Processor pressures return

Beef Processor Trading Conditions - March 2025 update

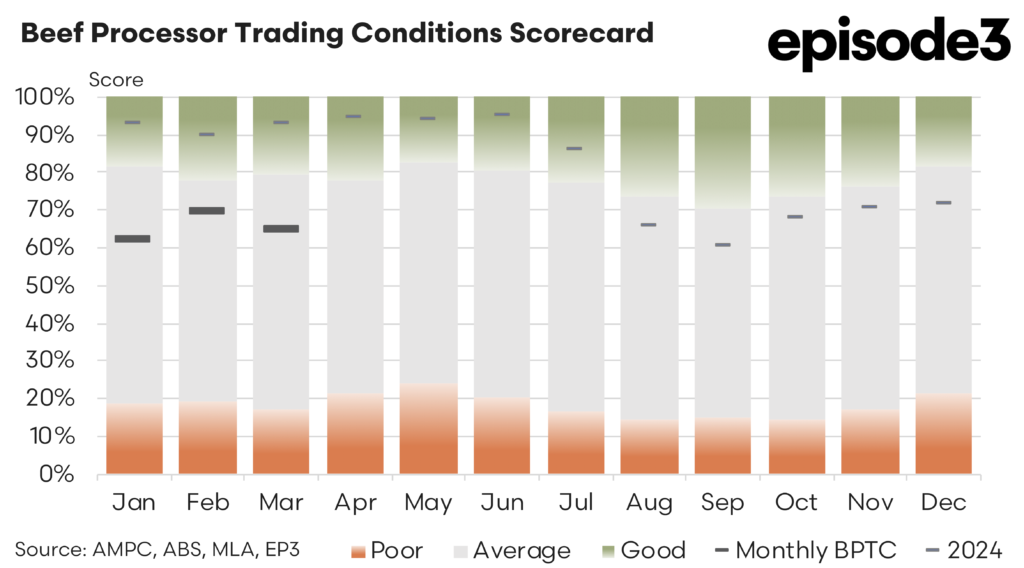

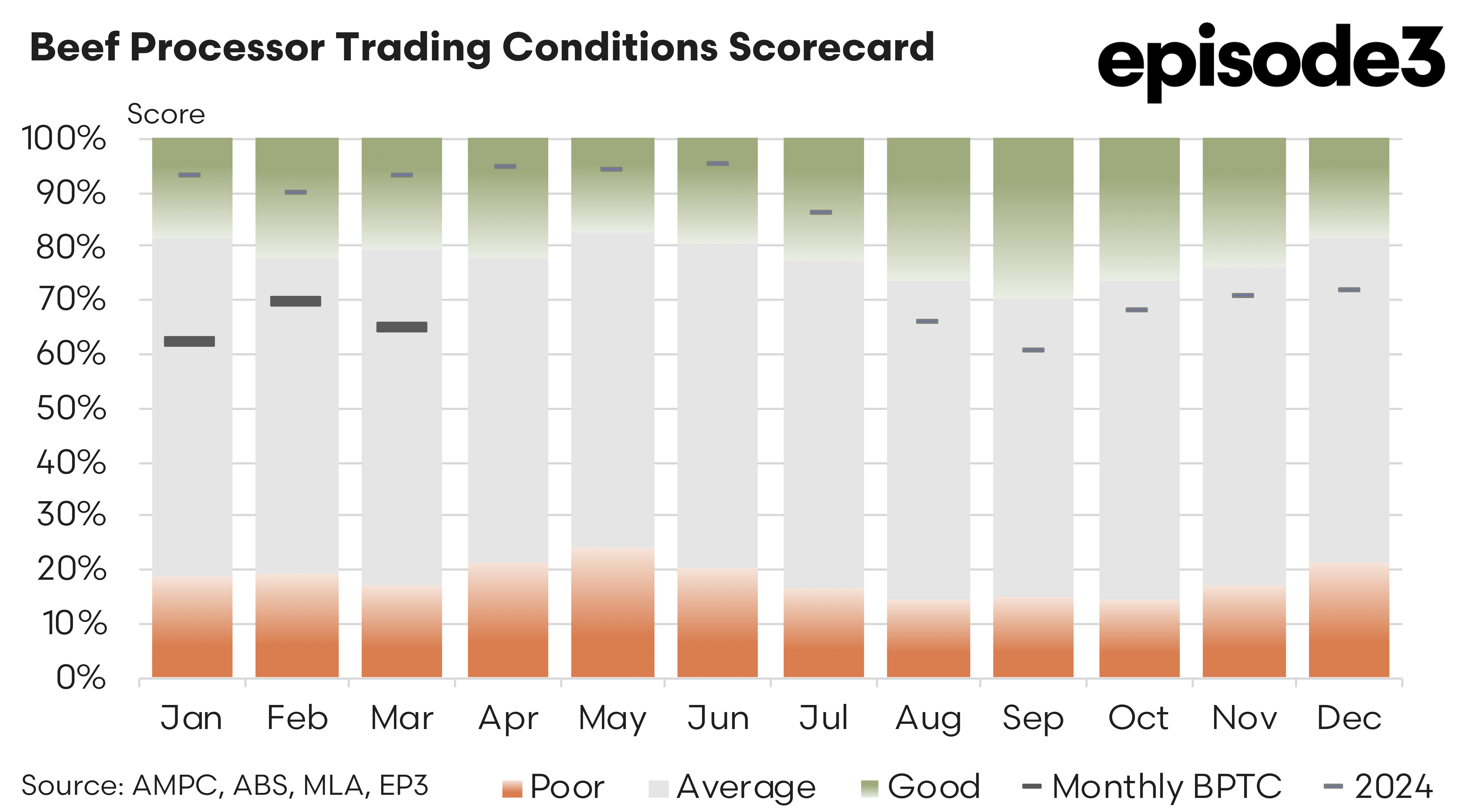

The pendulum that governs profitability between cattle producers and beef processors has swung once more in early 2025. Following a year where processors were largely in the driver’s seat, conditions have begun to tighten as producer margins improve, driving the latest shifts in the Beef Processor Trading Conditions (BPTC) index.

The opening months of 2025 were already signalling a change. From late 2024 through January and February, cattle prices had been steadily rising. Now, with March data included, that trend has continued. Between February and March, average domestic cattle prices lifted a further 2.7%. The standout movement came from feeder steers, which surged 8.1% over the month. Heavy steer prices climbed a more modest 2.2%, young cattle rose 0.4%, and processor cow prices remained flat. These price movements underscore a growing confidence in the restocker and backgrounding sectors, potentially hinting at herd rebuilding activity in northern markets and a more buoyant mood among producers that have had rain.

While this price lift is a welcome reprieve for cattle farmers, particularly after a prolonged period of subdued farmgate returns, it presents a renewed challenge for beef processors. Higher procurement costs place immediate pressure on processing margins, especially when export and domestic selling conditions remain mixed.

Export markets, which play a vital role in supporting processor revenues, delivered an uneven performance. Beef exports to the USA, Australia’s largest current customer, continued their positive trajectory with average export prices up 5.7% since the beginning of 2025. Japan also showed a mild improvement, with average beef export prices gaining 1.2%. However, these gains were counterbalanced by weaker results elsewhere: South Korea recorded a 3.0% drop in export prices, while China, a market that had briefly rebounded in February, saw a sharper 5.3% fall in average beef values. The net result across all key export destinations is that average export prices have remained relatively flat so far in 2025, limiting the ability of processors to fully pass through rising cattle costs.

Domestically, the situation has also been characterised by subtle shifts rather than significant gains. Retail beef prices crept up just 0.8% as at the final quarter of 2024, suggesting local demand remains steady but is not accelerating in a way that would support strong price inflation at the consumer level. On the cost side, processing expenses have begun to edge upwards, with average utility and labour costs increasing 0.2% since the end of last year. Though modest, this uptick contributes further to margin compression for processors already grappling with higher cattle acquisition costs.

The combined impact of these input and output changes has resulted in a downward adjustment to the BPTC index for March. After sitting at a healthy 70% in February, indicating better-than-average conditions for processors, the index has dipped to 65% in March. While still suggesting above-median operating conditions, this movement reflects growing pressure on processor profitability. The quarterly average BPTC score now stands at 66% for Q1 2025.

This drop, though not drastic, is indicative of the tightrope processors must walk in a cyclical industry like beef. Gains on the farm often come at a cost to processing businesses, and unless export returns or domestic retail values rise in parallel, processors can quickly find themselves squeezed. The current flat trend in average export values and only modest domestic price gains offer little cushioning against the rise in input costs from cattle markets.

An uncertain trade environment and the added volatility of Trump’s on again – off again tariff announcements brings an element of concern to 2025. Initial impacts of the targeting of China by the US administration appear to be favouring Aussie beef exporters as US beef access to China for around 300 American packers remains in limbo and Australian exporters/processors are starting to fill the void, improving Aussie beef market share into China.

Looking ahead, the Australian beef industry faces a familiar set of challenges and opportunities. For processors, strategic procurement, operational efficiency, and export market diversification remain critical tools to navigate margin pressures. Producers, meanwhile, are enjoying improved prices but must be mindful of external factors that could quickly reverse recent gains, whether in the form of seasonal variability, export market access, or shifting consumer preferences.

The Meat & Livestock Australia data on co-product values beyond October 2024 remains delayed, meaning some revenue sources for processors—such as hides, tallow, and offal—are still unaccounted for in the current BPTC calculations. When that data is released, there may be retrospective adjustments to better capture the true trading environment for processors.