Mutton to celebrate, except China

The Snapshot

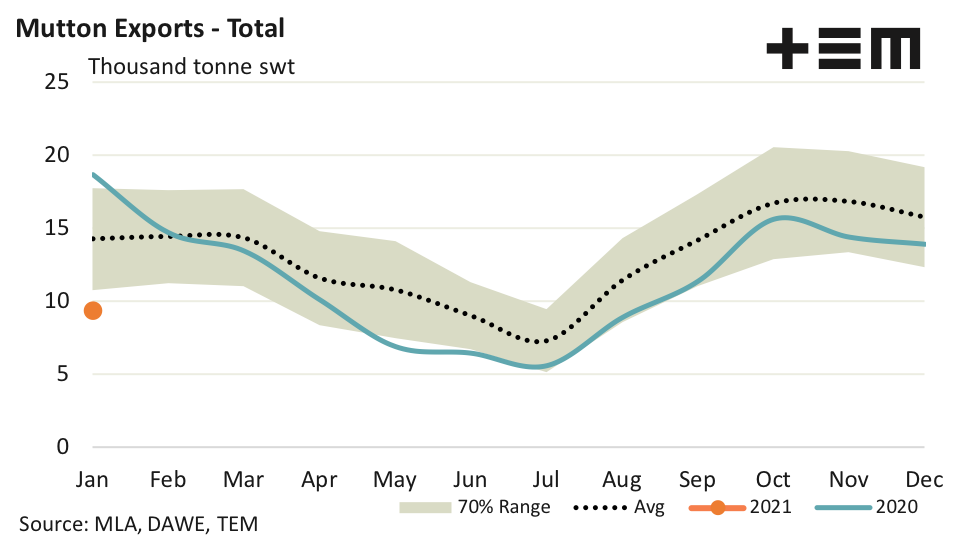

- Total mutton exports in January 2021 recorded their weakest start to the season since 2012 with just 9,364 tonnes swt consigned, a level 34% under the January average for this time in the year.

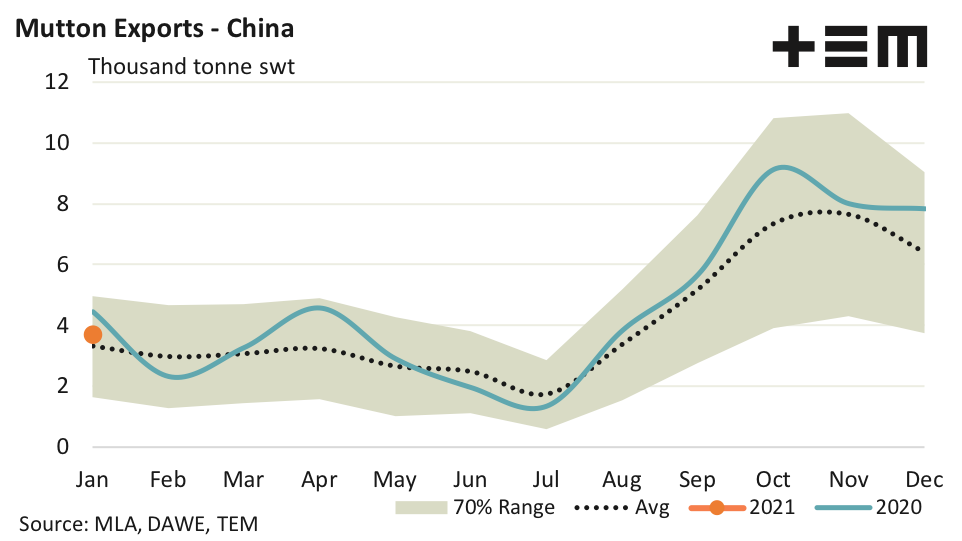

- Australian mutton to China in January was the only key trading destination to come in above the average seasonal pattern, sitting at 11% above the January trend.

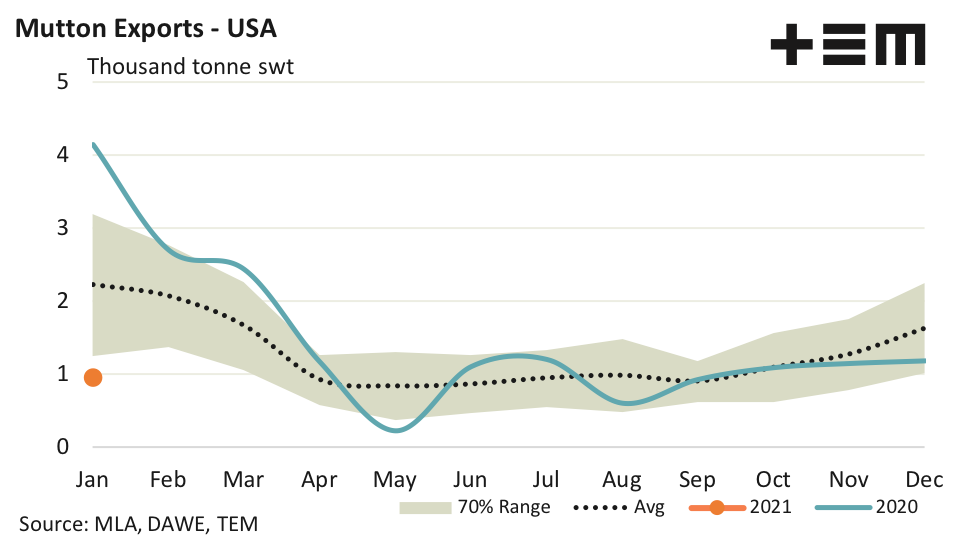

- January 2021 mutton flows to the USA registered just 954 tonnes swt, a level 57% under the five-year January average pattern and 77% below the levels achieved in 2020.

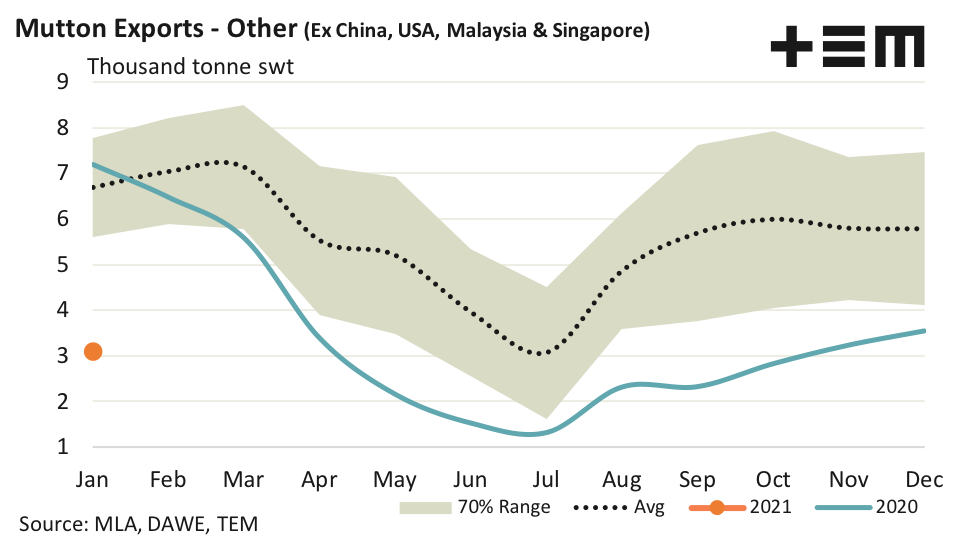

- Australian mutton exports to all “other nations” (i.e total flows less exports to China, USA, Malaysia and Singapore) recorded the lowest January volume on record and came in 53% below the five-year average trend for January.

The Detail

Total mutton exports from Australia in January 2021 recorded the weakest start to the season since 2012 with just 9,364 tonnes swt consigned. The five-year average trend for January comes in at 14,261 tonnes swt so this opening volume sits 34% under the average seasonal levels for this time in the year.

January 2020 saw the strongest opening season volumes on record at 18,643 tonnes recorded, so it is a bit of a swift fall from grace with this seasons figures running 50% below the levels achieved last year.

In 2020 China was Australia’s largest export destination for mutton by a country mile, taking out a market share of 39.7% of total mutton export volumes. The January 2021 mutton shipments to China managed 3,699 tonnes swt which pretty much matched their market share from last season at 39.5% of total mutton exported in January.

It was good to see the Chinese demand remain relatively unchanged in terms of market share as most other key export destinations came in below their respective January five-year average levels. Australian mutton to China in January was the only key trading destination to come in above the average seasonal pattern, sitting at 11% above the January trend.

The USA are the next cab off the rank in terms of market share. In 2020 they accounted for 12.8% of total Aussie mutton exports. However, this year their opening gambit eased to 10.2% of the January flows with shipments registering just 954 tonnes swt, a level 57% under the five-year January average pattern. It’s a stark contrast to the strong start we saw in January 2020 when the USA took a massive 4,149 tonnes swt. Compared to 2020 the current January mutton export levels to the USA are 77% lower.

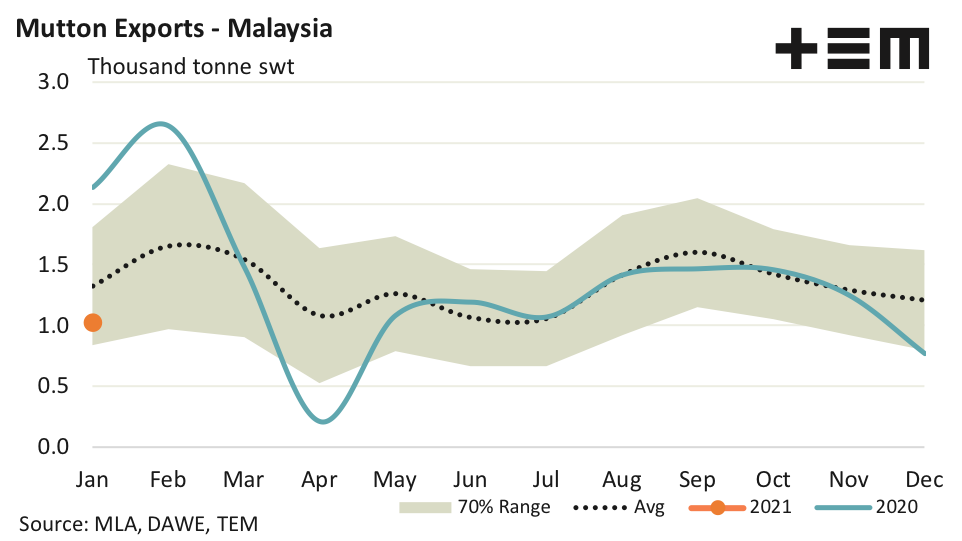

Malaysia was the third top destination for Australian mutton in 2020, taking 11.5% of the total export volumes that year. The January 2021 figures are off just a fraction, at 11.0% of total January export volumes, but at 1,028 tonnes swt they come in 22% under the average trend for January.

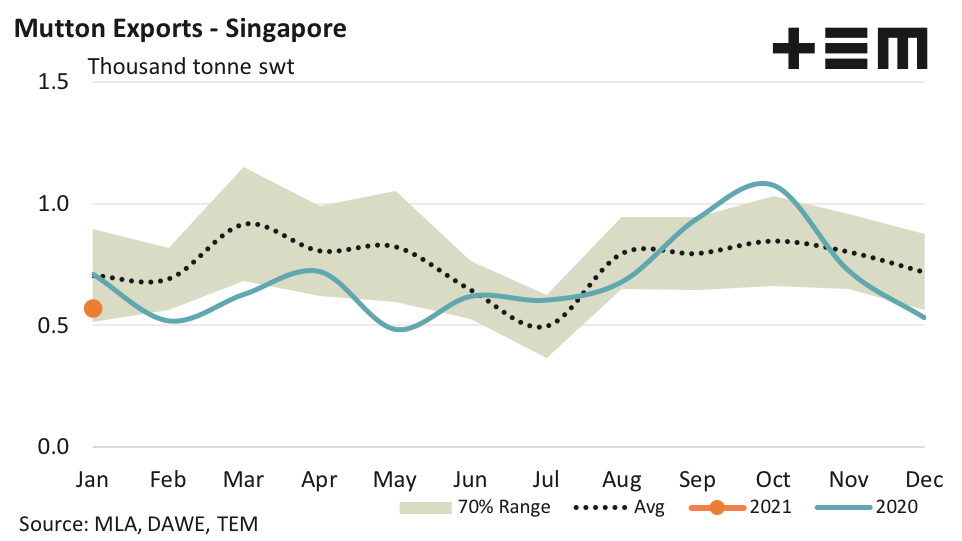

Singapore sits in fourth place in terms of market share and like Malaysia they have seen their proportion of total export flows ease from 6.1% in 2020 to 5.8% of the total mutton exports sent in January 2021. Singapore imported 570 tonnes swt of mutton from Australia in January, 19% under the five-year seasonal average pattern for this time in the year.

Australian mutton exports to all “other nations” (i.e total flows less exports to China, USA, Malaysia and Singapore) had a very disappointing start to 2021 with volumes of just 3,114 tonnes swt recorded. This is the lowest January volume on record for mutton exports to “other nations” and is 53% below the five-year average trend for January.

At least China started the new year off relatively well – “Kung Hei Fat Choy”.