Past the April lull

Market Morsel

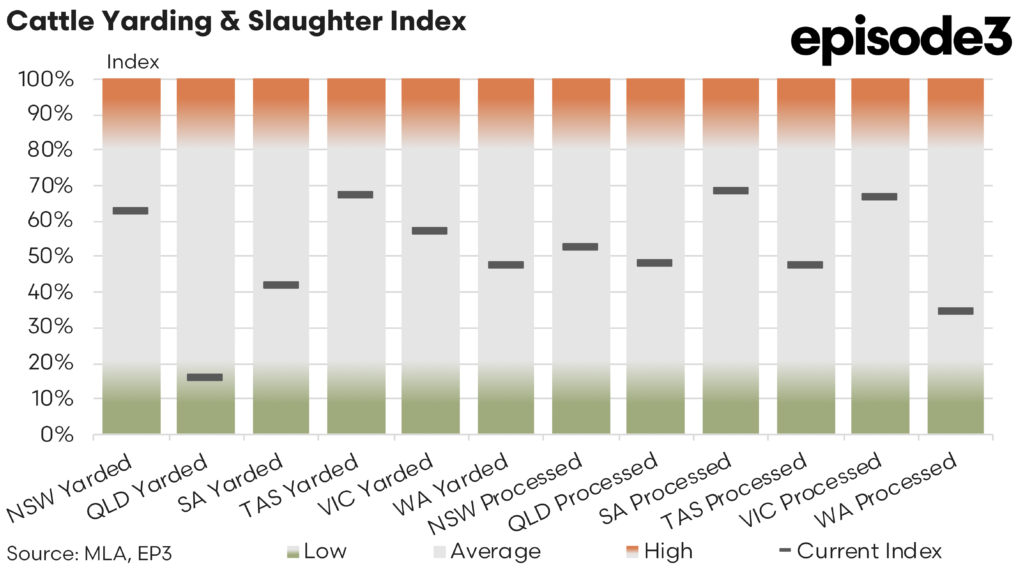

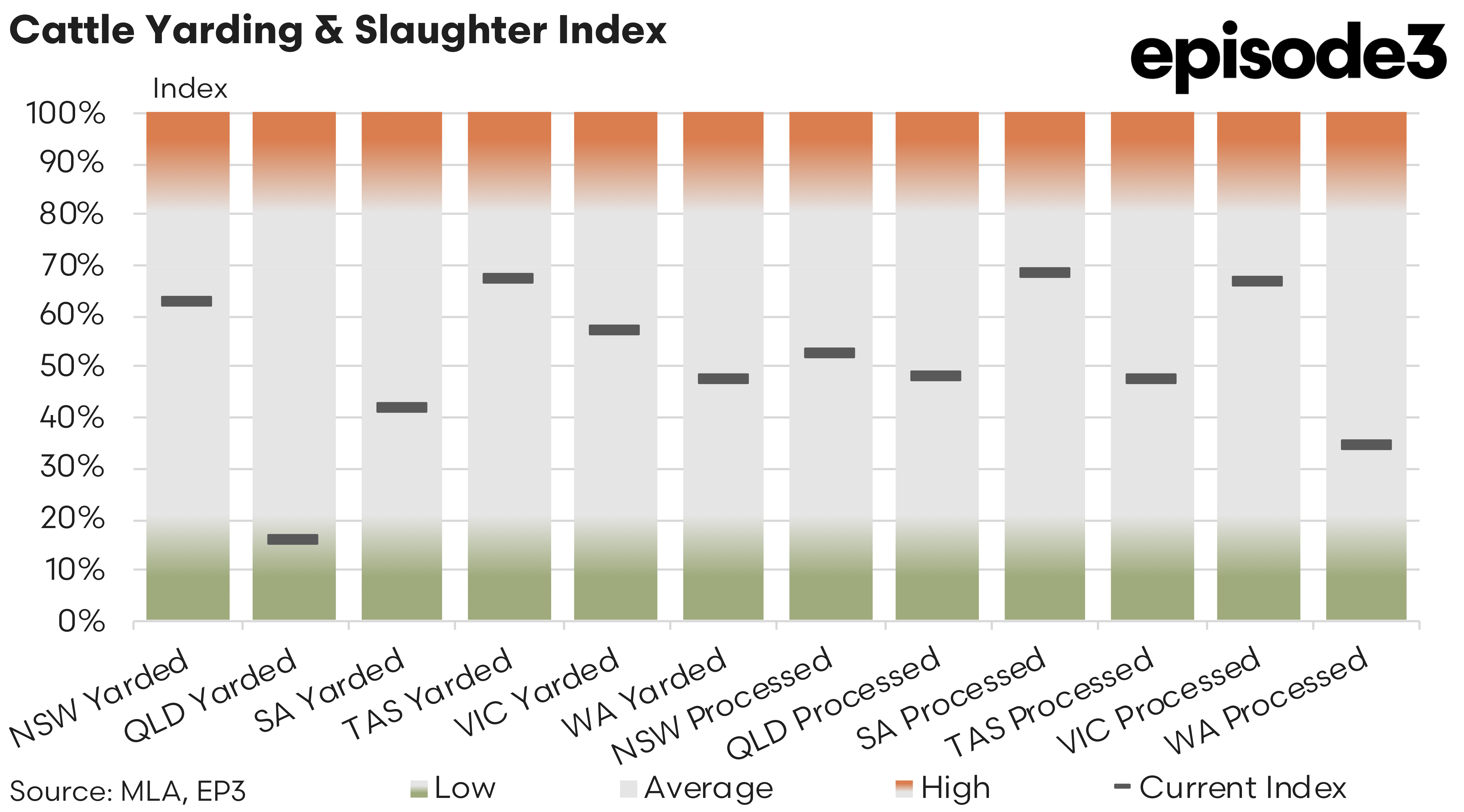

Now that we a through the April holiday disruptions to national beef processing Australia’s saleyard yarding and slaughter index reveals a sector beginning to lift capacity, but facing opposing weather systems across the country and shifting supply dynamics.

From March to April 2025, there was a significant shift in the volume of cattle yarded and processed across most states. The standout change is the sharp fall in Queensland yardings, down from 35% in March to just 16% in April. This drop is reflective of heavy rainfall in the state’s north and central regions, where producers delayed turnoff due to inaccessible paddocks and then struggled to find booking space amidst holiday disruptions. Consequently, processors in Queensland, although reportedly already heavily booked through May and into June, saw processing rates dip from 56% to 48%.

In New South Wales, yardings also retreated from 70% in March to 63% in April, while processing dropped from 81% to 53%. This suggests the state’s role as a slaughter buffer to Queensland was constrained, likely due to the flow-on logistics challenges from the April holiday slowdowns. As Queensland processors faced backlogs and stock held off-market, NSW’s own pipeline adjusted accordingly.

In contrast, Victoria and South Australia continue to underpin national processing volumes. Although both states saw reductions in slaughter capacity, the changes were relatively moderate. Victoria processed 67% of its benchmarked volume in April, down from 84% in March. South Australia eased from 90% to 68%, but still represents one of the most resilient parts of the national kill chain. This stability mirrors earlier observations that southern producers, facing declining and dry pasture conditions, are continuing to turnoff cattle proactively.

Tasmania’s processor throughput eased from 63% to 47%, despite relatively solid yardings. This disconnect may reflect labour constraints or capacity limitations rather than supply issues alone. Meanwhile, Western Australia remains a structural outlier. With just 15% of benchmark processing activity reached in March and a meagre 34% in April, the state continues to suffer from long-term processor capacity issues and distance-to-market barriers.

Despite regional disparities in processing activity, national cattle price indicators have generally shown resilience, albeit with signs of pressure emerging. Over the last four weeks, most indicators posted notable declines, even as year-on-year comparisons remain positive.

The Heavy Steer Indicator, now at 336c/kg live weight, has fallen 35c over the month. This trend likely reflects the reduced slaughter activity in key states like Queensland and NSW, where weather has restricted cattle movement and contributed to processor backlogs. Similarly, the Processor Cow Indicator declined by 28 cents over the month to 262c/kg, a sign that processors are less aggressively chasing lean manufacturing beef in the short term given the US tariff/trade uncertainties.

However, this easing must be viewed in the context of already-elevated levels. Compared to the same period in 2024, the Processor Cow and Heavy Steer indicators are still up by 30 cents and 41 cents respectively. This points to underlying demand strength in global and domestic beef markets, even as short-term logistical and seasonal factors drive weekly fluctuations.

The Feeder Steer Indicator showed a moderate drop of 14 cents over the month to 370c/kg. Given that southern states are still actively turning off cattle due to dry conditions, this fall may reflect higher throughput into feedlots, slightly weakening prices. Still, the year-on-year rise of 51 cents demonstrates that steady feedlot demand is still supporting values.

Recent restocker indicator changes tell a similar story. Yearling heifer prices fell over the month (down 13 cents), but remain sharply higher than a year ago. Restocker Steers eased too over the month (down 17 cents) but are 48c/kg higher year-on-year, suggesting confidence in medium-term pasture recovery, especially in the north where rain has renewed optimism about late-season weight gains.

The April figures reinforce the current differences in Australia’s cattle processing landscape. Northern states are temporarily constrained by rain and delayed mustering, while the south is running hard before pasture quality deteriorates further. This split dynamic is pressuring processor capacity in southern states, with some already experiencing backlogs as excess supply flows in from drier regions and Queensland begins to resume throughput.

Processors across Queensland are expected to face particularly tight conditions in May and June. Anecdotal reports highlight bookings stretching into June, signalling that cattle are queued up but cannot yet move. For processors, the challenge now becomes managing labour and logistics to handle these uneven flows.