Making ends meat

Producer Share March 2024 Quarterly Update

Improving livestock prices during the first quarter of 2024 have seen beef and sheep producers capture a greater share of the retail spend as CPI data for average retail beef and lamb pricing shows at the consumer end the price for meat has continued to ease. However, the additional share being retained by beef versus sheep producers isn’t being equally distributed.

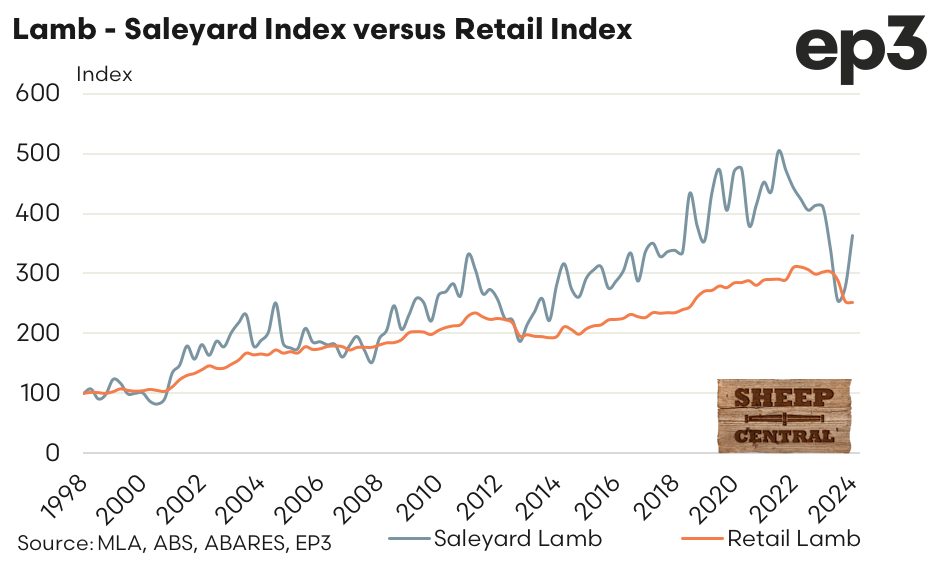

Before we jump into the producer share for each sector we will take a look at the pricing indices for each category. According to the index, saleyard lamb pricing saw a 31% increase from the end of 2023 to the end of March 2024 from 276 to 363. However, over the first quarter of 2024 retail lamb pricing hardly moved, with the index easing marginally from 254 to 252, a fall of less than 0.1%.

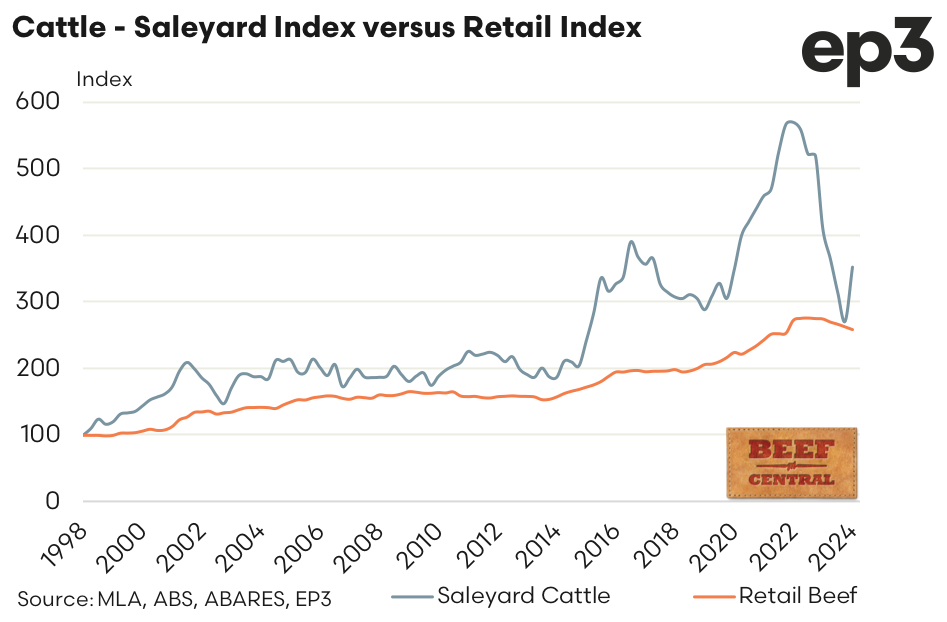

In the beef sector, the sale yard index bounced 30% over Q1 2024, from 271 to 352. As was the case with sheep meat at the retail level the retail beef prices eases marginally over the first quarter of 2024 with the CPI data showing a decline of 1.5% with the retail index dropping from 262 to 258.

As was the case with retail pricing being slow to respond to falling livestock prices that we saw during the end of 2023, there is also a lag effect when livestock prices rebound.

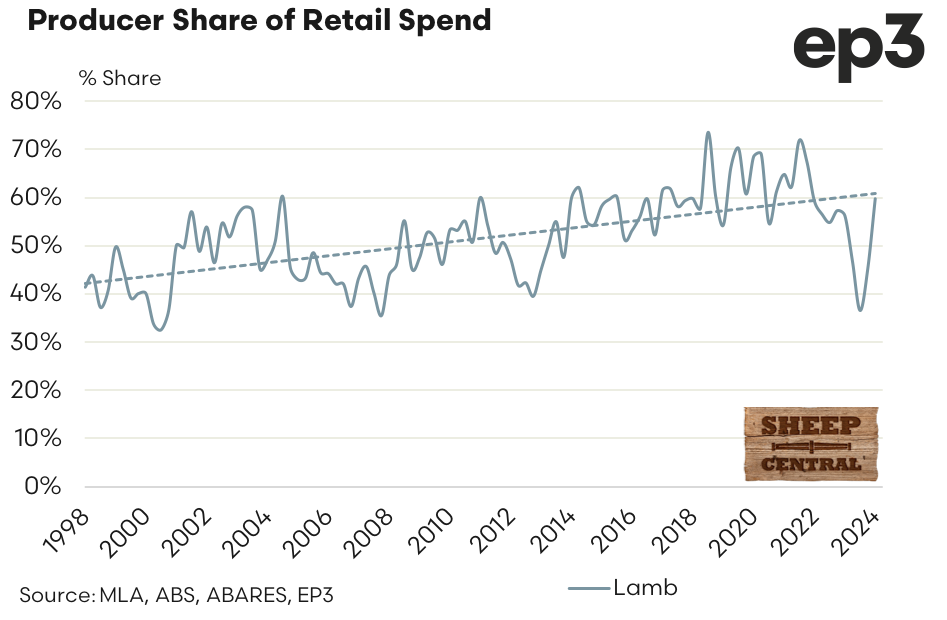

In terms of the producer share of the retail spend the lamb sector has seen a solid recovery in the sheep producer share over the quarter with the proportion rising from 45% in Q4 2023 to nearly 60% in Q1 2024. This is the highest the producer share has been for sheep farmers since Q1 2022 and places the producer share back in line with the trend line growth seen since 1998, as outlined by the dotted trend line.

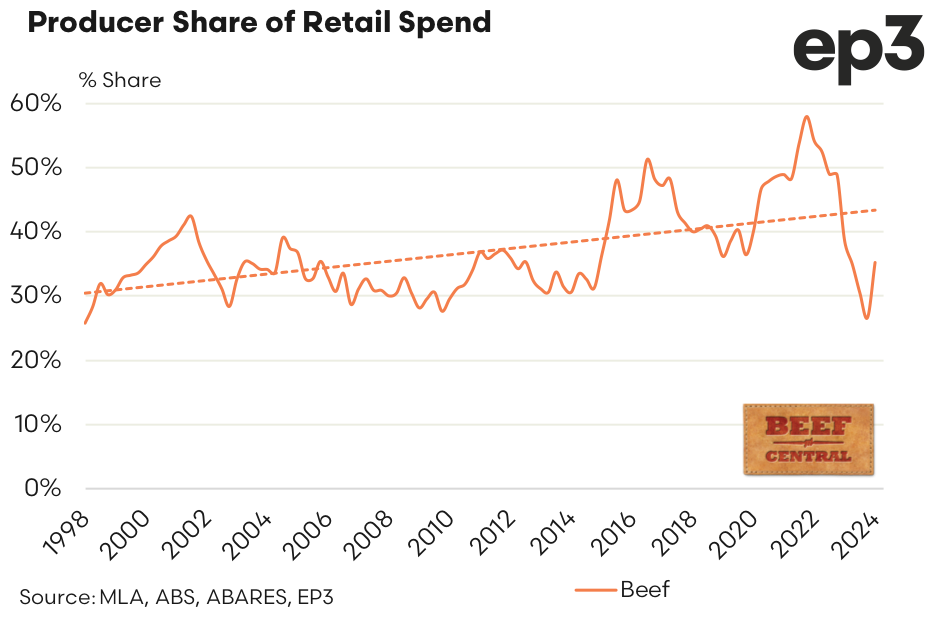

Unfortunately for the beef farmer the rebound in producer shares hasn’t been quite as robust as for lamb. The first quarter of 2024 has seen the beef producer share lift from record low levels in Q4 2023 to a little over 35% during Q1 2024. This is the best result seen for beef producer share since Q2 2023, but a long way off the trend line growth seen since the late 1990s.

This analysis is produced in conjunction with Beef Central and Sheep Central. At Episode 3 we are always happy to explore ways of working together with complimentary organisations. If you want to know more about what we do, or want to have a chat about how we can assist your business feel free to reach out to us on email at info@episode3.net or via the contact us page.