More like burger pawns than Burger Kings

The Snapshot

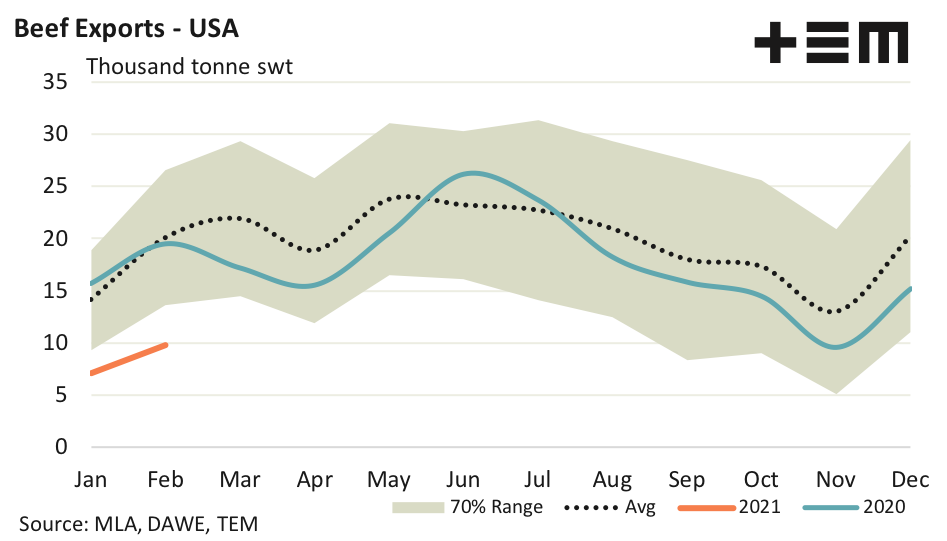

- Aussie beef export flows to the USA came in at 9,780 tonnes, which is 51% under the five-year seasonal pattern for February.

- The USA has slipped to fourth top destination spot for Australian beef, slipping behind South Korea for the first time on record.

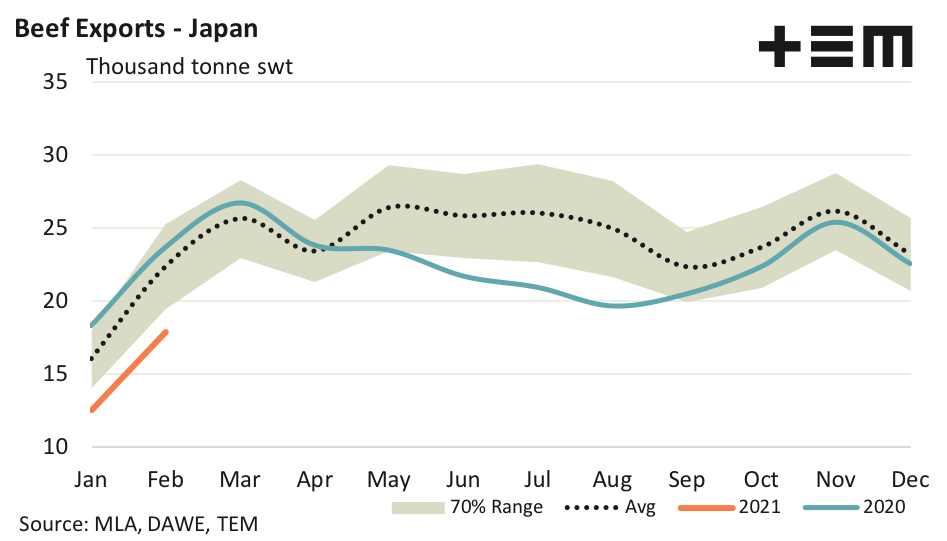

- Japan reported 17,878 tonnes for February 2021, which is 25% under the seasonal average pattern for this time in the year.

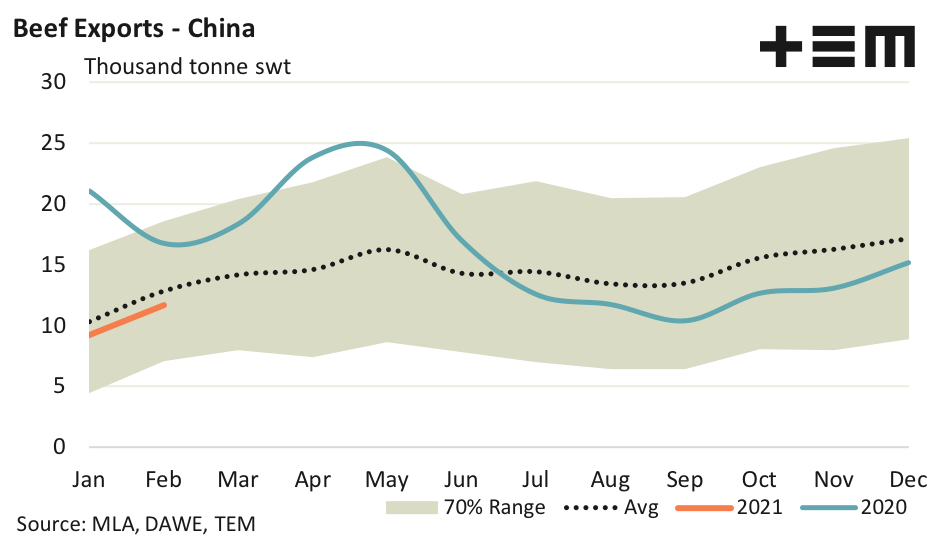

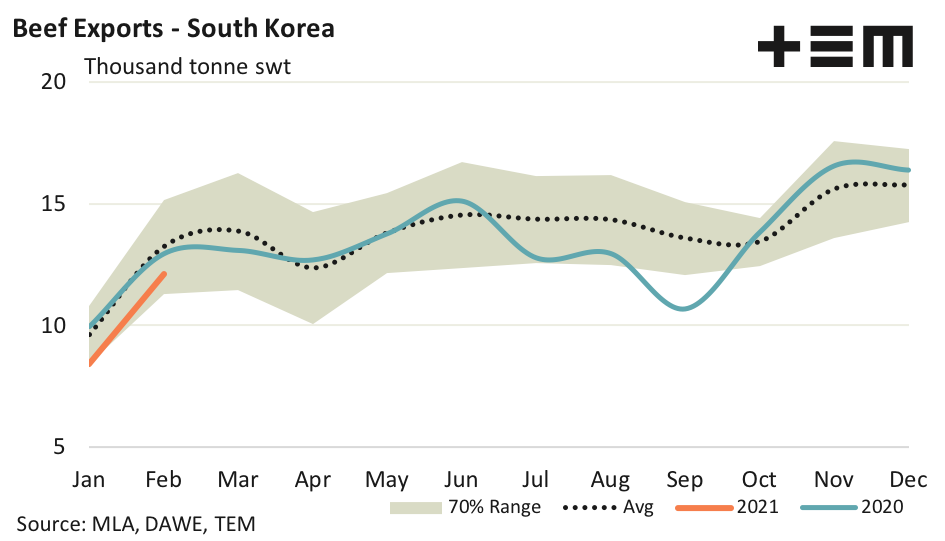

- Demand for Australian beef from China and South Korea is holding up well, compared the USA and Japan, with February flows just 9% and 8% under trend, respectively.

The Detail

Department of Agriculture, Water and Environment (DAWE) beef export trade statistics for February show a poor start to the year continues for flows to the USA. Volumes came in at 9,780 tonnes, which was a 38% lift from the very low levels seen in January, but still remain 51% under the five-year seasonal pattern for February.

Volumes have been so slow for beef export trade to the USA that their market share for the 2021 season has slipped to 14.5% of total volumes and put the USA in fourth top spot and for the first time on record they have fallen below South Korea, currently on 17.6%.

All of Australia’s key beef export destinations are below average levels, but some are performing closer to trend than others. Japan, our top destination for market share, reported 17,878 tonnes which is 25% under the seasonal average pattern for this time in the year.

Australian beef export flows to China are also under trend for February, but only by 9%. China took 11,676 tonnes of Australian beef last month, which was a 27% gain on the January flows. Reports that the rebuild to the Chinese pork herd are hitting a few barriers with the spread of new African Swine Fever variants could signal that the strong demand for all meat protein types we have seen from China in recent years isn’t over yet.

However, the February 2021 volumes are still 39% under the record February volumes seen during 2019 when it hit 19,097 tonnes and 30% under the robust 16,732 tonnes seen in February 2020.

Like China, South Korean demand for Australian beef is also holding up rather well with 12,110 tonnes reported for February. This places South Korean flows just 8% below the five-year average seasonal pattern.

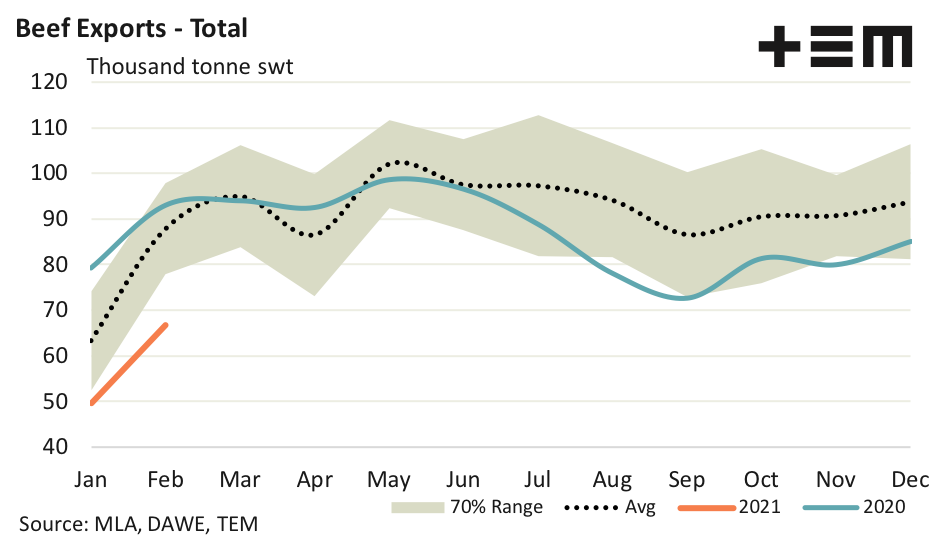

Despite the efforts of Chinese and South Korean beef consumers the very poor US performance thus far, combined with the subdued Japanese effort, means that total beef exports reached just 66,818 tonnes for February 2021. This is the lowest February beef export volumes since the 2010 season and 28% under the levels seen during February 2020.