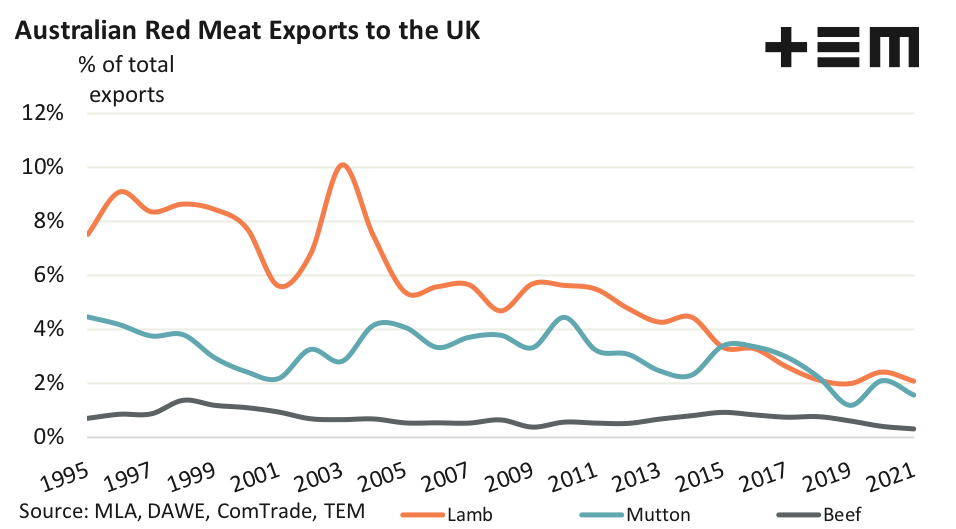

In the last three decades the proportion of lamb exports to the UK as a percentage of total Aussie lamb meat exports has been in steady decline moving from around 8% of exports to 2% in recent years. Mutton exports have shown a more moderate decline, albeit starting from a lower base in 1995 just above 4% of total mutton exports to dip below 2% in the last few years.

Meanwhile beef exports from Australia to the UK have been flatlining below 1% of total beef export flows for much of the last three decades. It would be fair to say that a UK FTA would open up the opportunity to capture more market share in the UK as there is quite a bit of upside potential available.

Indeed, analysis of the last five year average annual flows of beef from Australia to the UK saw around 4,600 tonnes shipped averaged across each season. Sheep meat (lamb and mutton combined) saw about 10,000 tonnes shipped each year over the same period, averaged across the five years.

Under the new FTA there is a safe guard quota limit set for beef at 35,000 tonnes per annum, which is set to grow to 110,000 tonnes by the next decade. Similarly the current quota for sheep meat is set at 25,000 tonnes and that is scheduled to grow to 75,000 tonnes by the end of the decade.

These generous quotas leave significant room for the UK to become a major destination for Australian red meat. It was only back in 2017 when China was taking 110,000 tonnes of Aussie beef per annum and at that at that stage they were our fourth largest export destination for beef product.

Similarly South Korea was at similar levels, taking approximately 125,000 tonnes a decade ago and were then our third largest offshore market for beef. This year South Korea are sitting in second place, so who knows what could be in store for our British friends in a decade from now.

It seems great times are ahead for the Aussie agricultural producer as more export diversity brings more opportunities, particularly for a trade reliant country like Australia with a relatively small domestic consumer population by international standards.