Mistaken bacon?

The Snapshot

- China is definitely in the process of rebuilding its swine herd, despite the impact of continued ASF outbreaks and CV-19.

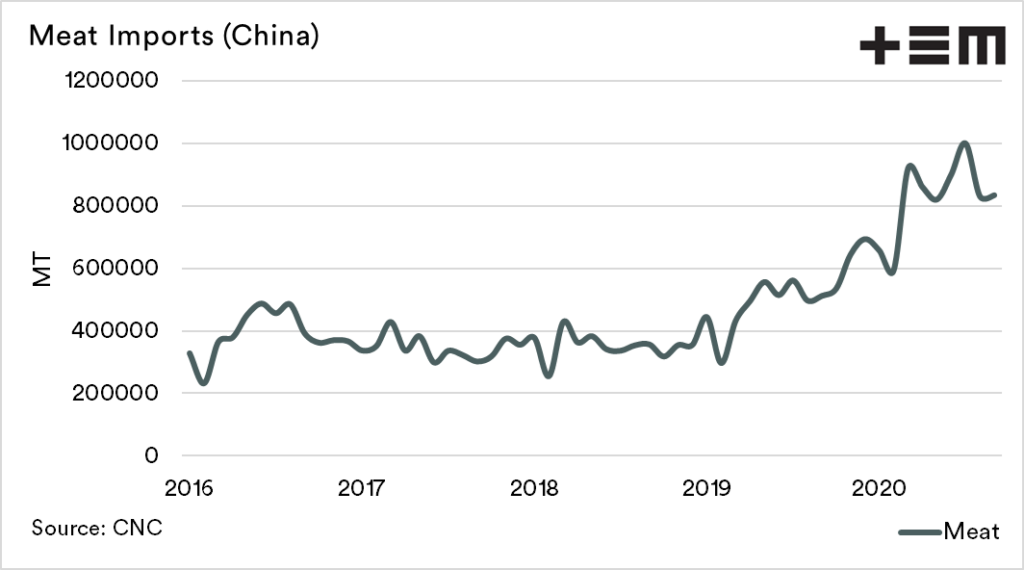

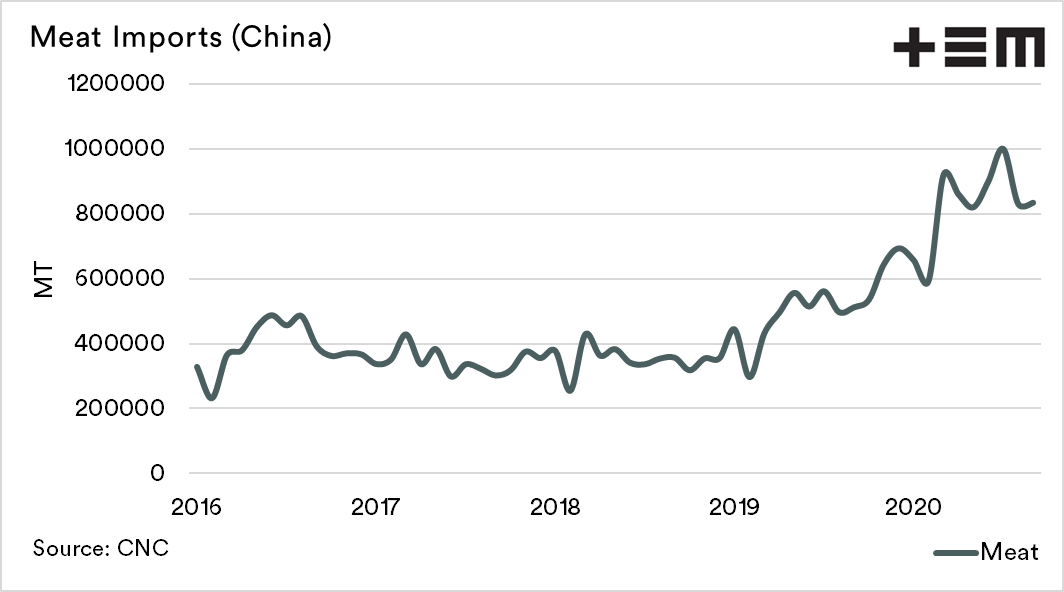

- Price and imports of meat are a signal of whether the rebuild is successful.

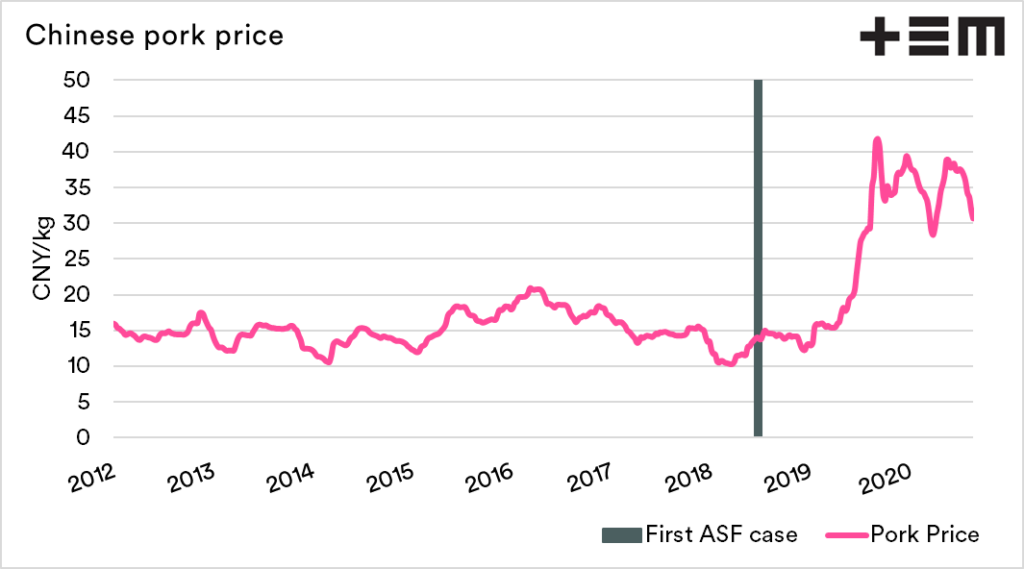

- The current average price of pork in China is 32CNY/kg. This is below the ASF peak of 42CNY/kg but above the pre-ASF height of 21CNY/kg and an average of 15CNY/kg.

- This inflated price signals that the pork industry still has a strong deficit and Chinese imports of meat remain historically strong, albeit below the record peak in July.

- There are concerns that the swine herd genetics are not great, resulting in reduced litters and potentially lower weight gains.

- The protein market is likely to be well supported for at least the next six months.

- The first signal of a strong and effective rebuild will be a sustained and significant drop in meat imports and domestic prices.

The Detail

The simplest way of examining supply and demand is to look at the price. When supply is high, prices drop and vice versa. There are aberrations to prices at times, however, in general, the fundamental drivers of supply and demand will set price.

The Chinese pig herd is going through a phase of rebuilding from the worst effects of the outbreak of African Swine Fever (ASF) in 2018/19.

The Chinese pork industry has been in the process of wholesale change since 2015 when environmental regulations caused many small scale producers to close down. A move that has been exacerbated by the current situation.

Also, many farms were encouraged to move from the southern/eastern regions to the north and the west. The result has been that the more commercial operators are likely to take up the slack and be the primary method of pig production, with reduced smallholder participation.

So the rebuild is on?

ASF put a match under the protein market, as China hoovered up protein of all kinds from all over the world. This was good news for Australian livestock producers, as it meant that during a time of stock liquidation during the drought that a reasonable price was available.

The peak price for pork in China pre-ASF was 21CNY/kg, experienced back in 2016. The average price pre-ASF was 15CNY/kg.

The first officially recorded case of ASF wasn’t until August 2018. The impact on price wasn’t felt initially.

In part this was due to farmers slaughtering pigs ahead of the virus causing an increase of supply, plus the release of government stockpiles. When the virus became endemic in 2019, the price of pork shot up faster than a rocket. The peak price on average for China rose to 42CNY/kg.

At present, the pork price is 32CNY/kg, a large drop from the peak. However, it remains well above the pre ASF peak and the long term average. If the rebuild was nearly complete, then we would expect to see prices shrink back further than the current market signals.

Herd rebuild = lower imports?

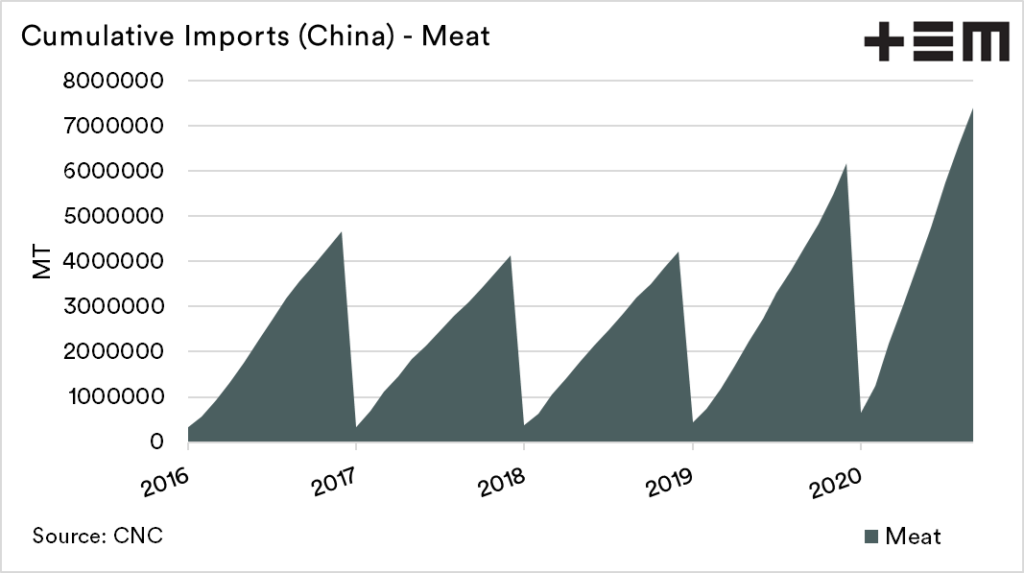

A signal of the rebuild being successful in addition to lower pork pricing in China would be a drastic reduction in meat imports. As I mentioned previously, China sucked up all the protein that it could get its hands on during 2019 and into 2020.

Many commentators have pointed towards reduced import demand for meat in China. This is on the back of reduced imports in August/September from July. However, it is important to note that July was a record month for meat imports in China. So a fall is not unexpected but remains at very high levels.

The interim import data for China shows that they have imported 20% more between Jan-Sept than they did during the entire 2019 calendar year.

A successful rebuild in head but not volume?

We are not denying that a rebuild is in progress. However, the signals are not displaying a fully successful rebuild – yet.

It may be true that the number of breeding sows is back up close to speed, but reports out of China are that the genetics are not as good as pre-ASF. This means smaller litters and potentially lower weight gain.

Whilst many are saying that the recovery is negative for livestock trade, It may be some time until China reaches optimal levels (2-3 years).

Over the next few months, if we see substantive changes to domestic pork prices or imports of protein, that will be a real sign of an effective rebuild.