Queensland’s state of origin improvement

The Snapshot

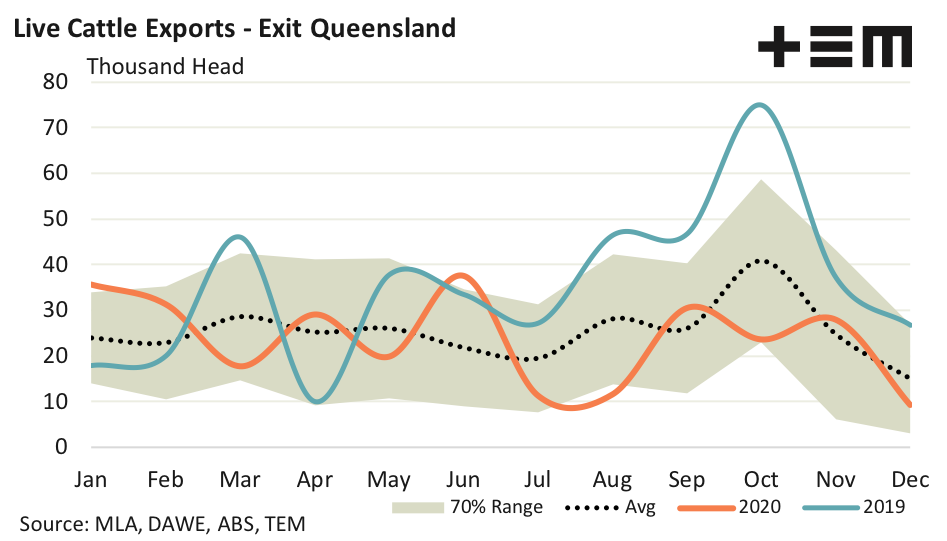

- Above average flow of live cattle during the later half of 2019 out of Queensland saw it take the top position from the Northern Territory during 2019 to hold 33% of the market share of total cattle exports compared to 29% exiting from NT ports.

- During 2020 average monthly live cattle export volumes exiting Queensland have been a little more subdued, running 5% under the average seasonal levels.

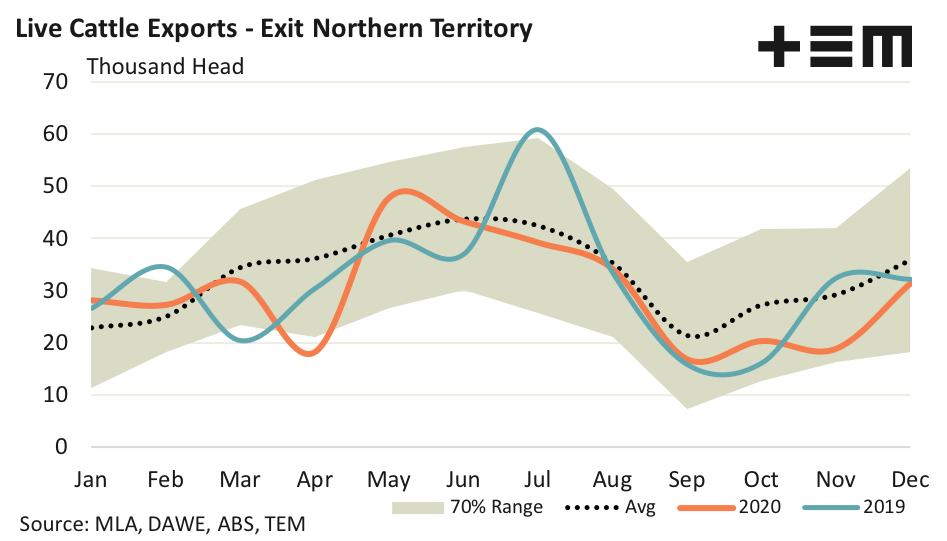

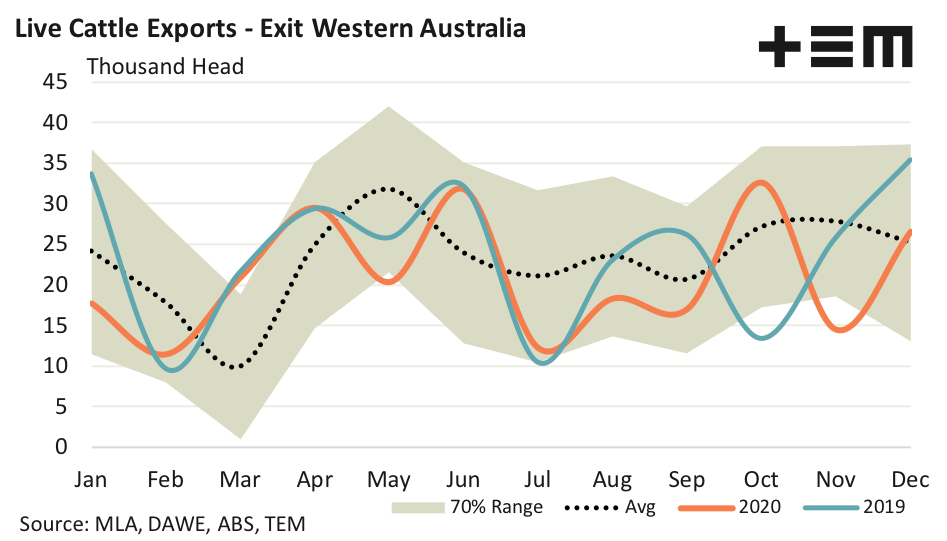

- The seasonal pattern for live cattle exports from the NT is running 9% under the average seasonal pattern. Similarly, volumes from Western Australia are also 9% under the average monthly trend.

The Detail

Strictly speaking the live cattle exiting from Queensland ports could have originated from outside of the state, but I cant’t miss a state of origin pun in the title knowing how mad “The Cane Toad’s” supporters are on anything state of origin related.

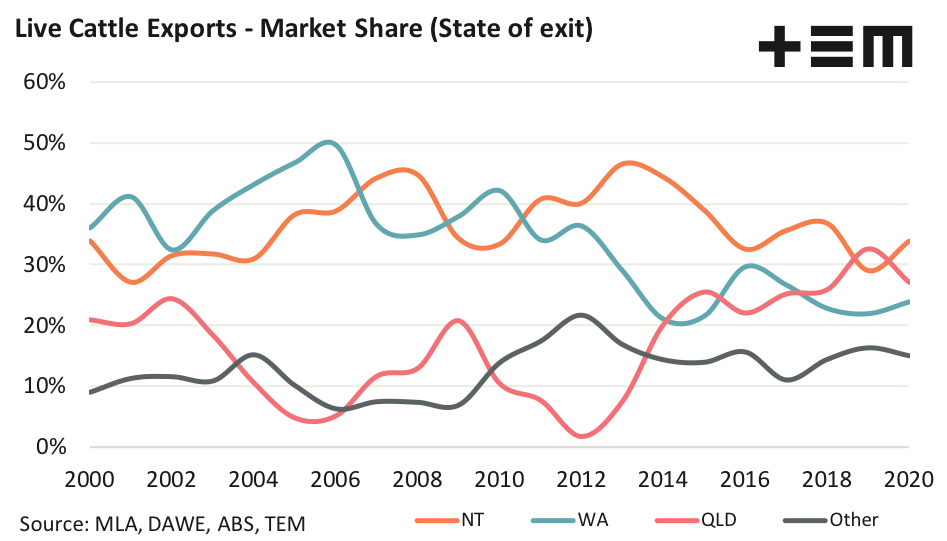

Nevertheless, the market share of live cattle leaving Australia, based on the state where the exiting port is located, shows that there has been some significant improvement in numbers leaving from Queensland since 2012. Indeed, in 2012 Queensland ports accounted for just 2% of the live export volumes compared to 33% in 2019, and 27% during the 2020 season.

Above average flow of live cattle during the later half of 2019 out of Queensland saw it eclipse the Northern Territory during 2019 to hold the highest market share of cattle exports. During 2019 the NT managed to send 29% of the total Australian live cattle export flows, compared to Queensland’s 33%. Data for the 2020 season shows that the NT has regained the top spot with just over 34% of the flow.

Analysis of the seasonal pattern in live cattle transports exiting Queensland highlights the strong volumes seen during July to December 2019, with average monthly levels running 68% above the five-year average pattern. This year average monthly volumes have been a little more subdued, running 5% under the average seasonal levels.

The seasonal pattern for live cattle exports from the NT during 2020 is running 9% under the average seasonal pattern. Similarly, volumes from Western Australia are also 9% under the average monthly trend. These lower than average volumes are unsurprising considering our high domestic cattle prices, appreciating Australian dollar and low supply situation.

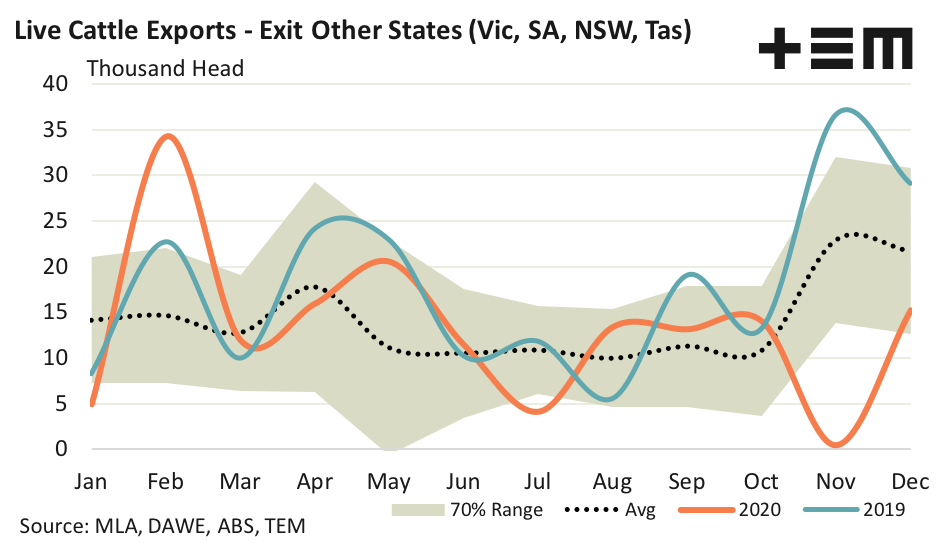

A look at the remaining states combined figures (dominated by cattle exiting Victorian ports) shows a somewhat volatile seasonal pattern with occasional spikes over 30,000 head as large shipments exit Portland. Despite the month on month volatility, the market share of cattle exported from the “other states” has been reasonably stable on an annual basis for the last five years at around 15% of total Australian live cattle exports.