Mutton with nothin’ to celebrate, except China

The Snapshot

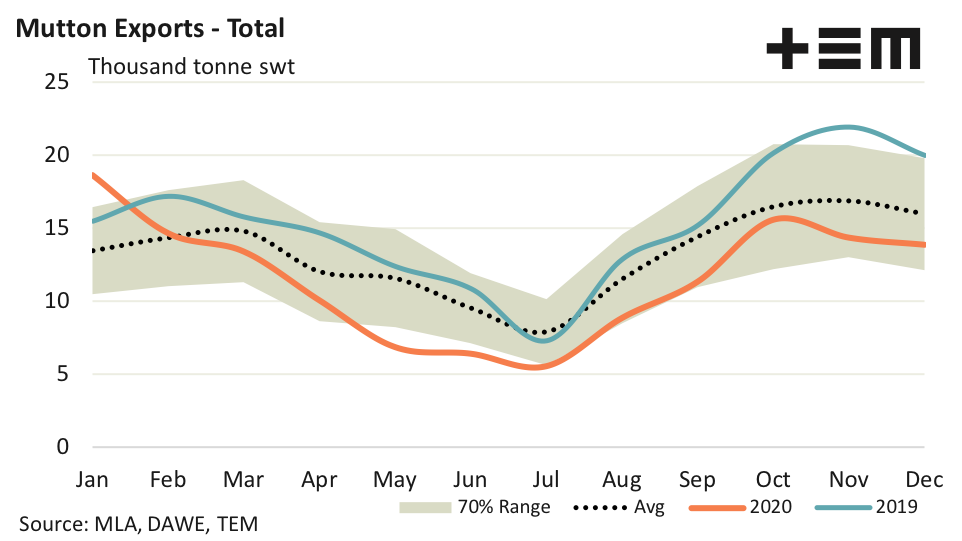

- The December mutton exports came in at 13,878 tonnes swt, a 3% easing from the November levels and 13% below the five-year average pattern for December.

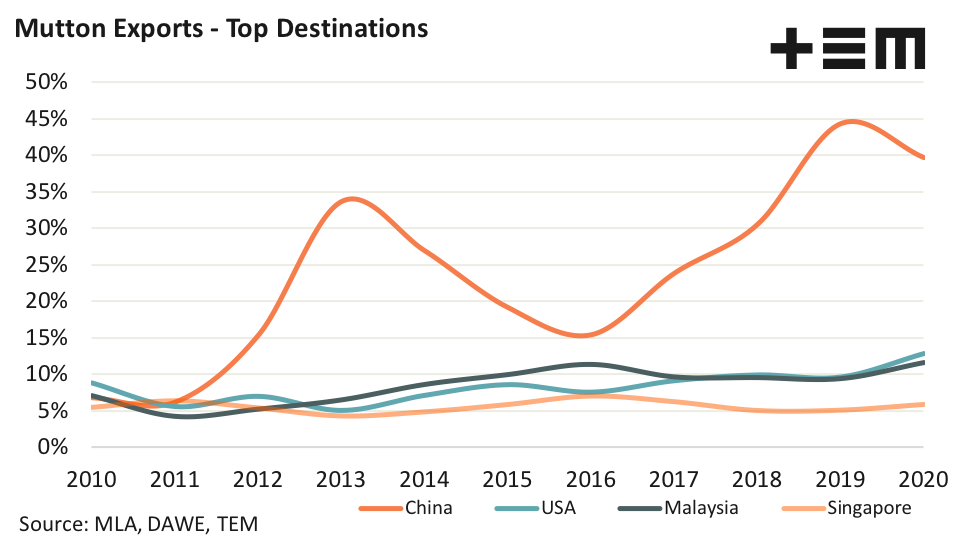

- China continues to dwarf the other top export destinations taking out top position with 39.7% of total mutton exported from Australia.

- Indeed, total mutton exports to China from Australia during the 2020 season was greater than the volumes sent to the USA, Malaysia, Singapore and Saudi Arabia combined by about 6,700 tonnes.

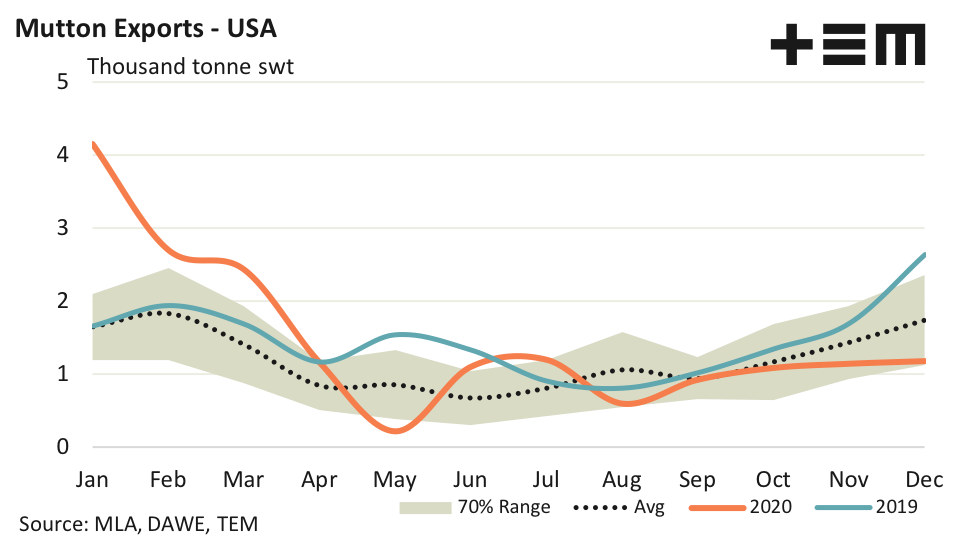

- After the Covid-19 disruption in May the USA was unable to regain it’s vigour with much of the second half of the year recording monthly mutton export volumes from Australia below the five-year average seasonal trend.

The Detail

Total Australian mutton export volumes finished the year mirroring the bulk of the 2020 seasonal trend with volumes remaining under the average pattern for December. The December mutton exports came in at 13,878 tonnes swt, a 3% easing from the November levels and 13% below the five-year average pattern for December.

The lower mutton export volumes are more likely representative of the much lower mutton slaughter seen during the 2020 season, reflective of the tight supply seen during last year and the strong intent to hold onto sheep as part of a flock rebuild, particularly in NSW.

In terms of market share of mutton exports, China continues to dwarf the other top export destinations taking out top position with 39.7% of total mutton exported from Australia. The annual volume of mutton exported to China from Australia in 2020 was 55,427 tonnes swt, while this is a 32% decline in the volumes recorded during 2019 it still represents more than three times what the second top destination for Aussie mutton, the USA, takes.

Indeed, total mutton exports to China from Australia during the 2020 season was greater than the volumes sent to the USA, Malaysia, Singapore and Saudi Arabia combined by about 6,700 tonnes. The USA hold second top spot at 17,932 tonnes for 2020, or 12.8% of total mutton exports. Malaysia is in third place with 16,133 tonnes, or 11.5% of total flows. Meanwhile Singapore is on 5.9% of total flows in fourth spot with 8,235 tonnes swt, ahead of Saudi Arabia with 4.5% of total flows.

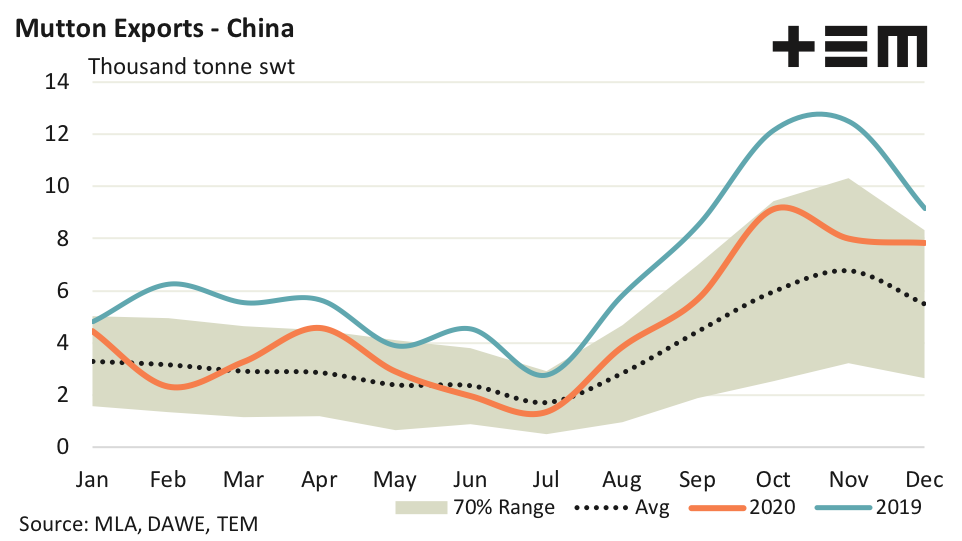

China

Mutton export flows to China performed strongly throughout the 2020 season, with particularly robust results over the second half of the year. December finished with off the solid season with 7,843 tonnes shipped, representing levels nearly 43% above the five-year December average.

USA

The USA started 2020 with incredibly strong mutton export volumes from Australia, but after the Covid-19 disruption in May was unable to regain it’s vigour with much of the second half of the year recording monthly export volumes below the five-year average seasonal trend.

December finished off in a lacklustre fashion with 1,183 tonnes swt reported, nearly 32% under the December average trend.

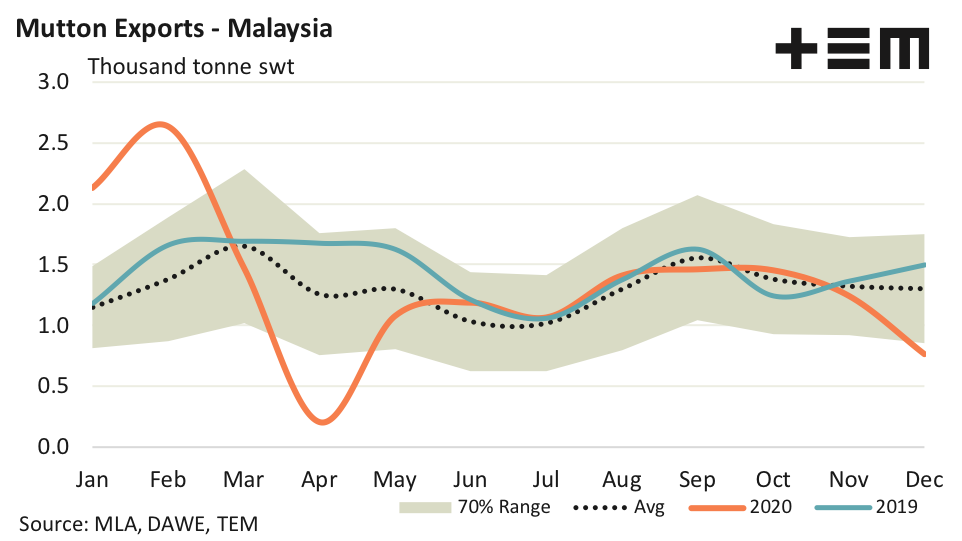

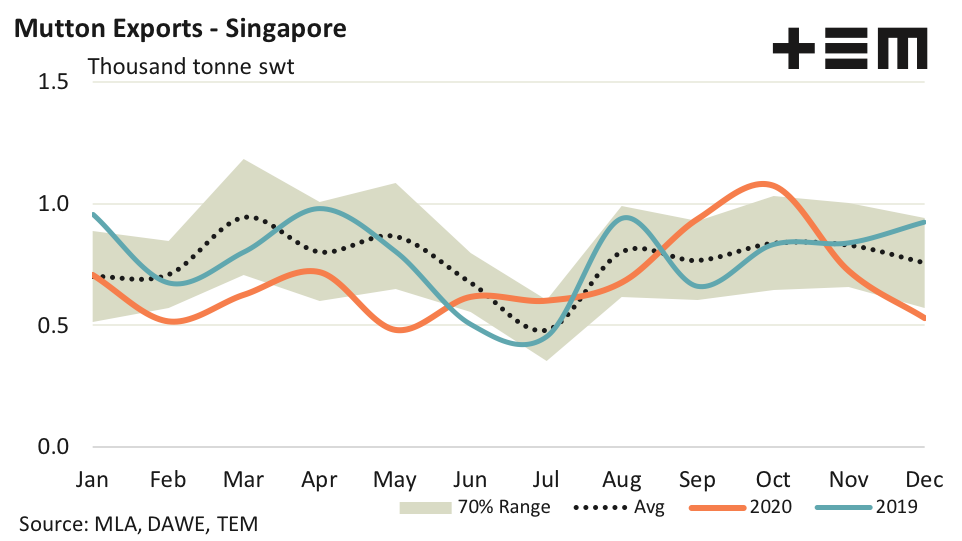

Malaysia and Singapore

Malaysia and Singapore both mirrored the weaker finish to the 2020 season shown by the USA with mutton export volumes from Australia for December declining by 38% and 26% from their respective levels recorded in November. Malaysian mutton volumes in December slid to 766 tonnes swt, representing levels 41% under the December five-year average pattern. Singaporean mutton demand came in at 532 tonnes for December, a level 30% under the December average trend.