Processor returns slide further

Beef Processor Trading Conditions - April 2025 update

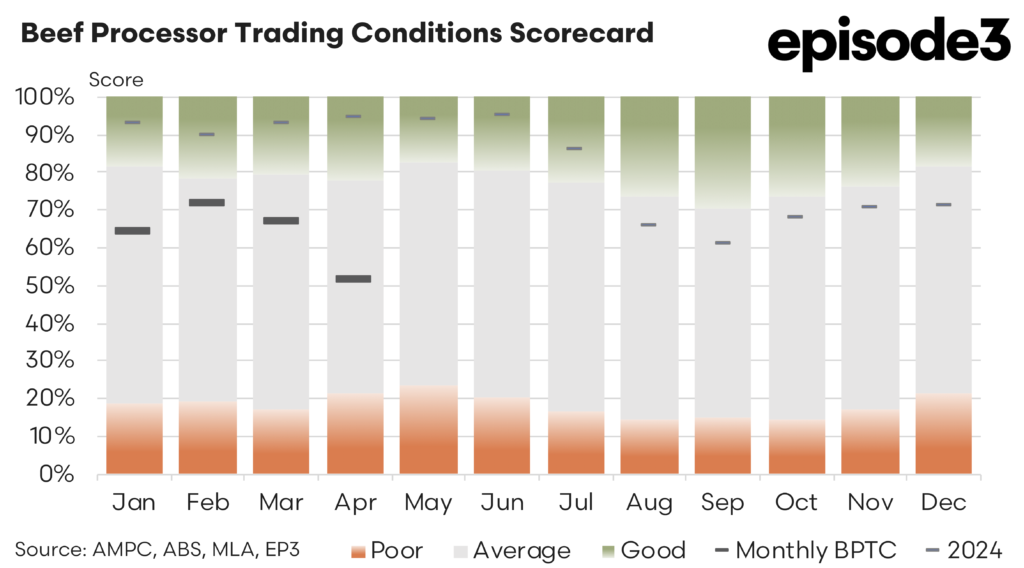

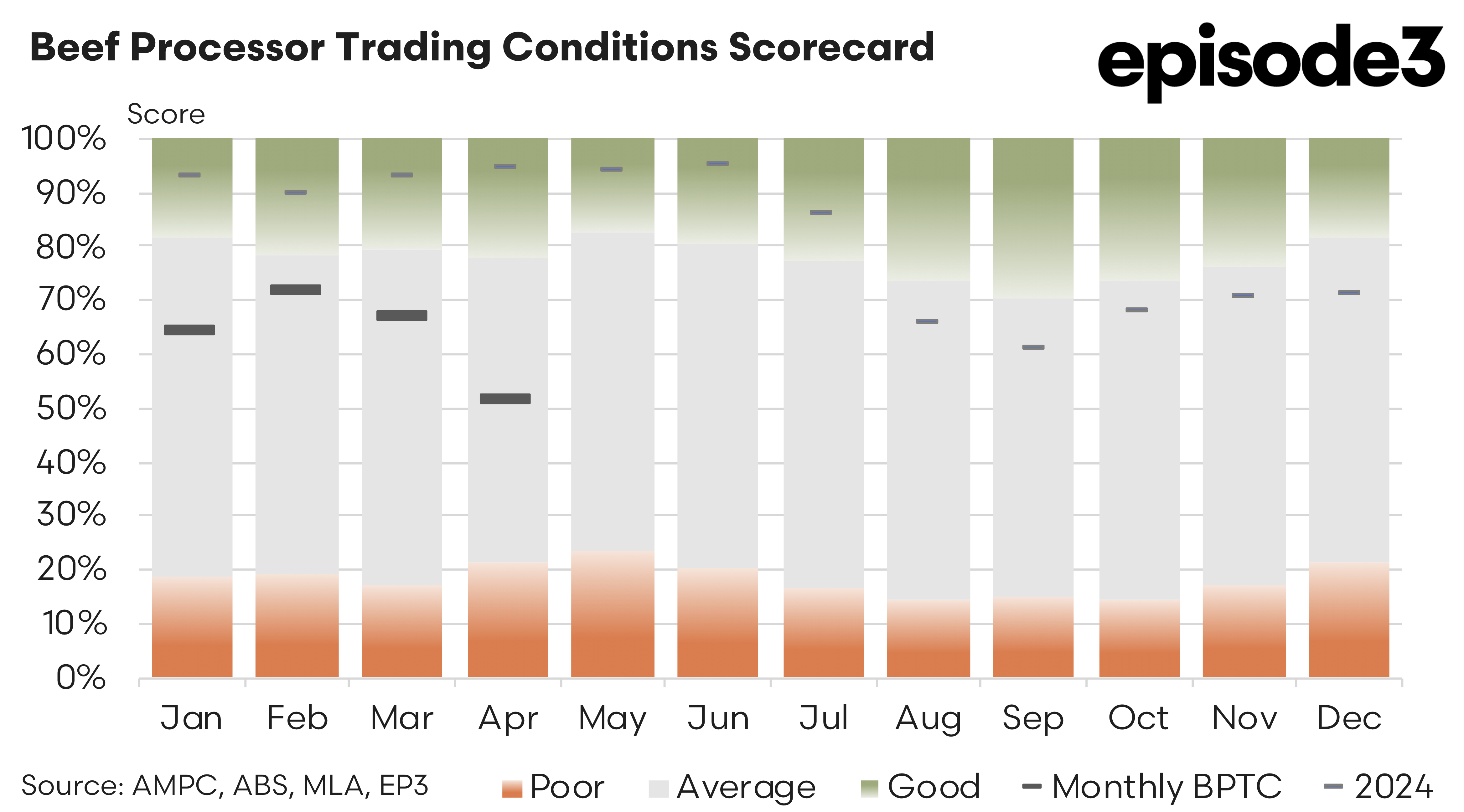

Beef processor trading conditions have taken a sharp swing in April 2025, deepening the pressure on processing margins while extending the upswing for producers. The latest data on the Beef Processor Trading Conditions (BPTC) index shows a significant deterioration in processor operating conditions. After holding relatively steady between 65% to 70% over the first quarter of 2025, the index dropped sharply to 51% in April. This marks the lowest monthly reading since October 2022 and drags the 2025 year-to-date average down to 64%.

The story of early 2025 is becoming increasingly defined by rising livestock input costs that are not being matched by sufficient returns from the sale of beef, neither domestically nor abroad. Cattle prices have continued to firm, reflecting growing producer benefit, particularly in northern regions where seasonal conditions may have supported some herd rebuilding activity.

Since the beginning of the year, heavy steer prices have increased by 4.7%, young cattle by 7.5%, and processor cow values by 4.8%. These movements are compressing processor margins at a time when their ability to offset such costs through improved beef prices remains constrained.

Export markets, a cornerstone of processor revenue, have not delivered the uplift required to compensate for elevated procurement costs. Despite some positive signs in March, the broader trend across Australia’s key trading partners has been underwhelming.

Average beef export prices to the USA have slipped by 0.8% since January. Japan has edged up just 0.8%, while South Korea and China posted more encouraging gains of 4.1% and 2.8% respectively. On aggregate, export prices to the four largest markets have increased by only 1.6%, falling well short of the nearly 6% lift in average livestock input costs borne by processors over the same period.

Domestic markets have offered little relief. Retail beef prices rose just 1.5% over the first quarter of 2025, reinforcing a picture of steady but uninspired demand. This sluggishness limits processors’ ability to pass through higher wholesale prices to retailers, further squeezing profitability. Meanwhile, operational costs have continued to edge higher. Manufacturing input costs into the food sector lifted by nearly 5% in Q1, reflecting broader inflationary trends. Utility charges and labour costs, though more stable, still rose by close to 1%, adding to the accumulation of margin pressure.

Taken together, these dynamics paint a challenging picture for the processing sector. With livestock input costs rising more than three times faster than export returns, and domestic markets offering limited pricing power, the drop in the BPTC index to 51% is a direct reflection of the financial stress now facing processors.

In contrast, the producer side of the industry is enjoying a turnaround in fortunes. The uplift in cattle prices, particularly for young and feeder stock, suggests renewed restocker activity and growing confidence in herd rebuilding. These trends are particularly evident in Queensland and northern NSW, where rainfall has reinvigorated pasture conditions. For producers who weathered the downturn of late 2023, the current market settings are delivering much-needed relief.

However, the cyclical nature of the cattle and beef supply chain means these gains are often zero-sum. As producers reap the benefits of stronger livestock prices, the viability of processors comes under pressure. The widening gap between input and output pricing in the beef supply chain reflects the challenge of maintaining balance in a system heavily exposed to international trade dynamics and local seasonal conditions.

Compounding the issue is the fragile global trade environment. The uncertainty caused by renewed US/China tensions, particularly the inconsistent stance of the Trump administration on tariffs, is creating both risk and opportunity. US beef access to China remains restricted for hundreds of American packers, creating space for Australian exporters to increase market share. While this shift has buoyed export volumes to China, the price gains remain moderate and have not fully offset weaker trends elsewhere.

Looking ahead, the trajectory for the processing sector will depend on several key factors. A stronger recovery in global beef prices would provide much-needed relief. Similarly, further growth in Chinese demand, should it materialise, could help restore processor margins. On the cost side, any easing in cattle prices would also help stabilise trading conditions.

For now, though, the message is clear. Processors are navigating a tightening margin environment, and strategic management of procurement, labour, and market access will be critical in the months ahead. At the same time, producers should not assume that current pricing strength will persist indefinitely. With export demand uneven, domestic consumption flat, and trade policies in flux, market sentiment can shift rapidly.