Moderating, but firm

Market Morsel

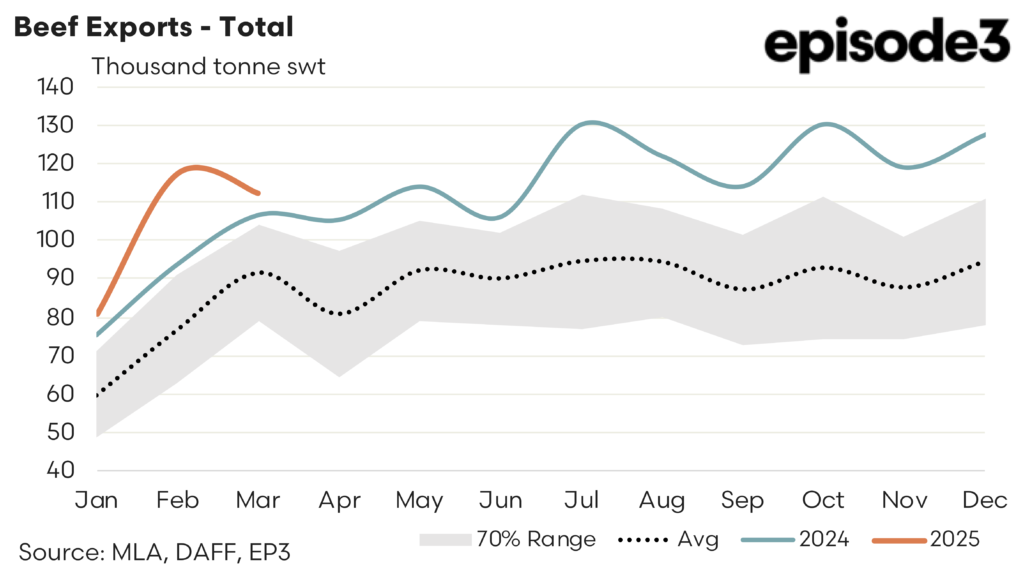

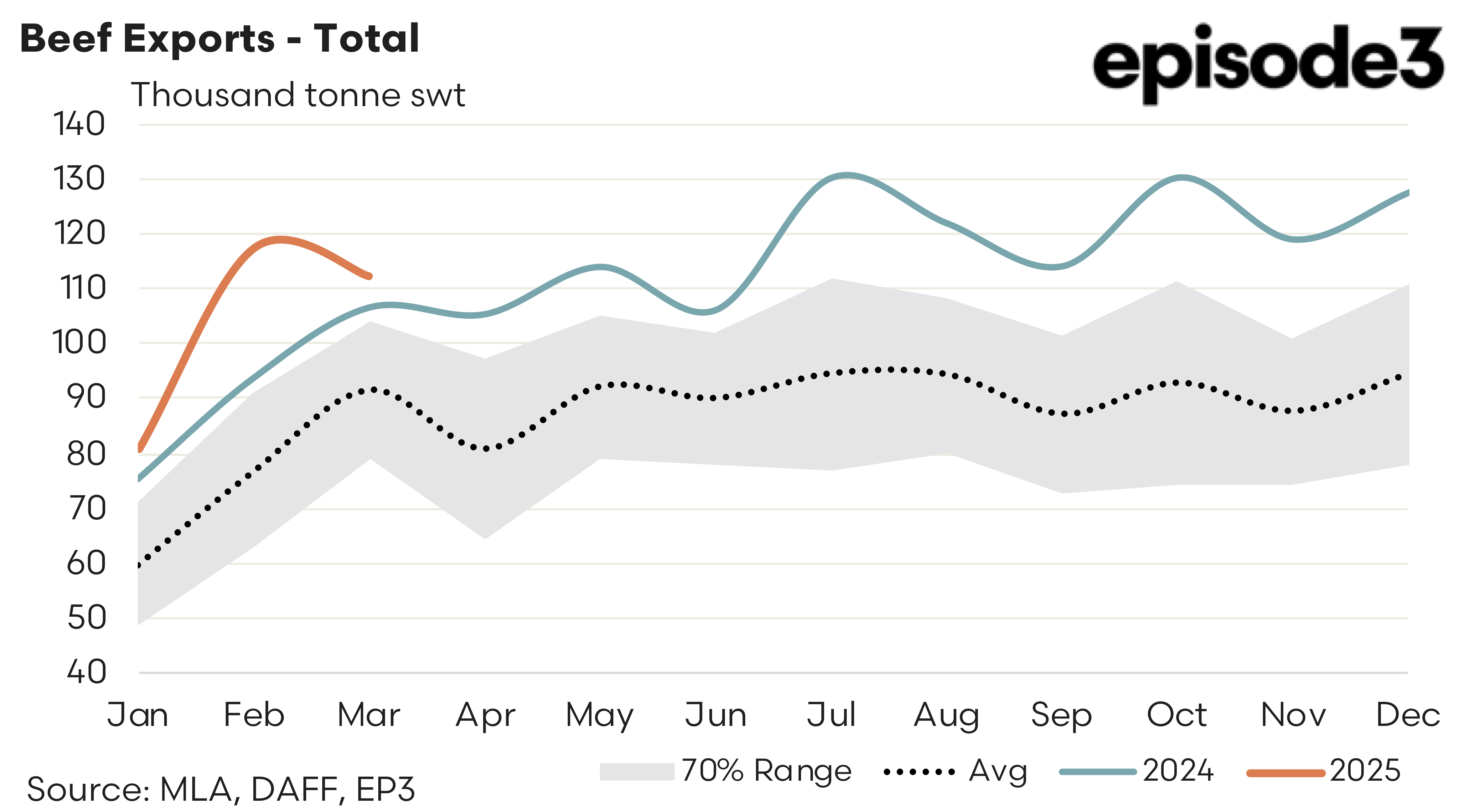

Despite ongoing concerns over the tariff shenanigans of the Trump administration there is still much positive news on the Aussie beef export front. Three of the top four beef trade destinations are running trade volumes above average levels and despite a slight easing in the trade over March 2025 the first quarter of the year was a promising start.

Total Aussie beef exports saw 310,974 tonnes shipped for the first quarter of 2025. This is the strongest Q1 beef trade volumes on record and represents trade flows that are 13% above the Q1 levels seen in 2024. Indeed, compared to the Q1 average trade volumes seen over the last five years the current export flows are running 36% stronger.

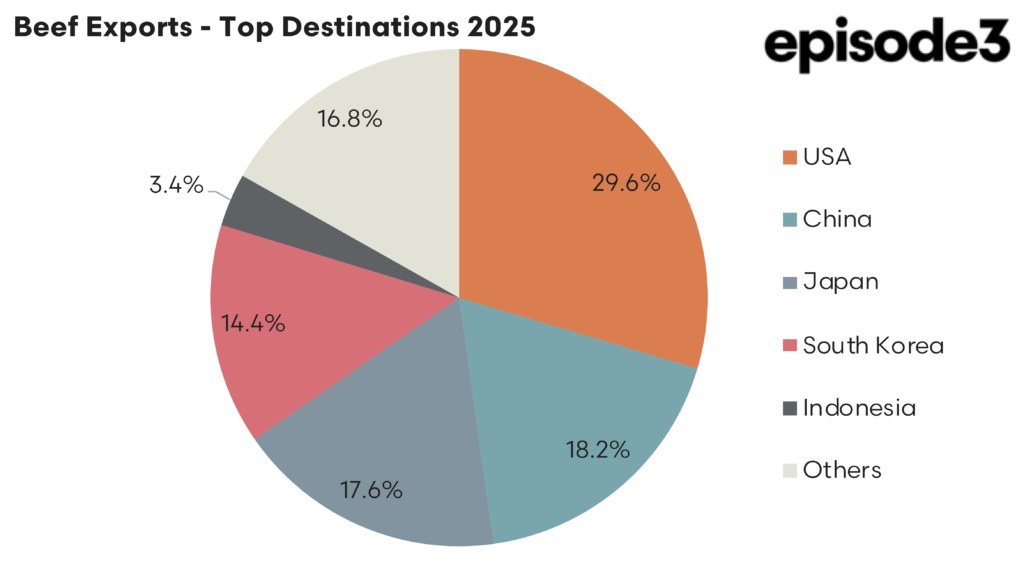

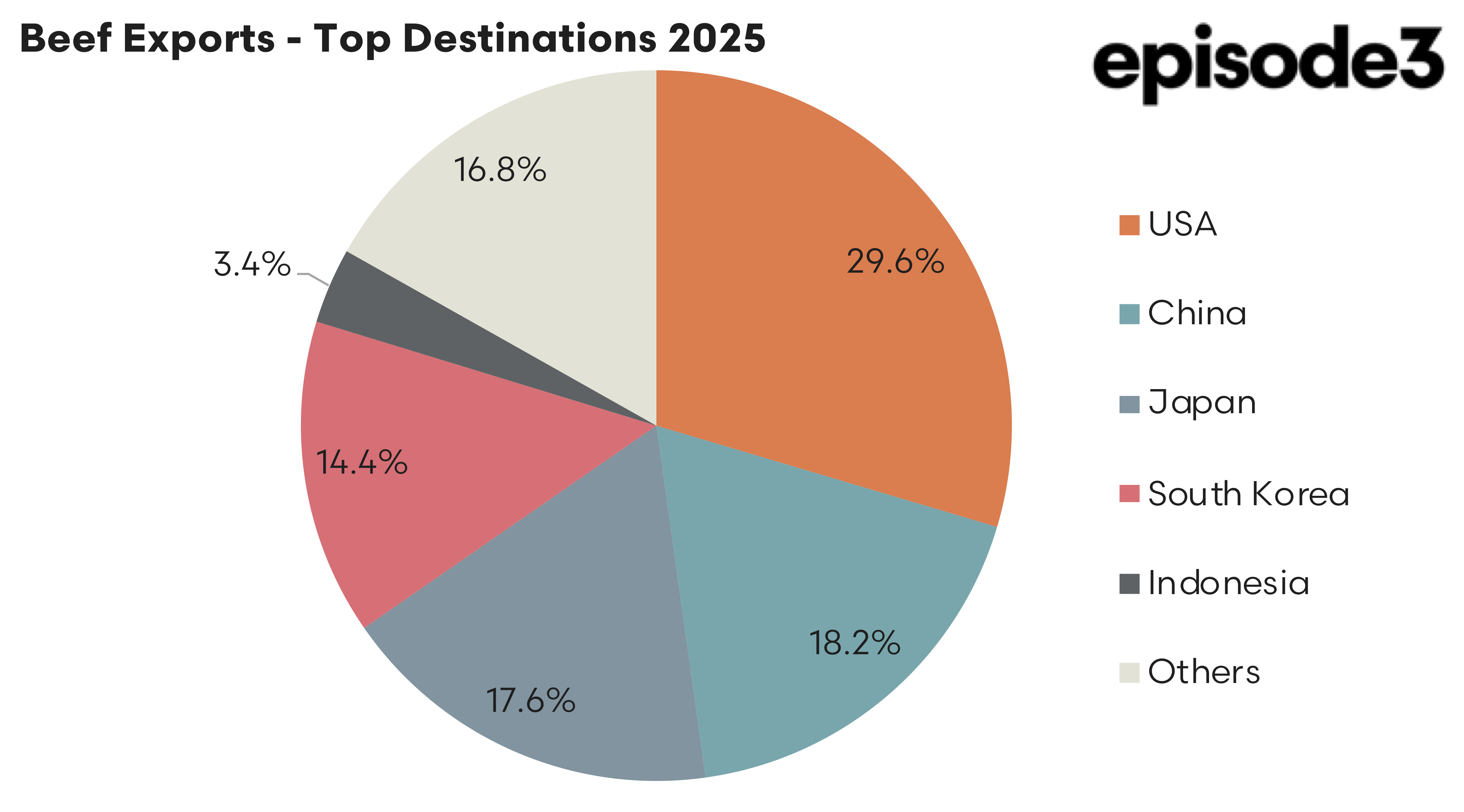

The USA remain top trade destination for Australian beef with nearly 30% of the export trade. China sits in second place with a little over 18% of the trade and Japan are snapping at their heels in third place on 17.6%. Meanwhile, South Korea round out the top four spots on 14.4%.

A summary of the top trade locations, in order of top market share for 2025, is as follows:

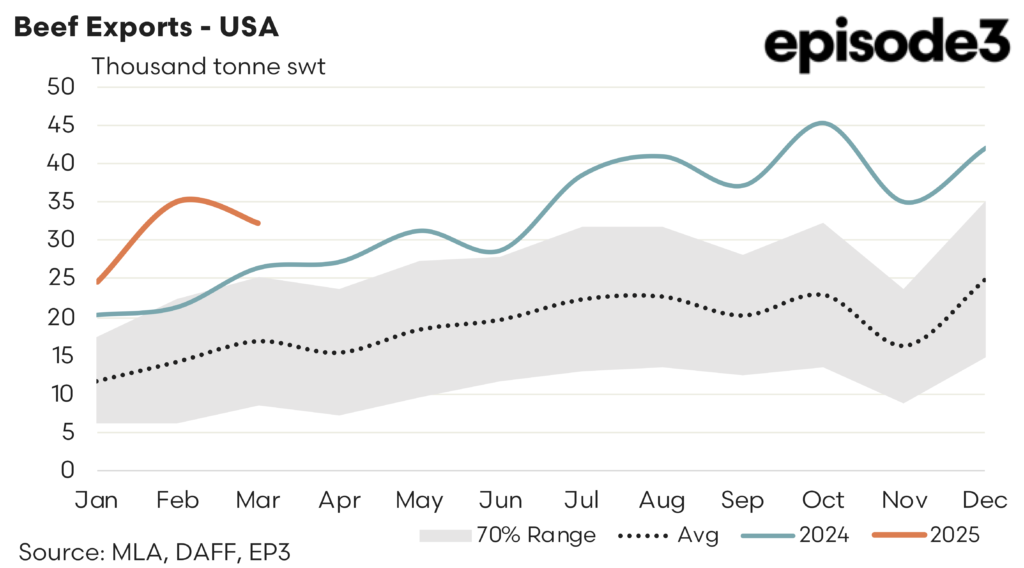

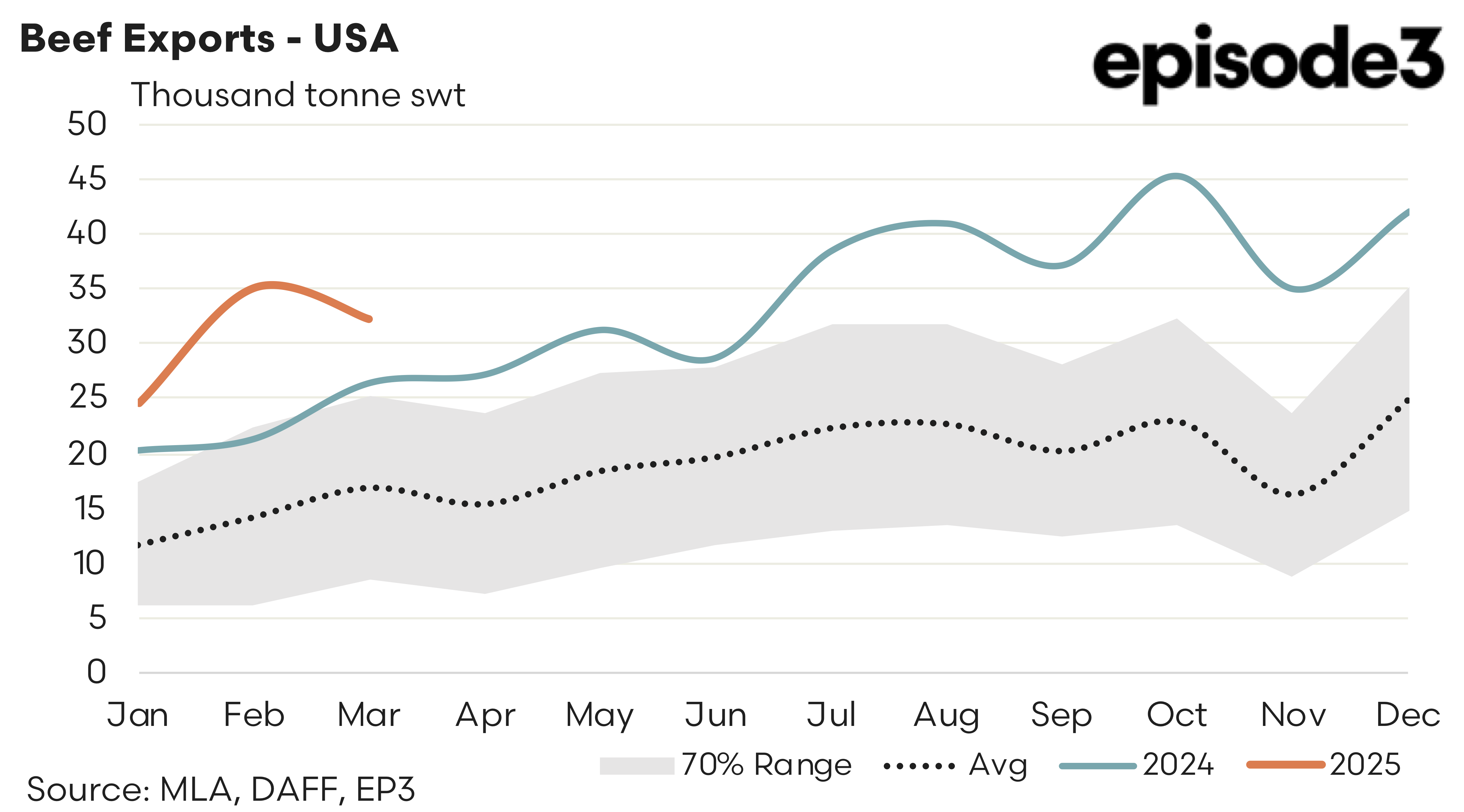

USA – Beef flows to the USA over Q1, 2025 reached 92,060 tonnes, which is the strongest start to the season since Q1, 2015. Compared to last year the Q1 flows are running 35% higher and a comparison to the five-year average volumes for Q1 demonstrate the strong turnaround in US demand for Aussie beef seen in the last few years with the current volumes sitting 114% above the five-year Q1 average volumes. A 10% tariff should do little to quell the current US appetite for Australian beef, particularly given their tight cattle numbers presently and high domestic prices for livestock and beef.

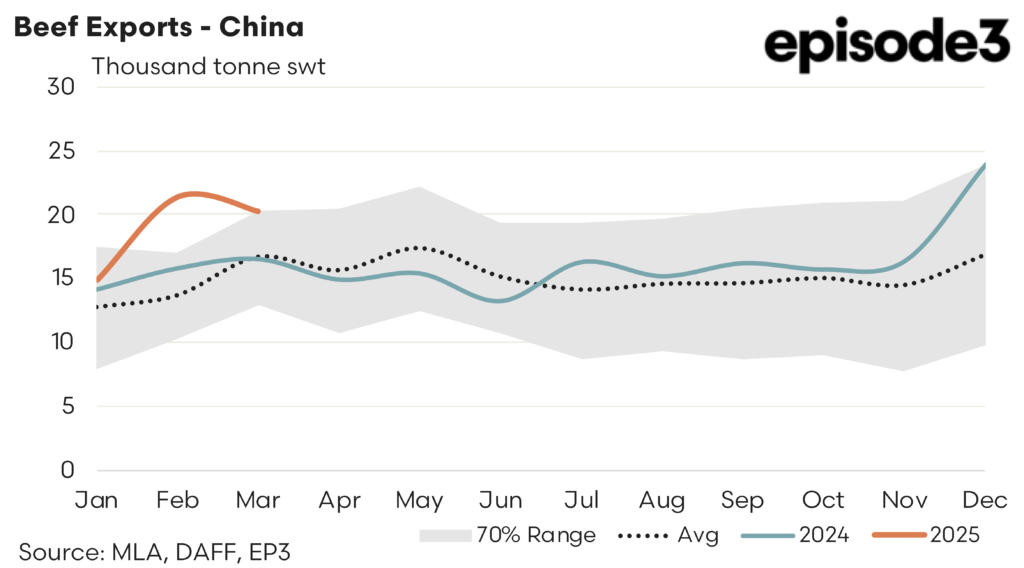

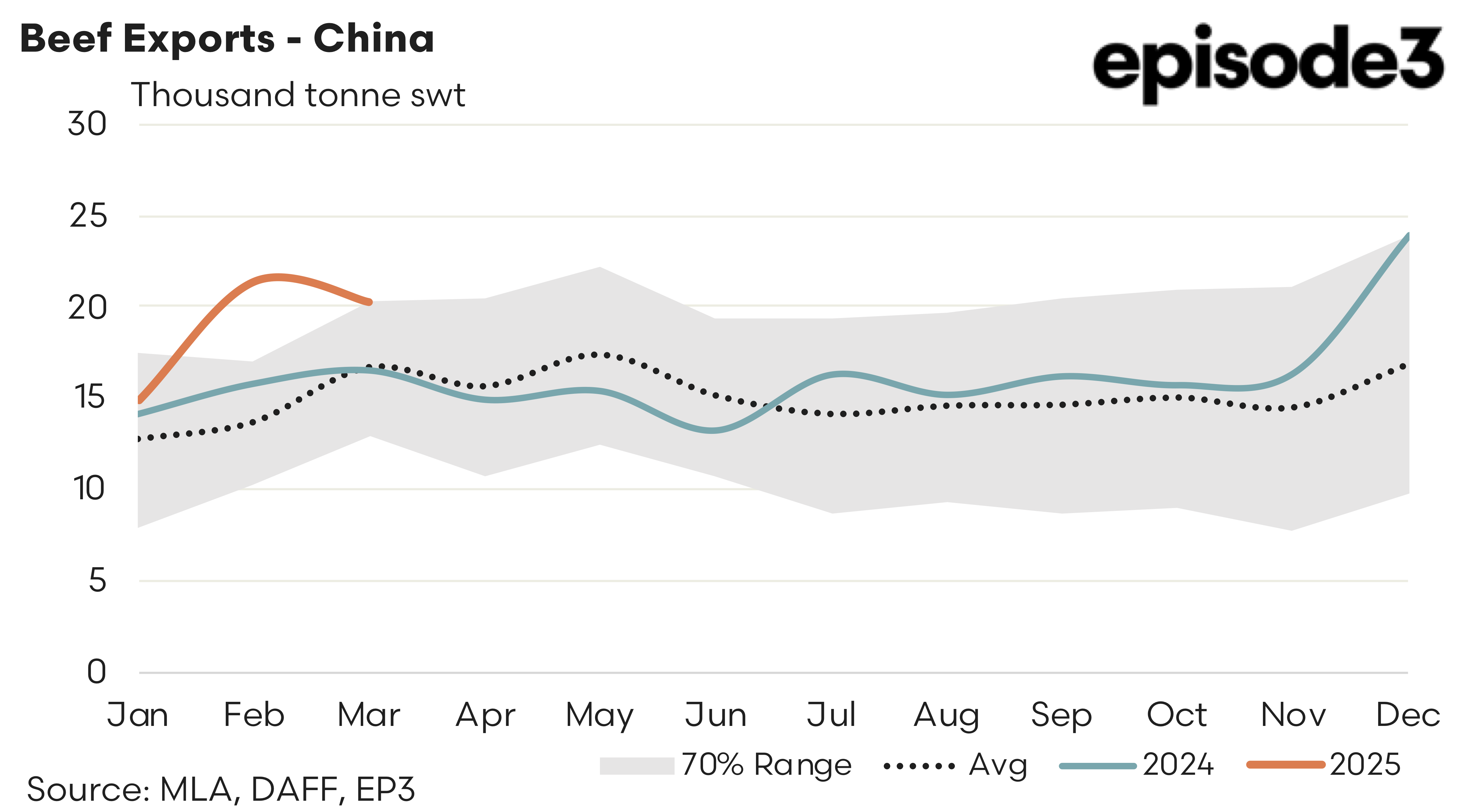

China – A resurgent China has seen Q1 beef imports from Australia reach 56,544 tonnes over the quarter. Like the USA this is the strongest start to the year on record for Aussie beef export flows to China beating the previous record set in 2019 by a mere 0.8% – still a record is a record. Compared to 2024 the current flows are 22% firmer and sit 31% above the five-year average flows for Q1.

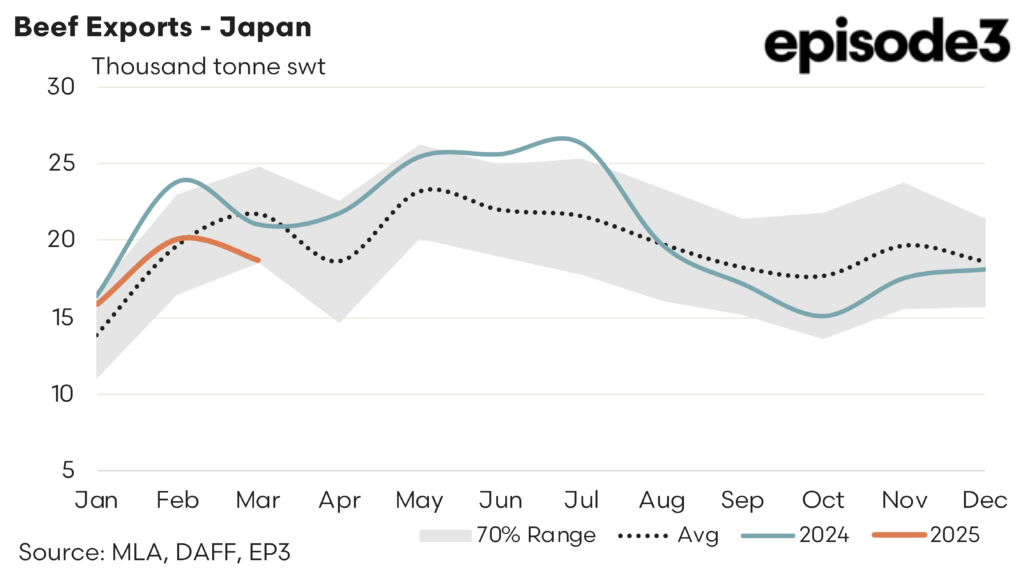

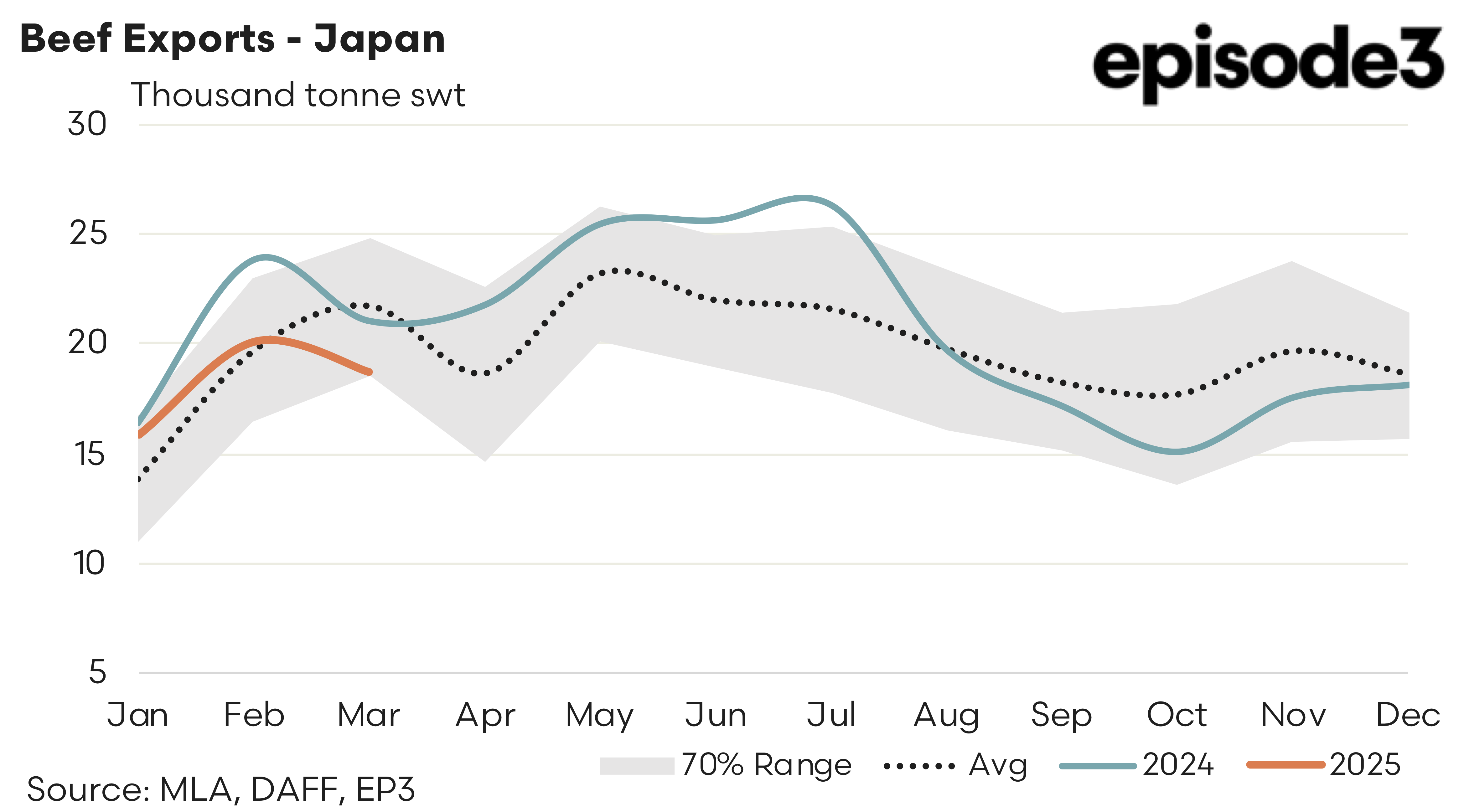

Japan – Beef trade to Japan is the only dull spot in the top four with current Q1 trade volumes sitting 11% under the levels exported during the first quarter of 2024. There was 54,639 tonnes reported shipped to Japan over Q1, 2025 a mere 1% under the Q1 average volumes, based on the last five years of the trade. Japanese consumers remain trapped in a cost of living crisis and continue to swap higher priced beef for cheaper alternatives or choose to consume reduced volumes in an attempt to keep their grocery costs under control.

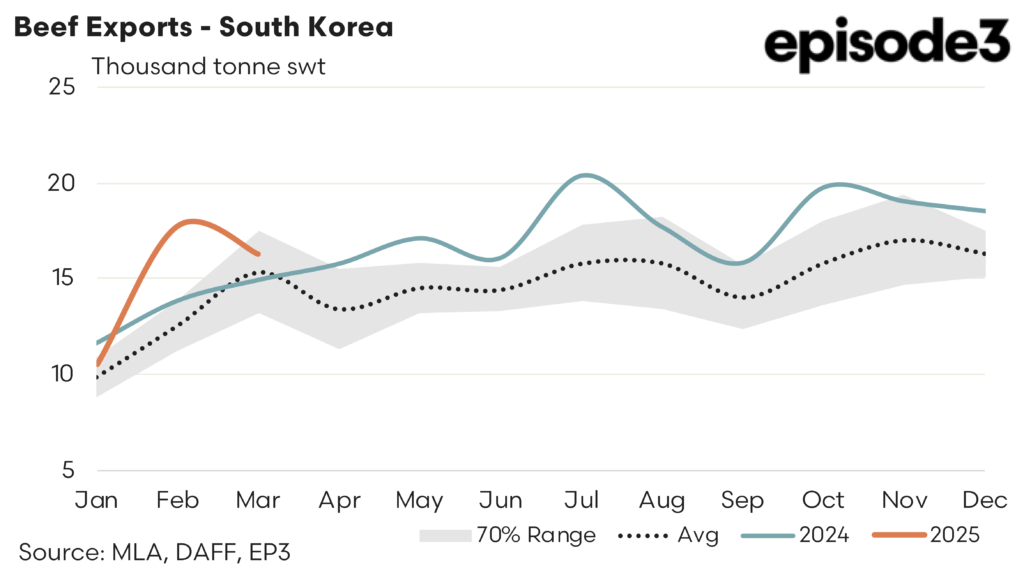

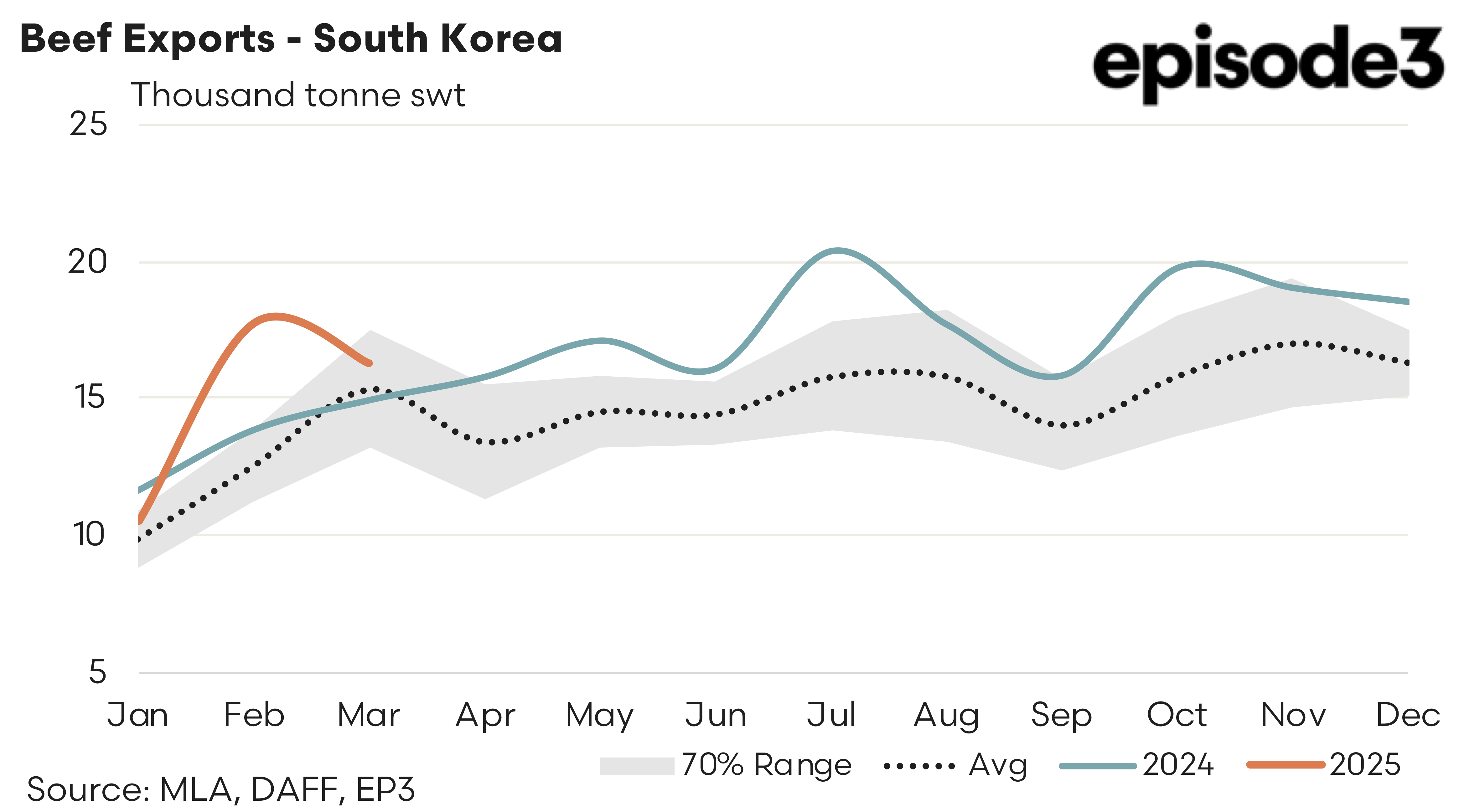

South Korea – Just like China and the USA, the Q1 beef trade volumes to South Korea from Australia managed to score a record Q1 peak. The first quarter of 2025 saw 44,699 tonnes shipped to South Korea, beating the previous Q1 record high set in 2022 by 3%. Compared to Q1, 2024 the current South Korean demand for Aussie beef is 10% stronger and sits 18% above the Q1 average trend, based on the last five years of the trade.