Place your beefs

The Snapshot

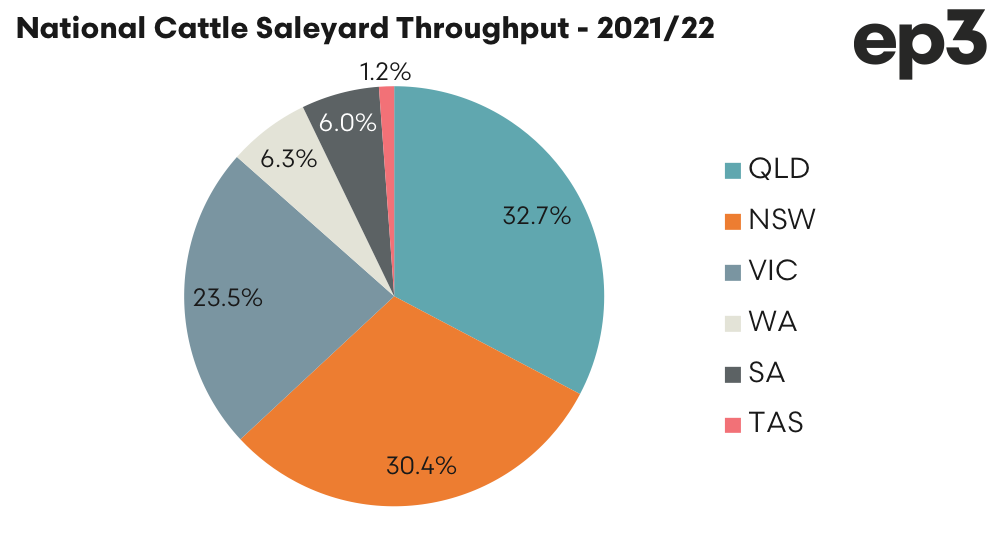

- Nearly 87% of the national saleyard transactions occurred in either Queensland, NSW or Victoria for the 2021/22 financial year.

- Queensland holds the highest market share of saleyard throughput at nearly 33% of the national yarding volumes, followed by NSW on 30%.

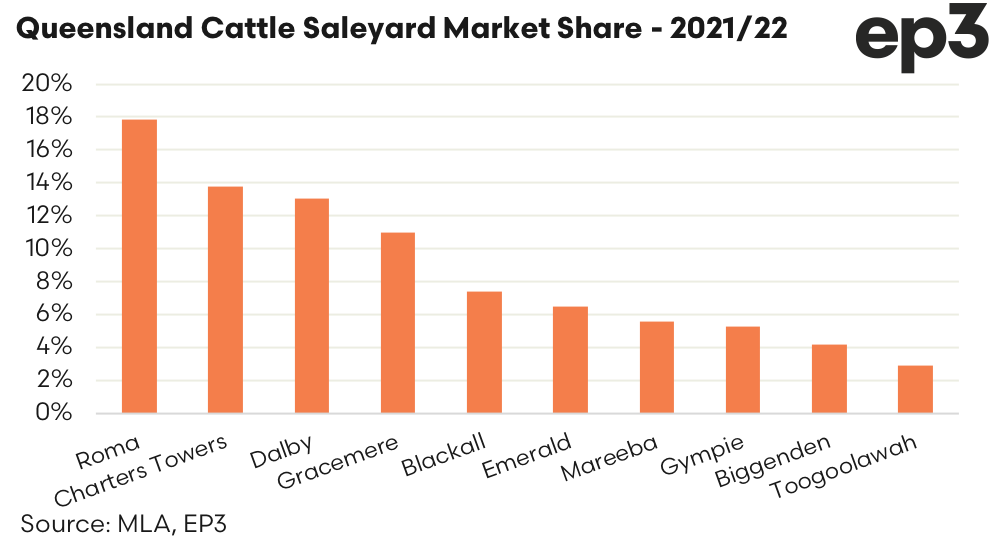

- In Queensland the Roma saleyard holds the highest market share of cattle sales with nearly 18% of the states annual throughput.

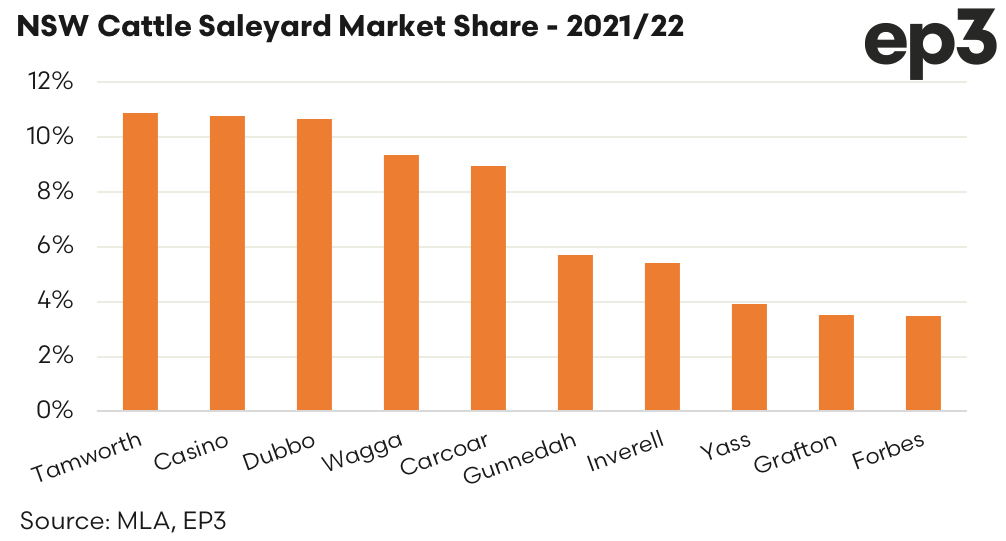

- Saleyards in NSW show much more even distribution across their top five saleyards with the market share ranging from 9% to 11%. Tamworth holds the top spot, albeit marginally from Casino and Dubbo.

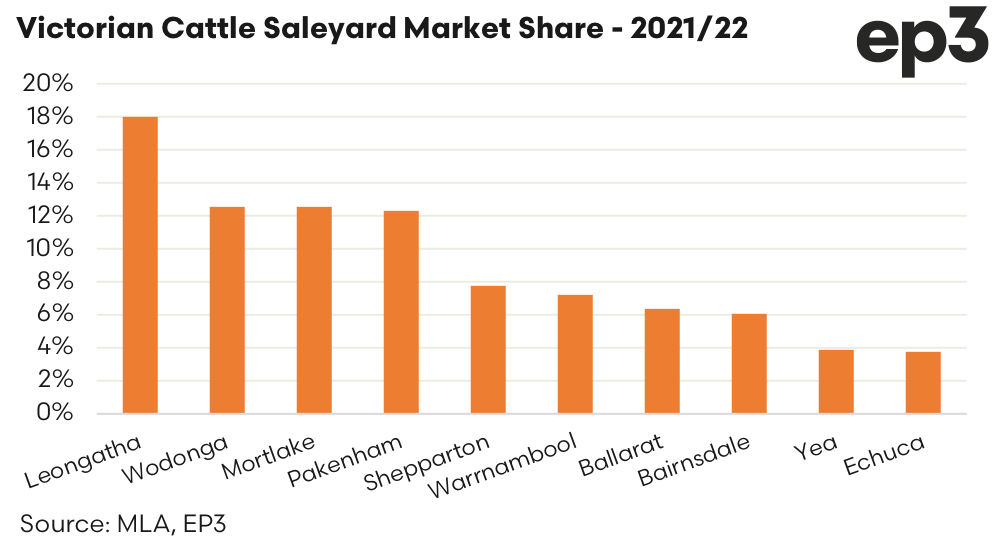

- The Victorian saleyard of Leongatha is the standout when it comes to market share of their cattle yarding at 18%.

The Detail

Saleyards across the mainland east coast dominate Australian cattle throughput with nearly 87% of saleyard transactions occurring in either Queensland, NSW or Victoria for the 2021/22 financial year. Queensland is home to the most cattle so it stands to reason that they would account for the highest market share of saleyard throughput at nearly 33% of the national yarding volumes.

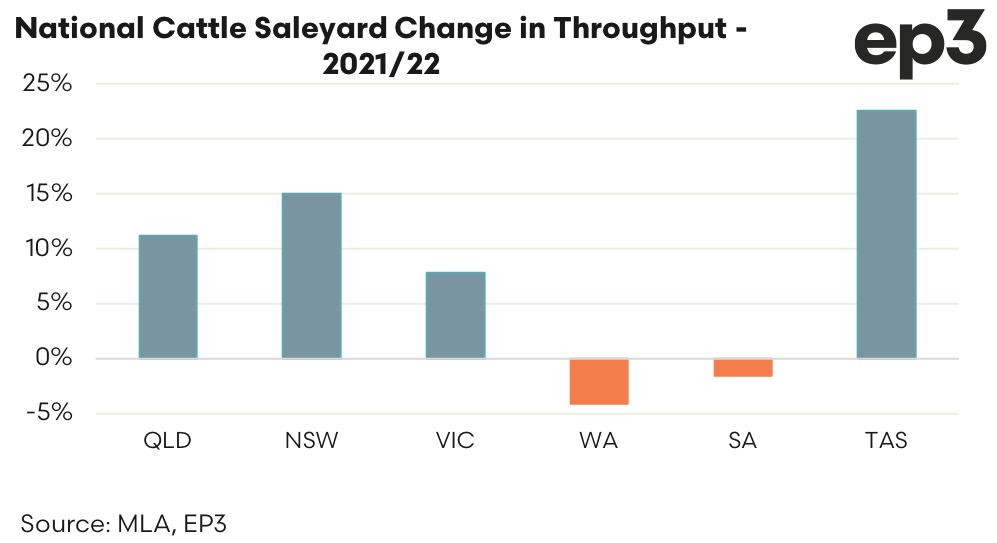

NSW isn’t far off the pace though, in second place with a little over 30% of the national throughput and Victoria sits in third place on 23.5% of the national cattle yarding volumes. In terms of annual growth in saleyard cattle transactions NSW was the strongest mainland state, posting a 15% lift from 1 million head last season to 1.15 million head this year. Queensland and Victoria managed healthy increases of 11% and 8%, respectively. However, the strongest gains overall were in Tasmania at a rise of nearly 23% – too bad they only account for about 1% of the national cattle throughput figures.

In Queensland the Roma saleyard holds the highest market share of cattle sales with nearly 18% of the states annual throughput. Roma managed to hold onto top spot despite posting an 8% decline in volumes over the 2021/22 season to see around 220,000 head of cattle transacted.

Charters Towers leapt into second place with a massive 202% gain in cattle volumes from the previous year, up from 56,000 head to over 170,000 head this season. Charters Towers has gone from 5% of the states cattle throughput to nearly 14% in one year. Out of the top ten saleyards in Queensland, Gracemere and Biggenden saw the largest annual declines in cattle throughput down 18% and 19%, respectively.

Saleyards in NSW show much more even distribution across their top five saleyards with the market share ranging from 9% to 11%. Tamworth holds the top spot, albeit marginally from Casino, at 124,863 head versus 123,713. Dubbo isn’t that far behind in third place with 122,289 head for the 2021/22 season.

Across the top ten saleyards in NSW for cattle throughput Wagga Wagga was the only yard to post a decline for the 2021/22 financial year, down a little over 5% to 107,000 head. Meanwhile Carcoar saw the largest gains, with cattle throughput volumes up nearly 61% from 64,o00 head to 103,000 head. Carcoar’s proportion of total NSW cattle throughput lifted from 6% to 9% during the last year.

The Victorian saleyard of Leongatha is the standout when it comes to market share of the states cattle yarding. During the 2021/22 financial year Leongatha accounted for 18% of the Victorian cattle throughout, with Wodonga and Mortlake pretty much on a tie for second place with 12.6% of the state’s cattle yardings apiece. Pakenham isn’t too far out of the race for second place sitting on 12.3% of the market share.

Mortlake was the big winner out of the top five Victorian saleyard for the 2021/22 season with annual gains in cattle throughput of nearly 23%, from 91,000 head last year to nearly 112,000 head this year. Meanwhile Wodonga and Shepparton were the only two Victorian saleyards in the top five to post a decline in annual cattle throughput of 8% and 6%, respectively.