Red Meat 2025 – Round 1

Round 1 - Beef Supply

The Australian cattle market is winding up for the 2024 season and now there will be a break to cattle sales and processing throughput as the industry goes into a brief Christmas hibernation. As slaughter and processing data becomes scarce over the next few weeks we will take the opportunity to look at some interesting developments that will likely impact red meat markets into the new year.

In this first instalment of three, we take a look at the tightening global supply picture for beef in 2025 and what that could mean for the Australian red meat sector. Analysis of recent data on beef production and herd numbers from leading beef-exporting countries highlights several critical factors influencing this trend.

The global beef market is poised to experience significant tightening in 2025, creating opportunities and challenges for the Australian red meat sector. This shift is underscored by changes in cattle herd sizes and beef production dynamics across the leading beef-exporting countries.

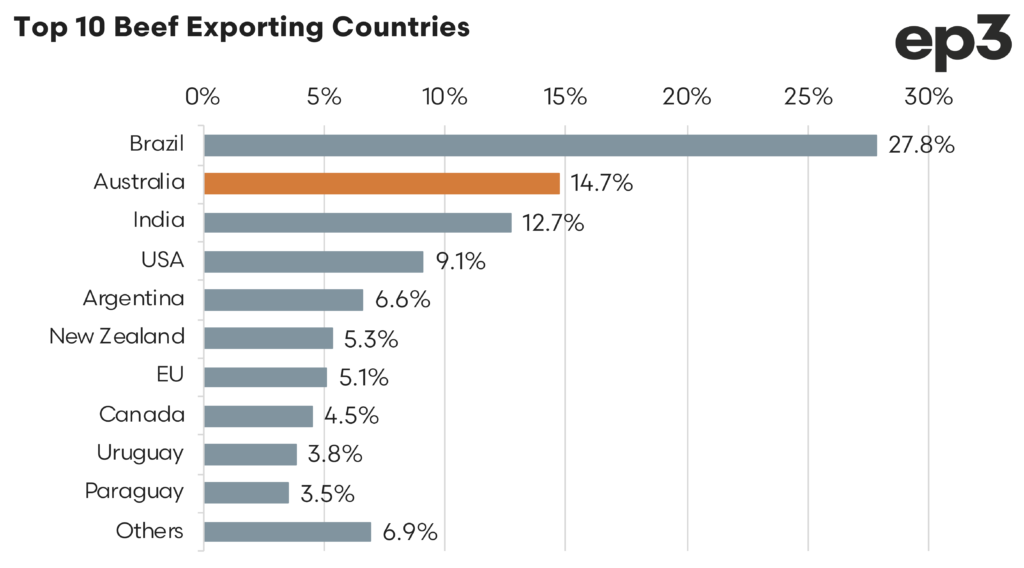

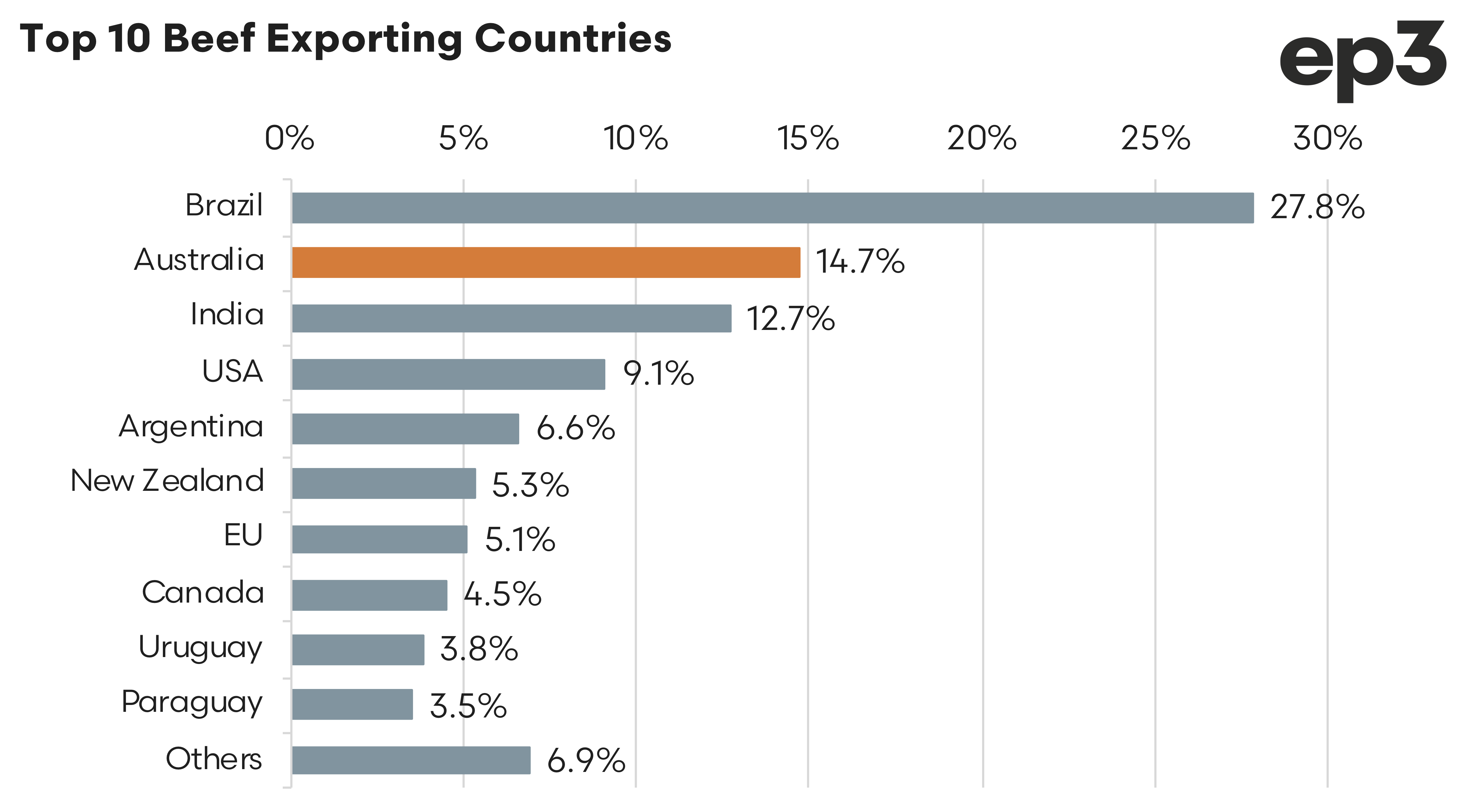

During 2024, the global beef export market was dominated by five key players, each with significant shares of the market. Brazil led the pack, commanding a substantial 27.8% of global beef exports. Following Brazil, Australia held a notable 14.7% share, positioning itself as a major player in the international beef trade. India, another significant contributor, was responsible for 12.7% of the exports. The United States also played a critical role, contributing 9.1% to the global beef export figures. Argentina rounded out the top five, with 6.6% of the market share. These countries collectively shaped the dynamics of the global beef market, influencing pricing and supply chains.

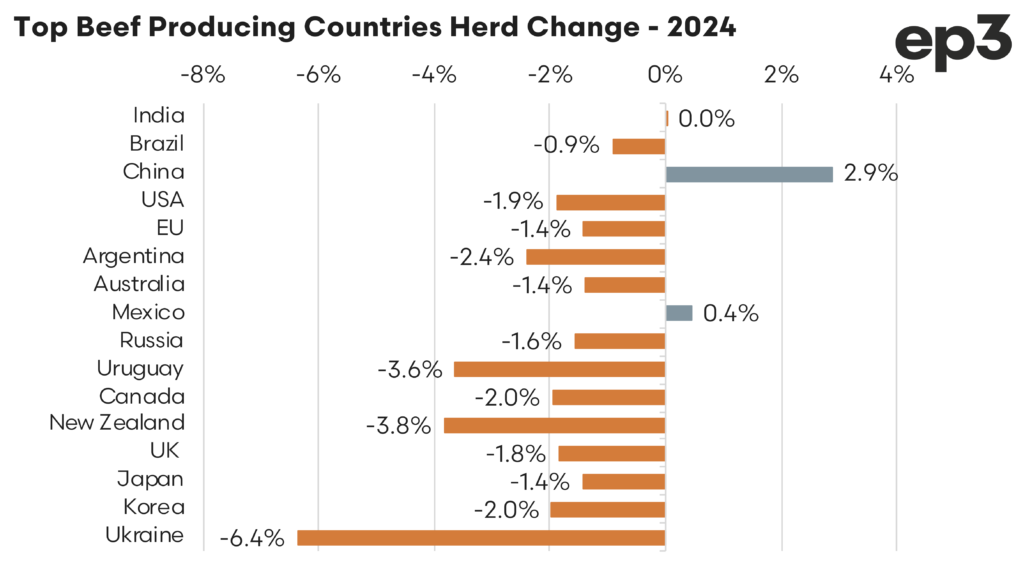

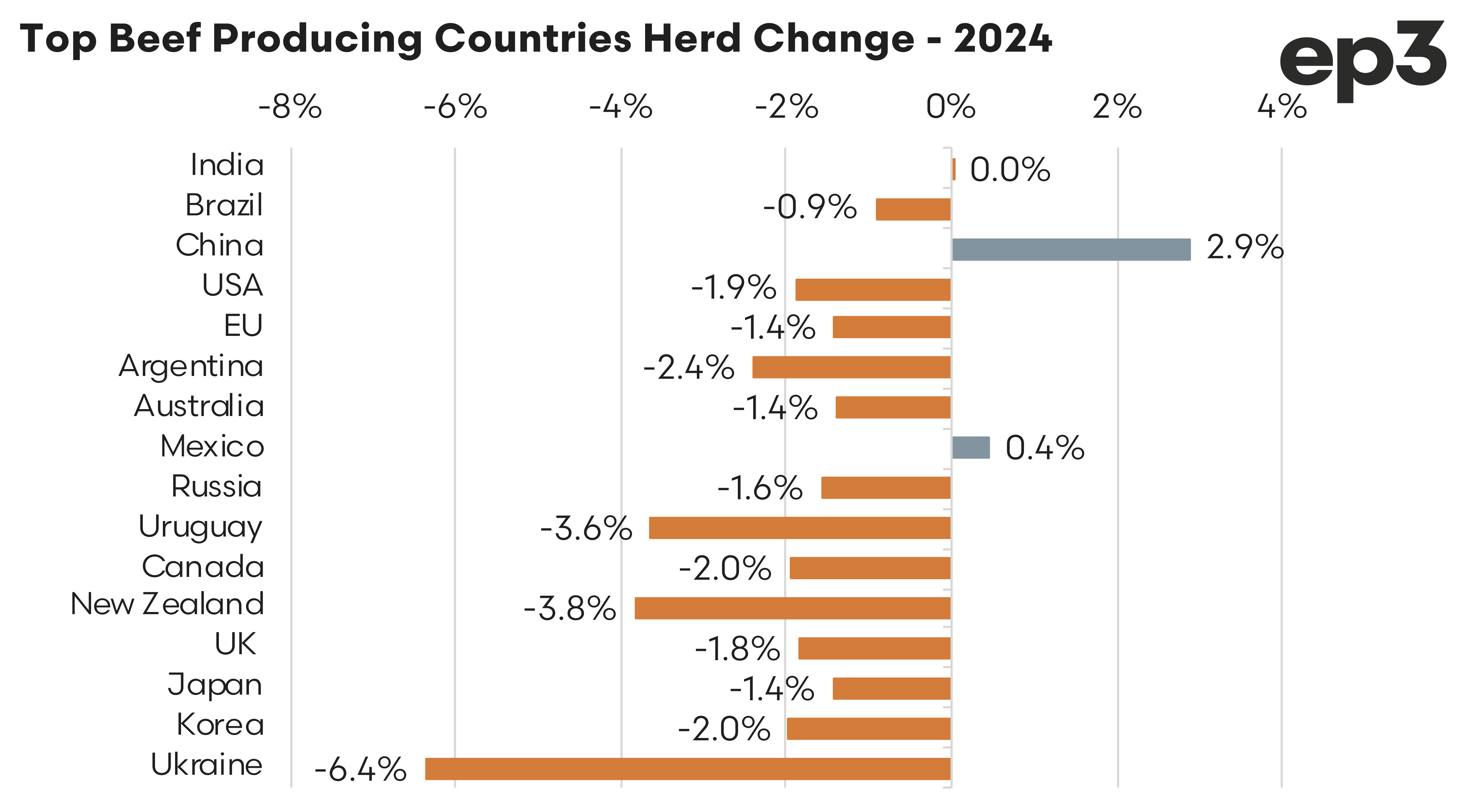

Throughout 2024, the cattle herds in these top exporting countries experienced various changes, significantly impacting their production capacities. Brazil saw a decline of 0.9% in its cattle herd, reflecting broader climatic challenges and tough market conditions. Australia’s herd decreased by 1.4%, after coming off three favourable seasons of solid herd rebuild. India’s herd was without major change but holds the largest herd globally so remains a significant source of beef export supply.

The United States reported a more substantial reduction of 1.9%, driven by ongoing drought and is presently in its fifth consecutive year of liquidation. Argentina’s cattle numbers decreased by 1.4%, aligning with local economic pressures and turbulent beef export policy. During 2024 only two of the top beef producing nations, China and Mexico, saw herd growth of 2.9% and 0.4% respectively

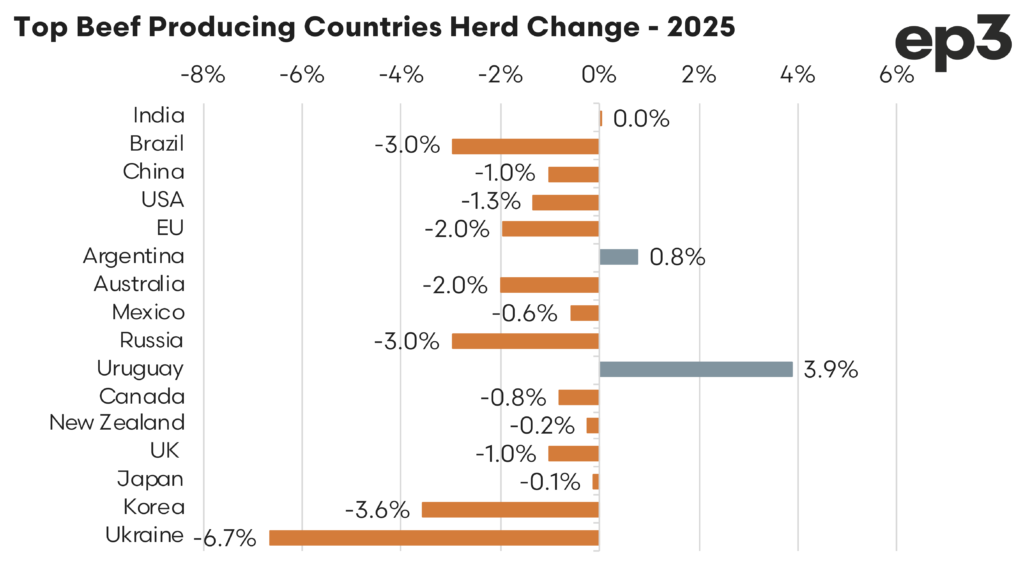

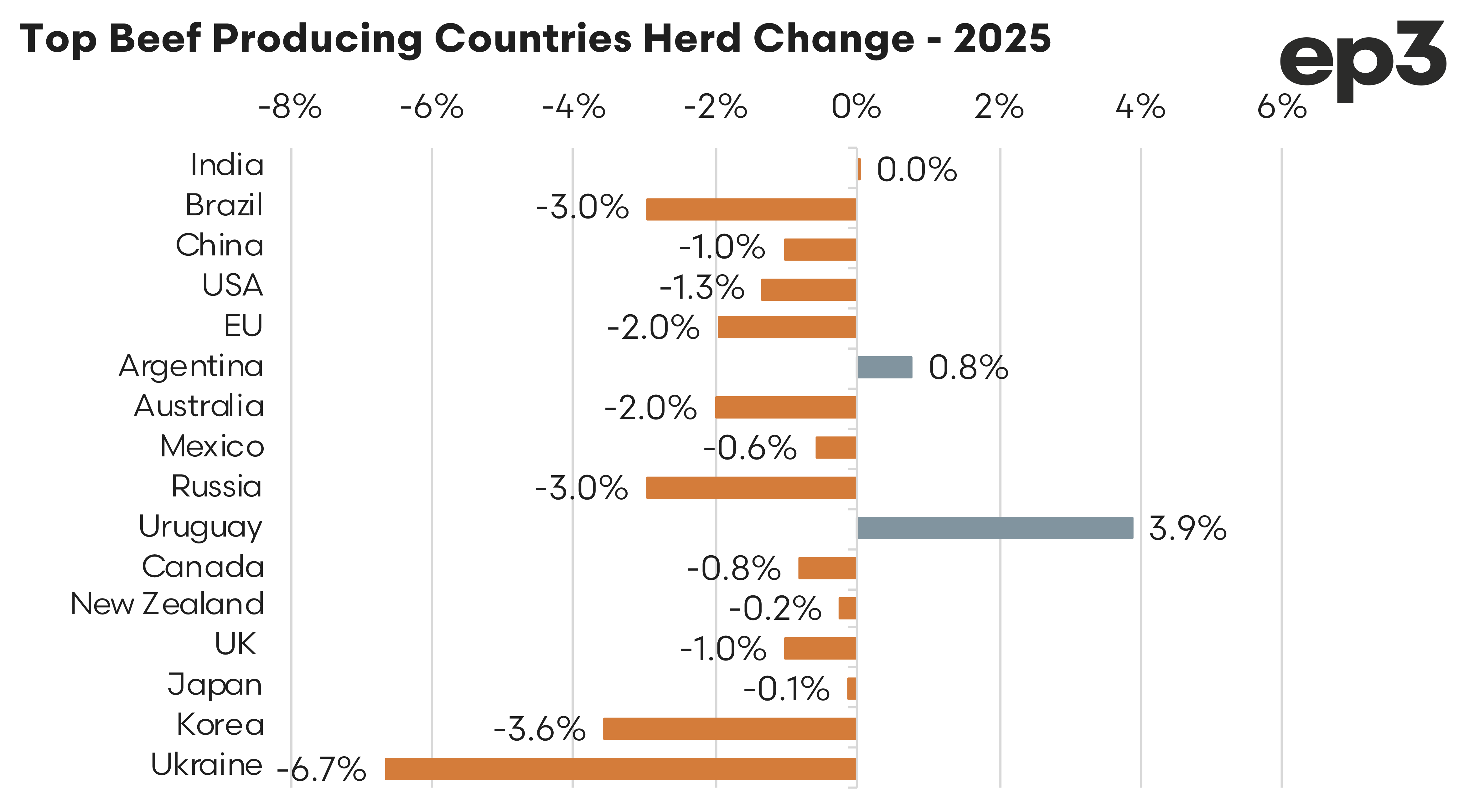

Looking ahead to 2025, the trends in cattle herd sizes are expected to continue influencing these top beef exporters, albeit with some variations. Brazil is anticipated to see a further decrease of 3.0% in its cattle herd, continuing its trend from the previous year. Australia is expected to decrease too, with a projected decline of 2.0%.

India is again unchanged, suggesting relative stability in its cattle industry. The United States is forecasted to undergo a reduction of 1.3% in herd size, reflecting ongoing industry adjustments and the sixth year of liquidation pushing its herd to the lowest level in six decades. Argentina is one of only two top beef producing nations to see an increase in herd size with a marginal lift of 0.8% expected. The other, Uruguay, will see a 3.9% increase to their herd in 2025 but this is coming off the back of a 3.6% drop seen during 2024 somewhat offsetting each other.

The decline in herd sizes directly impacts beef production volumes, which are expected to remain low, thereby keeping cattle and beef prices elevated. This scenario not only affects beef but also opens the market for other meat proteins, as consumers and suppliers look for cost-effective alternatives.

The tightening supply in other major exporting countries, especially the USA, positions Australian beef favourably in international markets. It is important to remember that the USA is not only a top destination for Australian beef and sheep meat, but it is also the main competitor for beef exports into Japan, South Korea and China. The current discounted Australian cattle price relative to US cattle values will keep Australia competitive in the beef export space in 2025.

The Australian cattle herd has shown resilience expanding steadily during 2020-2023 to peak at 30.6 million head last year, the highest level the herd has been since 2018. This increased herd size, combined with competitive pricing, places Australian beef producers/exporters in an advantageous position to increase their market share as global supplies tighten.

To capitalise on these opportunities, the Australian red meat sector should consider exploring new markets or expanding in existing ones, particularly in Asia, India and the Middle East, to help mitigate risks associated with reliance on traditional markets. Investing in processing capabilities to offer value-added products can attract higher premiums and meet specific market demands. Emphasising sustainable farming practices can appeal to a growing band of environmentally conscious consumers in UK, US and EU markets, further differentiating Australian beef and lamb.

The expected continuation of tight global beef supplies next year creates a favourable environment for Australian red meat exports. In the follow up piece next week we will delve further into the export market growth opportunities facing the Australian beef and sheep meat sectors into 2025 and beyond.