Live Export 1: Prohibition Era

Live Sheep Export Special Edition

This article is part of a series focusing on the live sheep export trade and the recent decision by the Australian Government to phase out the trade by May 2028.

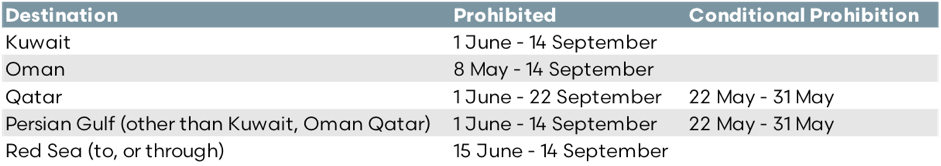

Since 2018, the supply chain for live sheep exports has been subjected to a seasonal ban during the northern hemisphere’s summer months, preventing the departure of vessels from Australia from mid-May to mid-September, with the specific dates varying by year and destination.

Historically, live sheep export mortalities have peaked during this period. In response, the industry voluntarily imposed a moratorium in 2018 to explore methods for mitigating heat stress. Subsequently, in 2019, the Australian government made it illegal to export live sheep by sea during these months, a prohibition that has persisted through to 2024.

Before the establishment of these restrictions, August was identified as the month with the highest risk, with mortality rates occasionally surpassing 1.2% and fluctuating between 0.8% and 1.8%. The imposition of the moratorium and prohibition has noticeably reduced the average annual mortality rates. Nevertheless, the seasonal ban from May through September has not been without significant economic repercussions for the supply chain and regional workers, particularly in Western Australia, which heavily relies on live sheep exports.

A 2020 analysis commissioned by LiveCorp and Meat & Livestock Australia estimated that the moratorium cost the industry approximately $83.6 million in 2018 and an additional $65.8 million in 2019. Although farmers and exporters have adapted their operations to accommodate the moratorium, its duration has severely impacted various participants in the supply chain.

For example, shearing teams in regional towns have had to cut their workforce from forty to ten, struggling to retain scarce shearing contractors. Livestock transport operators reported an 85% reduction in their usual workload in 2019. This drastic decrease in contract work also had financial implications for regional service providers like fuel depots, tyre fitters, mechanics, and engineering firms.

The economic effects of the moratorium have extended beyond shearing and transportation to include feed mills, contract balers, feed suppliers, livestock agents, veterinarians, and other related services, all of which have seen declines in business revenue comparable to those experienced during the 2020 Covid-19 lockdowns.

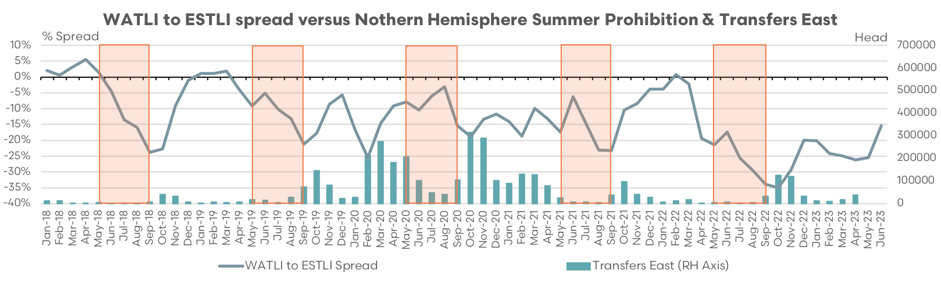

The chart above displays the relationship between the WATLI to ESTLI price spread and the movement of sheep from Western to Eastern Australia, particularly during the Northern Hemisphere Summer Prohibition, indicated by orange shaded areas from May to September each year. During these prohibition periods, there is a noticeable deterioration in the price spread between western and eastern lamb and sheep, which correlates with the prohibition phases.

However, this price spread deterioration is less pronounced during periods of substantial eastward sheep transfers, notably in 2020 when a peak in transfers corresponded with a smaller decline in price spread compared to other years. The chart highlights the variability in both price spreads and the number of sheep transferred annually, illustrating how internal transfers can mitigate the adverse effects of export prohibitions on local market prices.

Additional price spread analysis on an annual basis shows that since the moratorium’s inception, the price spread discounts for WA lambs relative to the east typically worsen by 16% during the May to September ban. More recently, this discount has increased to 20-25% due to additional challenges from Covid-19 and labor constraints at WA abattoirs. However, in 2020, nearly 2 million head of WA sheep were transported east, aligning the discount more closely with historical long-term averages, despite a slight increase from the typical 7% to 9%.

The potential for an eastern transportation option suggests a partial remedy for WA farmers and supply chain participants. However, further expansion in WA processing capacities and the lamb feedlot sector, along with the development of offshore markets, could also provide broader solutions and diversify options for WA sheep producers. These necessary adjustments are required in order to successfully pivot away from the live sheep export trade in WA, but they will take more than 3-4 years to put into place.

Support EP3

Please note that EP3 are not paid to do this analysis by any sheep industry representative nor live export representative bodies. We believe it is valuable information that should be provided to Australian farmers, the live export supply chain participants and any other interested parties, so we allocate time out of our work day to produce these articles completely free of charge to the reader.

We prepare our reports based on the data available and we aim to maintain objectivity in our analysis so that the insights delivered are only what the data shows.

If you want to support the work of EP3, then remember to sign up and forward our articles to your friends, family and other contacts.