Nailed by the coughin’

The Snapshot

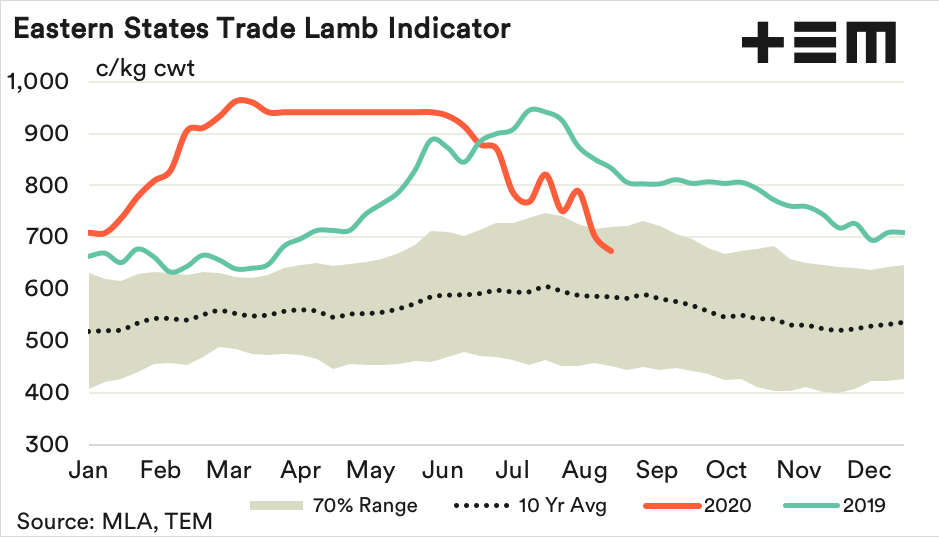

- Despite the relative tight supply the Eastern States Trade Lamb Indicator has softened 30% from its seasonal peak in March.

- The fair value range for quarter three of 2020 sits between 655-955c/kg cwt so we could expect to see some support for trade lamb prices as we approach the 650c/kg level.

- Scenario testing a decline in offshore sheep meat demand as economic growth in key trade partners stagnate into 2021 suggests that weaker trade lamb prices could persist until 2022.

The Detail

Usually during winter, we see lamb prices grind higher as supply tightens. Last season lambs become thin on the ground and new season lambs aren’t yet available. However, this season despite the relative tight supply the Eastern States Trade Lamb Indicator (ESTLI) has softened 30% from its seasonal peak in March to close yesterday at 674c/kg cwt.

Weighing on the ESTLI has been a number of factors. An appreciating Australian dollar and softening lamb export volumes, particularly from March through to May have contributed to the softening. Since reaching a low of 55US cents the Australian dollar has rallied by 30% trading above 72US cents in recent weeks. Meanwhile, monthly lamb export volumes have eased nearly 27% from the March peak just over 25,000 tonnes swt to see August record volumes in the low 18,000s.

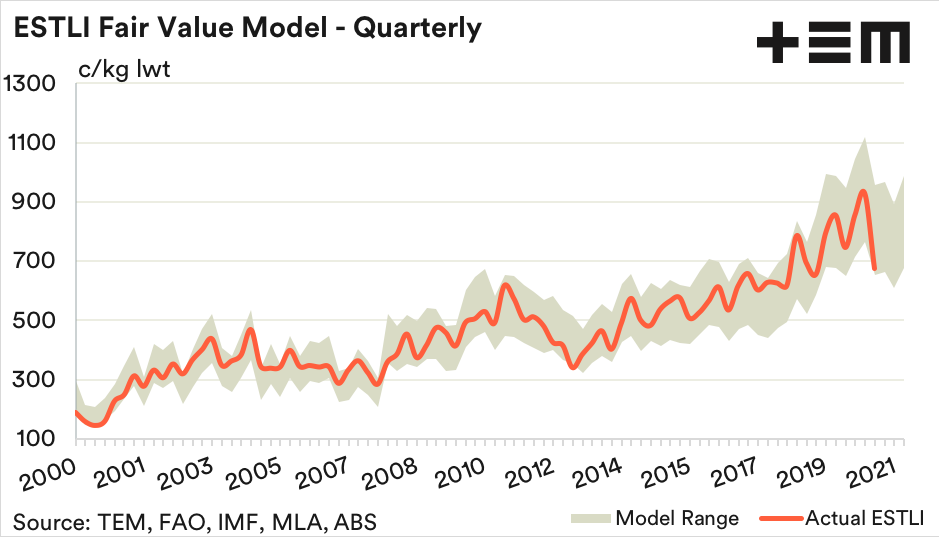

Fair value modelling of the ESTLI on a quarterly basis, considering key factors that drive price movements such as; lamb slaughter volumes, the Australian dollar level and export demand shows that the recent move in the ESTLI below 700c/kg cwt pushes it into the lower region of the fair value range.

The fair value range for quarter three of 2020 sits between 655-955c/kg cwt so we could expect to see some support for trade lamb prices as we approach the 650c/kg level. Although, with the spring flush just around the corner the price consolidation may be somewhat short lived with the fair value model for quarter four showing the bottom of the range closer to 600c/kg cwt.

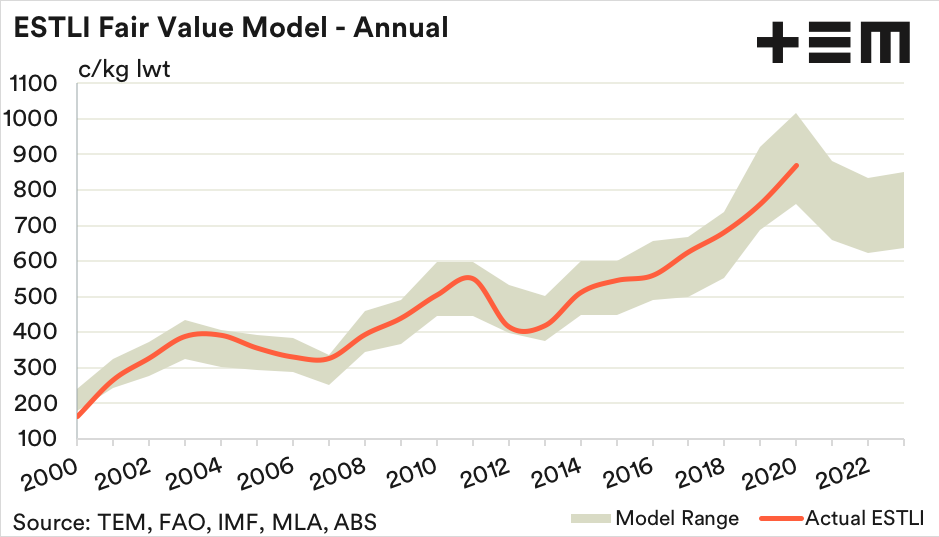

Turning to the longer term annual fair value model for the ESTLI we can see the impact of projected reduced economic growth across key Australian lamb export destinations. Scenario testing a decline in offshore sheep meat demand as economic growth in key trade partners stagnate into 2021 suggests that weaker trade lamb prices could persist until 2022, where the annual model shows an ESTLI between 620-830 c/kg cwt as fair value.

It is important to keep in mind that the fair value model output is based on a most likely scenario, according to current forecast levels for the key inputs that drive the model. As these forecasts for the inputs change the fair value range will also alter. Subscribe to the regular and free updates from Episode3 to keep abreast of any revisions to the model as circumstances change.