Returning to normal

Market Morsel

It has been a while since we looked at the Episode 3 Beef Processor Profitability Index (BPPI). Indeed, last time was in October 2023 when we noted that the margin index was improving strongly in favour of the nation’s beef processors.

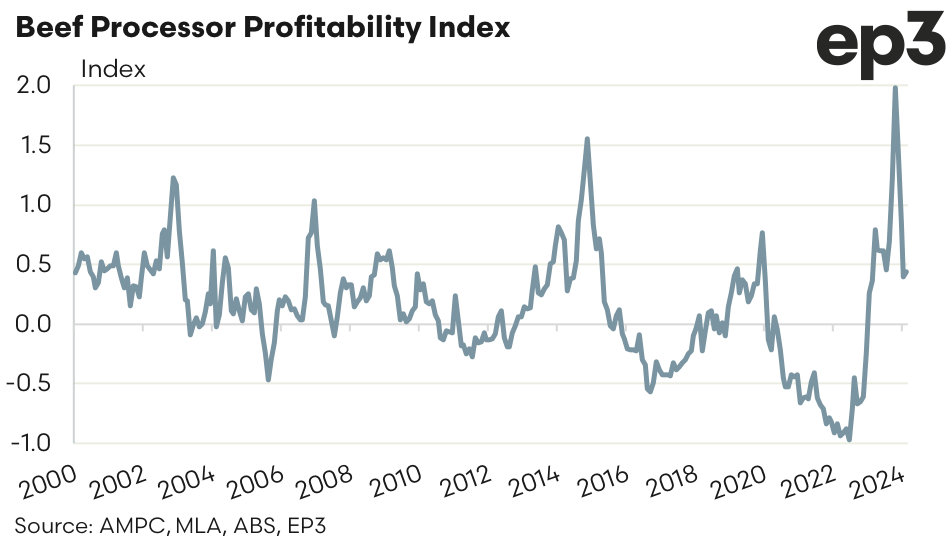

October 2023 saw the index peak at 1.99 as local Australian cattle prices bottomed out that month and export values were booming thanks to tight US supplies.The final quarter of 2023 saw the BPPI ease from it’s peak finishing the year at 0.86 in December 2023.

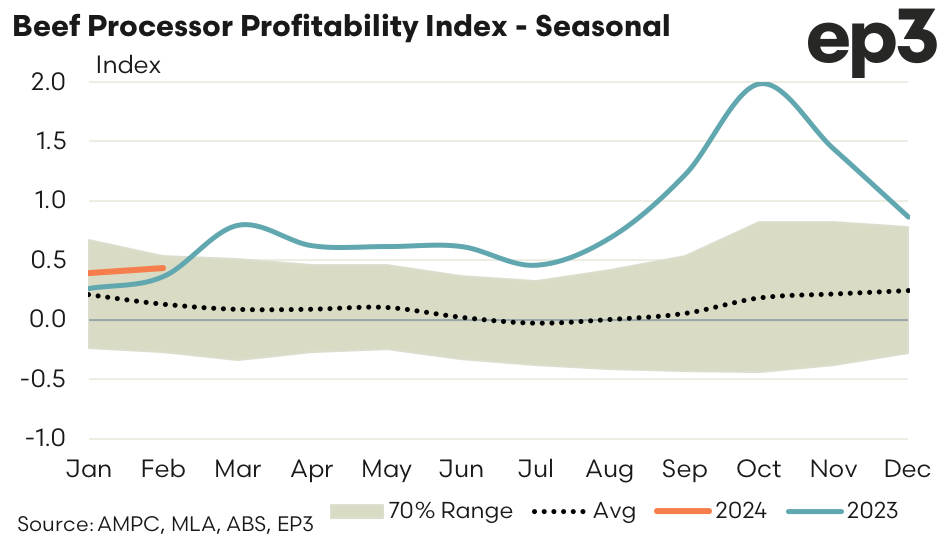

For the first few months of 2024 the BPPI has returned back into the normal range posting a 0.39 for January and a 0.44 for February. The grey shaded 70% range denotes what is relatively normal behaviour for the BPPI as it represents where the index spends 70% of the time based on historical monthly fluctuations since 2000.

It is important to note that this BPPI calculation is based upon a theoretical processor margin model and is a simple representation of the Australian beef processing sector. A BPPI in negative territory does not suggest that all processors are losing money, similarly a BPPI in positive territory doesn’t suggest that all processors are making money. A more useful reading of the BPPI would be that a negative index suggests a tougher processor trading environment, versus a positive BPPI which is reflective of a more beneficial processor trading environment.

The chart below outlines how the BPPI has fared on a monthly basis since 2000. The 2022/23 seasons were a picture of the extreme volatility seen in the cattle market in recent years with the BPPI swinging from the worst result on record to the best result on record within a 16 month period.

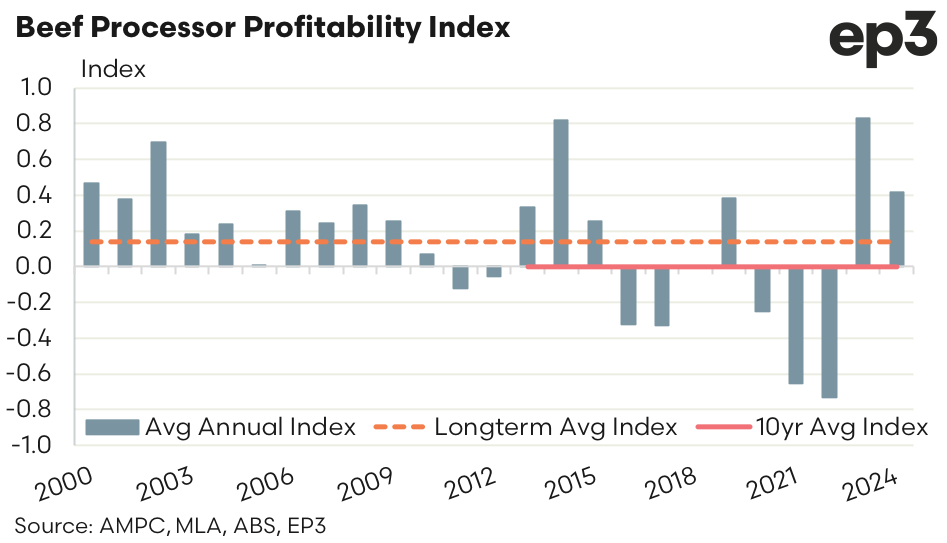

Analysis of the annual average BPPI each year since 2000 shows that 2023 was a good season for beef processors with the annual average coming in at 0.83, rivaling the previous best year in 2014 when the BPPI scored 0.82 as an annual average. So far in 2024 the annual average BPPI sits at 0.42.

However, an assessment of the last 10 years shows that the index has fluctuated wildly between profit and loss. Indeed the ten-year average index sits at 0.00, which highlights how tough the beef processing game has become over the last decade. The long term average BPPI sits at just 0.14 suggesting that deep pockets and a long term approach is the best strategy for this sector.

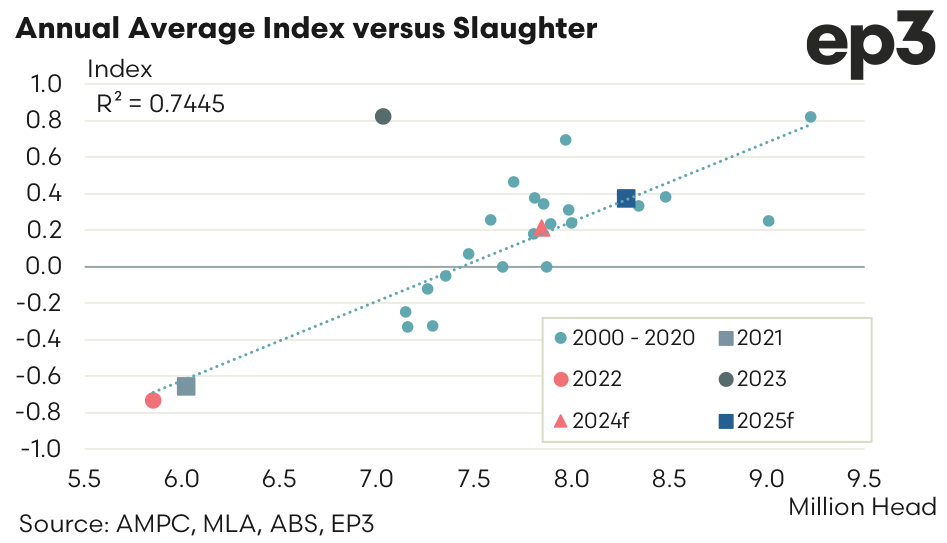

The projection of increased annual cattle slaughter as we head toward the middle of the decade should continue to assist with positive annual average margins for beef processors.

The scatter plot of the historic correlation between annual slaughter versus the annual average BPPI shows that an index of 0.21 is anticipated for 2024 and 0.38 for 2025 based on current Meat & Livestock Australia (MLA) slaughter projections.