Massive WA discounts

Market Morsel

Western Australia’s sheep industry is facing major challenges, driven by the decision to phase out live sheep exports by May 2028. Historically, live exports accounted for around 30% of farmer sheep turnoff, but since the moratorium introduced in 2018, this has dropped to just 11%. The decline has caused instability, leading many farmers to exit the sector.

WA has been central to Australia’s live export trade, particularly to the Middle East, providing a profitable market for sheep unsuitable for domestic meat production. The system suited WA’s large, extensive farming operations, where access to processing facilities is limited.

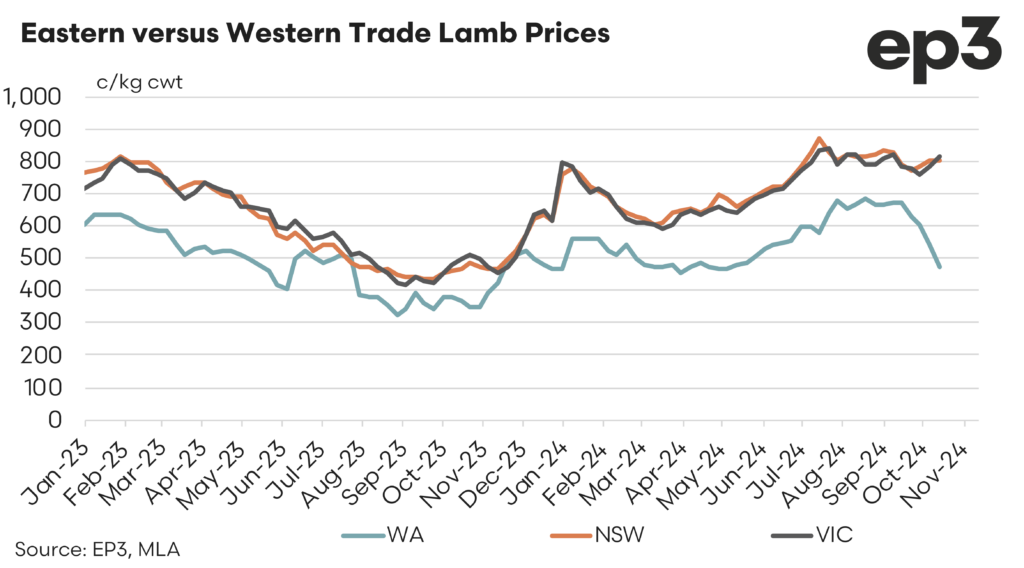

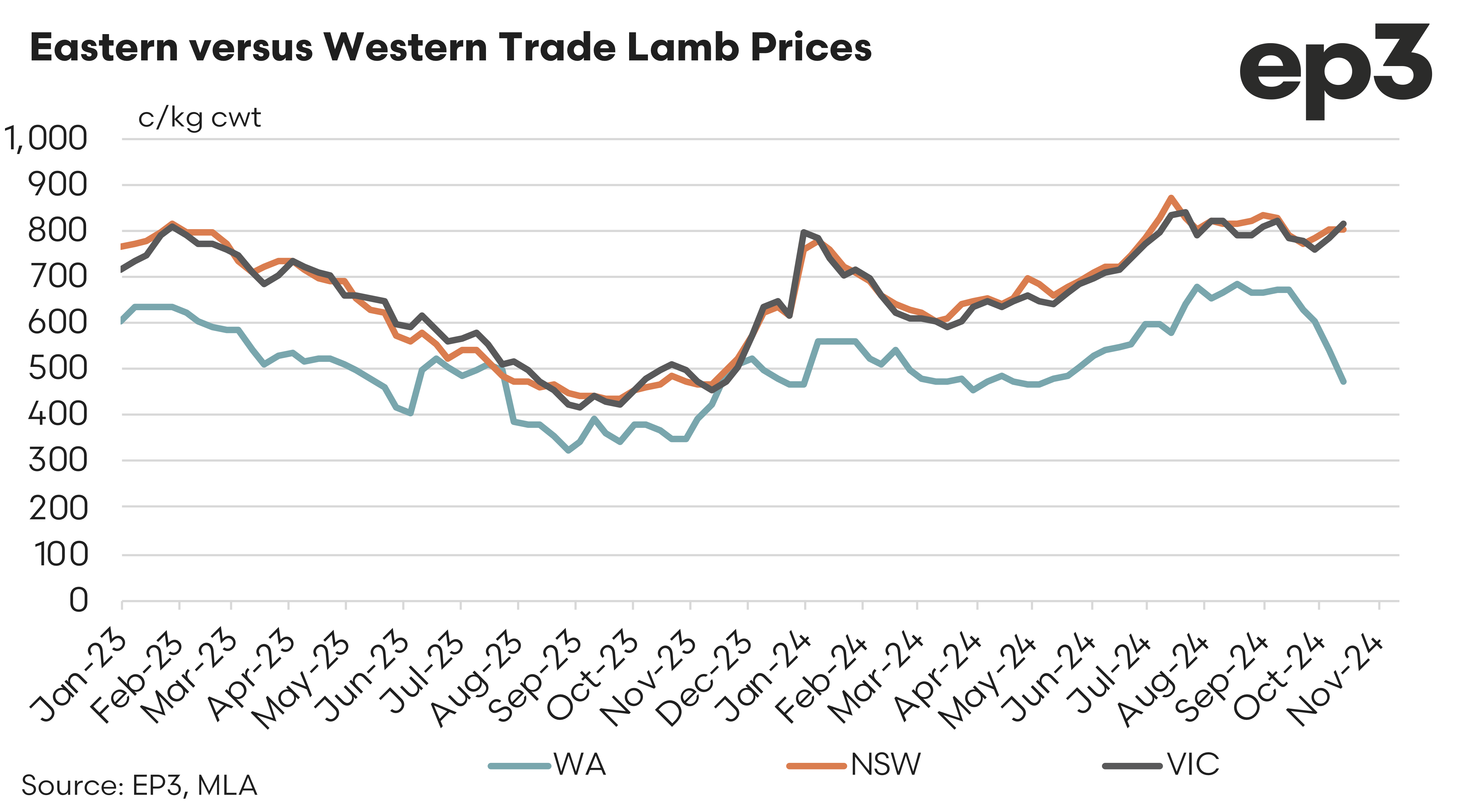

Live exports provided farmers with a reliable outlet and pricing stability, shielding them from domestic price volatility. However, with the sector shrinking, farmers have become more reliant on domestic processing, which lacks the capacity to absorb the surplus, driving down prices. In mid-October, trade lambs in WA fetched 472 cents/kg, 42% lower than in the east. Mutton prices have followed a similar trend, with WA mutton priced at 162 cents/kg, 40% below the national average.

The Australian Labor Party plans to transition to boxed meat exports, but WA lacks the processing infrastructure to handle this. Boxed exports may also be less profitable, especially for sheep traditionally sent to live export markets. There are concerns Middle Eastern buyers may not fully embrace boxed meat as a replacement for live sheep.

The phase-out is expected to cause further exits from the sheep farming sector, particularly in areas with limited processing facilities and high transport costs. Additionally, jobs across the supply chain, including farmers, transporters, and port workers, are at risk. The industry is already feeling the effects through volatile prices and uncertainty.