Mutton surge

Market Morsel

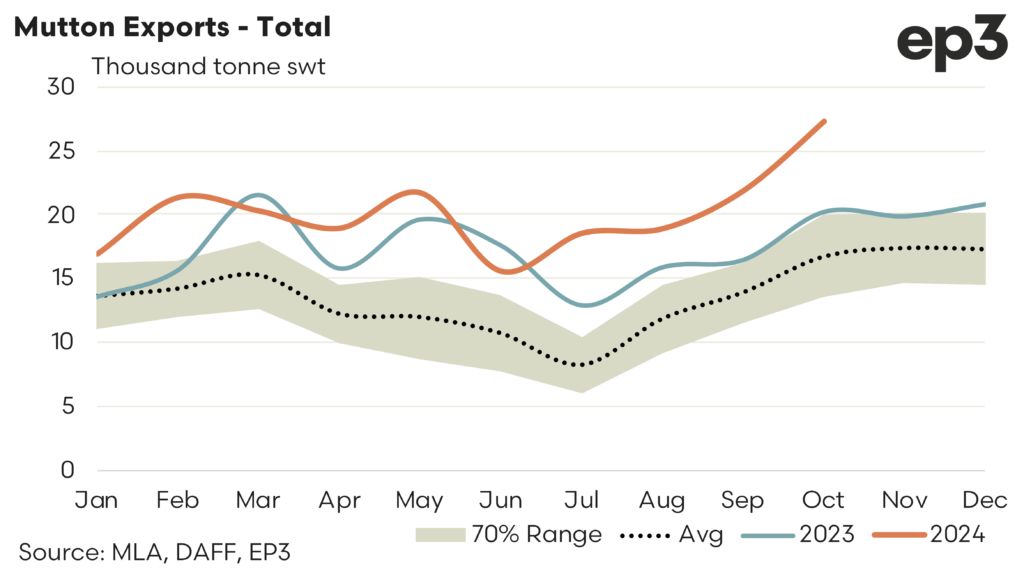

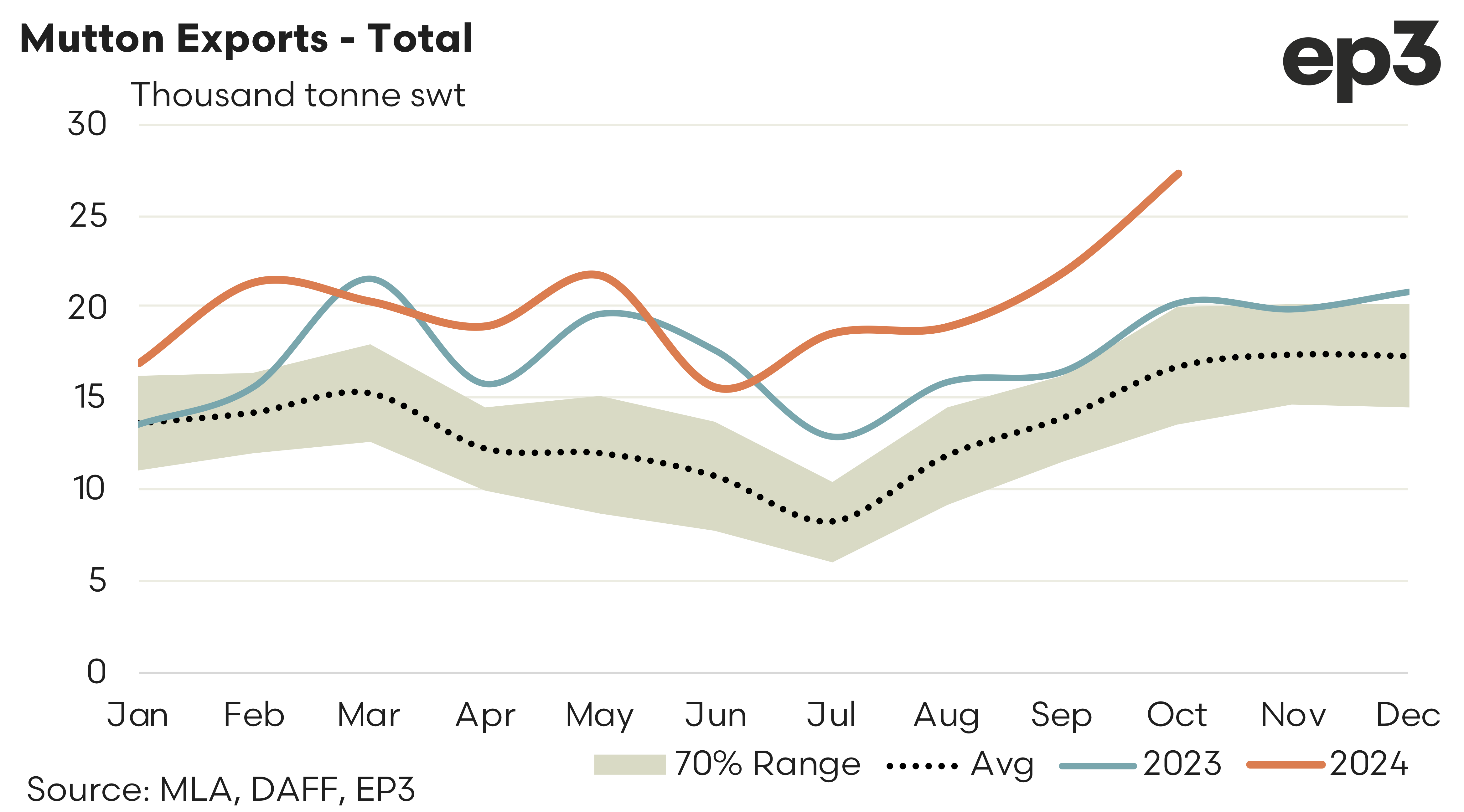

October 2024 has seen a strong lift in mutton exports from Australia largely fuelled by big increases in flows to the top two trade destinations for mutton – China and Malaysia. Total mutton exports for October came in at 27,217 tonnes swt which is the strongest October flows on record and the second highest monthly flows ever seen. Indeed you would have to go back to 1994 to find a month that recorded higher mutton export flows.

Compared to the September 2024 export volumes October saw a 25% lift in the total mutton trade out of Australia and the current export volumes are running 35% higher than the levels set during October 2023 and nearly 63% above the average October volumes, based on the last five years of the trade.

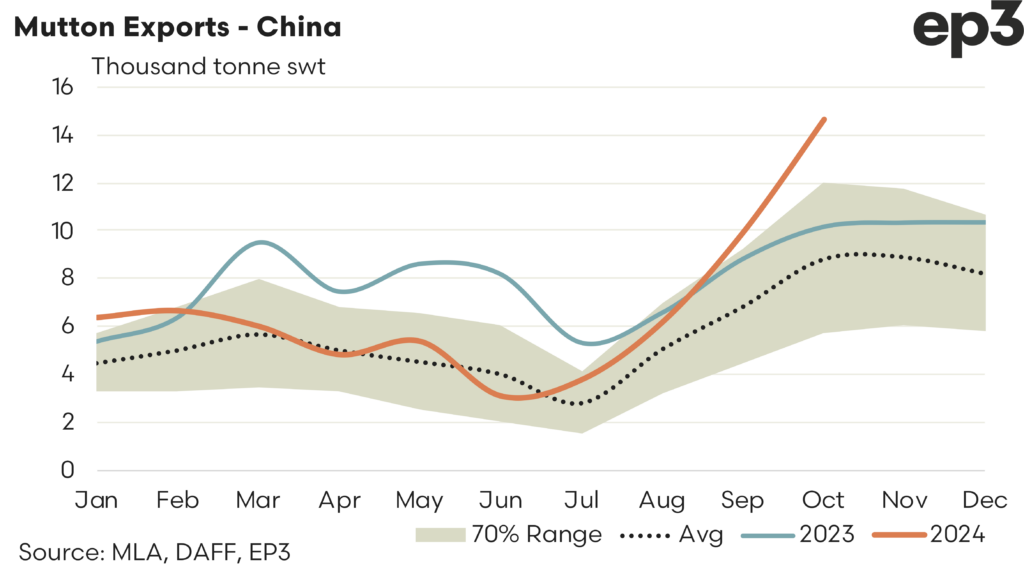

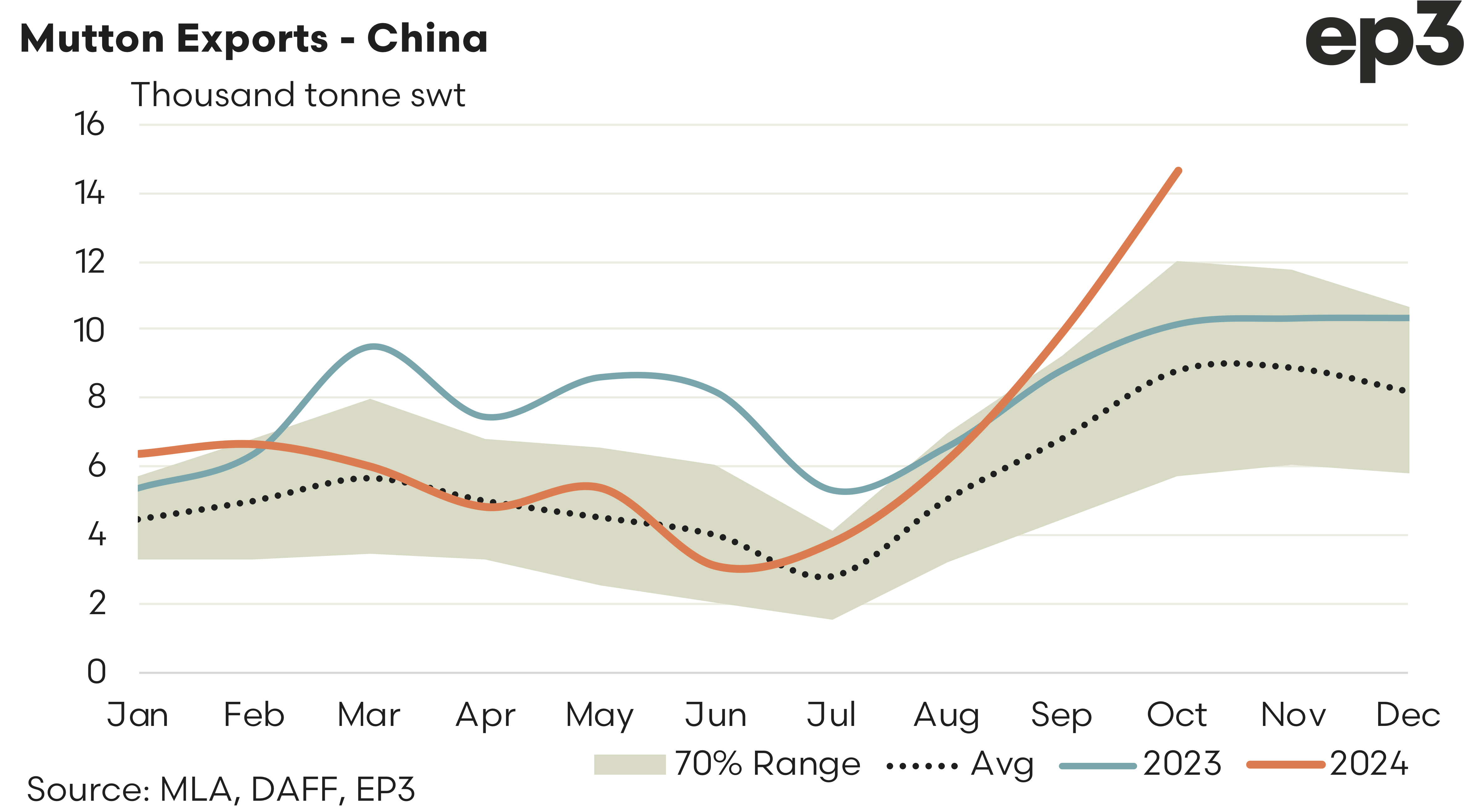

As outlined previously it is the growth in demand from the top two trade destinations fuelling much of the increased volumes over October.

China – There was a 47% increase in Aussie mutton exports to China during October to hit 14,613 tonnes shipped, making a new record monthly volume to China. This result beats the previous record high mutton trade levels by 17%. Current October trade flows to China are sitting 43% higher than October 2023 and 65% above the five-year average monthly flows recorded for October.

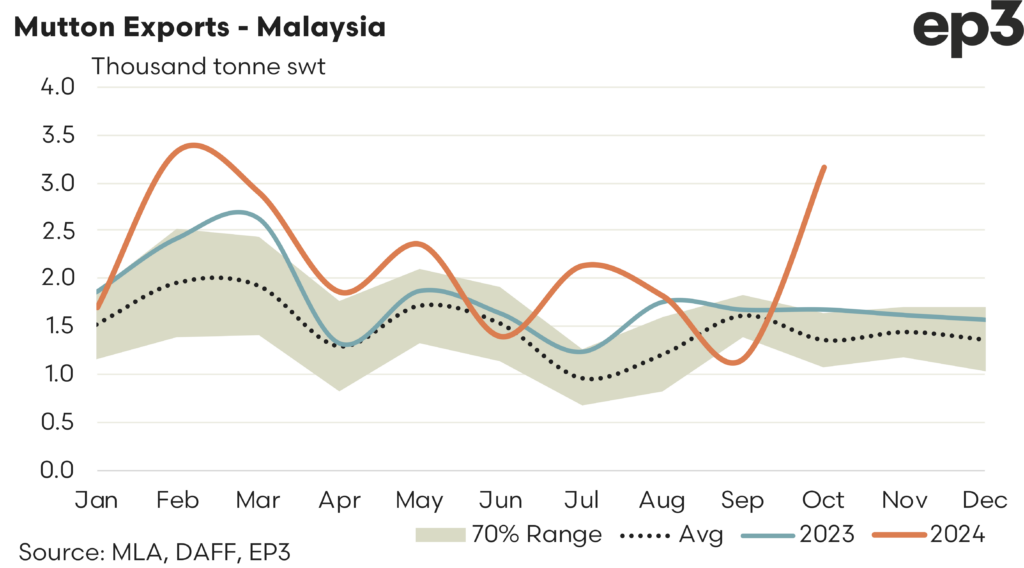

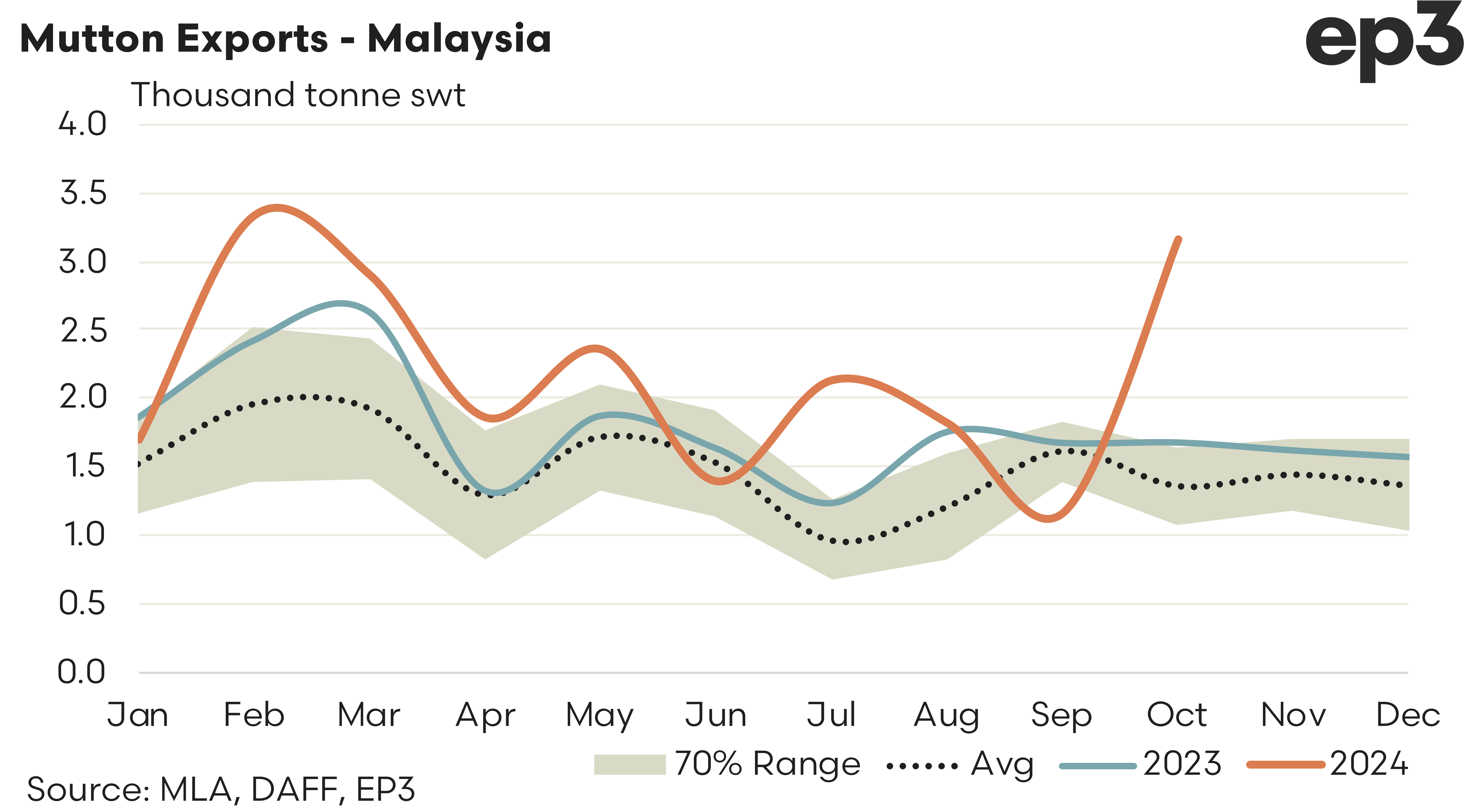

Malaysia – Second spot in the Aussie mutton trade has well and truly been cemented by Malaysia taking the place of the USA. During October there was a 169% increase in trade volumes to hit 3,164 tonnes swt of mutton exported from Australia. This is the second highest mutton flows on record, nearly reaching the record set earlier this year in February when 3,339 tonnes of mutton were shipped from Australia to Malaysia. Current flows are sitting 87% higher than October 2023 and 132% above the October average export levels, based on the last five years of the trade.

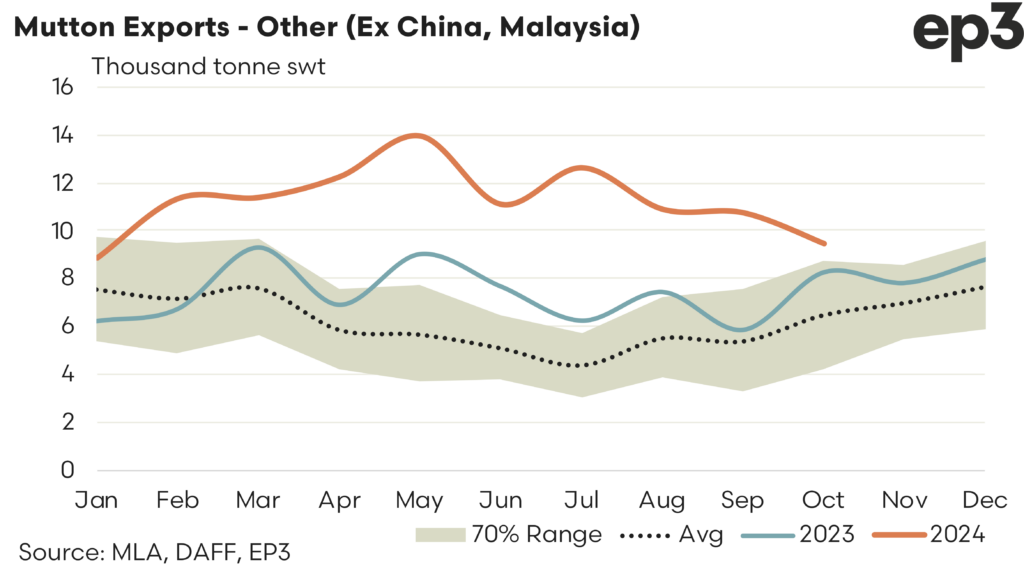

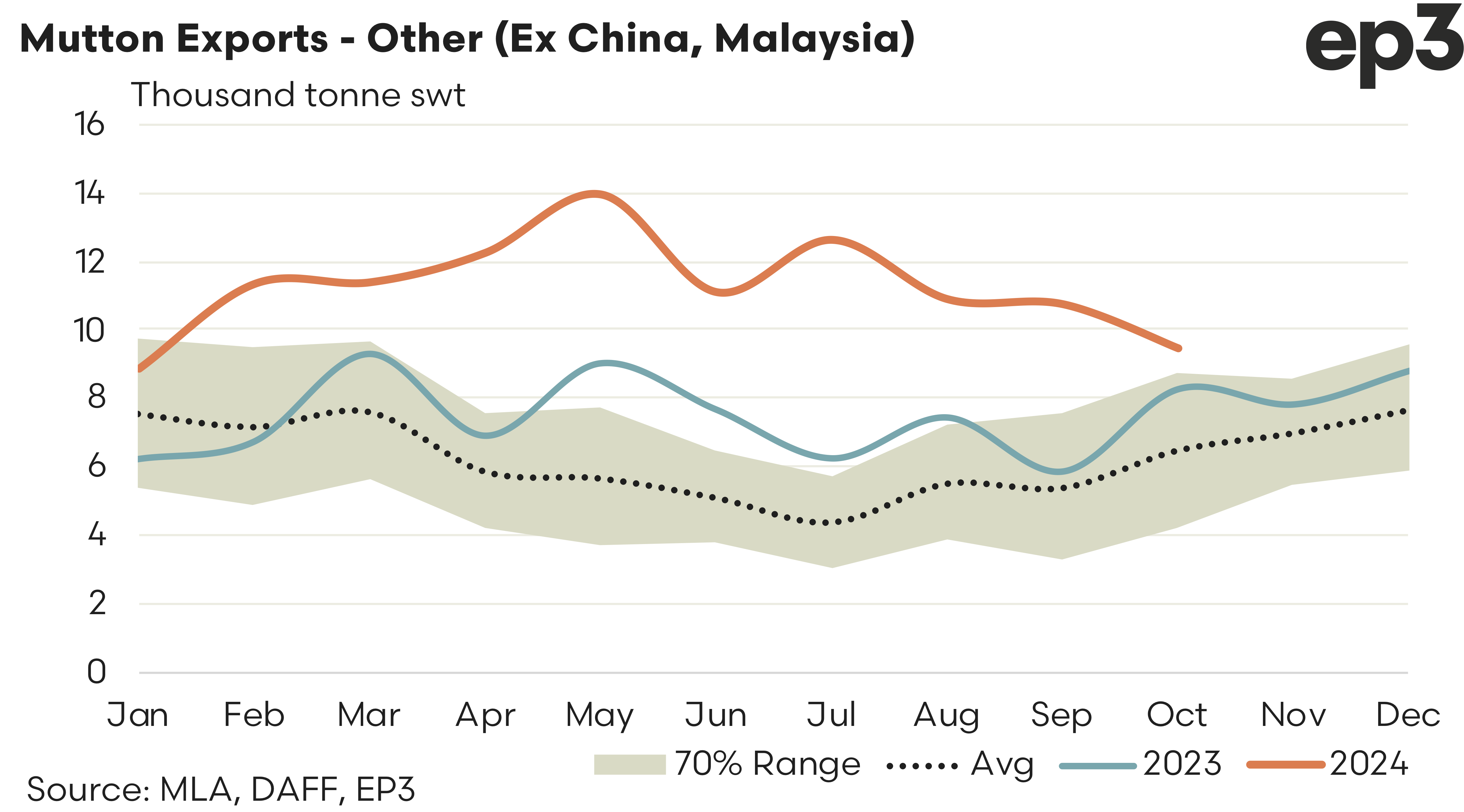

The others – Mutton flows to the “others” (excluding China and Malaysia) softened by 12% during October. There was 9,440 tonnes reported shipped over the month. While this is a softening in the trade these levels still represent pretty strong October flows on a historic basis though as volumes are still 14% higher than October last year and nearly 45% above the October five-year average flows.