Processor conditions recover

Beef Processor Trading Conditions - May 2025 update

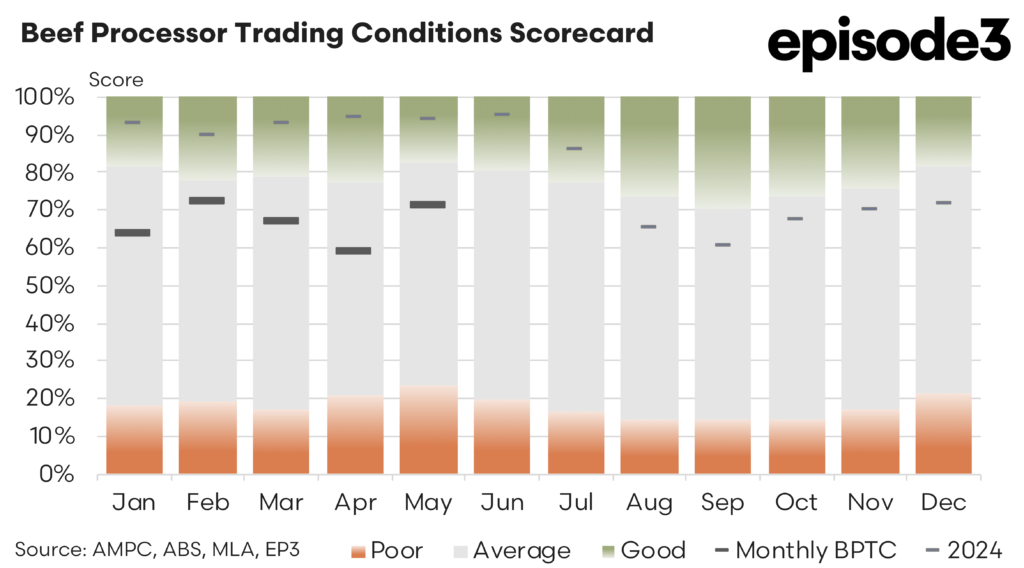

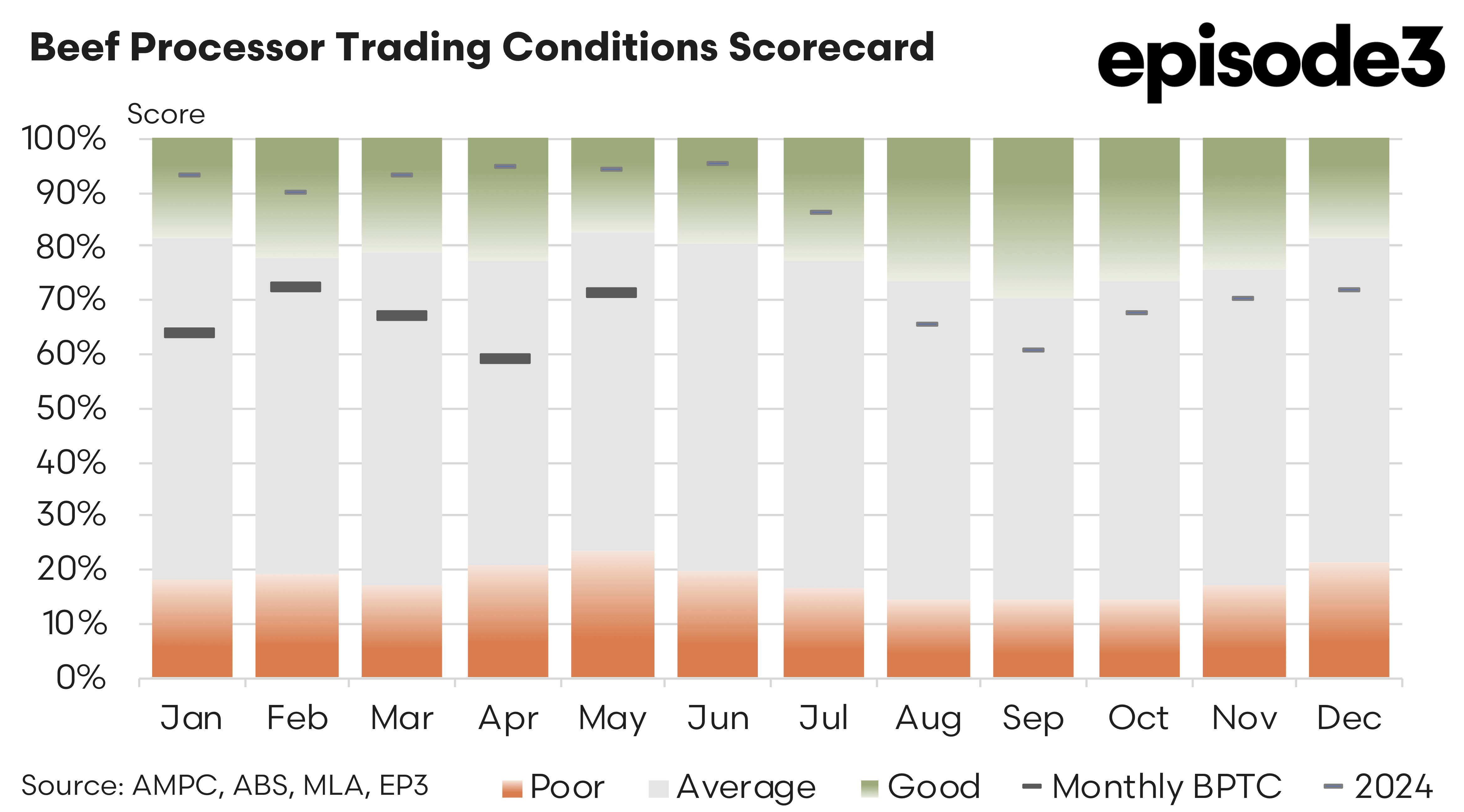

After a tougher trend from February to April, Australia’s beef processing sector experienced a welcome rebound in trading conditions during May. Following a seasonal lull in April, the Beef Processor Trading Conditions (BPTC) index has staged a solid recovery, offering some respite for an industry under pressure from high livestock procurement costs and mixed export returns.

Initially reported at 51%, the BPTC index for April 2025 has been revised upward to 59% due to updated beef export pricing data. Even so, April remained the lowest point in over a year and reflected the margin squeeze processors faced as cattle prices climbed faster than the returns from selling boxed beef, both domestically and abroad.

However, May marked a turning point. The BPTC lifted sharply to 71%, the highest monthly reading since February 2025, driven by a convergence of easing livestock prices and improving export market conditions. This recovery, while not yet signalling a full return to complete comfort, indicates a shift toward more balanced conditions for processors as they head into the middle of the year.

At the heart of the improvement were softer livestock input prices. Heavy steer values fell by 5.8% over the month, while processor cow prices declined by an even sharper 10.2%. Young cattle also eased, down 1.9%. These price corrections, though modest in the case of restocker-type cattle, relieved some of the immediate cost pressures that had plagued processors earlier in the year.

The easing in livestock prices coincided with stronger demand signals from overseas markets. Average beef export prices across Australia’s top four destinations, the United States, China, Japan and South Korea, increased by 3.2% in May. China and Japan led the way, posting gains of 8.9% and 5.1% respectively, as demand recovered and seasonal buying patterns supported improved pricing outcomes.

This export strength helped offset the cost-side challenges that persist within the processing sector. Input costs into the food manufacturing industry rose by another 5% during the month, reflecting broader inflationary pressures that continue to affect logistics, packaging, and ingredient inputs. Utility charges also lifted slightly, up by around 1%, adding to the operational burden. Nonetheless, these cost increases were insufficient to override the benefits from improved cattle procurement pricing and stronger export returns, allowing the BPTC to climb.

Domestically, retail beef prices increased by nearly 2% over the same period, providing a modest but valuable boost to wholesale margins. With consumer demand showing signs of resilience despite ongoing cost-of-living pressures, processors were better able to pass through higher prices, aiding profitability.

The current balance between input and output prices for processors has seen the BPTC average just 66% year-to-date, as at the end of May 2025. Compared to this time last year the BPTC was a healthy 93% index score, so while conditions this year are better than average they are a far cry from the early part of the 2024 season.

Despite the gains in May, challenges persist. While livestock prices have temporarily eased, any resurgence in demand from producers, particularly in the north where pasture conditions have improved, could quickly firm cattle values once more. Queensland and northern NSW continue to report restocker interest, buoyed by rainfall-driven confidence in herd rebuilding.

Moreover, the broader trade environment remains uncertain. While export prices to China and Japan improved in May, the outlook is clouded by geopolitical tensions, particularly the unresolved state of US–China trade relations. A change in US trade policy or greater access for American beef into China could quickly erode the market share advantage Australian processors are currently enjoying.

From a cost perspective, food manufacturing inputs are continuing to rise, a trend that shows little sign of reversing in the short term. Processors will need to remain vigilant in managing labour, energy, and logistics costs to preserve the gains made during May.

The improved BPTC index reading of 71% for May reflects a temporary alignment of easing cattle prices, improved export returns, and modest domestic price growth. While it signals a healthier financial position for processors compared to the sharp margin compression experienced in April, the beef supply chain remains exposed to rapid shifts in pricing and demand. Strategic cost control and careful monitoring of market access dynamics will be critical if processors are to consolidate these gains in the months ahead.

Meanwhile, producers should remain aware that current cattle price stability may not hold if seasonal or global market conditions shift. The sector continues to operate within a delicately balanced system, and one where advantage can swing quickly between producers and processors depending on rainfall, trade policy, and global consumption patterns.