More value in mutton?

Market Morsel

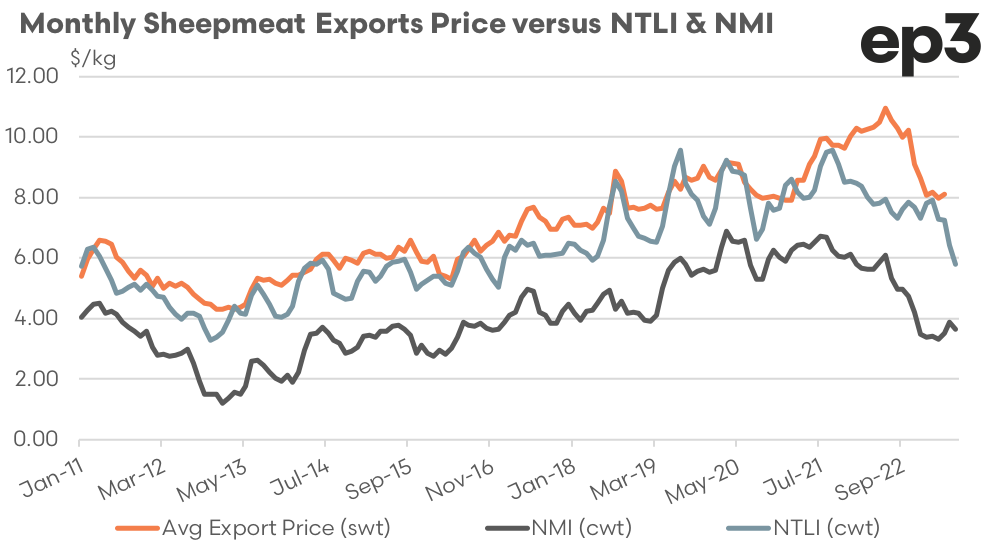

Average monthly sheep meat export pricing has been on a steady upward trend since early 2013, rising from around $4/kg to a peak of $11/kg in mid-2022.

The first few months of 2023 (to end of April) it has hovered around $8/kg, a decline of around 25% from the peak. This has mirrored the price easing seen in the National Trade Lamb Indicator (NTLI) which has retreated 24% off its peak (as of April 2023).

The National Mutton Indicator (NMI) has seen a greater magnitude fall from it’s peak, down by nearly 48% (as of April 2023). Since April 2023, the NTLI has fallen a further 20%, meanwhile the NMI has gained 3%.

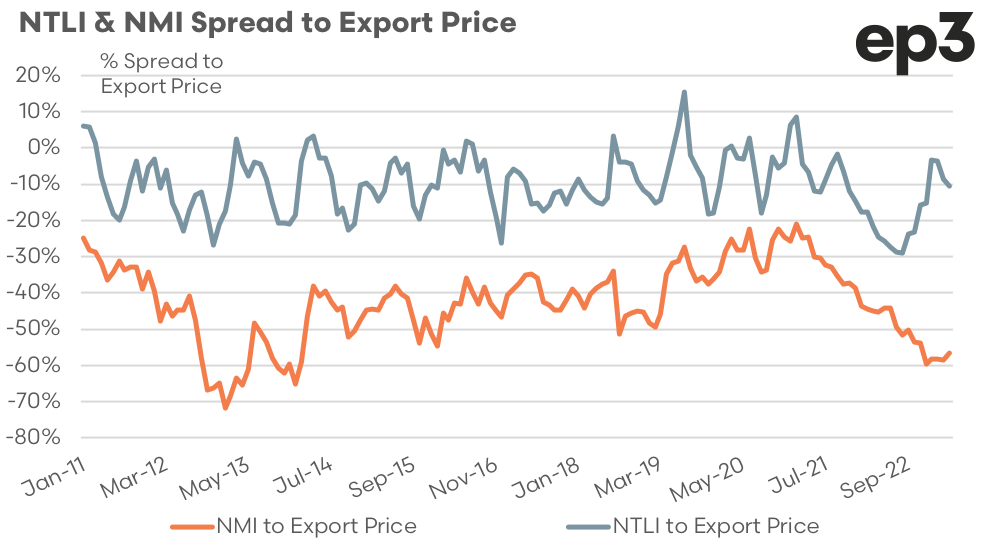

A comparison of percentage spreads for the NTLI and NMI to the average sheep meat export price shows that mutton is nearer to it’s historic discount while the NTLI is trading mid-range.

Spreads of the NTLI to the export price have ranged between a 10% premium to a 30% discount since 2011, with the long term average spread sitting at a 10% discount. As of April 2023 the NTLI was pretty close to the long term average, trading at a discount of 11%.

In comparison the historic range of the NMI spread to the export price has been between a 20% discount to a 70% discount. As of April 2023 the NMI spread was trading at a 57% discount, which is quite a bit below the long term average spread seen for the NMI since 2011 of a 43% discount.

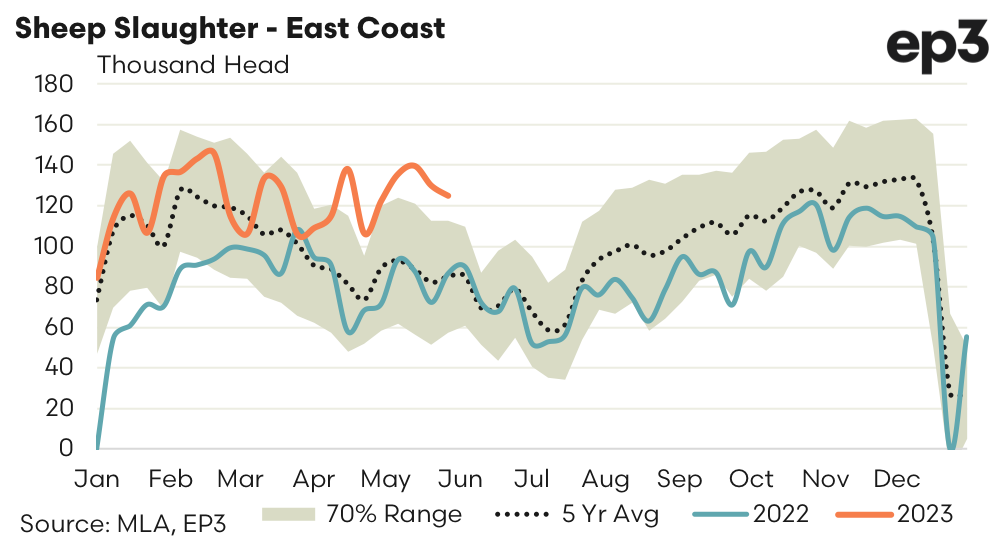

In 2022 the NMI spread to export price averaged a discount of 49%. So far in 2023 this spread has averaged a discount of 58%, signalling that relatively lower mutton pricing compared to export pricing is potentially allowing for some additional margin to be captured. It probably demonstrates why sheep slaughter volumes have recovered so much during 2023 and what is helping to keep volumes elevated into the middle of the year.