Market Morsel: This little piggy went to market.

Market Morsel

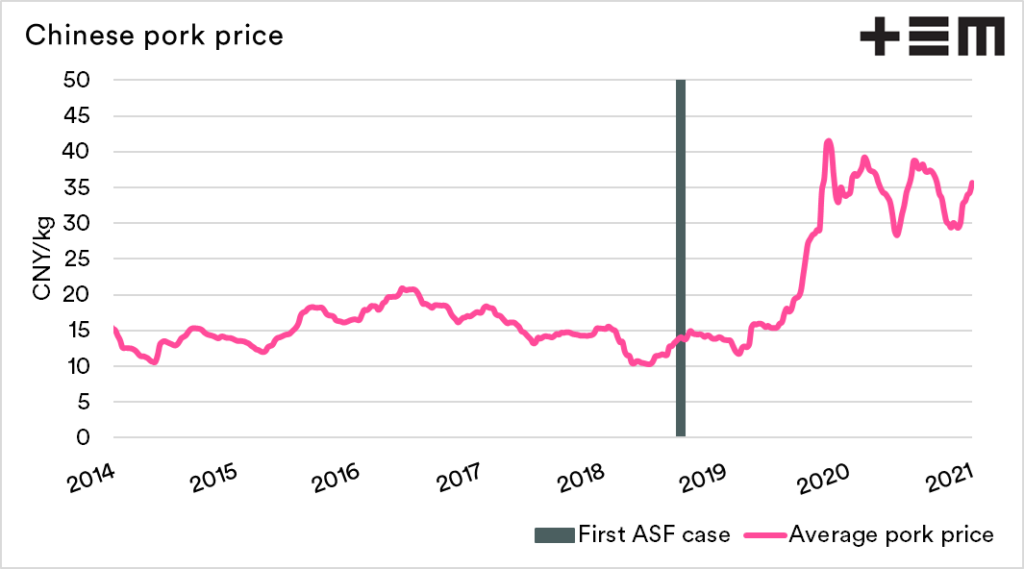

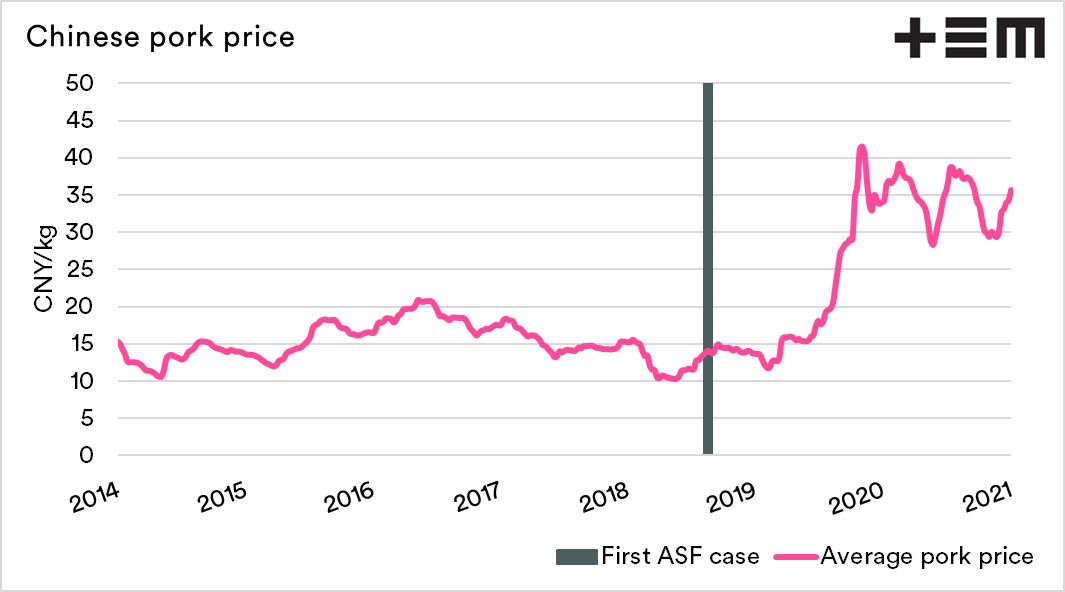

The outbreak of African Swine Fever has been one of the most significant contributors to the increase in global protein values in recent years. The destruction of the Chinese swine herd has caused an explosion of demand.

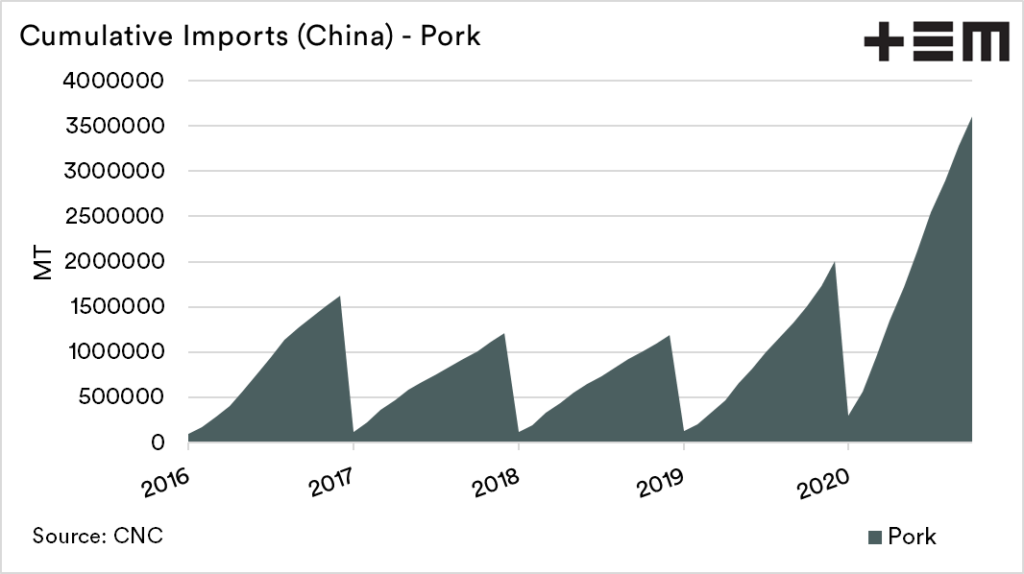

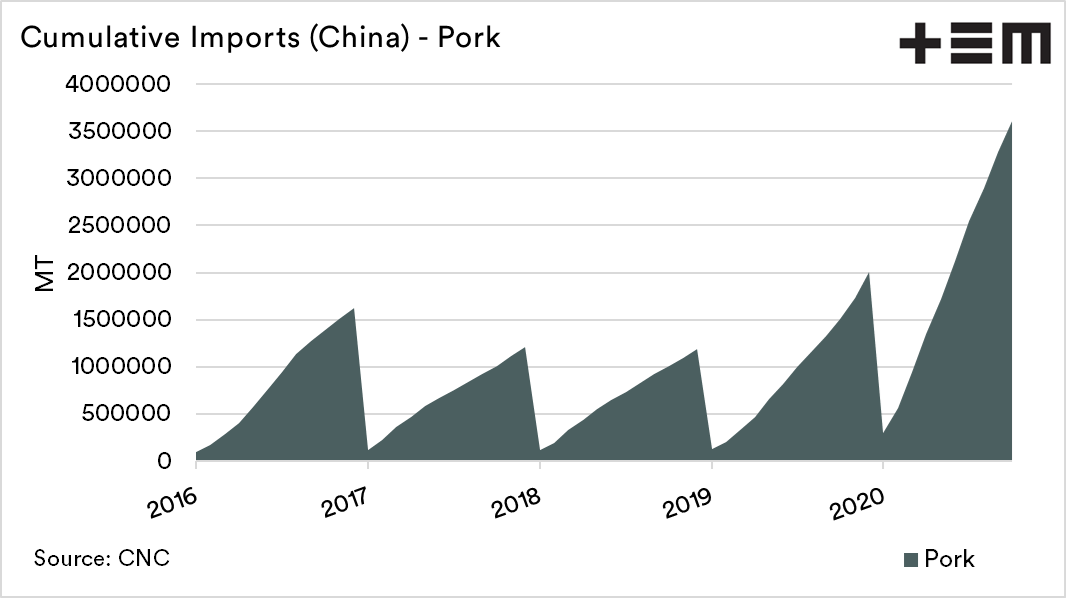

Whilst efforts are made to rebuild the herd, pork imports remain high, which points to either stock building or a herd rebuild which is not entirely effective.

The pork price at present in china still remains well above historical levels. In recent months, it has been moving higher than lower, which you would expect with increased supply from a rebuild.

A portion of this rise can be attributed to the coming holiday season, which can increase demand as people celebrate – which were limited due to COVID-19 in 2020.

The Dalian Commodity Exchange has introduced a new live hog futures contract, to allow pork producers and consumers to hedge their requirements.

Whilst it is expected to stabilise prices, the first day of trading on Friday saw major losses across the board (Sep -12.6%, Nov -15.99% & Jan 22 -15.83%). The first available month is February. There is a sharp discount from recent spot prices of 36200cny/mt to the September contract at 26810cny/mt.

This is due to the likelihood that China should have made some progress in the nine months between now and the September contract month.

The contract remains in its infancy but will provide some insights in the coming months into the future of pig pricing in China – and in return, our protein export markets.

Once we start seeing the signals of an effective rebuild, then we may see a reduce demand for our protein into China.