Persistent Liquidation

Market Morsel

After months of speculation about whether the US cattle sector has entered a rebuild phase, new data from the first five months of 2025 makes one thing clear. The American herd remains in liquidation, though the pace has slowed. The latest Female Slaughter Ratio (FSR) figures show that while some progress has been made toward herd retention, the numbers still fall short of confirming a true transition into a rebuild. For Australian cattle producers, this has important implications not only for market direction but also for price competitiveness on the global stage.

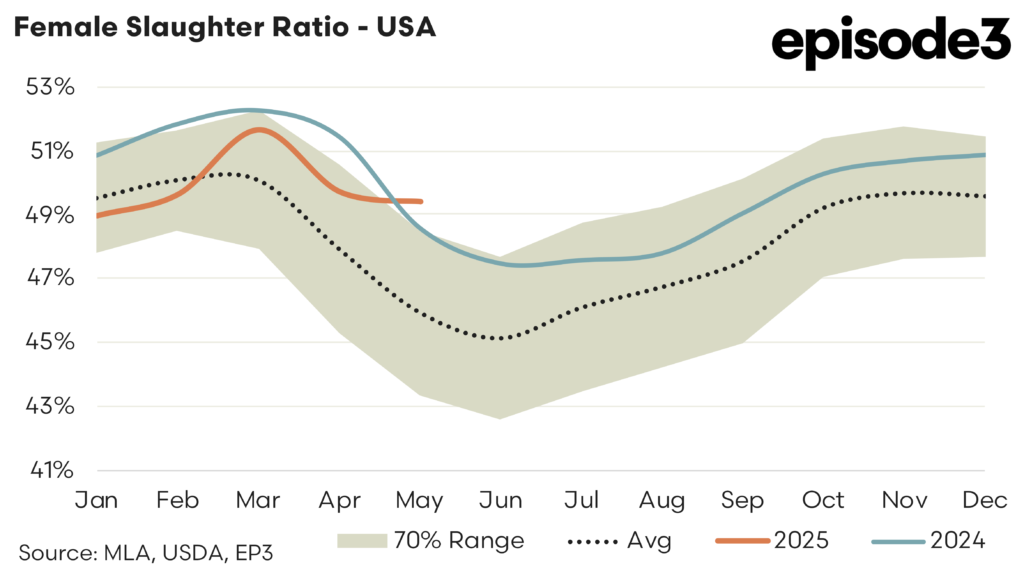

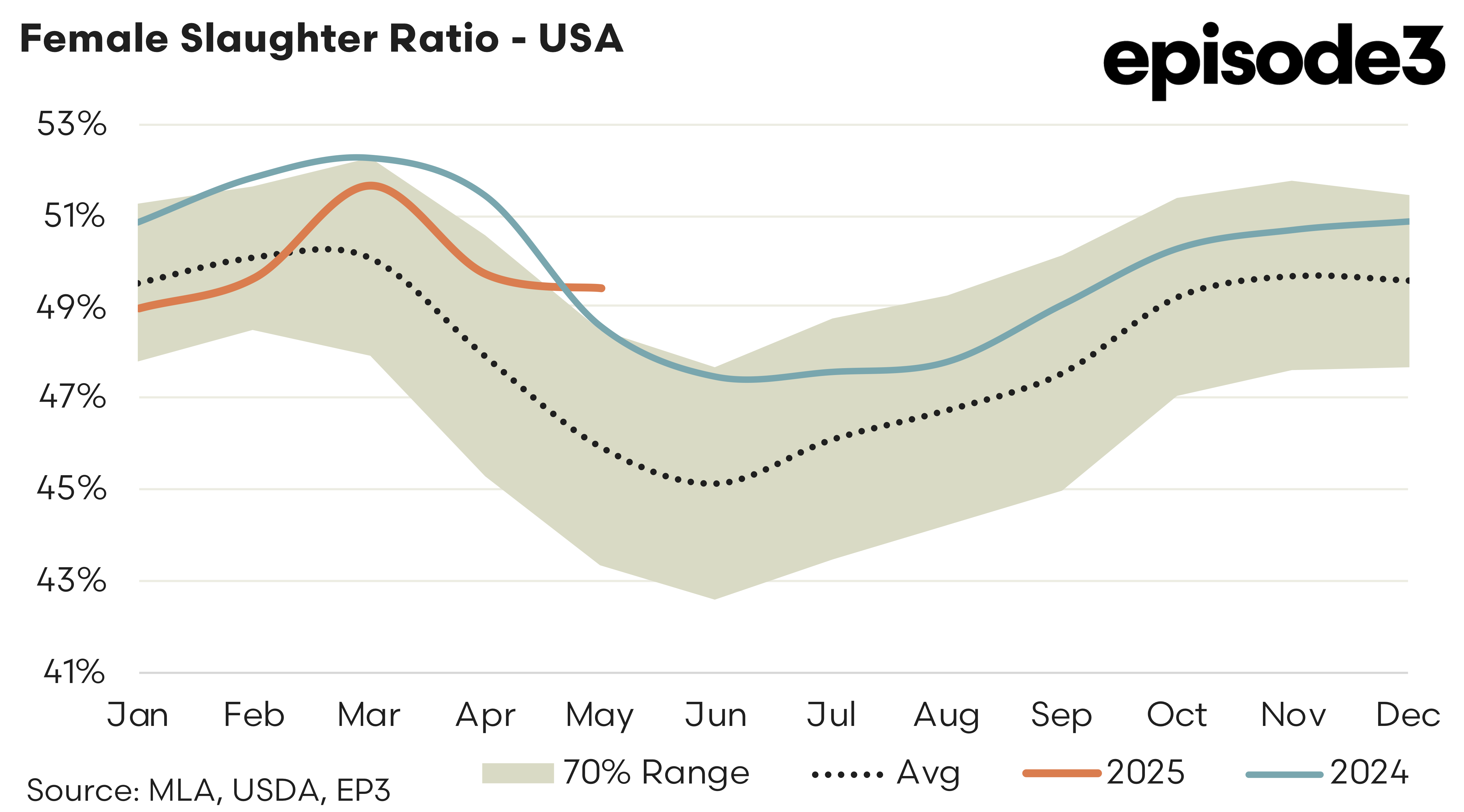

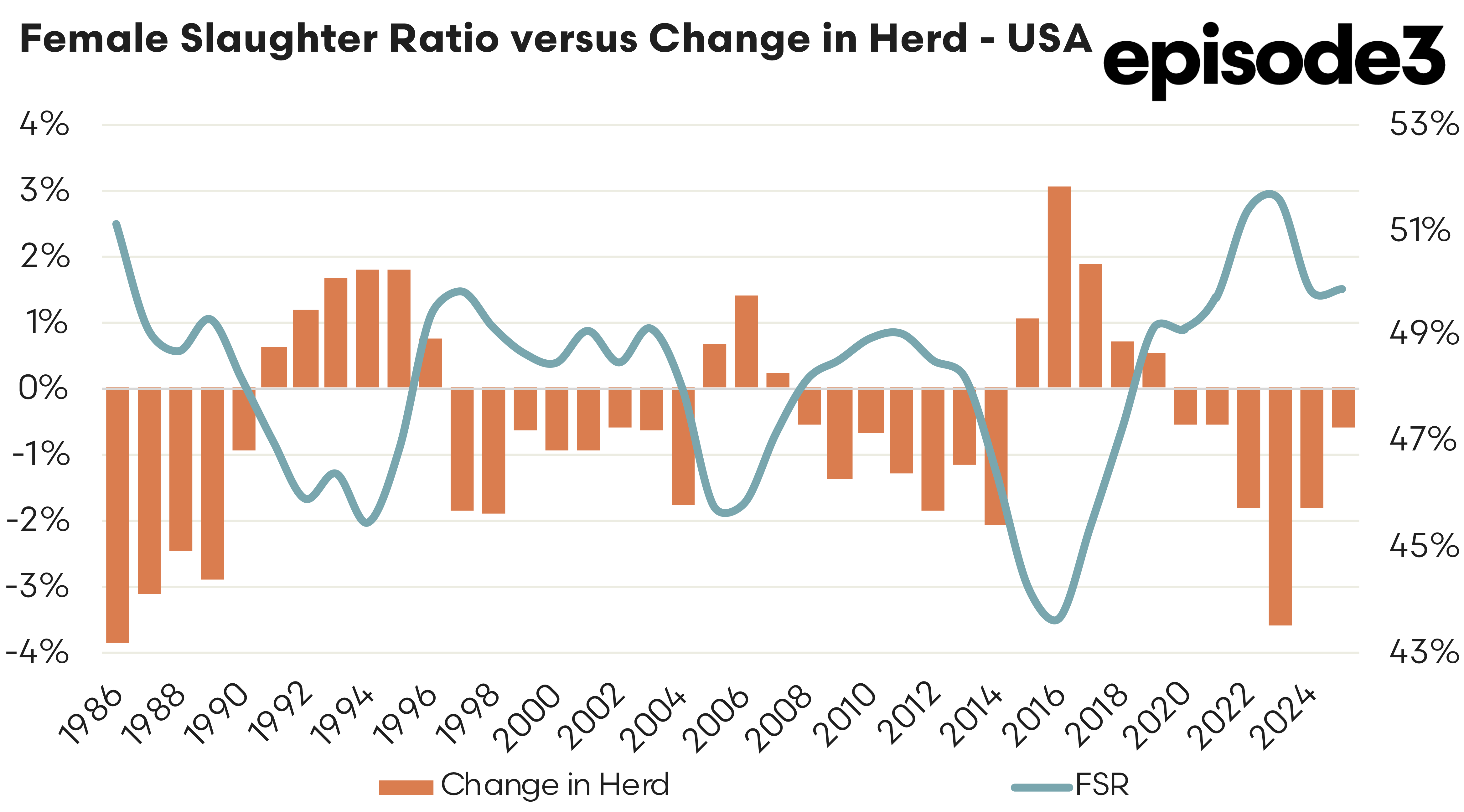

The monthly FSR for 2025 to date shows the following values: January at 49.0 percent, February rising to 49.6 percent, March peaking at 51.7 percent, then falling slightly to 49.7 percent in April and 49.4 percent in May. Averaged over the first five months of the year, the figure stands at 49.9 percent. That remains well above the historically reliable rebuild threshold of 48 percent. The current 2025 FSR average is identical to the 2024 annual average achieved of 49.9 percent, which saw the US cattle herd decline nearly 2% last year.

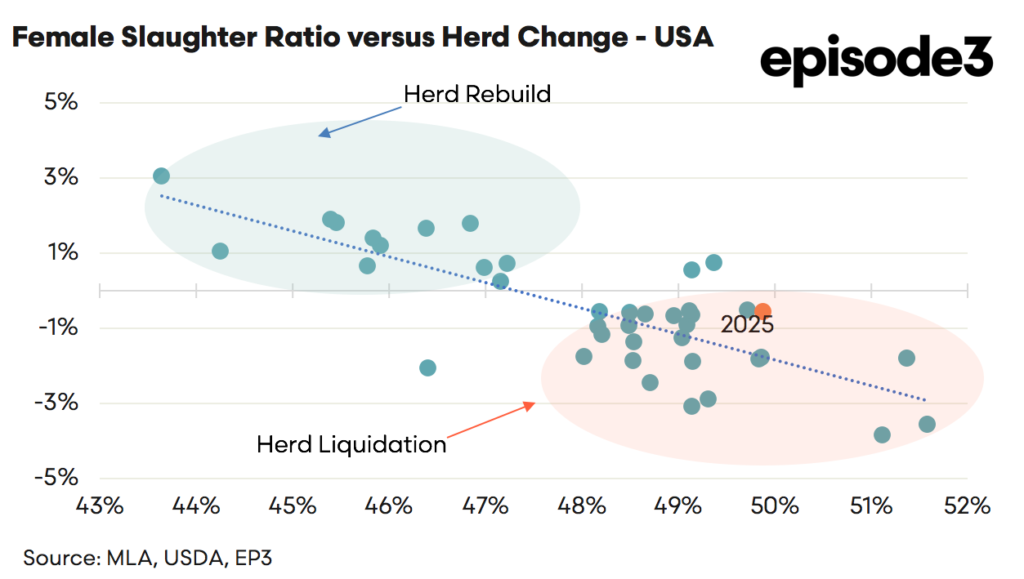

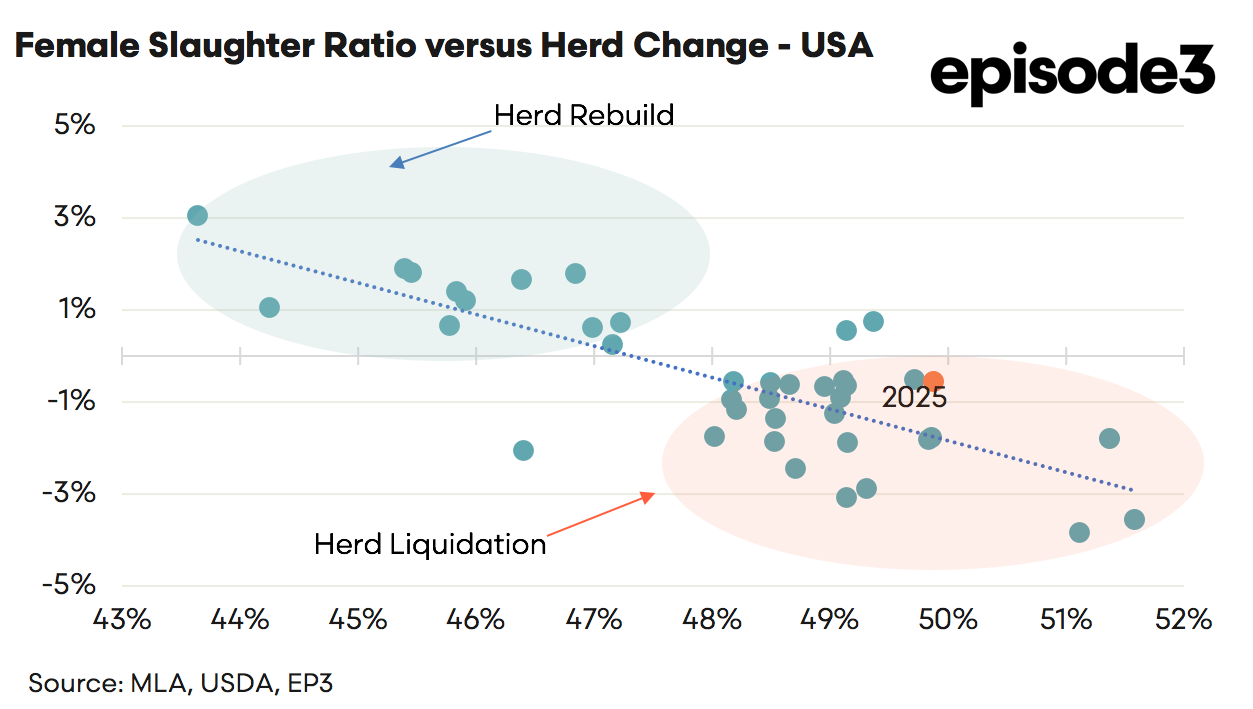

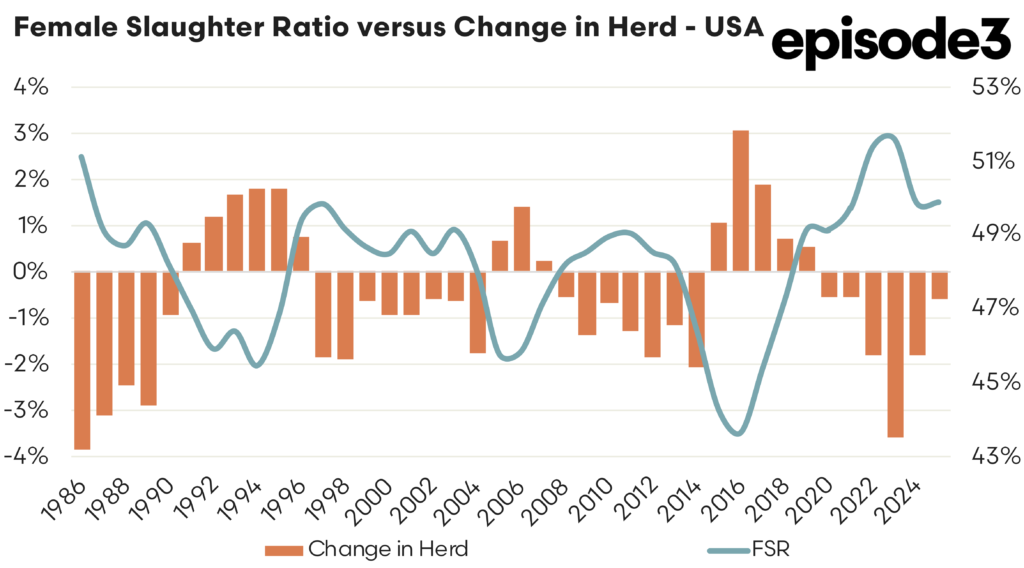

This is consistent with longer-term herd change data from the USDA and visualised in historical trend charts. While the US herd has been shrinking for six consecutive years, reaching an estimated 86.7 million head in early 2025, the FSR pattern suggests liquidation remains the dominant trend. That conclusion is further supported by the relative position of 2025 data in the scatter plot comparing FSR against year-on-year herd change. The 2025 marker still sits squarely in the liquidation zone, mirroring years in which the herd shrank by between one and three percent.

The third chart in the series provides additional insight, showing the 2025 monthly FSR track against both 2024 levels and the long-term average. The early months of this year are tracking just above average, with only a brief spike in March. This underscores the fact that while there is downward pressure on the FSR, consistent with producer sentiment shifting toward rebuild, the momentum is insufficient to confirm a phase shift.

For Australian beef producers, this delay in the US rebuild phase is strategically important. When the US is in liquidation, it means that fewer breeding females are retained, limiting the capacity for herd growth and suppressing future supply. This tightening of supply is one of the key factors underpinning strong US cattle prices, which remain historically high. These elevated prices provide a floor for global beef markets, allowing Australian cattle prices to find support even amid local seasonal or cost pressures.

In addition to price support, Australian exporters also benefit from the relative price discount compared to US product. With Australian cattle continuing to trade at lower levels, Australian beef remains attractive to international buyers. This is particularly evident in the US itself, where Australia has climbed to become the second-largest beef import supplier. The United States is now the top destination for Australian beef exports, a reversal from previous years where markets such as Japan and China held that title.

It is also worth considering the timeline ahead. If a US rebuild were to commence later this year or early in 2026, the lag time between retention and actual uplift in beef supply would be significant. It takes two to three years for retained heifers to translate into marketable cattle. That means global beef supply conditions are likely to remain tight well into 2027, reinforcing the current price environment and keeping Australian export demand firm.

While there is always the risk of policy intervention or economic headwinds dampening beef demand in key markets, the global fundamentals remain favourable. A sluggish US rebuild delays the supply response, and that sustains higher price points across export markets. For Australian producers, particularly those with access to processor grids and export-aligned supply chains, the continuation of the US herd liquidation phase represents a supportive tailwind.

Producers should, however, continue to watch the key indicators closely. A sustained FSR drop below 48 percent or a sharp fall in heifers on feed in the US would mark the beginning of a genuine rebuild phase. Until then, the current conditions suggest that the US cattle sector remains in contraction mode and that Australian beef is well positioned to benefit from the global dynamics this creates.

We will keep an eye on the US FSR as the year progresses and update you once we think there is a clear signal that the rebuild has begun. Keep an eye out for the weekly email and make sure you are subscribed on this link, so you don’t miss the updates.