Producer share update

Producer Share March 2025 Quarterly Update

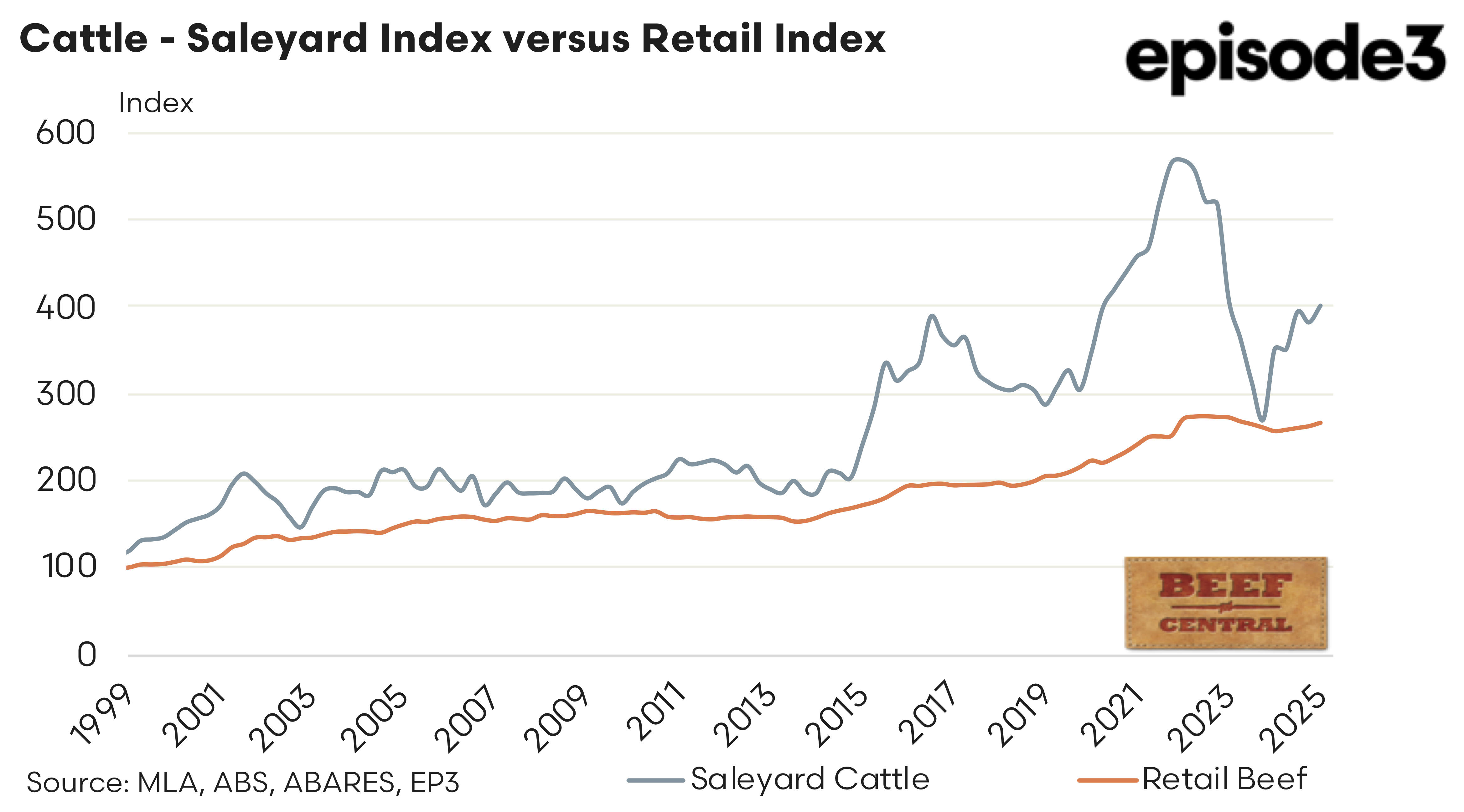

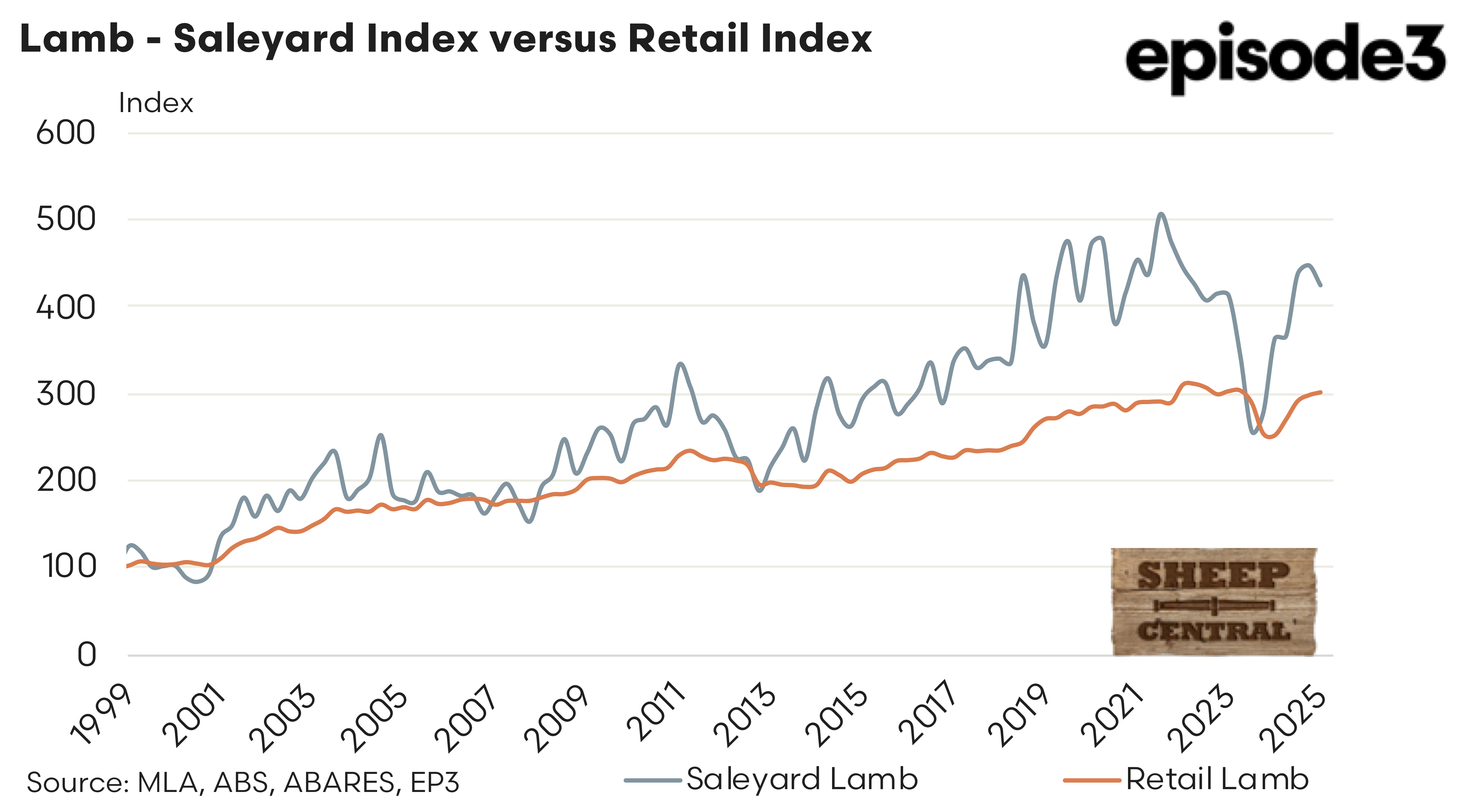

In the first quarter of 2025, Australian cattle and lamb producers experienced modest improvements in saleyard prices, yet diverging retail trends and cost dynamics led to mixed outcomes in producer share of the retail dollar.

The saleyard cattle index climbed from 383 to 402, indicating stronger returns to producers. The retail cattle index also moved up from 264 to 268, maintaining the upward retail trend. For lamb, the saleyard index dipped slightly from 446 to 423, while the retail lamb index rose from 298 to 301.

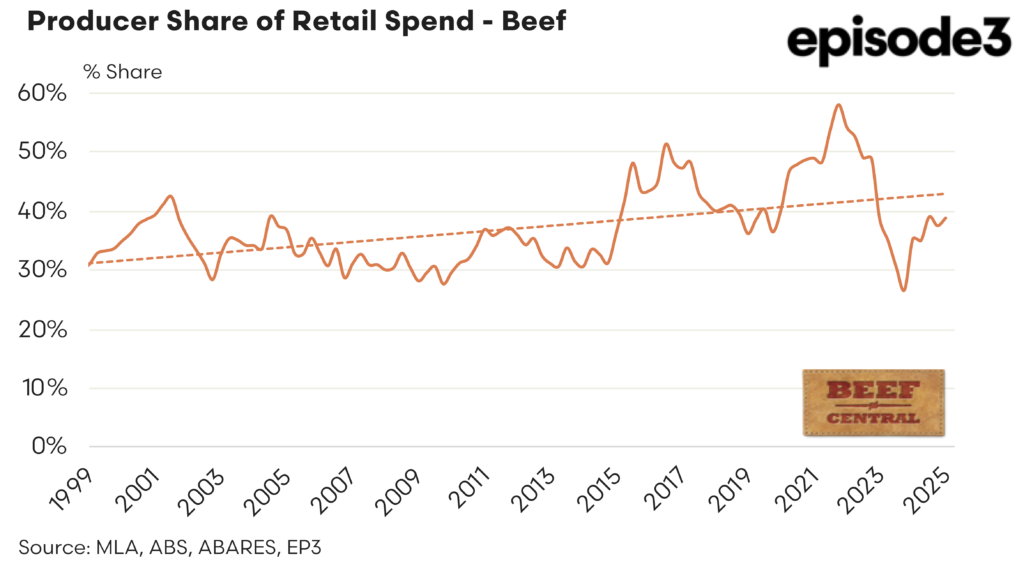

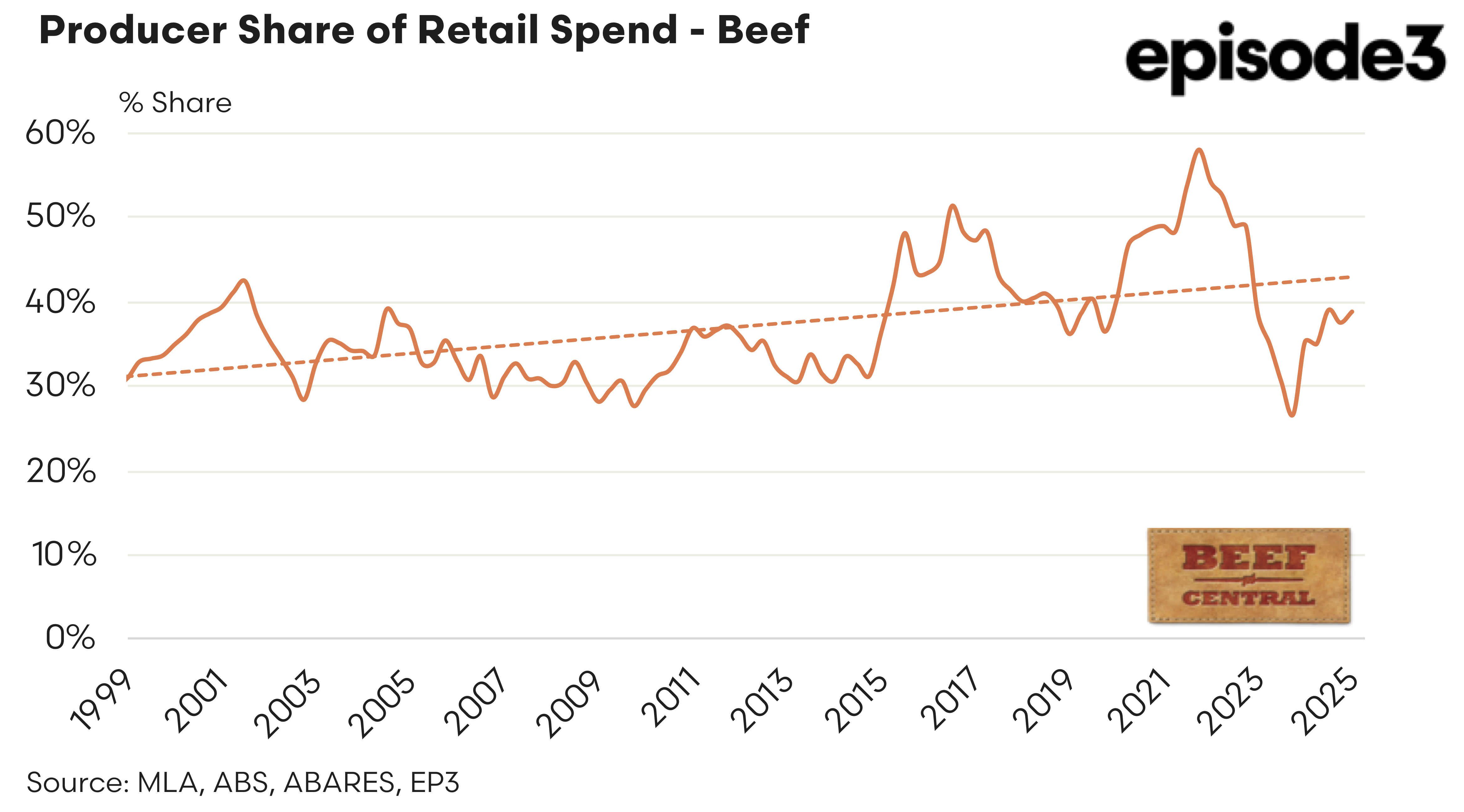

For cattle, saleyard prices rose from 669 c/kg cwt in Q4 2024 to 703 c/kg cwt in Q1 2025, continuing the gradual recovery observed since the mid-point of 2024. Retail beef prices also lifted, increasing from 25.97 $/kg rwt to 26.36 $/kg rwt. This parallel movement in both upstream and downstream prices meant that the producer’s share of the retail beef value remained relatively stable, lifting marginally from 37.5% to 38.8%. This marks a partial recovery from the 35% low recorded in mid-2024, suggesting more favourable market conditions for cattle producers in early 2025.

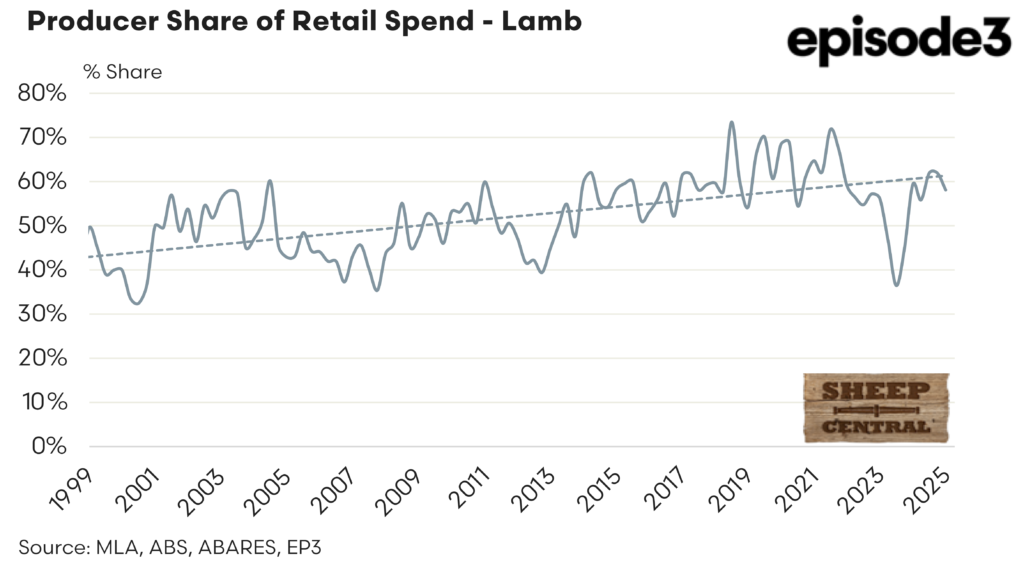

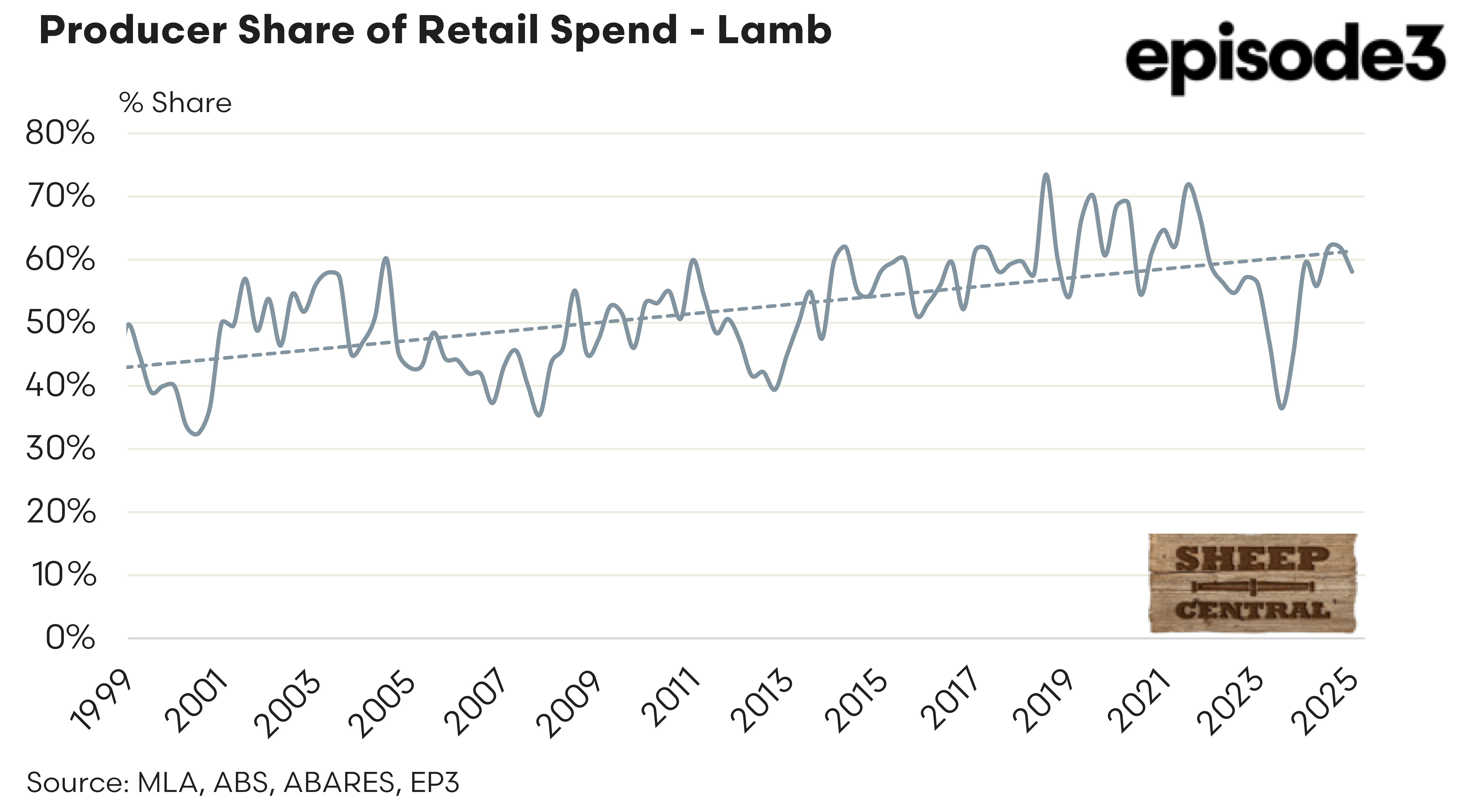

Lamb producers faced a slightly different scenario. While the saleyard price fell marginally from 826 c/kg cwt to 784 c/kg cwt in Q1, retail lamb prices lifted from 19.06 $/kg rwt to 19.27 $/kg rwt. This decoupling led to a reduction in the producer share of the retail lamb value, declining from 61.9% to 58.1%. Although still historically high, this retreat indicates that retail price increases are not fully translating back to farmgate returns, potentially due to margin expansion along the supply chain.

Overall, the start of 2025 brought signs of cautious optimism for cattle producers as both saleyard and retail prices strengthened, improving their share of the retail value. For lamb producers, however, early signals suggest a need to monitor downstream pricing behaviour more closely, as higher retail values are not currently matched by proportionate gains at the saleyard level.

This analysis is produced in conjunction with Beef Central and Sheep Central. At Episode 3 we are always happy to explore ways of working together with complimentary organisations. If you want to know more about what we do, or want to have a chat about how we can assist your business feel free to reach out to us on email at info@episode3.net or via the contact us page.