Rollercoaster revisions for beef processors

Beef Processor Trading Conditions - June 2025 update

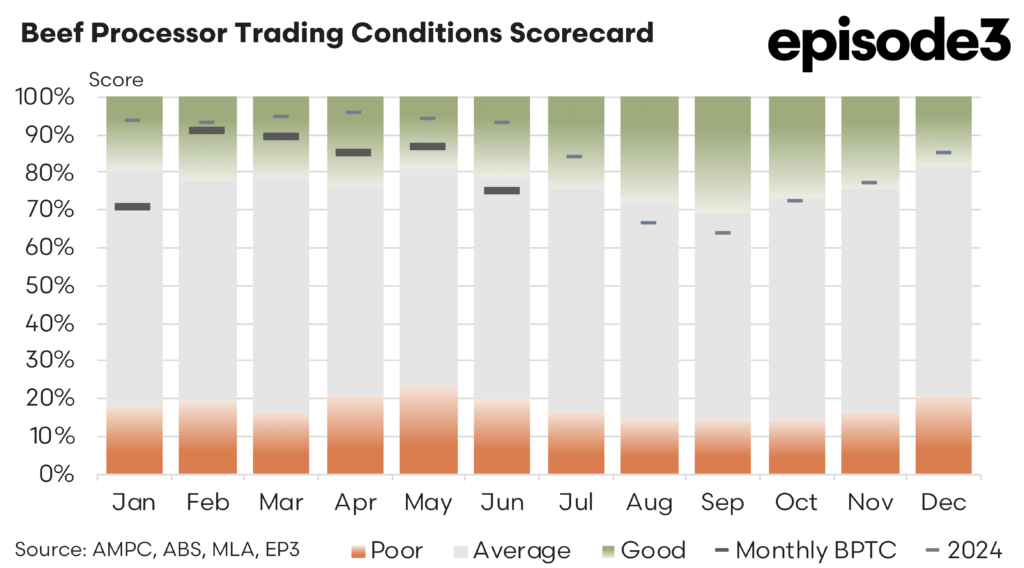

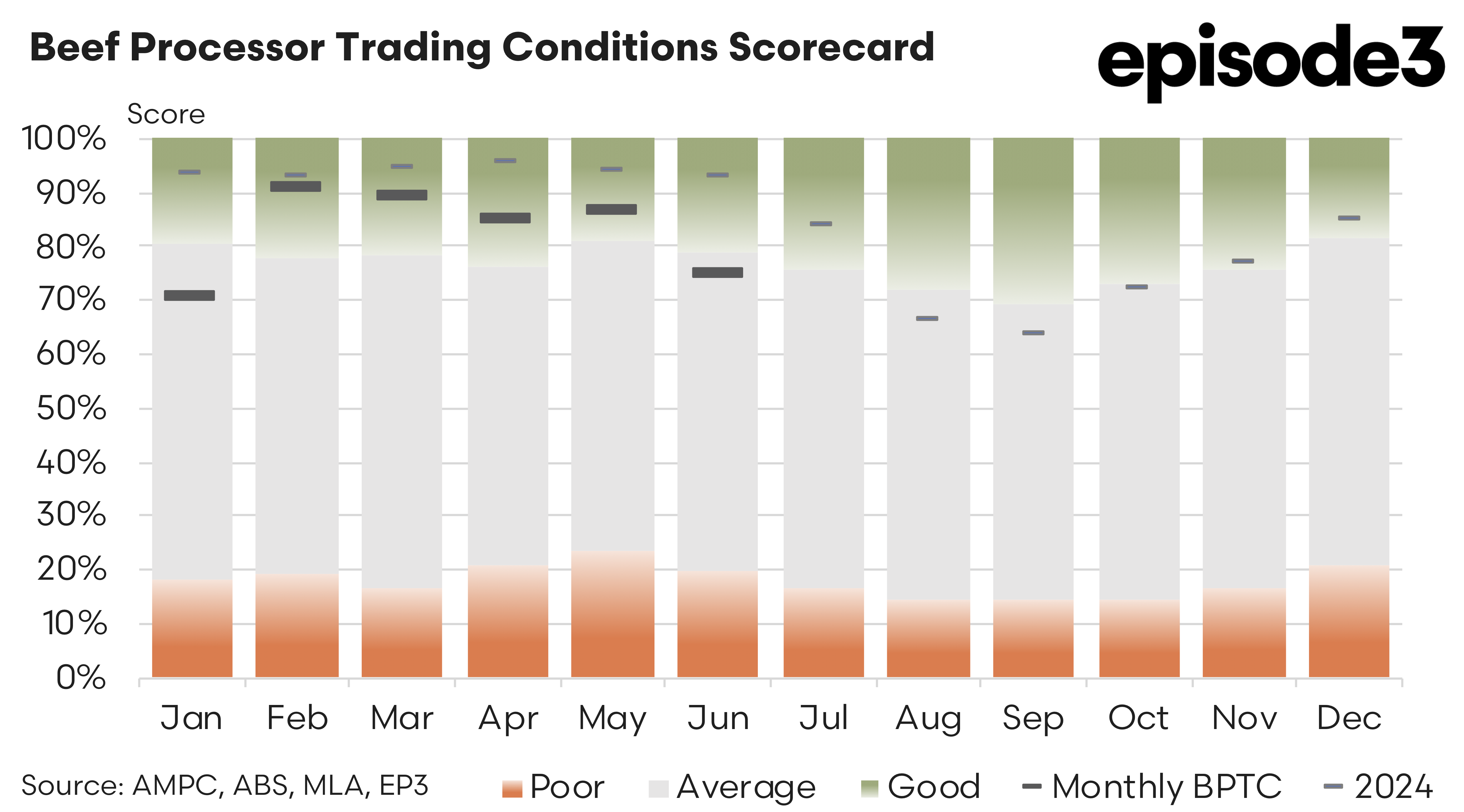

Australia’s beef processors enjoyed a notable improvement in trading conditions through the first half of 2025, with the Beef Processor Trading Conditions (BPTC) index undergoing substantial upward revisions following updates to data on co-products, rendered materials and pharmaceutical revenue. While conditions improved more than initially reported for earlier months, the most recent figures for June suggest some pressure is starting to re-emerge as input costs rise and key revenue streams soften.

The most significant revision occurred for May 2025, with the BPTC index score jumping from the previously reported 71% to 87%. This updated figure reflects stronger than expected contributions from offals, rendered product sales and pharmaceutical exports. The revised data also pushed up the BPTC scores for several earlier months in 2025, boosting the average index value for the first half of the year to 83%. This represents a healthy improvement on the original estimate and gives some cause for optimism following a more volatile trading environment earlier in the year.

However, despite these gains, June saw a clear moderation in processor margins, with the BPTC index slipping to 75%. Although still relatively strong by historical standards, the month-on-month decline highlights emerging challenges on both the cost and revenue sides of the processing equation.

Livestock input costs were a key contributor to the softer index reading in June. Heavy steer prices climbed by 4%, young cattle lifted 3% and processor cows increased by a significant 6%. These rises add direct pressure to processor profitability and signal a tightening supply picture, likely linked to restocker competition and winter season herd management dynamics.

On the revenue side, beef export values were mixed across Australia’s major markets. Average export values across the top destinations fell by 1% in June. The United States led the decline with a drop of 5% in average export prices. In contrast, Japan and South Korea saw modest gains of close to 2%, offering some offset to the broader decline. China remained subdued, with export values easing by 2%, continuing a trend of volatility in that market amid macroeconomic headwinds and shifting consumer behaviour.

Domestically, there was a small improvement in retail beef pricing, with values lifting 1.5%. While this helps to support processor margins on product sold into the local market, it does little to outweigh the export side softness and rising input costs.

Co-product performance in June was mixed. The average price for offals rose by an impressive 11%, providing a helpful boost to overall processor receipts. However, this was more than countered by a near 6% drop in rendered product revenue and a steep 46% collapse in pharmaceutical prices. The latter is particularly significant given the high per-unit value of pharmaceutical by-products, and it contributed heavily to the fall in the overall BPTC index for the month.

Adding further pressure, food manufacturing input costs rose by 3% per cent in June. These costs, which include energy, packaging and labour components, form a substantial part of processor overheads and reduce the net margin achieved even in the face of stable or firm product prices.

While the June BPTC score of 75% still indicates that most processors are operating at a margin, the decline from May’s revised high points to growing fragility in trading conditions. The annual average to date remains respectable, but the mix of rising cattle prices, falling pharmaceutical revenues and softness in key export markets presents a warning sign for the months ahead.

Looking forward, much will depend on how livestock supply balances against processor capacity, as well as the trajectory of export demand and co-product pricing. If cattle prices continue to lift while export values remain under pressure, margins could tighten further in the second half of the year. However, if demand from Japan and Korea holds up and China recovers, there may be room for stabilisation.

The improved readings for the first half of 2025 are an encouraging sign, but June’s shift serves as a reminder that margins in the processing sector remain sensitive to small changes across multiple fronts. Co-product revenue, often overlooked, is again proving to be a key swing factor in the monthly index, and its volatility could continue to surprise. Processors will be watching market signals closely in the coming months to determine whether May’s improved trend were a fleeting moment or a signal of more stable conditions to come.