Market Morsel: An offally close relationship

Market Morsel

At EP3 we regularly look at the co-products which are important and relevant for Australian agriculture. A commodity which we often get asked about, especially by those in intensive agriculture or the food industry is offal – especially tallow and blood and bonemeal.

Meat and bone meal (MBM) is produced from abattoir waste products which are not suitable for human consumption. MBM is used extensively in animal feed. Tallow is rendered fat and is also used for feeding animals, but also in making a wide range of soaps and lubricants.

Commodities do not exist in a vacuum they tend to operate in subsets. These are generally commodities which are replaceable with one another. A good example is corn and wheat, they can have similar uses, so when one becomes too expensive, the other will be replaced.

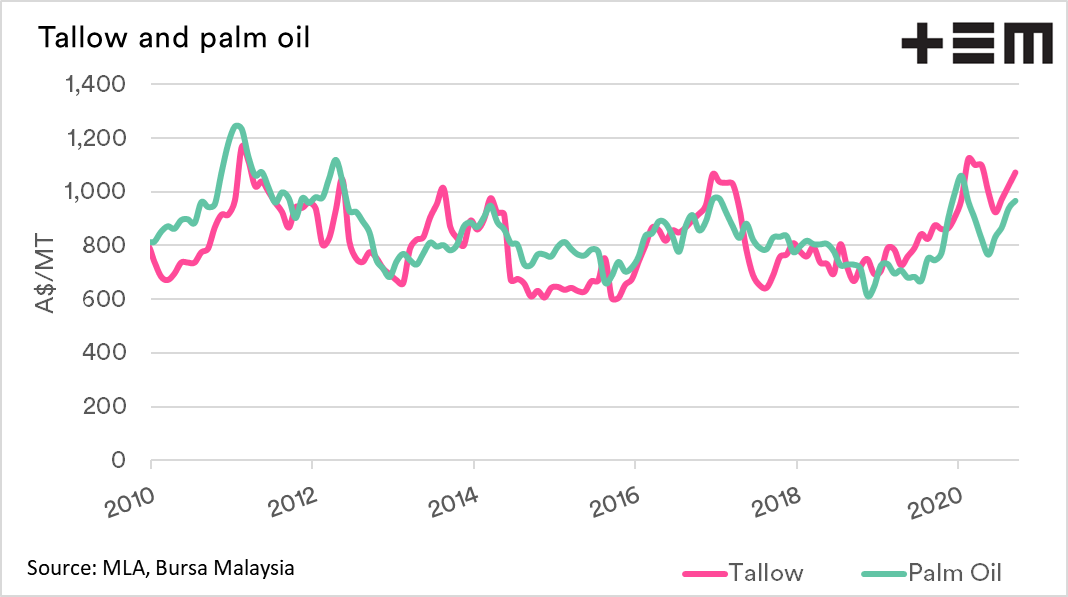

This can be seen in tallow, as a rendered fat it can be classed in the same category of commodities as oilseeds. These are wide-ranging incorporating the oil from cotton, palm, soy and canola. The relationship between tallow pricing in Australia, and palm oil (Malaysia) is close. This allows the possibility of hedging tallow requirements using Malaysian palm oil futures.

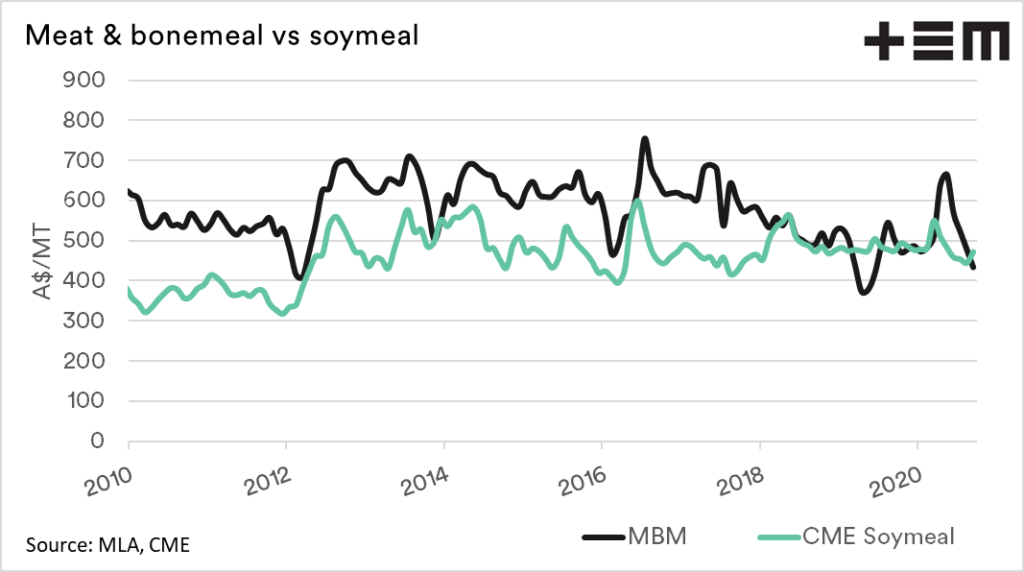

MBM is an animal feed and can be replaced with several other products. The common replacements would be other meals such as canola or soybean meal. MBM maintains a relatively strong relationship with soybean meal.

It is crucial when examining commodity markets to examine the other commodities which operate in close subsets. This can provide insights into the direction of the market or provide opportunities for risk management.

The price rise experienced in palm oil and soybean meal futures is likely to flow through to tallow and MBM prices.