Margin Crunch Deepens for Beef Processors

Beef Processor Trading Conditions - September 2025 update

Beef processor trading conditions have tightened even further than initially thought, with updated co-product and rendering price data revealing a deeper squeeze on margins through late winter and early spring.

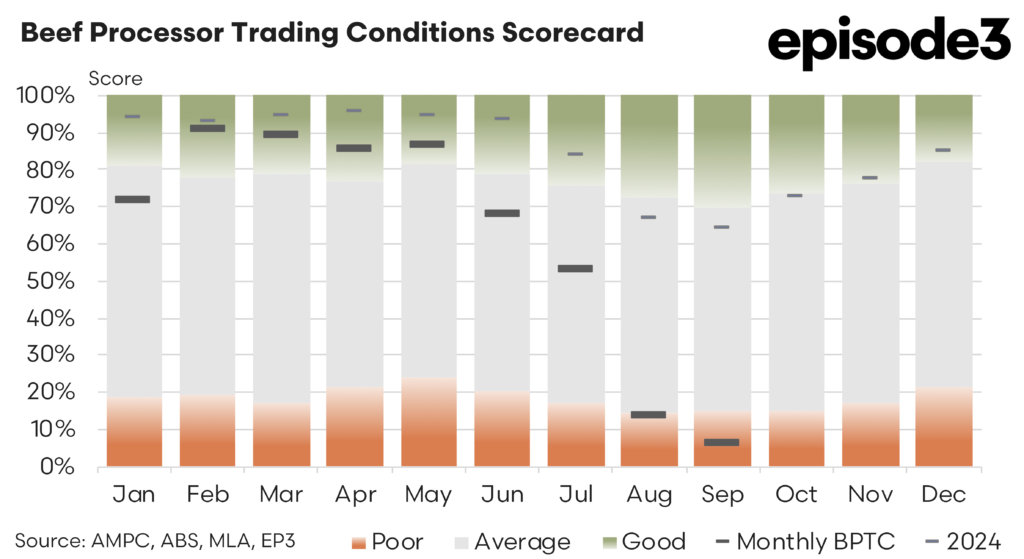

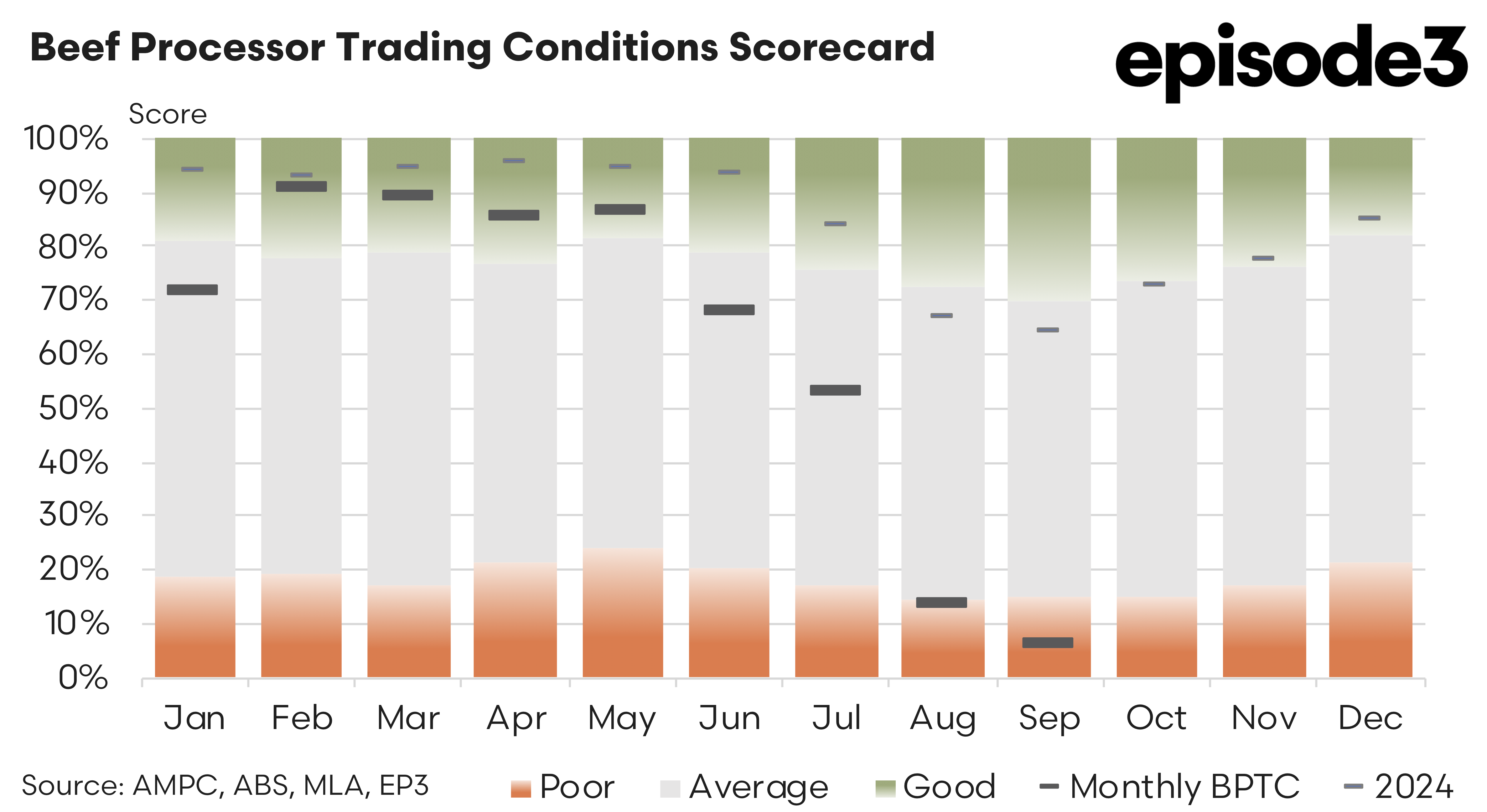

The revision of co-product values, including hides, offals, meat and bone meal and tallow, has resulted in the August Beef Processor Trading Conditions (BPTC) index being downgraded from 21 percent to just 13 percent. This correction underscores how critical these secondary revenue streams are for processor profitability. With September’s BPTC now confirmed at an exceptionally weak 6 percent, the sector has seen trading conditions deteriorate to some of the lowest levels recorded in recent years. The cumulative effect is stark, pulling the year-to-date average BPTC down to 63 percent, a sharp reversal from the relatively comfortable position processors enjoyed through the first half of 2025.

A comparison of second-quarter to third-quarter trends shows clearly where the pressure has been applied. Cattle procurement costs have risen dramatically, with heavy steer prices up by 21 percent over the period and processor cow values rising even more sharply by 35 percent. These increases reflect firm restocker and feeder competition, improving seasonal confidence and tightening supplies entering spring.

For processors, however, these higher input costs have hit at a time when market returns have failed to keep pace. Export values across major markets offer a mixed picture. The United States has maintained strong underlying demand for Australian beef, but returns have remained flat across the quarter, providing no additional support to offset rising procurement costs. Japan has performed somewhat better, with export values lifting by 7 percent, though the gains were too modest to materially change processor margins. China, which has been volatile at times during the year, posted only a 1 percent rise in export values, reflecting ongoing caution from buyers and higher competition from South American suppliers. South Korea, typically a stable contributor to Australian export performance, weakened slightly, with export values falling 3 percent over the quarter. When combined, these export trends demonstrate a market that is neither weak nor strong, but insufficiently buoyant to help processors absorb escalating livestock costs.

Co-product markets, which often provide a crucial buffer during periods of tight margins, have also failed to offer relief. The updated data over the last two quarters shows co-product values down by 1 percent, while tallow and meat and bone meal have fallen by 6 percent. These reductions are meaningful in a segment where margins are often made or lost at the edges. In earlier parts of the year, co-products contributed solidly to processor profitability, helping to counterbalance cattle price rises. Their recent deterioration has compounded the margin squeeze, as revenue from hides and rendering streams declines at the same time that procurement costs are accelerating. The combination of rising cattle values, static-to-soft export returns and weakening co-products has pushed the BPTC index sharply lower, capturing the cumulative impact of these shifts on processor viability.

Domestic market conditions have provided little additional upside. Retail beef prices rose by only 2 percent over the quarter, a modest increase that confirms that processors and retailers have not been able to pass higher cattle prices along the supply chain. Australian consumers remain highly price sensitive, and the retail sector is cautious about pushing through price increases in an environment where households are already facing elevated living costs. This flat retail environment reinforces the structural challenge faced by processors. Their major input costs have risen quickly, while both export and domestic market returns have been far slower to respond, resulting in shrinking processor margins over consecutive months. The narrowing spread between cattle prices and wholesale and retail returns is a classic sign of a processing sector under pressure, especially at a time of year when processing volumes normally begin to lift.

September’s BPTC reading of 6 percent captures the full extent of the challenge. It represents not just a continuation of August’s downturn, but a further deterioration driven by persistent high livestock prices and ongoing softness in secondary revenue streams. For a sector that relies on narrow and volatile margins, two consecutive months of such weak trading conditions sends a clear warning about financial stress building inside processing plants. Throughput schedules are likely to be adjusted as processors attempt to avoid locking in losses at scale. Plants may reduce weekly kill numbers, extend maintenance periods or prioritise higher-value orders to protect margins where possible. None of these strategies, however, fully resolve the structural imbalance created by high cattle prices and insufficiently responsive market returns.

The broader narrative is one of mounting tension across the beef supply chain. Producers have benefited significantly from the surge in cattle prices, particularly those with well-finished stock ready to meet processor specifications. Their optimism is fuelled by favourable seasonal conditions and firm restocker interest. In contrast, processors face a completely different reality.