Risky business

The Snapshot

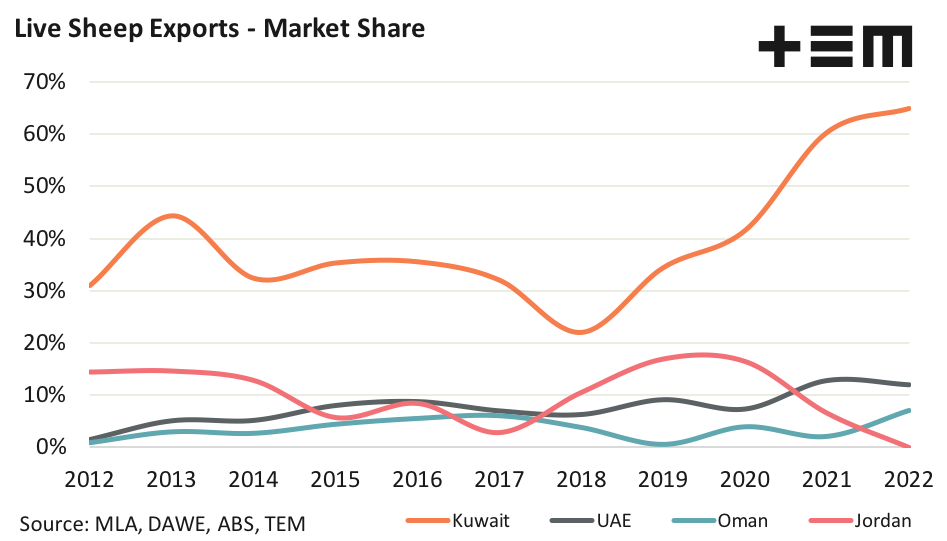

- So far in 2022 Kuwait accounts for 65% of the live sheep trade exiting Australia, followed by the United Arab Emirates (UAE) at 12% and Oman holding 7% of the trade.

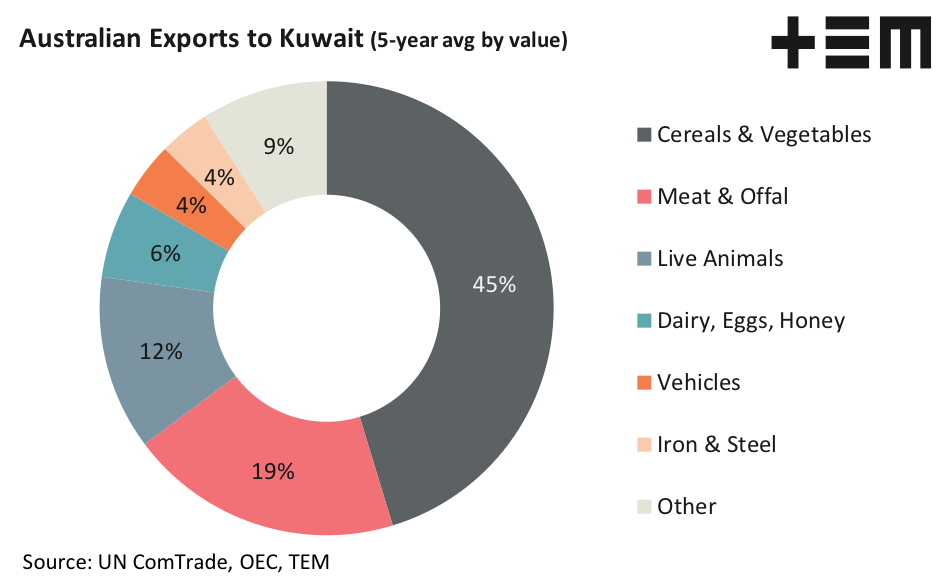

- Analysis of the average annual value of Australian export flows to Kuwait over the last five years equates to nearly A$500 million Australian dollars.

- Nearly half of the export flow from Australia to Kuwait is comprised of the cereals & vegetables category (primarily wheat, which is about 30-40% of the total export trade).

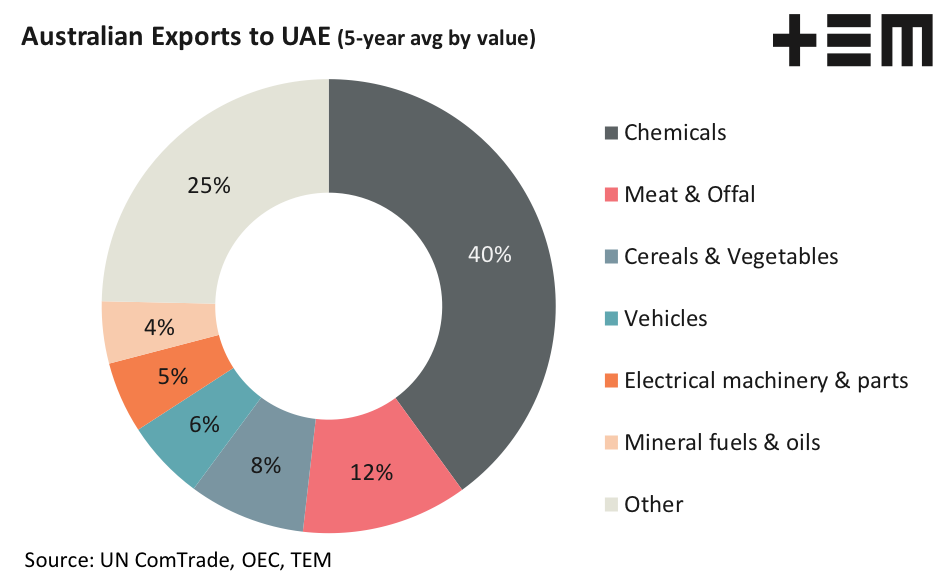

- The United Arab Emirates (UAE) are a larger overall trade partner with Australia than Kuwait with a total average annual export value of nearly A$3 billion.

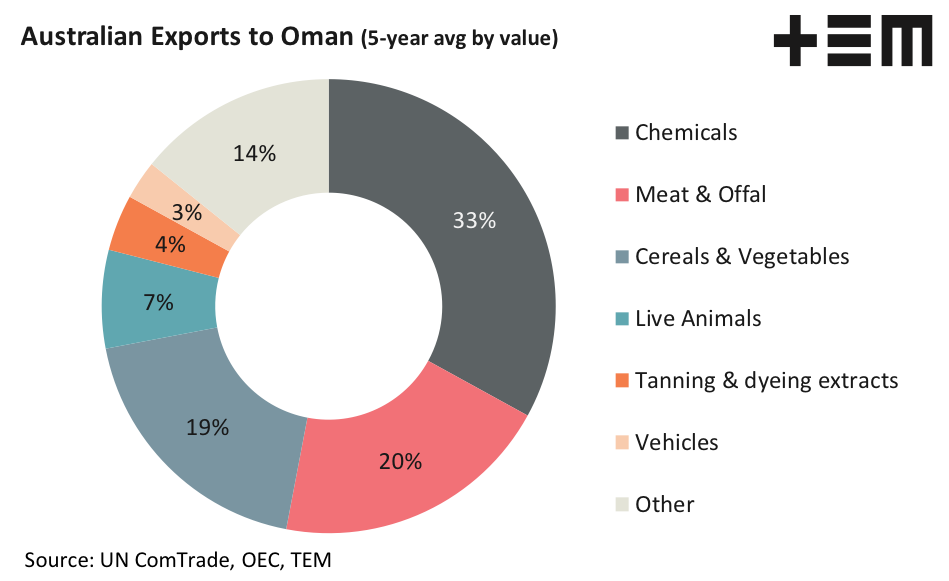

- Meanwhile, the total export trade value to Oman is worth an annual average of nearly A$364 million per annum.

- The UAE and Oman also provide Australia with a reasonable amount of our import requirements for key agricultural inputs such as petroleum and fertiliser.

The Detail

The new federal agriculture minister, Murray Watt, appears resolute in his commitment to phasing out live sheep exports from Australia. While I respect a politician that fulfils their election promises, I also like to see politicians consult widely, analyse relevant data and consider all the implications of their actions before setting into stone a new policy direction.

Since 2018 Kuwait has risen to become the dominant trade partner with Australia when it comes to live sheep exports. So far in 2022 Kuwait accounts for 65% of the live sheep trade exiting Australia, followed by the United Arab Emirates (UAE) at 12% and Oman holding 7% of the trade. During the midst of the Covid epidemic in 2020 the Kuwaiti trade and industry minister, Khalid Nassir Alrowdan, and the CEO of Kuwait Livestock Transport and Trading (KLTT), Osama Boodai, both penned individual letters to the Australian government pleading for reconsideration of the three month northern hemisphere summer moratorium.

Mr Boodai was noted asking the Australian government to “to consider the gravity of this decision making by your animal exports regulator and put into perspective what this means for bilateral relations, trade and social and economic well being of all countries impacted here, including your own.” Minister Alrowdan followed up by stating that “Kuwait considers Australia its strategic partner in securing its livestock needs” and requested that the current Australian agriculture minister at the time, David Littleproud, “reconsider the Australian livestock export ban during the hemisphere summer to our region assuring that we will take all the necessary precautionary measures for animal welfare, to enhance our national food security and the Australian national economy”.

Given the concern expressed by the Kuwaiti government and KLTT about the three month trade ban it stands to reason that the idea of a complete phase out of the Australian live sheep trade would pose even greater concerns for this trade partner.

Analysis of the average value of Australian export flows to Kuwait over the last five years demonstrates that we send more than just live sheep. Total annual average export value from Australia to Kuwait over the last five years (2017-2021) has reached US$342 million which equates to nearly A$500 million Australian dollars. Nearly half of the export flow from Australia to Kuwait is comprised of the cereals & vegetables category (primarily wheat, which is about 30-40% of the total export trade). The annual average value of the cereal and vegetable trade over the last five years is estimated at approximately A$221 million.

Chilled, frozen and fresh meat and edible offal make up the next largest category of exports (by value) at just under one-fifth of the total export trade from Australia to Kuwait and is valued at an average annual figure of A$95 million over the last five years. Live animal exports comes in at third place, averaging 12% of the total export value at approximately A$61 million. Meanwhile, other animal edible products such as dairy, eggs and honey accounts for about 6% of the export flows at an average annual value of approximately A$30 million.

However, Kuwait isn’t the only trade partner to import Australian live sheep. The United Arab Emirates (UAE) are a larger overall trade partner with Australia than Kuwait with a total average annual export value of US$2.1 billion from 2017 to 2021. In Australian dollar terms the export value of the UAE trade is nearly A$3 billion.

Over the past five years 40% of the export flow from Australia to the UAE consisted of chemical products (mainly Aluminium Oxide), representing an annual average of about A$1.2 billion of export value to the Australian economy. Chilled, frozen and fresh meat and edible offal made up around 12% of the export trade value at an annual average of nearly A$353 million. The cereals and vegetables category (mainly wheat, barley, legumes and root vegetables) accounted for 8% of the export trade at a fraction under A$250 million, as an average annual value over the last five years.

Rounding out the top three trade partners for the Australian live sheep trade is Oman. Analysis of total Australian exports to Oman, by value, highlights that the trade is worth an annual average of nearly US$255 million based on the export trends seen over the last five years. This equates to nearly A$364 million per annum.

As was the case with the UAE the dominant category for Australian exports to Oman is the chemicals sector, which accounts for a third of total exports from Australia at an annual average value of A$120 million, and is predominantly made up of Aluminium Oxide exports. Chilled, frozen and fresh meat and edible offal make up around one-fifth of total Australian exports with an annual average value of nearly A$73 million, over the last five years. Cereals and vegetables (mostly wheat and barely) account for another fifth of total exports at about A$69 million per annum, on average between 2017 to 2021. Meanwhile, the live animal trade from Australia accounts for about 7% of total export value at an annual average of nearly A$26 million.

Kuwait isn’t a significant exporter of products to Australia. However, the UAE and Oman do provide Australia with some of our import requirements for key agricultural inputs such as petroleum and fertiliser. Over the last three years the proportion of refined and crude petroleum imported from the UAE/Oman into Australia was about 16% of our total import value for this product. Meanwhile, the importation of nitrogenous fertiliser from the UAE and Oman into Australia accounted for about 13% of our total fertiliser imports, by value over the last three years.

Hopefully careful consideration is given to the importance of these bilateral trade relationships that exist between Australia and Kuwait, UAE and Oman before any final decision is reached to permanently end the live sheep export trade. As the KLTT CEO, Mr Boodai noted in his plea to the Australian government “Restricting the trade of Australian sheep puts the region’s sovereign food security at risk and damages very long time trading relationships. This continual and repeated interference in the live sheep trade from your country and doubt from the Australian government has unreservedly caused widespread resentment and business impacts across all markets.”

With this view in mind, I don’t think a phase out of the live sheep sector from Australia will be well received by these trade partners.