Market Morsel: Nothing foul about them

Market Morsel

Poultry (predominantly chicken) is the most consumed meat category in Australia accounting for more than 40kg per person per annum, compared to beef and pork which are the next two highest meat consumption items, each account for around 25kg per person per annum. Fish comes in at about 15 kg per person a year, meanwhile sheep/goat meat (mostly lamb) is less than 10kg per person per annum.

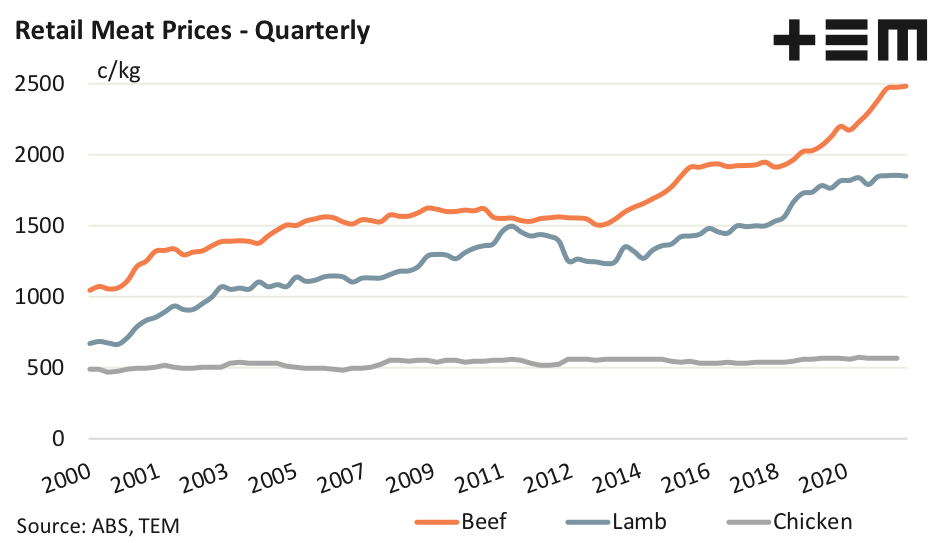

A comparison of the retail price trends over the last two decades for beef, lamb and chicken highlight one reason behind the growth of chicken as our most dominant meat based meal. The average quarterly retail price of chicken, as reported by the Australian Bureau of Statistics, has barely moved from $5/kg since the early 2000s, rising by just 15% over the last twenty years. In contrast, the average retail price of beef has risen by 138% to nearly $25/kg. The increase to lamb prices has been even more spectacular, lifting 178% since 2000 to around $18.5/kg as at the end of 2021.

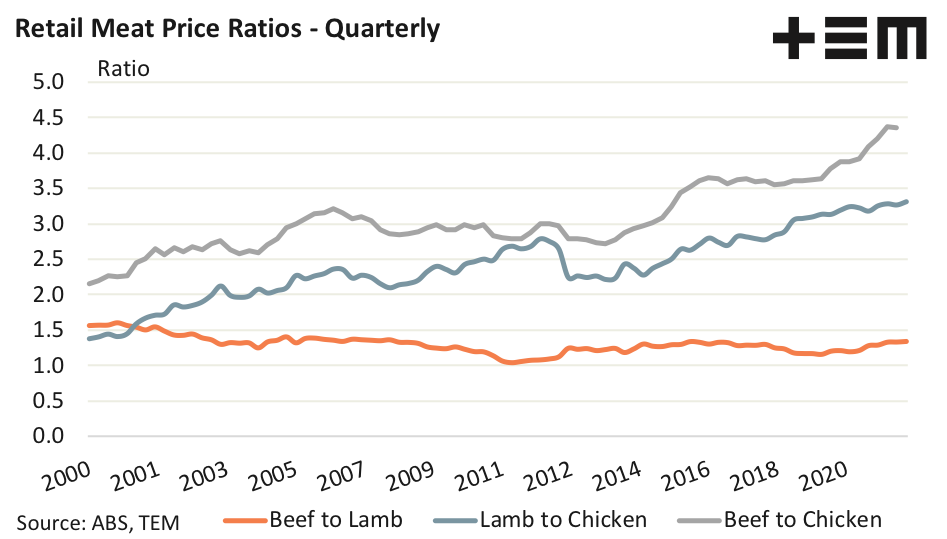

On average retail lamb prices have grown by 5% per year since 2000 and retail beef has grown by around 4%. Meanwhile retail chicken has averaged less than 1% growth per year. Analysis of the price ratios between these three meats tells a similar story of chicken competitiveness. The ratio of beef to lamb has been relatively flat over the last two decades with beef costing between 1.0 to 1.5 times the price of lamb over the last twenty years, averaging about 1.3 times the price over the entire period.

Compared to chicken, lamb began at around 1.5 times the price of the humble chook in the early 2000s. However by the end of 2021 was sitting at about 3.3 times the price of chicken. Beef began the 2000s at about 2.2 times the price of chicken, but by the end of last year was fetching nearly 4.5 times the price.