Market Morsel: Nearly back to normal

Market Morsel

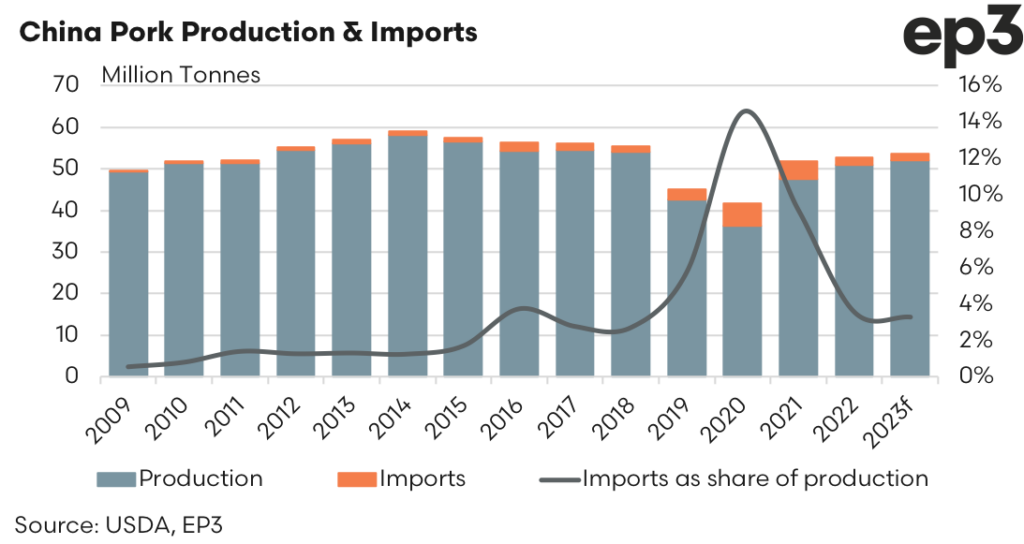

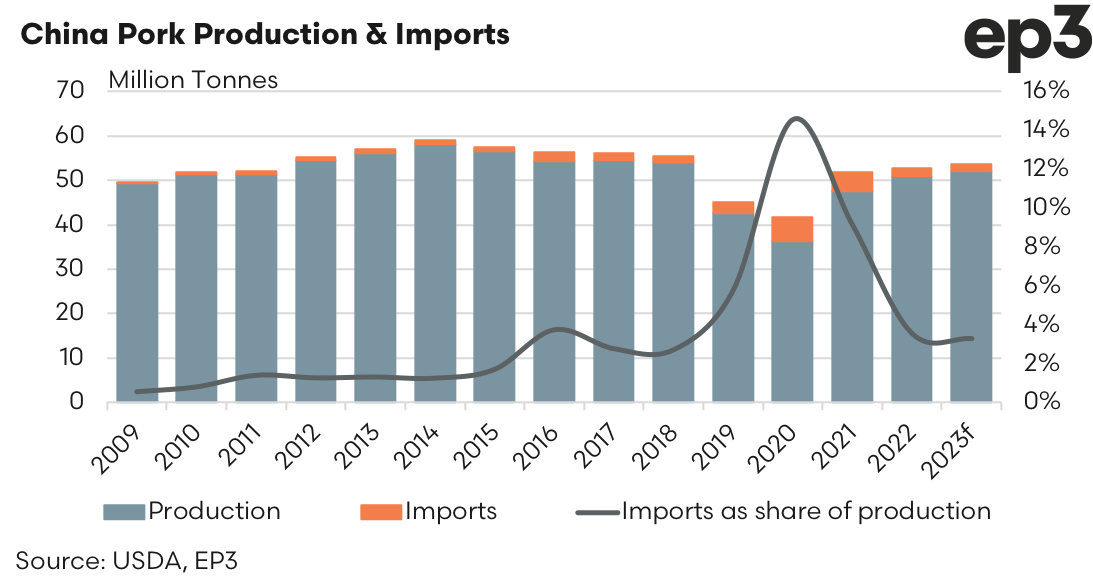

It has been a few years since China was impacted by African Swine Fever (ASF). In 2019 the level of Chinese pork production declined sharply as their pig herd dropped by a reported 200 million head. It was estimated that into 2020 there was a void of pork protein in China of around 24 million tonnes, which was partially filled with imported meat of all types.

Chinese consumers scrambled to get their hands on as much imported pork as possible, with the ratio of pork imports to pork production climbing from around 2% in 2018 to over 14% in 2020. During 2021 the beginnings of a recovery to the Chinese pig herd saw the reliance on pork imports begin to lessen somewhat. Further growth in production into 2022 has seen the ratio of pork imports to pork production in China return to near pre-ASF levels at around 3%.

USDA forecasts for 2023 shows the situation in China regarding pork supply is expected to continue to stabilise. However, it may be a few more years yet until Chinese pork production levels reach the pre-ASF record set in 2014.

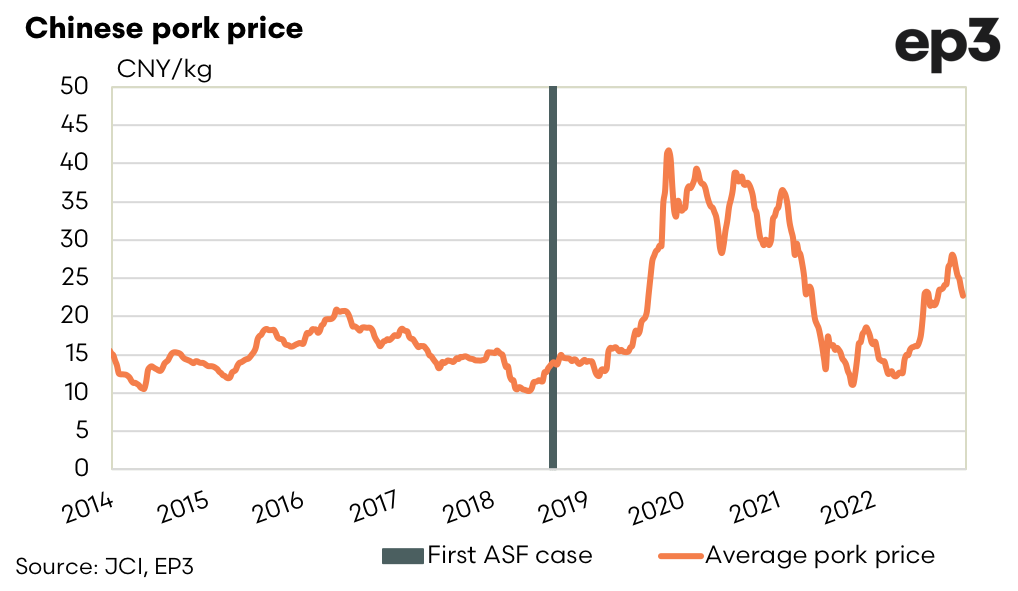

Pig pricing in China returned to pre-ASF levels earlier in 2022 but at these lower pricing levels pig trading margins were negatively impacted and producers reacted by reducing pig numbers. In recent months the tighter supply has seen pig prices in China lift back above 20 CNY/kg providing some improvement to trading margins.